Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: A MAJOR RISK-OFF PIVOT

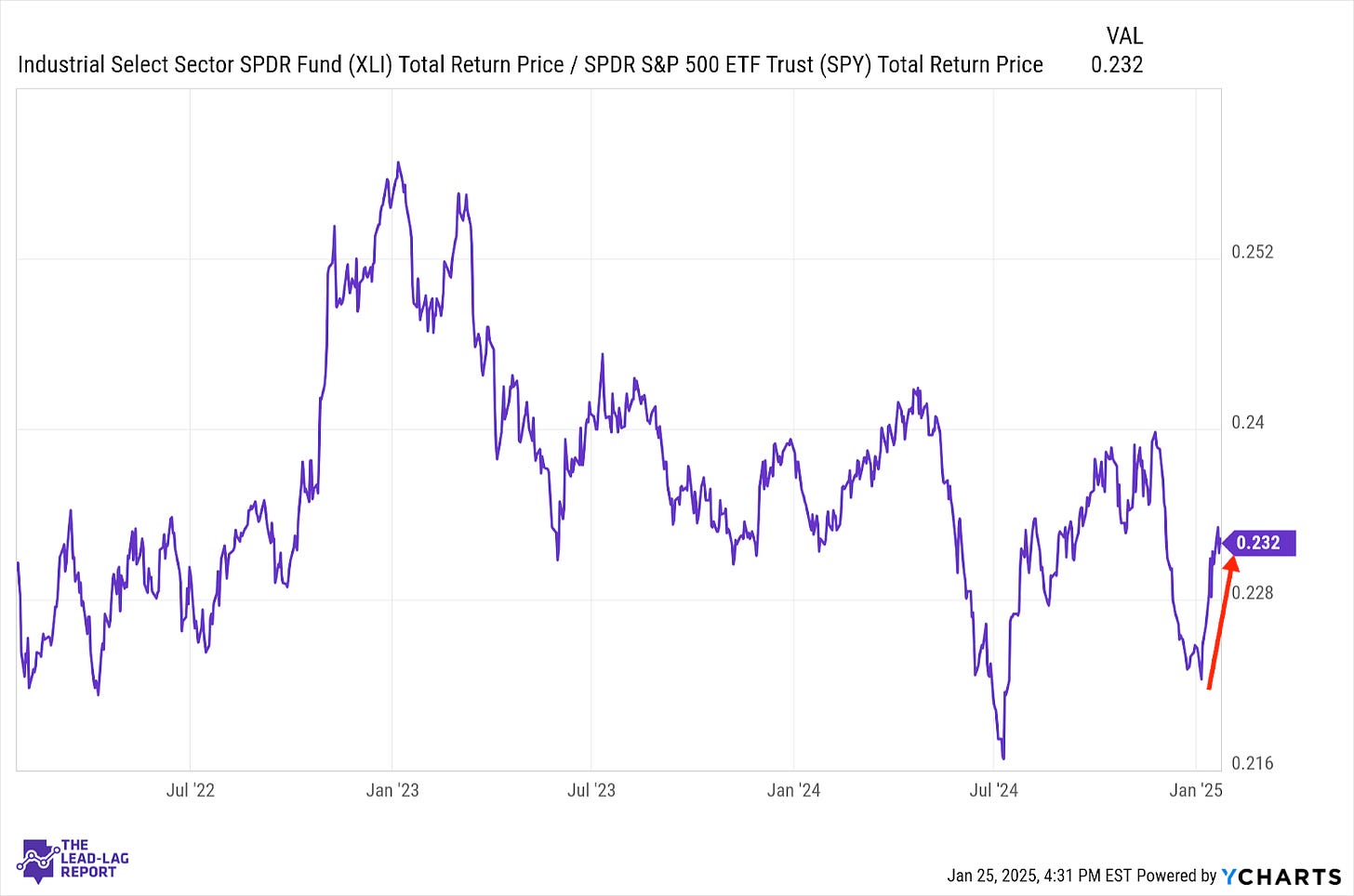

Industrials (XLI) – The Story Is Improving

Industrials have held up relatively well in the first week of the Trump administration. His early emphasis on reshoring and deregulation has given a boost to cyclicals, but they may be starting to get some data to back up the enthusiasm. Manufacturing PMI in the U.S. moved into expansion for the first time since June and new home sales firmly beat expectations in December. The story here looks like it’s improving.

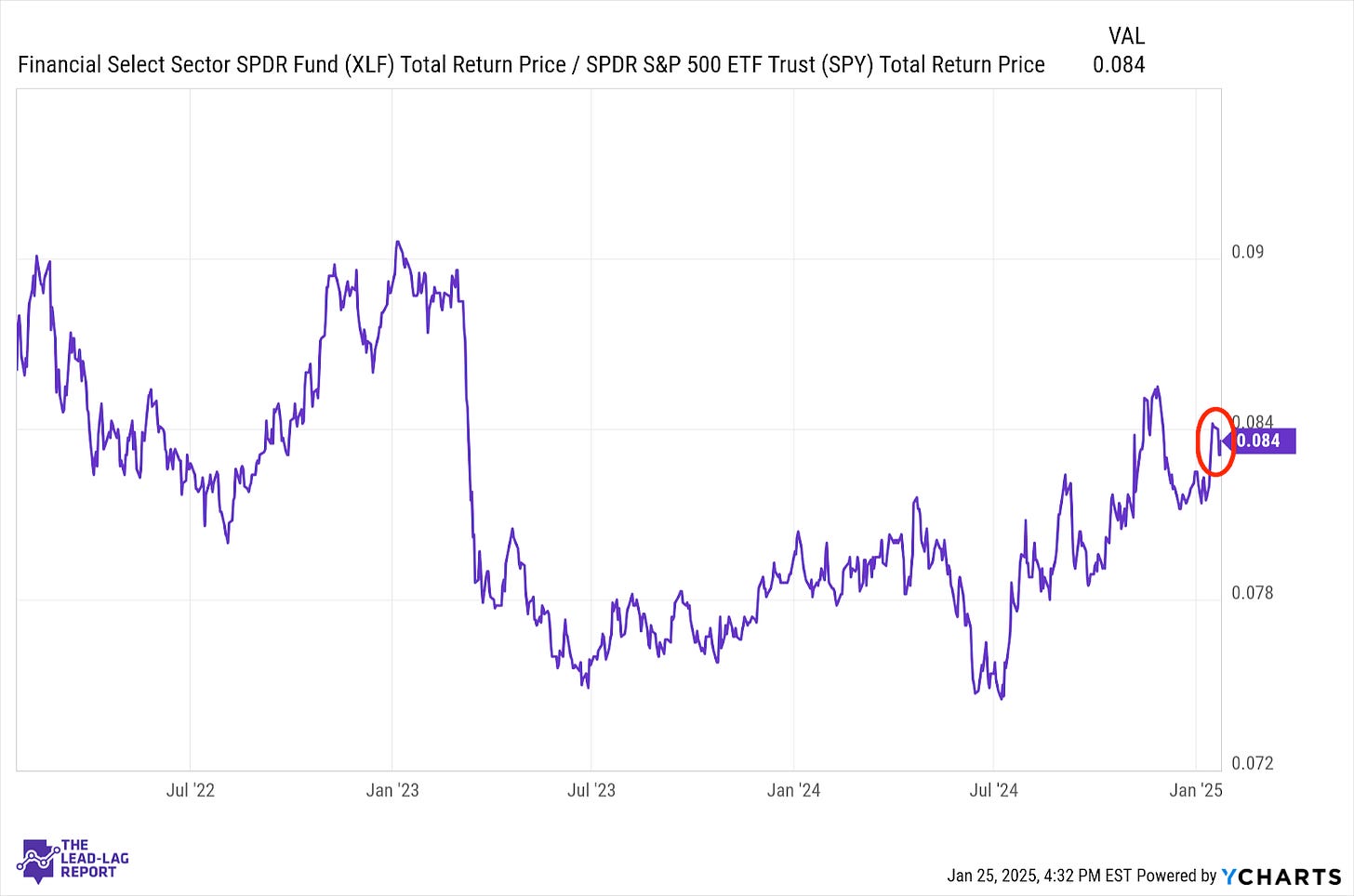

Financials (XLF) – Credit Conditions Remain A Concern

The outperformance of financials has generally been tied to the rise in longer-term interest rates over the past six months. Over the past two weeks, the 10-year yield has dropped by 25 basis points, so it stands to reason that we could see banks underperform for a little while. Credit conditions remain a concern, but it’s encouraging that fundamental economic conditions could be ticking higher.

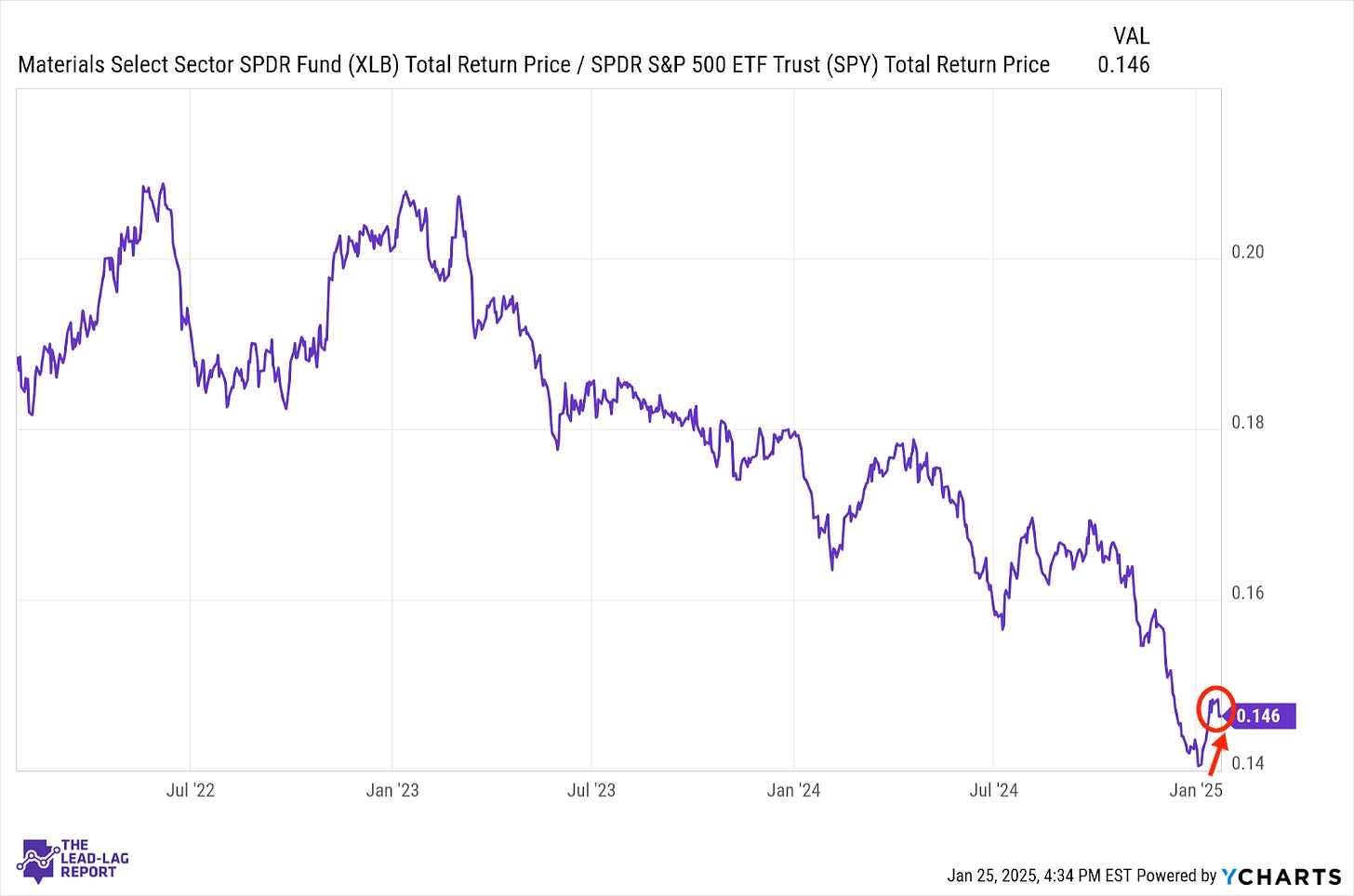

Materials (XLB) – Needs To Finally See Some Sustainability

The materials sector is one that, up until recently, has gotten almost no interest from the street. Some improved sentiment rewarded investors with one of the market’s better pops (commodities and lumber prices have been doing better lately), but we’re at the point where we need to see some sustainability. The last couple of bounces were met with further underperformance pretty shortly thereafter.

