Large-caps have begun re-assuming the lead over small-caps again and the reasoning probably isn’t surprising. We’ve seen many times over the past couple years that investors haven’t necessarily been inclined to abandon stocks for bonds, but they have been willing to rotate into the bigger names when there are potential signs of trouble. Even though the S&P 500 and Nasdaq 100 are establishing new all-time highs, there does seem to be some damage done to sentiment by the ongoing threat of tariffs and current mass layoffs being executed by DOGE. Perhaps that’s why retail sales took a dive in January; people are growing more concerned about their personal situations and are tightening the purse strings a bit.

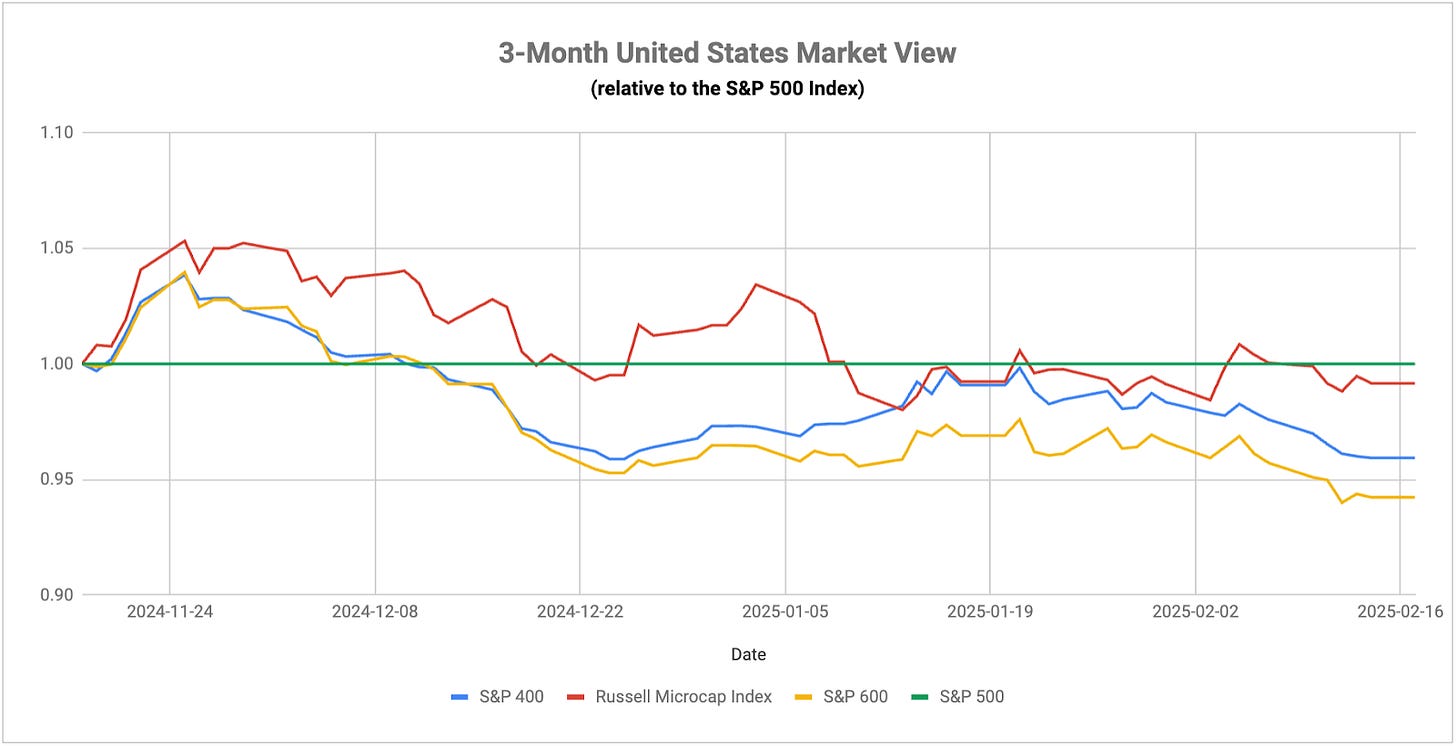

The market is continuing to broaden out to some degree and tech is no longer the market driver it once was. As it stands right now, tech is the 3rd worst performing sector year-to-date and is trailing the S&P 500 by nearly 1%. Part of the reason is the trend in corporate earnings. While mag 7 growth rates are still high, they’re definitely coming down from their AI mania peak. Conversely, earnings at a high level from areas outside of mega-cap tech are actually improving. That’s helping to contribute to traditionally lagging sectors, such as materials and healthcare, to suddenly turn into market leaders. Small-caps also had a comparatively better earnings beat rate in Q4, but it hasn’t translated into outperformance there yet. Growth and high beta themes are still doing well, but it’s branched out beyond just narrow tech leadership.

The mass layoffs currently being executed in the name of efficiency could have much broader implications. Not only will it impact consumer spending and economic growth, it could have a major effect on the housing market. In Washington DC, where the majority of the cuts are happening right now, new real estate listings have shot through the roof. Zillow says that of the 2400 current listings in the area, about 20% of them have been added in the past two weeks. About 17% of them have recently reduced the listing price. This is how a housing market crash happens. Yes, federal workers impacted by this are a small percentage of the overall workforce, but it’s clear that the economic impact of this can extend far beyond just the people directly impacted. I’d expect more of this coming in the future.

The recent NY manufacturing report for February showed activity expanding again for the 5th month in the last seven. That’s easily the best run since the post-COVID economic rebound in 2021 and signals that the tepid recovery in manufacturing is still intact. The manufacturing outlook from the same report, however, continues to slide, reflecting the potentially challenging environment ahead on the global trade front. When you take a look at the collective headlines - manufacturing sentiment, inflation expectations, retail sales - it certainly appears that overall consumer confidence has taken a hit in recent weeks.

Europe’s impressive rally to kick off 2025 is still progressing. Most of the gains up to this point have been on the perception that the European economy might be bottoming and getting ready to finally turn the corner higher. Now, there’s a sense that this rally might have longer-term legs. In a weekend piece in the Financial Times, former Italian prime minister Mario Draghi endorsed an EU plan that would focus on revamping the European economy to be much more business-friendly and focus more on the technological advances currently transforming the global economy. While the United States and Asia are considered big tech development hubs, Europe’s economy has been considered stodgy and reliant on slow growth industries. If the EU is interested in putting forward a plan that will focus on the economic expansion of key growth areas, we could finally see the tailwind that has been absent in this region for a long time. Of course, this could be a long and drawn-out process, if it even happens to any significant degree, but it is an important recognition by the EU that the world economy is changing and it needs to change with it.

The Australian central bank joined the rest of the world by finally cutting interest rates for the first time after holding steady since Q4 2023. In cutting rates, the RBA expressed confidence in the economy’s inflation path, which has slowed to 2.4% annually and includes minor 0.2% gains in each of the past two quarters. The cut could ultimately become the first of several. GDP growth has been steadily slowing since 2022 and now is running at just 0.8% year-over-year. It also noted weakness in private sector demand and growing skepticism of whether or not consumers will be able to sustain spending to keep growth in positive territory.