Tech Titans Lead the Charge: Exploring the Razor-Thin Playing Field in Today's Market

A Very Narrow Market

Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: TECH LEADS A VERY NARROW MARKET

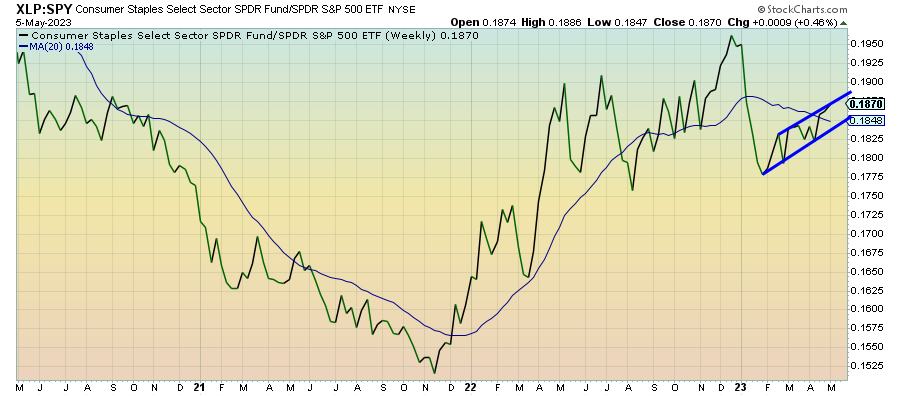

Consumer Staples (XLP) – Sentiment Swings, But Story Is Still A Positive One

Even as investors continue to remain willing to push into risk assets, consumer staples is the one defensive group that’s still leading the market higher. Earnings results were generally pretty good for this sector and consumer spending for core expenses is still healthy, even as discretionary spending slows. Short-term sentiment has swung positive again and that could slow some current momentum, but this sector still looks to be positioned nicely in 2023.

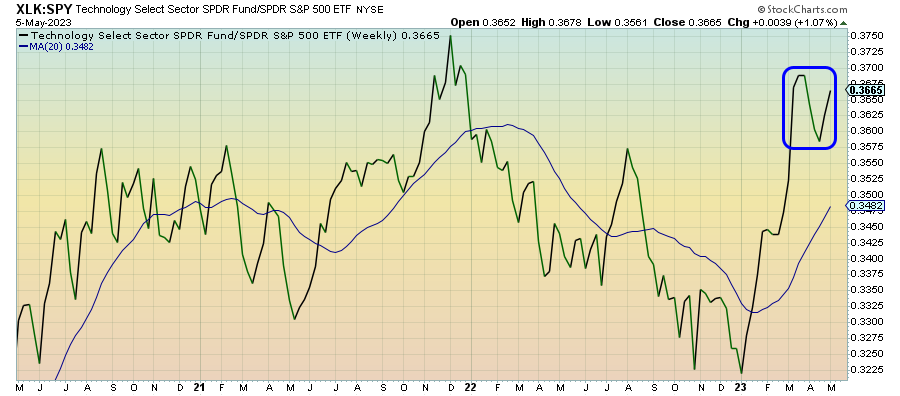

Technology (XLK) – Not As Broadly Strong As It Looks

Tech stocks are suddenly getting bounced around quite a bit, but good news from the Fed and the labor market is pulling the buyers back in. I want to emphasize, as I did last week, that the gains in this ratio are being driven by a few mega-caps. The broader sector has not performed nearly as well and I think we need to pay attention to that as a sign of sentiment. Tech is still a “safe place” for some investors, but the volatility is concerning.

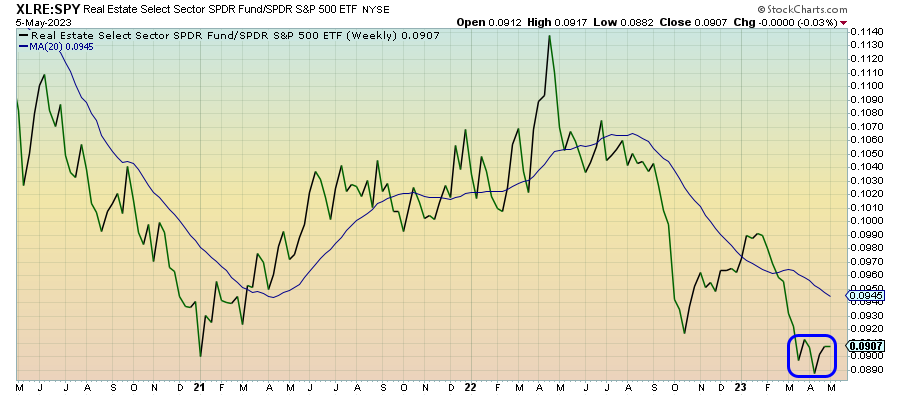

Real Estate (XLRE) – Significant Repricing At Hand

This is the one sector where I’d be inclined to ignore short-term price fluctuations and pay more attention to the macro narrative. That narrative would be that the commercial real estate sector is deteriorating substantially, fueled by the work-from-home trend, and an inevitable tightening in the credit cycle won’t likely help spur increased demand. I still believe conditions are ripe for a significant repricing as lumber prices tumble and vacancy rates rise.

Communication Services (XLC) – A Bullish Backdrop For Now

Communication services stocks are kind of holding the line here, seemingly past the conditions that saw them underperform in 2022, but also seeing the 2023 rally starting to fizzle. The positive earnings results from Facebook and Alphabet are certainly providing a bit of a bullish tone to the sector, but the ad revenue environment, while solid in Q1, will need to be monitored for deterioration.

Treasury Inflation Protected Securities (SPIP) – Less Consequential Inflation Report