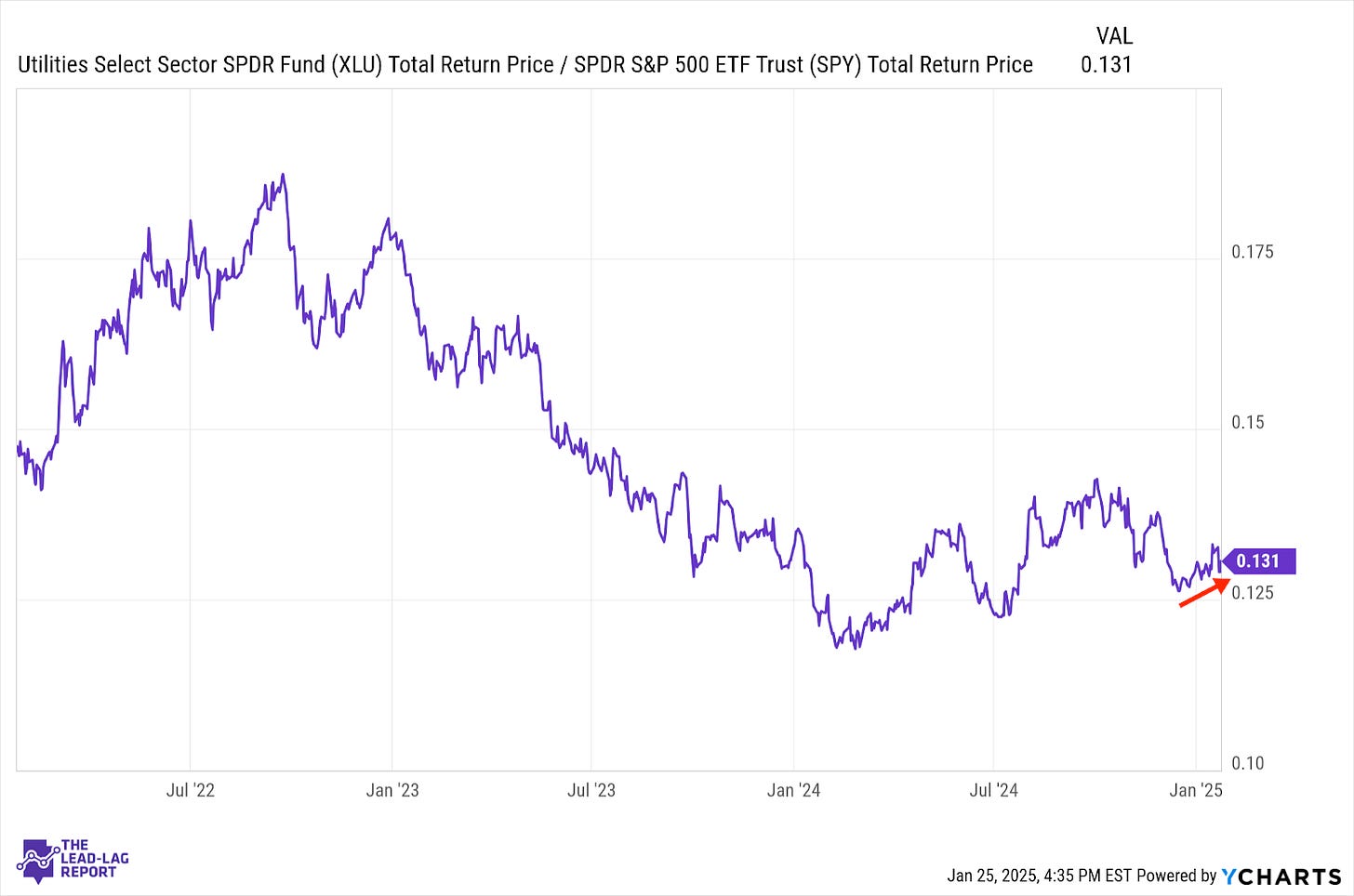

Utilities (XLU) – Pulled Down By AI?

Utilities has been steadily outperforming the market for about a month now, but it really hasn’t been signaling risk-off conditions for the broader market up until this week. The fact that this sector was actually underperforming tech for chunks of the day on Monday is curious, but could reflect the energy piece of the AI narrative.

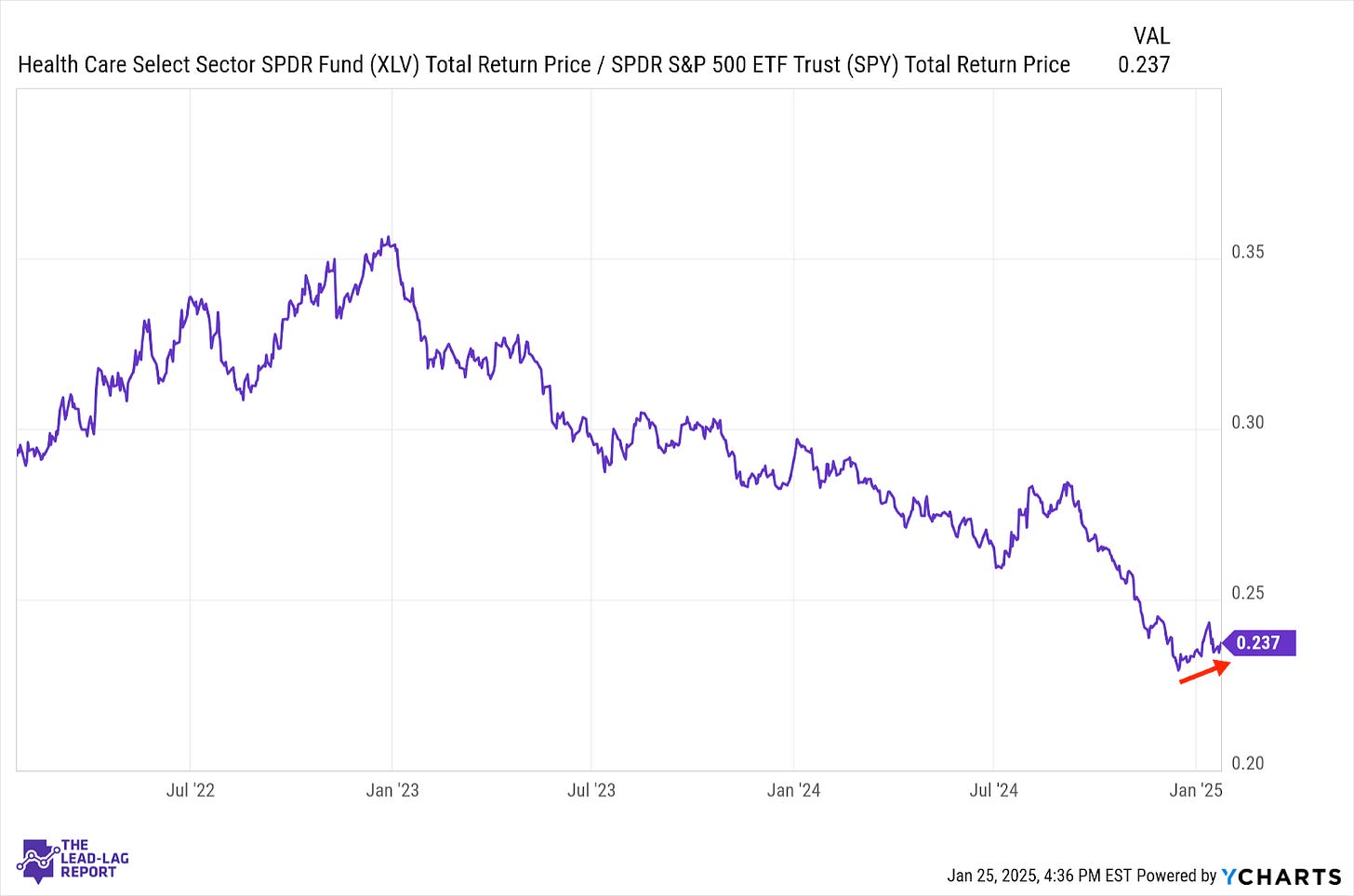

Health Care (XLV) – Classic Risk-Off Returns

Healthcare has quietly been showing some improvement here, which could ultimately be a stronger risk-off signal. This sector has rarely outperformed over the past two years, which is generally consistent with the rise we’ve seen in U.S. stocks over that time. Now that it’s starting to lead again (and outperformed the market by a wide margin on Monday) could be a sign that classic risk-off is returning.

