This Week at a Glance

Markets cooled after an exuberant October. In the U.S., private data hinted at a softer labor market, with unemployment near 4.4% and planned layoffs at a 22-year high¹². The S&P 500 fell roughly 2.4% from recent highs but remains up double digits year-to-date³.

Abroad, the eurozone showed renewed momentum: the composite PMI reached 52.5, its best level in nearly 30 months⁴, while inflation stabilized around 2%⁵. Japan’s new government turned expansionary, pledging stimulus even as exports rose 4.2% in September⁶.

Flows revealed tension between optimism and caution. Global equity funds drew $22 billion⁷, yet money-market holdings surged to a 10-month high⁸. The dollar weakened on rate-cut bets, while the euro and yen advanced modestly.

U.S. Macro & Markets

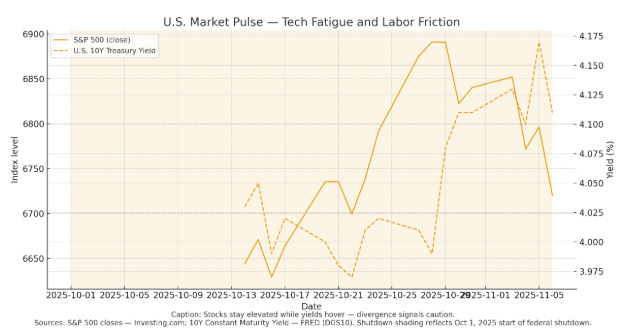

The post-AI rally hit pause. The S&P 500 slipped 2.4% over eight sessions⁹; semiconductors fell 2.4%¹⁰. Absent official data during the government shutdown, investors relied on private indicators: the Chicago Fed’s estimate of 4.4% unemployment¹ and Challenger’s report of 153,000 planned layoffs—an 183% jump from last year².

Despite warning signs, inflows remained robust. Large-cap funds added $12.6 billion¹¹ ⁷, the largest since early October, while small- and mid-caps lagged¹². Treasury yields held firm, with the 10-year near 4.1% and the 2-year 3.6%, leaving the curve ~0.55% inverted¹³ ¹⁴.