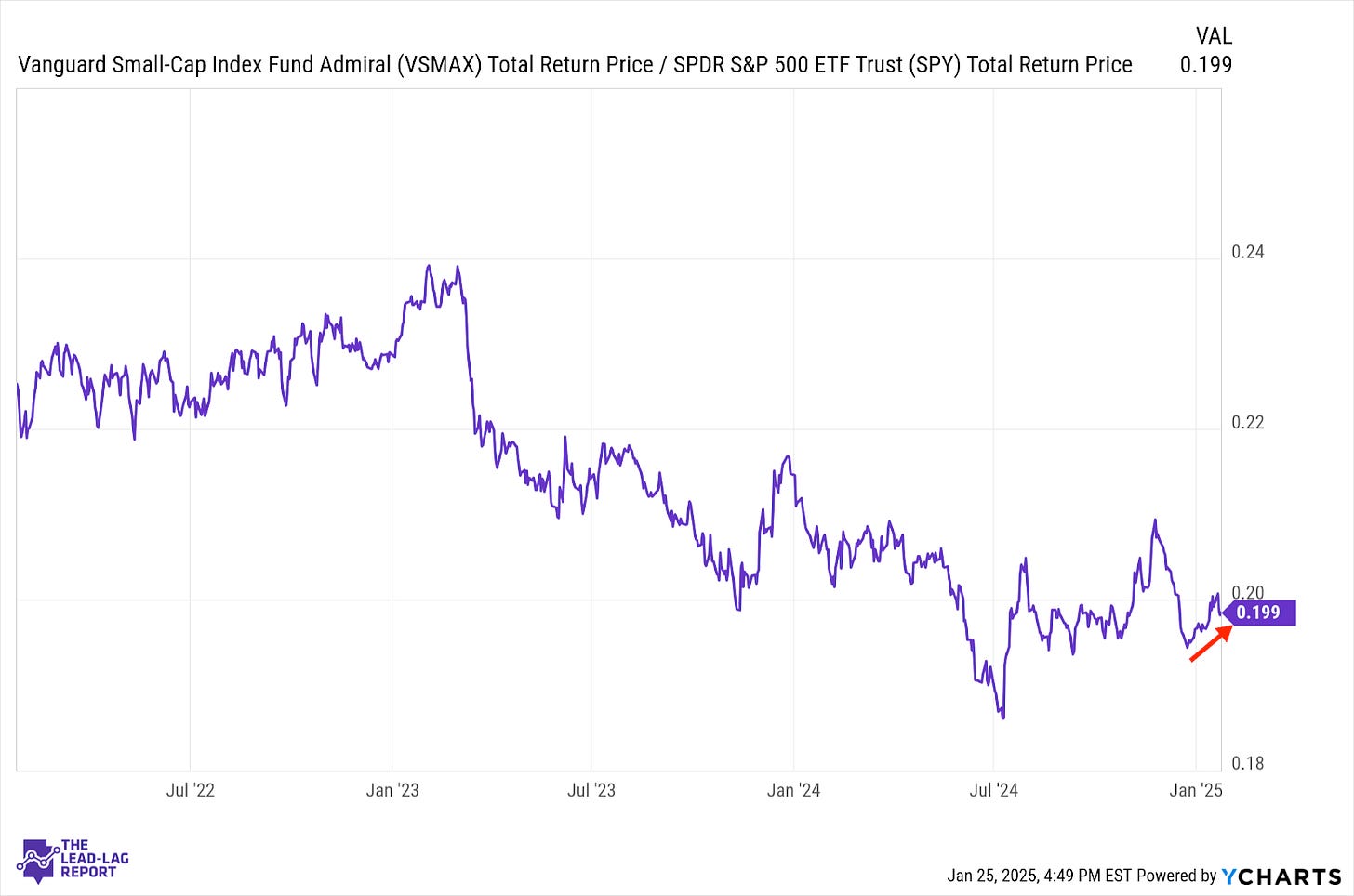

Small-Caps (VSMAX) – The Case For Leadership

Small-caps, not surprisingly, held up much better in Monday’s carnage, but this is a trend that’s been developing for weeks. If DeepSeek is the real deal, it’s reasonable to think that valuations in the mega-cap names are about to get trimmed. Small-caps are much more cyclical and value-oriented, which could be a further catalyst for outperformance here.

Special Announcement

Today’s Lead-Lag Report is brought to you by our friends at YCharts.

‘Sell in May and go away,’ ‘Timing the market is the key to success,’ and of course, the all-time favorite, ‘Now is the wrong time to invest.’

Advisors hear these classic financial myths all the time, and yet, clients continue to believe them.

YCharts’ Debunking Financial Myths Deck is packed with data and visuals that advisors can use to tackle these tired misconceptions and help clients start 2025 with clarity and confidence in their financial goals. This is the kind of resource you’re going to want to have in your back pocket ready for any client or prospect meeting.

Download your copy of the deck, and get 15% off your initial YCharts Professional subscription when you tell them I sent you (new customers only).

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been given access to YCharts for free. The information provided in the link is solely the creation of YCharts. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of YCharts, and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

Long Bonds (VLGSX) –DeepSeek Could Trigger A Sharp Reversal

Long-dated T-bonds have been leveling out relative to the broader bond market, so there was a sense that the bleeding had stopped well before this week. The DeepSeek development could be the biggest risk-off catalyst the market has seen since the yen carry trade reversed in August. If investors are really rethinking tech valuations and returns on AI capex, I think this ratio could rise sharply and quickly.

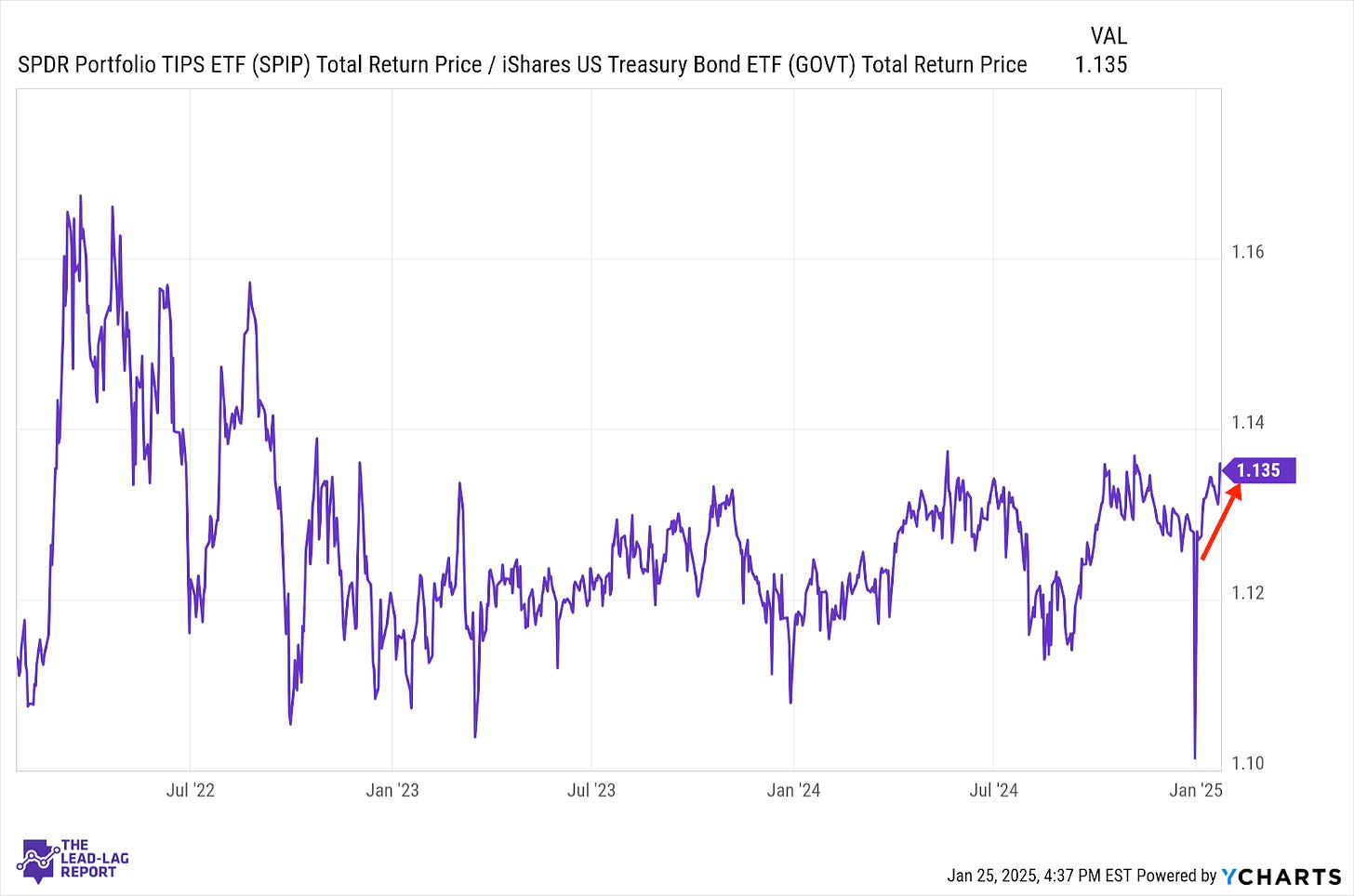

Treasury Inflation Protected Securities (SPIP) – Deflation Scare

Investors haven’t shown much interest in layering on inflation protection despite some bias to the upside. What’s happening with DeepSeek, however, could be a short-term deflation scare. TIPS haven’t necessarily done a good job in recent months in gauging inflation sentiment in this market, so I’m skeptical we’d see a sharp downturn in this ratio.

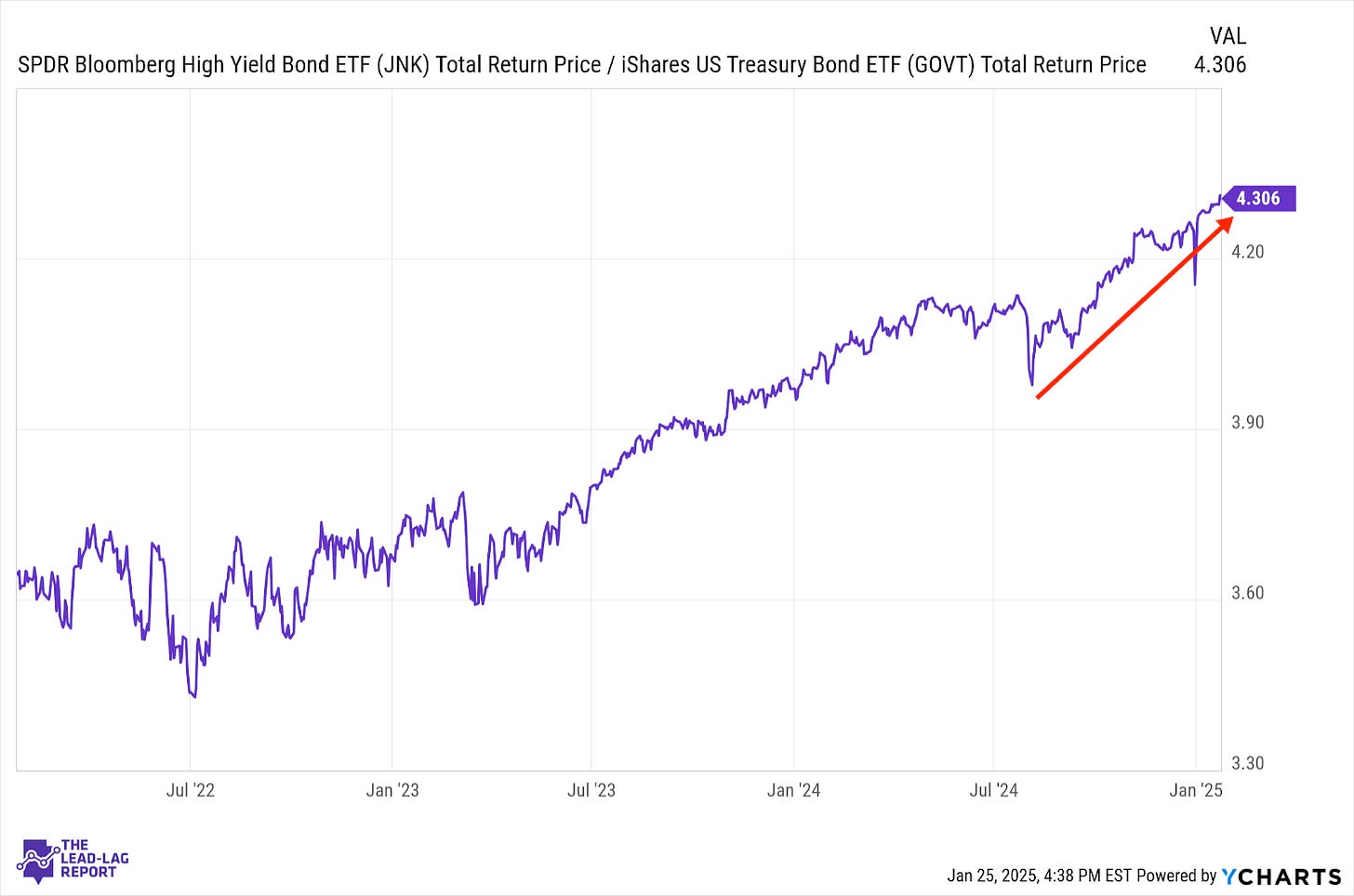

Junk Debt (JNK) – Is This What Unsticks Spreads?

Even though the DeepSeek development would indicate a flight to safety pulse here, junk bonds are still managing to make gains. With spreads sticking at 16-year lows, I’ll be interested in seeing if this is a catalyst that could “unstick” them finally. There have been events that have shocked spreads into expanding, most recently the reverse yen carry trade, but investors seem quite convinced at this point that credit risk is still non-existent.

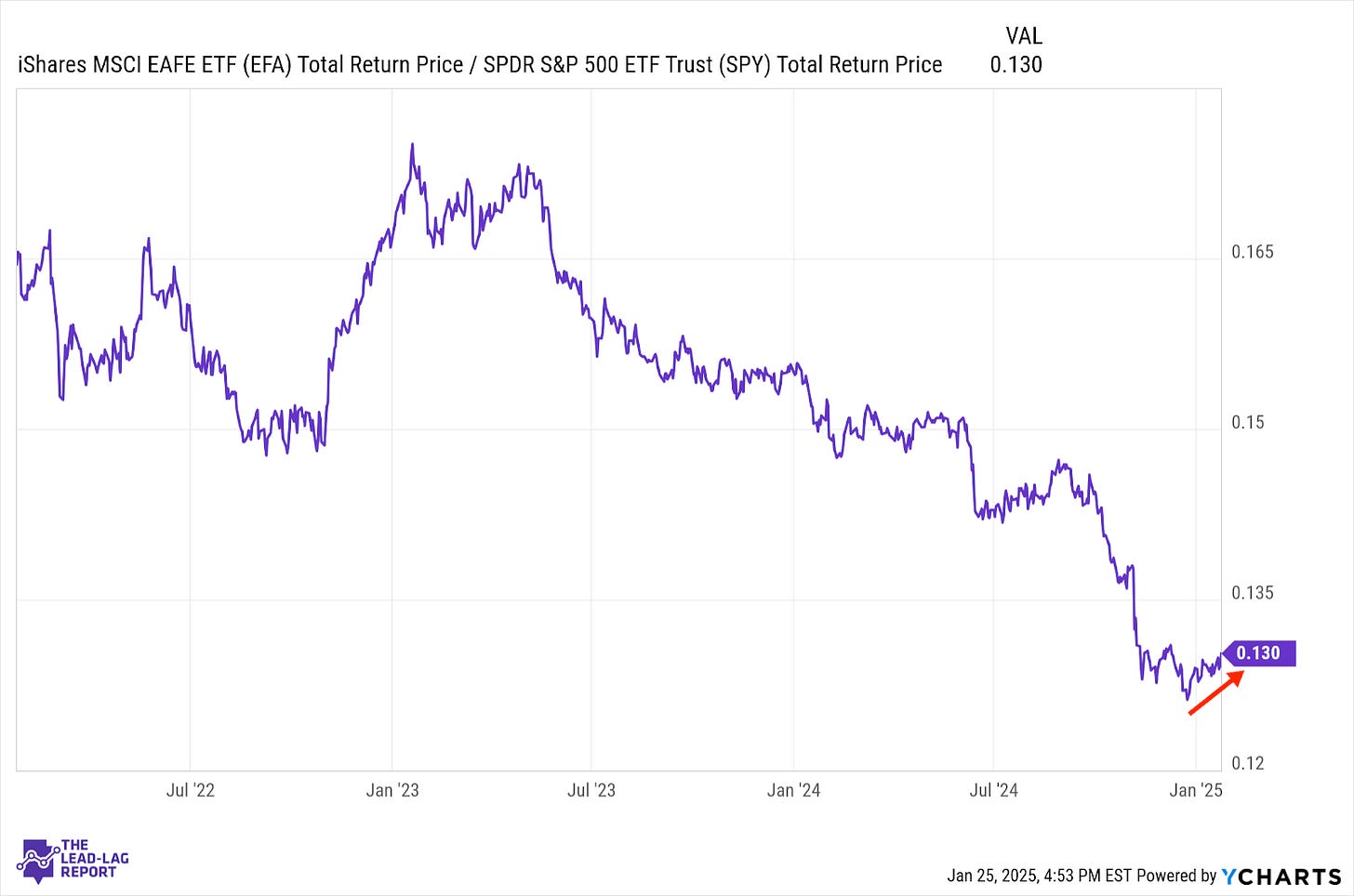

Europe, Australasia, and the Far East (EFA) – A Sustainable Reversal Could Be Near

As value and defensive issues slowly come back to life, so do international stocks. While sentiment has been pretty pitiful for this group for years, there’s a case to be made that this could be a sustainable move. If stocks reverse higher on the appearance of an improvement in conditions, the early stage rally could commence. A series of rate cuts from central banks coupled with the recent reversal higher in growth and manufacturing data could be the triggers.

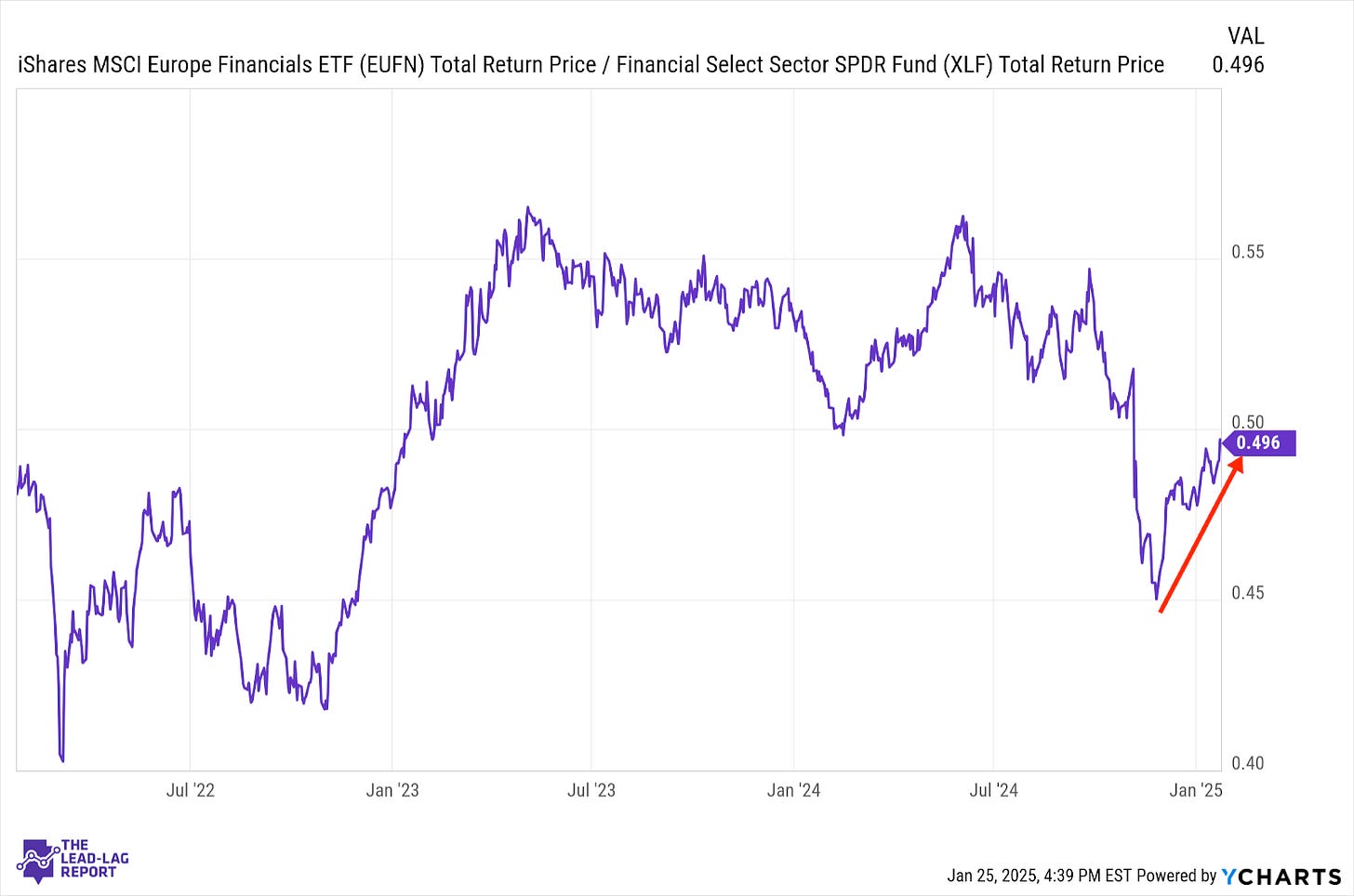

European Banks (EUFN) – Advent Of A Reversal

European financials have been one of the best performing groups within the region and the upside might not be done. The region is still facing recession risk, but the latest batch of data suggests that a bottom might actually be forming. If there are firmer signs of recovery and Europe equities are able to stage a reversal higher, this could be one of the biggest beneficiaries.

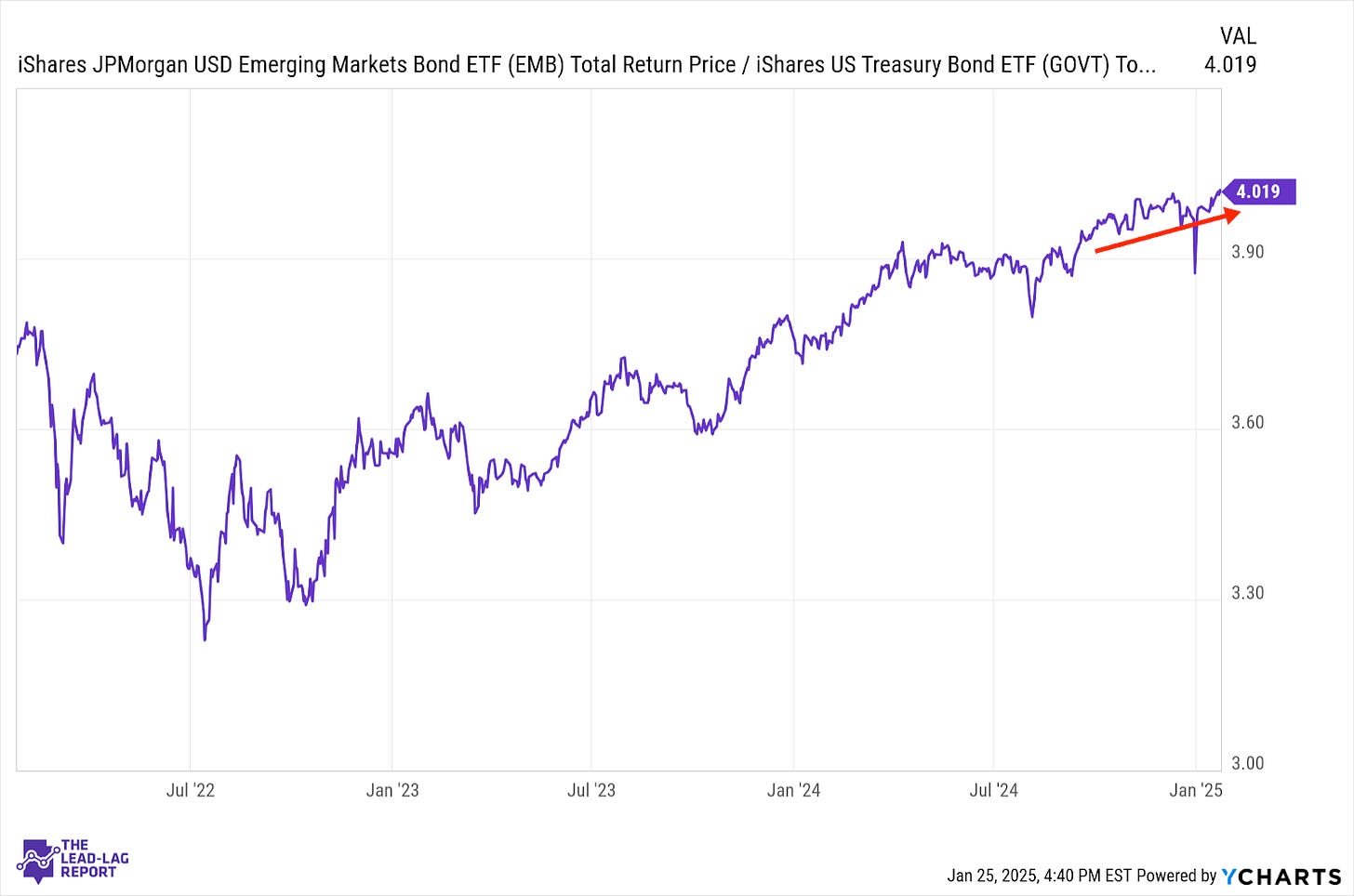

Emerging Markets Debt (EMB) – Dollar Catalyst

Emerging markets bonds are still making some progress here, although it appears to be slowing somewhat. Gains over the past couple of years have been achieved despite the dollar trending stronger, so the latest dollar weakness could be a big catalyst. Sentiment in Asia, especially China, remains cautious, but anticipated central bank easing could be a tailwind.