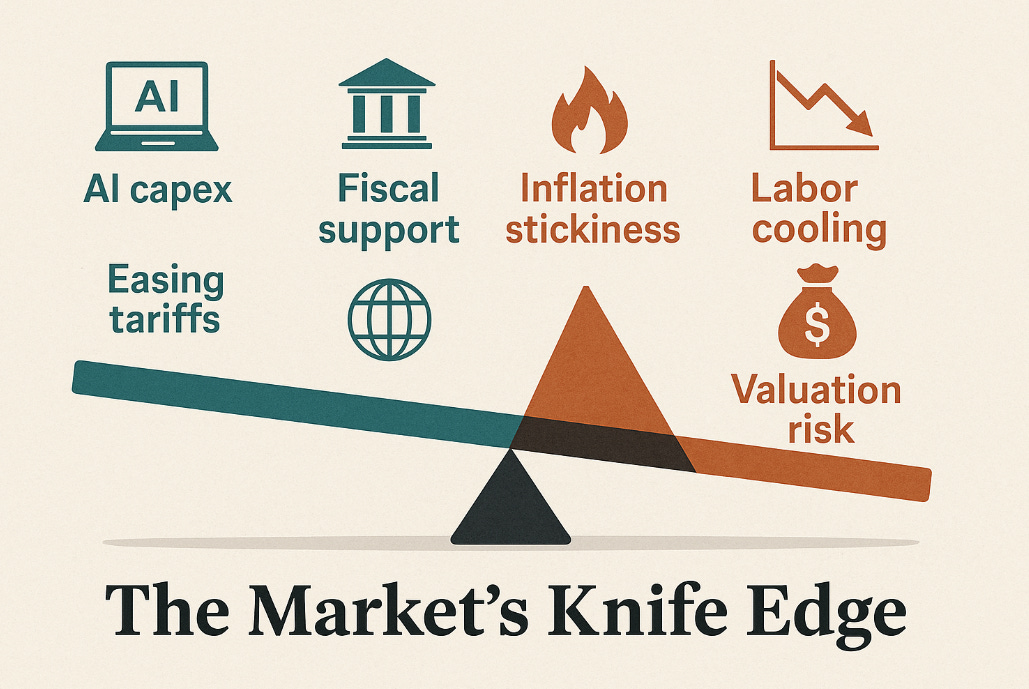

For now, equities balance easing expectations with weakening fundamentals—a recipe for volatility if inflation or growth data surprise.

Sector & Style Rotation

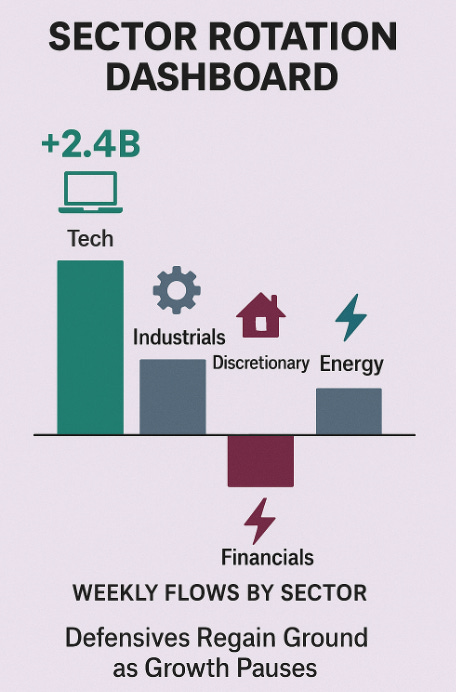

Large-cap strength persisted. Investors funneled $11.9 billion into those funds¹² and $2.4 billion into tech¹⁵, while mid-caps lost $1.2 billion. Growth and AI themes remain dominant, though valuations are drawing scrutiny¹⁰.

Defensive sectors outperformed: consumer discretionary dropped 2.5% (week’s worst), while energy gained as oil prices steadied¹⁶. The rotation suggests investors prefer blue-chip quality and cash-flow resilience over high-beta exposure.

Developed Markets

Europe. The eurozone’s PMI hit 52.5⁴, signaling expansion led by services; manufacturing hovered near 50¹⁷. Inflation eased to ~2.1%⁵ (core 2.4%), aligning with the ECB target. Rates have held at 2% for three meetings¹⁸, and a Reuters poll showed consensus that tightening is over¹⁹. Policymakers expect inflation to settle at 2% next year²⁰. The euro strengthened to about $1.155 on confidence in ECB stability²¹.

United Kingdom. Inflation remains elevated at 3.8% —the highest among the G7²² but below forecasts. With Bank Rate at 4%, traders see a 75% chance of a December cut²³. The November 26 budget will weigh fiscal tightening against persistent services inflation (~4.7%).

Japan. Prime Minister Takaichi signaled fiscal expansion and potential tax cuts²⁴, complicating the BoJ’s plans. While October minutes show many members favor rate hikes, the yen’s weakness (+4.2% export boost in September) provides short-term relief⁶. U.S.-bound shipments fell 13%, keeping Japan in deficit. The new fiscal-monetary dynamic could reshape Asia’s policy balance.

Emerging Markets

China. Growth continues to slow, with Q3 GDP expected around 4.5–4.8% year-over-year²⁵. Property weakness deepened—home prices fell 0.4% in September across 63 cities²⁶. Low inflation and soft confidence have spurred expectations for further stimulus: a 10-bp rate cut in Q4²⁸ and 500 billion yuan in policy funds for infrastructure and high-tech projects²⁹. Trade relations with Washington remain fragile, though a truce to reduce tariffs could take effect by 2026²⁷.