LAGGARDS: DEEPSEEK DEEP SIXES THE MARKET

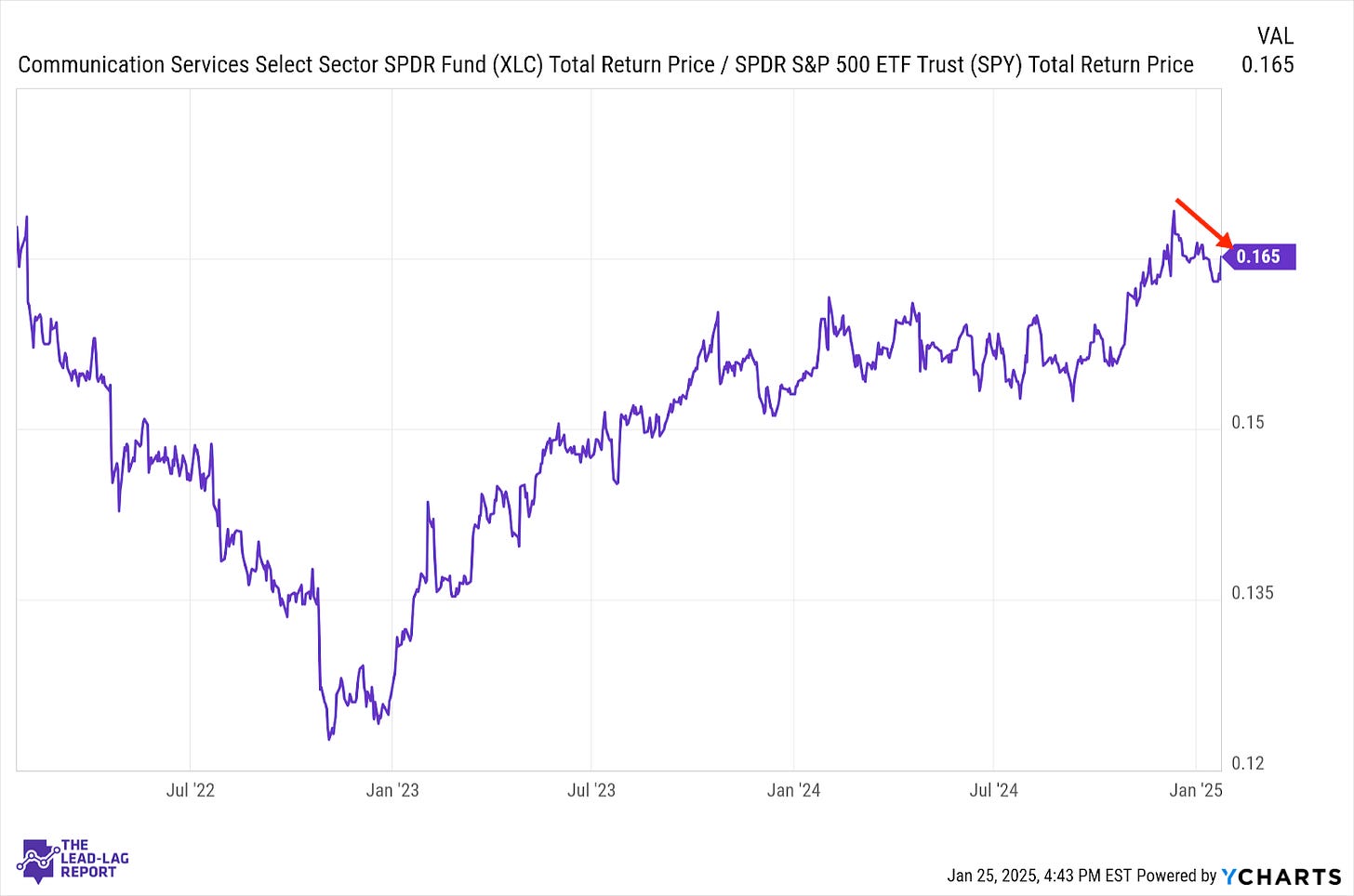

Communication Services (XLC) – Dragged By AI Risk

Investors may not be watching this sector as close as technology in the DeepSeek drama, but they should. Alphabet and Facebook are major players in the AI war and have similarly committed major capital to its growth. Investors will be much more eager to see returns on existing capex spending now and any lack of progress could be dealt with harshly.

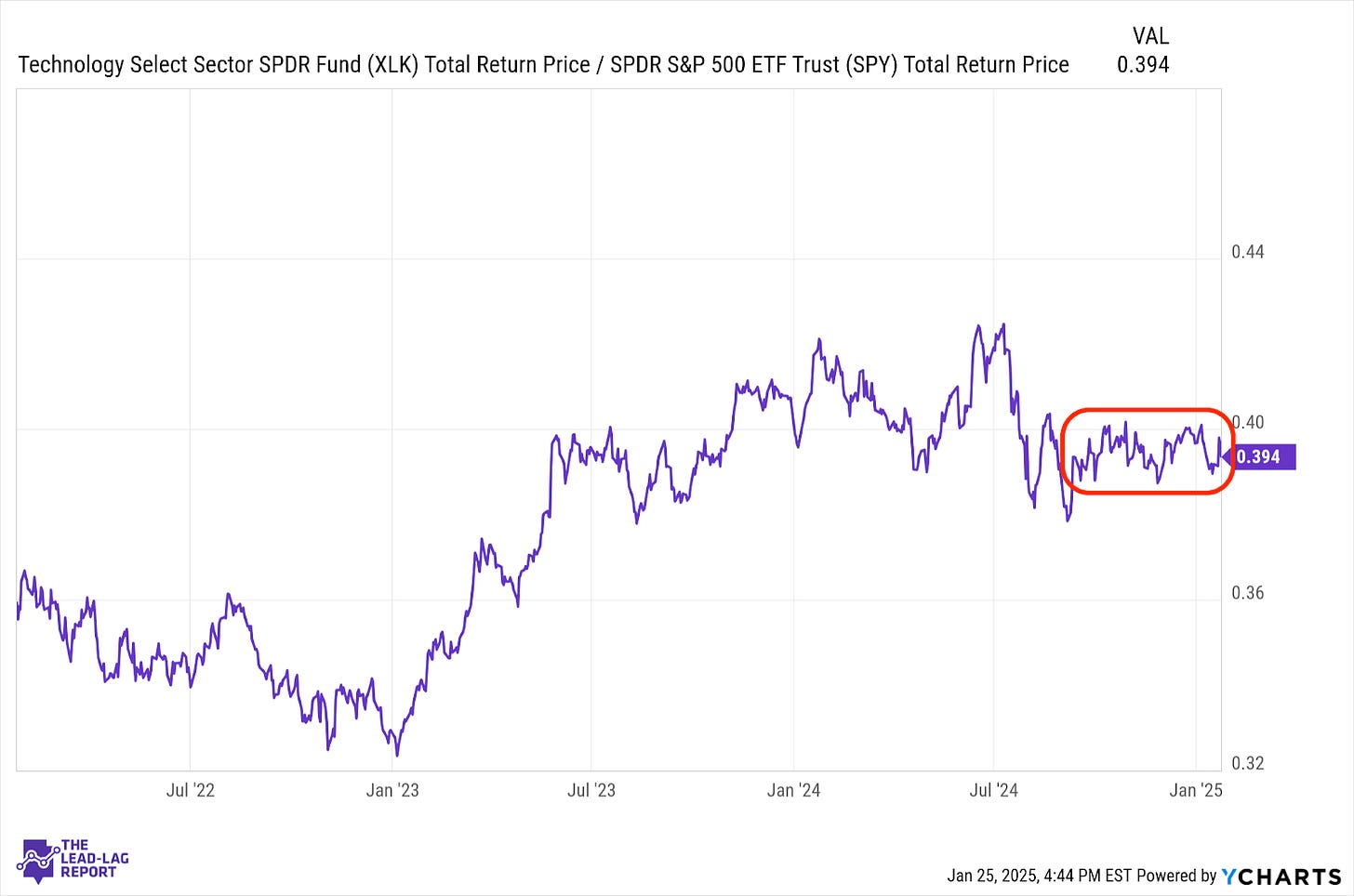

Technology (XLK) – DeepSeek Resets The Market

If China’s DeepSeek is the real deal, it could completely upend what we think we know about the AI market. If U.S. tech giants are spending tens of billions of dollars on AI development, while China can create a comparable product with older chips and just a $6 million investment, is the profit ceiling suddenly much lower? And could China win the AI race? It’s still early, but investors seem ready to take some froth off of the sector.

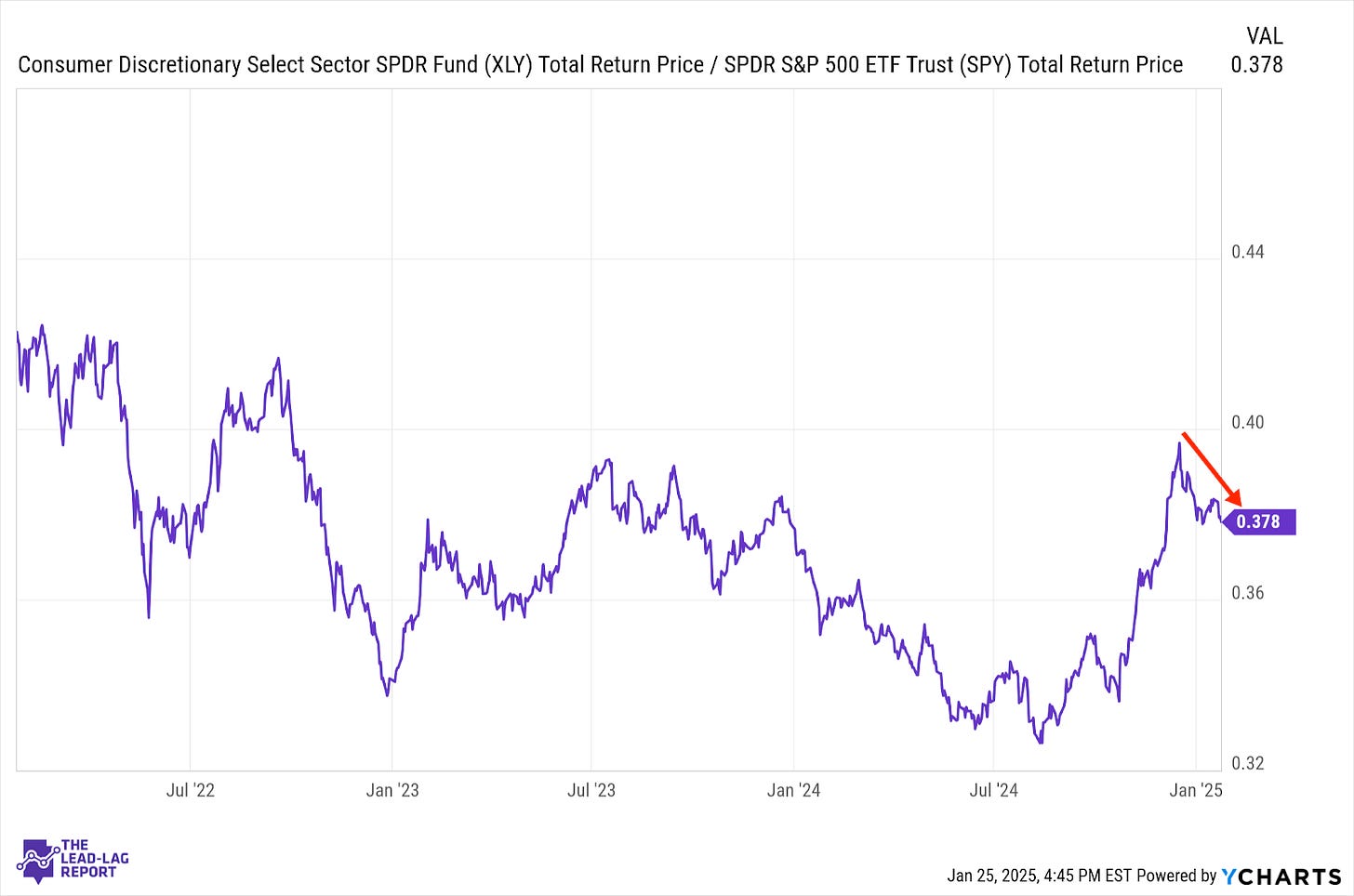

Consumer Discretionary (XLY) – Two Negative Factors

After leading the market from the end of last summer through the election cycle, discretionary stocks have done an about face. The overall supporting data - consumer spending, retail sales, etc. - still look pretty positive, but I think we’re running into two issues here - deteriorating sentiment for traditional growth sectors as a whole and concerns about tariffs. The latter would almost certainly damage retail sentiment quickly.

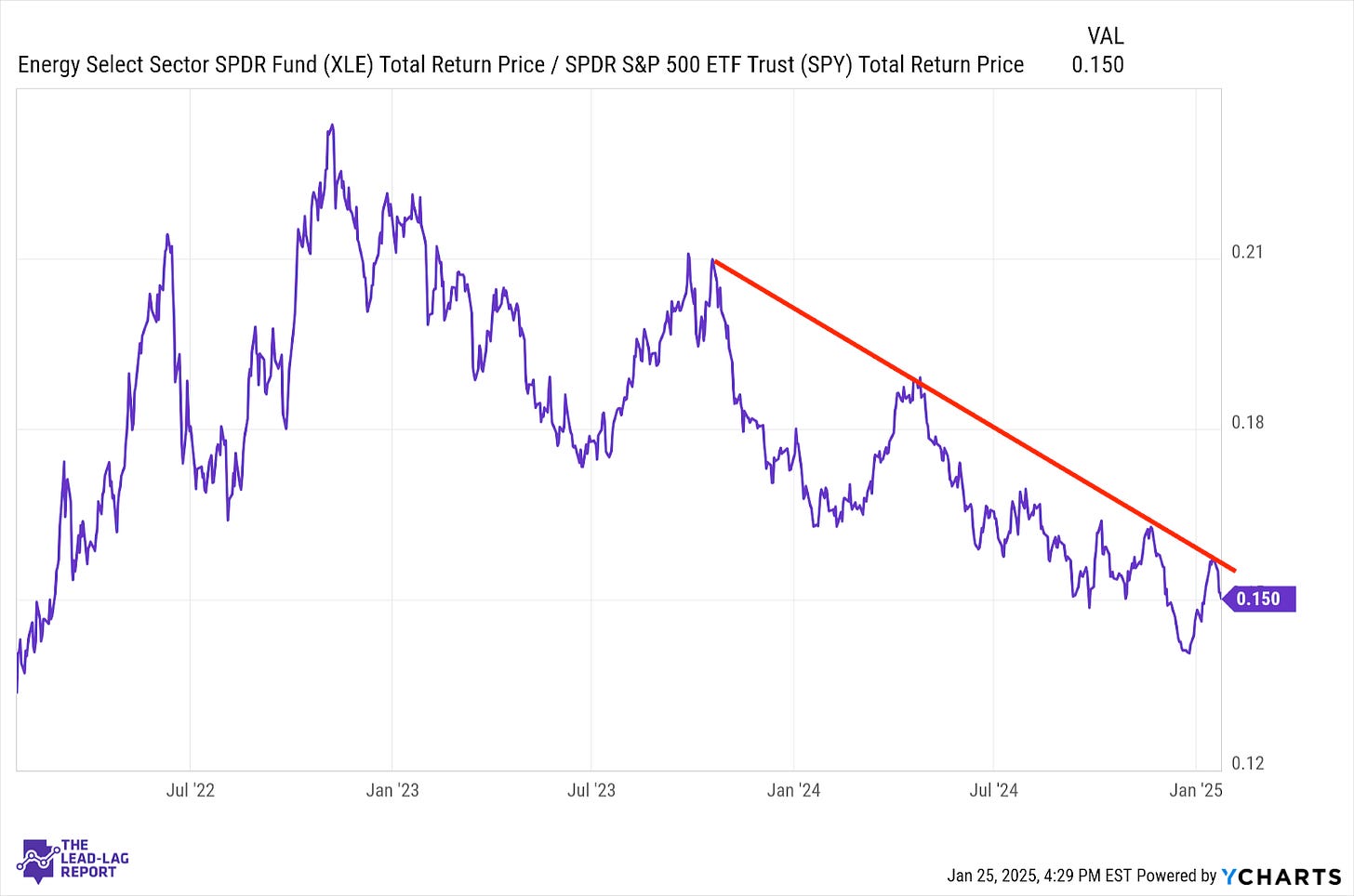

Energy (XLE) – Geopolitical Risks Calm…For Now

While energy stocks have had their moments, they’ve still been failing to create anything sustainable. Geopolitical risks seem to have calmed down for the time being, but the Trump tariff threats, including what happened with Colombia, mean that risks could reignite at any moment. The recent uptick in manufacturing readings, both in the U.S. and Europe, could bode well for short-term sentiment.

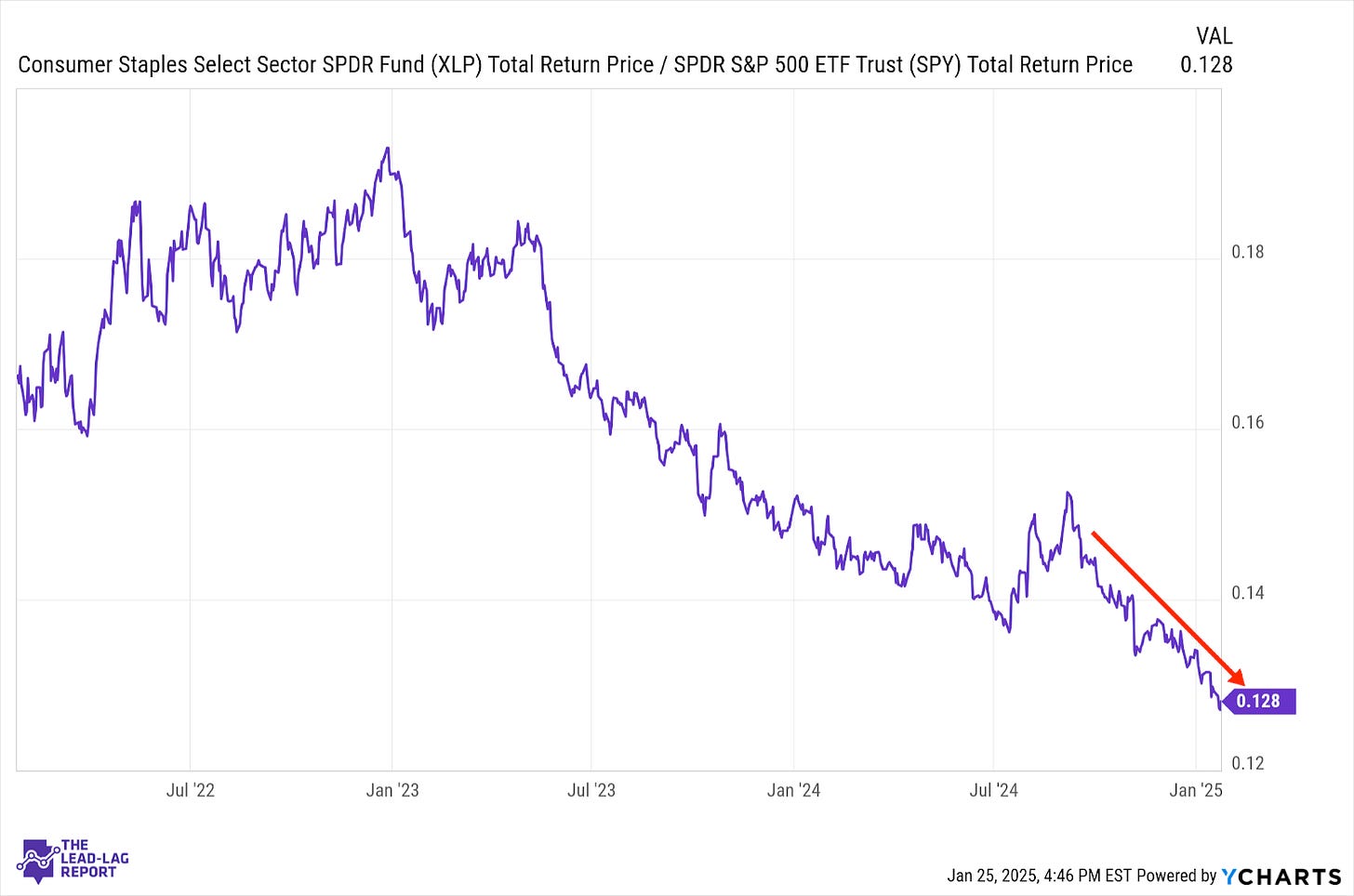

Consumer Staples (XLP) – Preview Of Risk-Off Potential

Keeping with the retail theme, staples have demonstrated nothing but underperformance since the end of August. The lack of interest in defensive issues, in general, has certainly contributed, but this is the area where we may be seeing more concern about the consumer environment. On the other end, this sector was a huge winner in Monday’s DeepSeek market rout, so it could be a big outperformer if these risk-off conditions persist.

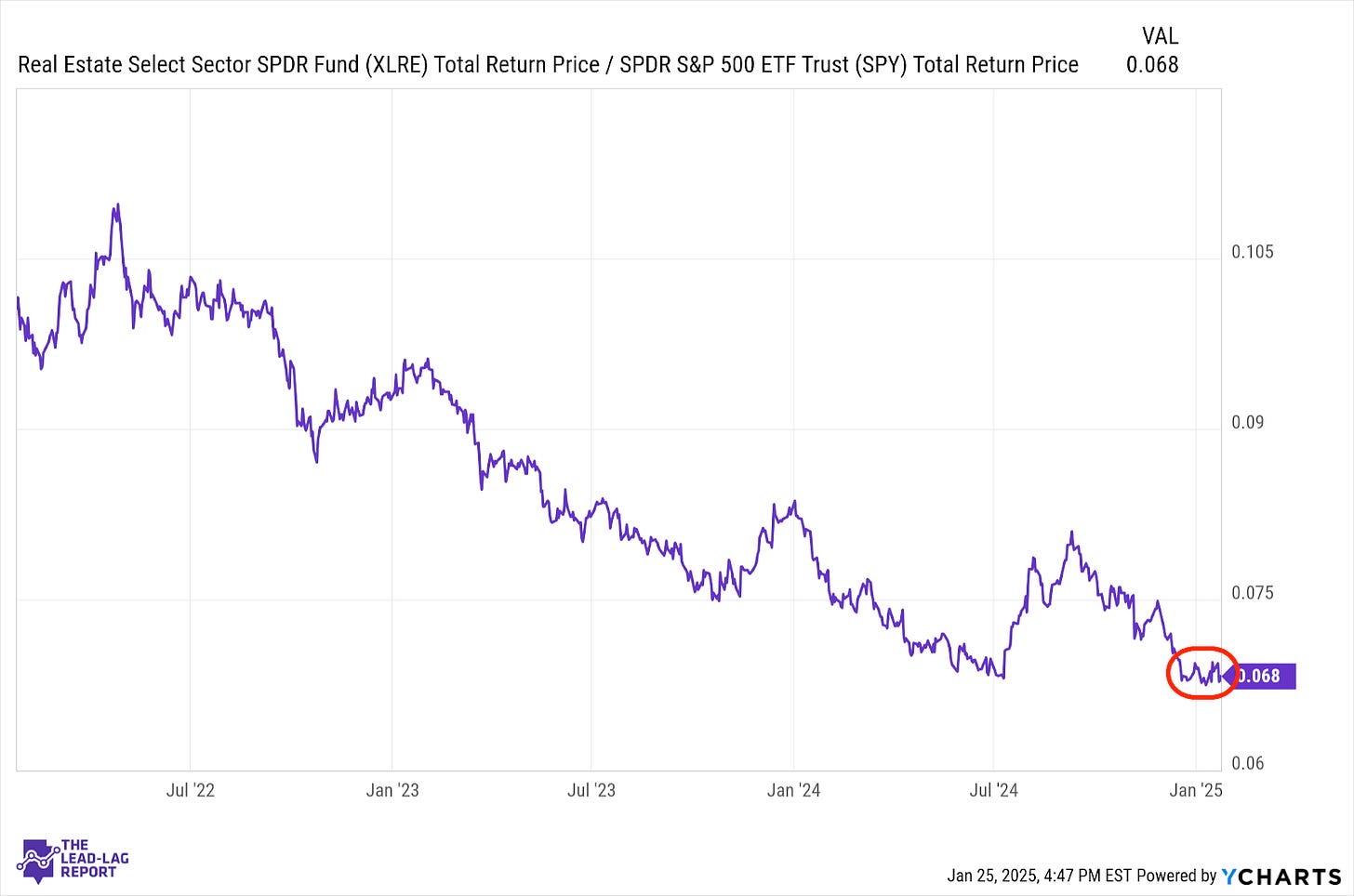

Real Estate (XLRE) – Short-Term Comeback Potential

REITs have a long way to go to look fundamentally sound, but the recent improvement in housing activity is a good start. So is the recent pullback in long-term yields. This ratio has been building a base for several weeks, so there is the potential that it could take off if these trends continue, but there’s a lot of work to be done still on the fundamental side.

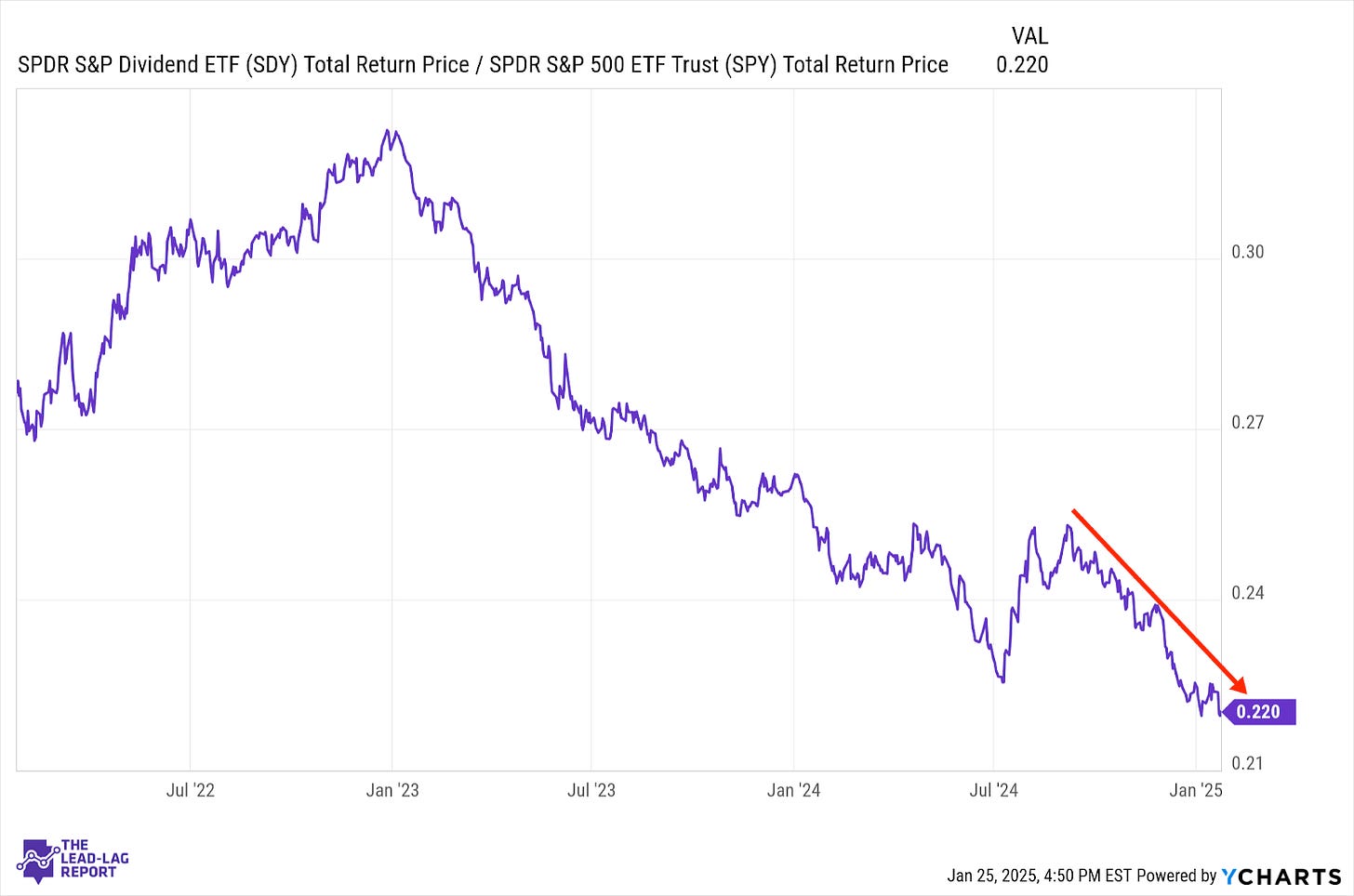

Dividend Stocks (SDY) – A Chance At Leadership

Even though individual defensive and cyclical sectors have had moments of leadership over the past several months, there’s not been enough consensus to make dividend stocks a leader. Monday’s tech rout could change the picture. All of the big dividend stock sources outperformed the broader market, which bodes well for this group if this momentum can continue.

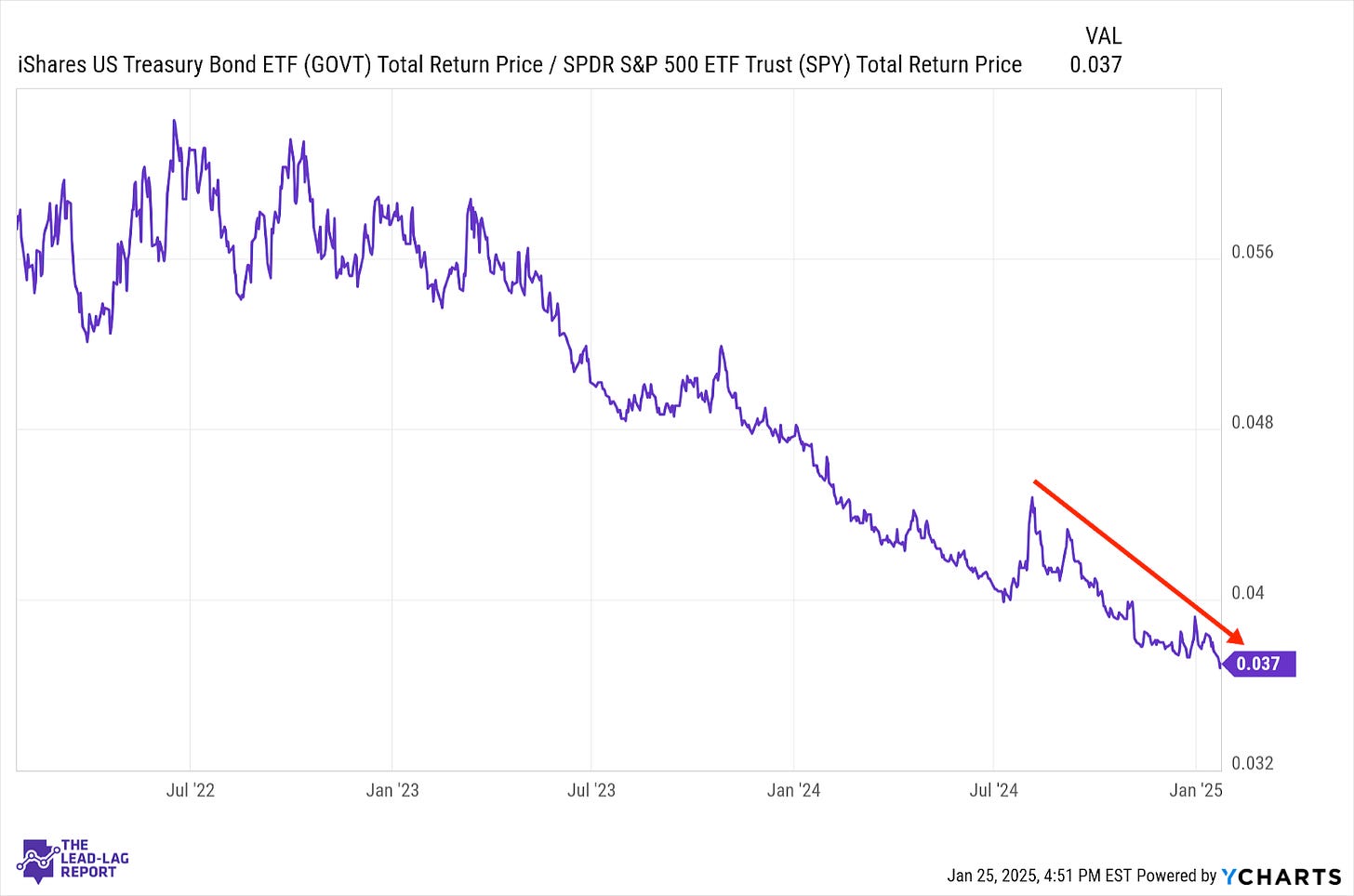

Bonds (GOVT) – Big Risk-Off Shift

Even though bond yields have dropped substantially over the past couple weeks, the group is still underperforming stocks, suggesting there hasn’t been a big flight to safety move over the recent past. That changed on Monday when Treasuries, value, dividends, low volatility, staples and healthcare weren’t just outperformers. They were big gainers. This was a very risk-off move that could mark a turning point for Treasuries.

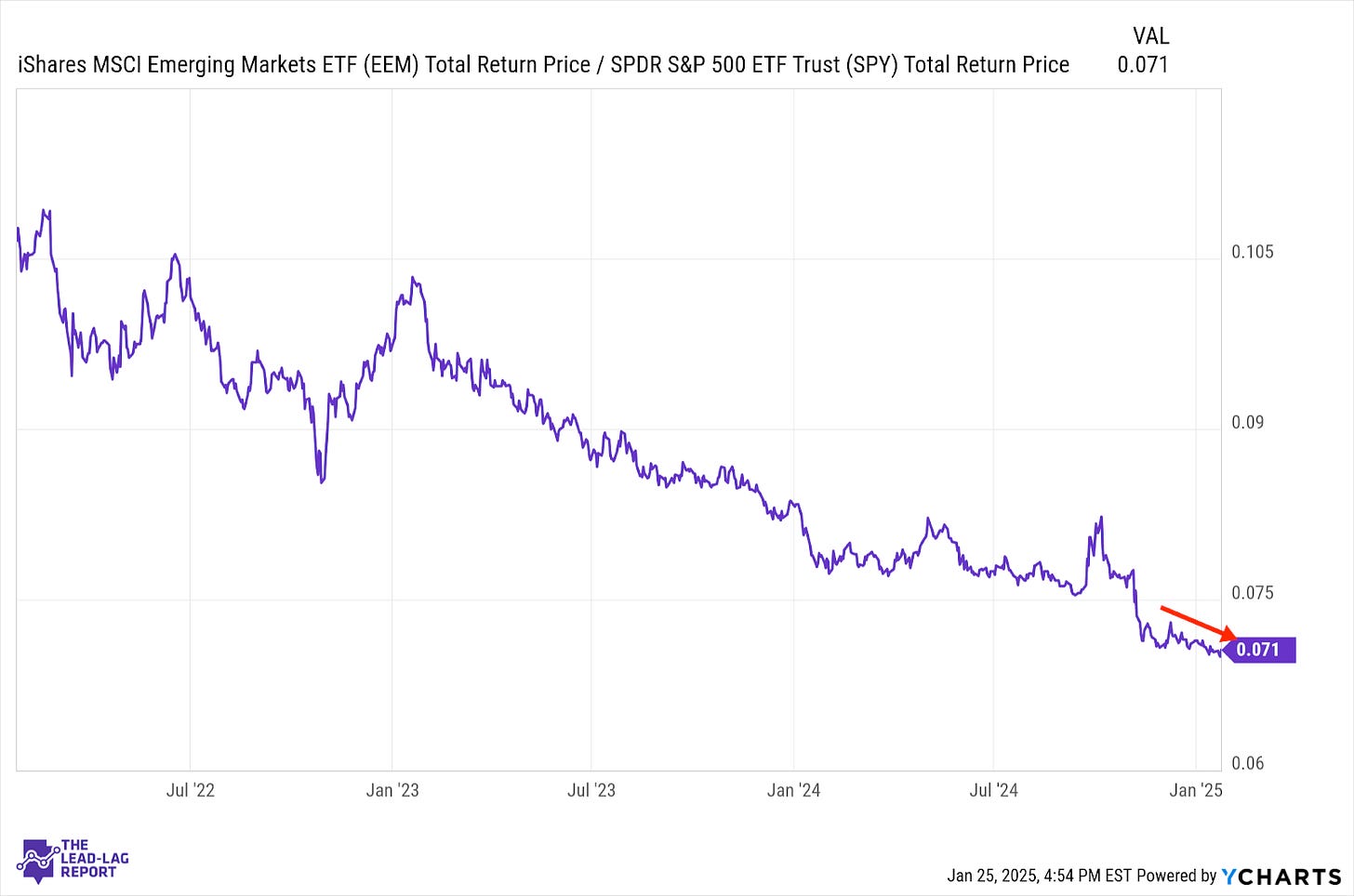

Emerging Markets (EEM) – Is DeepSeek The Catalyst?

If developed markets are starting to outperform again, there’s no such behavior in emerging markets. Asian equities are still struggling, led by two of the group’s biggest economies, China and India. The latter looks to be broken for the time being, but DeepSeek could spark a reversal higher in Chinese equities, which is what happened on Monday.

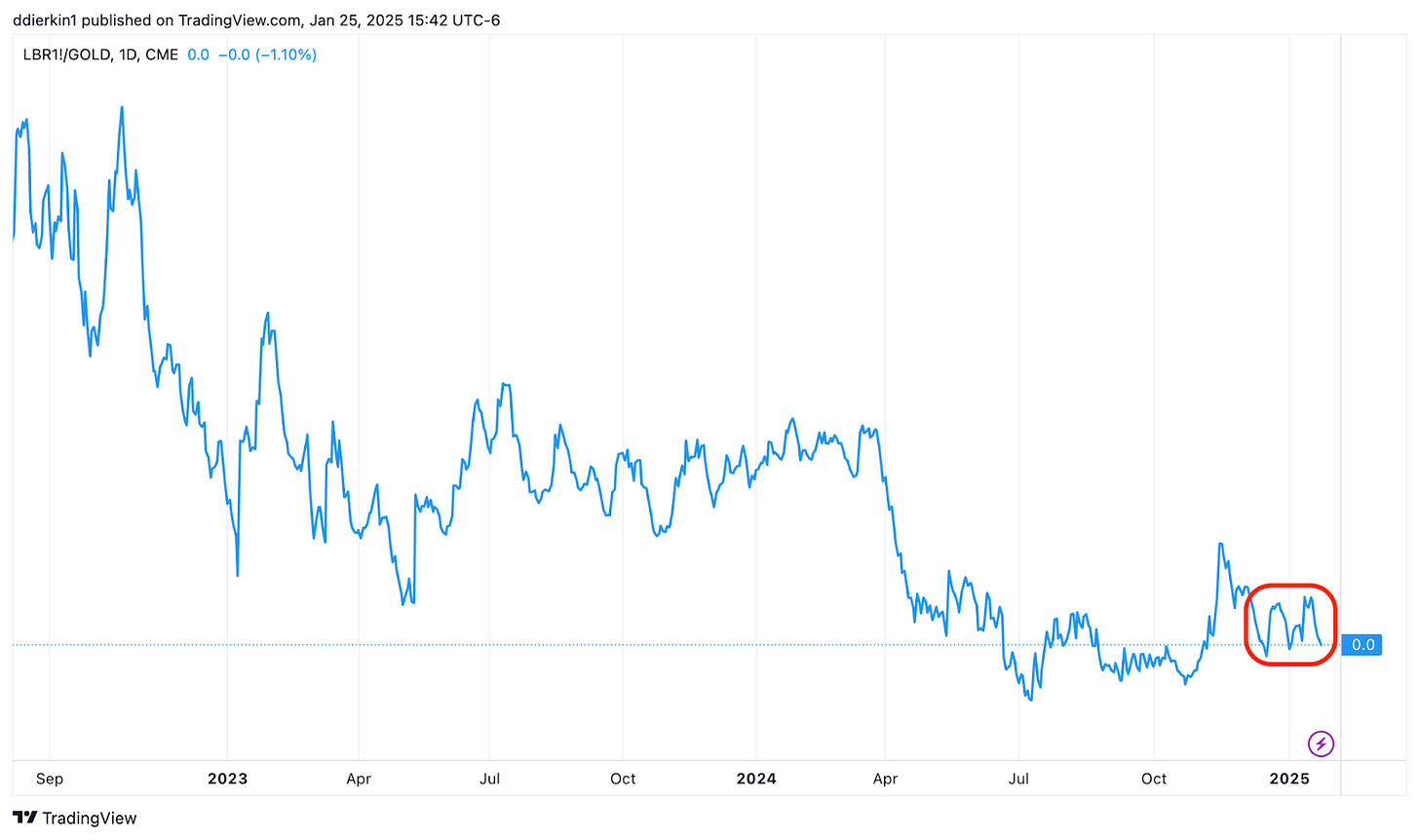

Lumber (LUMBER) – Volatile, But No Progress

Lumber prices have bounced up and down over the past three months without much progress. Gold is still trying to establish a new high, although it’s topped out just north of $2800 for the second time since October. Home sales data provides some reason for optimism, but the current correction in lumber prices over the past week suggests that the market remains unconvinced.

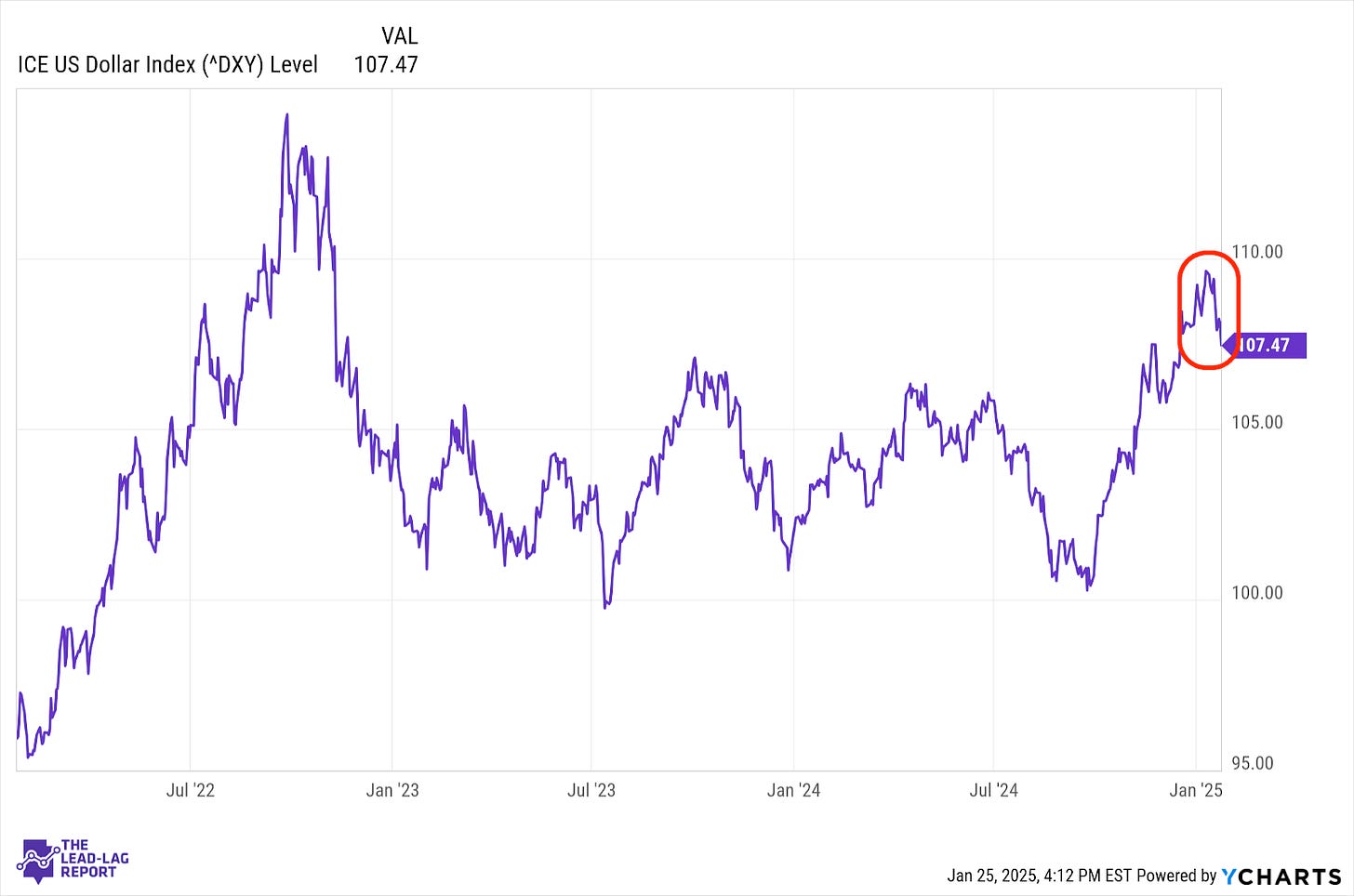

U.S Dollar ($USD) – Trio Of Downside Catalysts

The dollar has made a sharp reversal thanks mostly to a rate hike by the Bank of Japan, but also thanks to a series of economic data showing some improvement in regions outside of the United States. The DeepSeek-induced flight to safety pulse has also pulled yields lower creating a trio of catalysts that may keep the dollar depressed for a little while.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

another excellent overview.