Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: HERE COMES THE YEN!

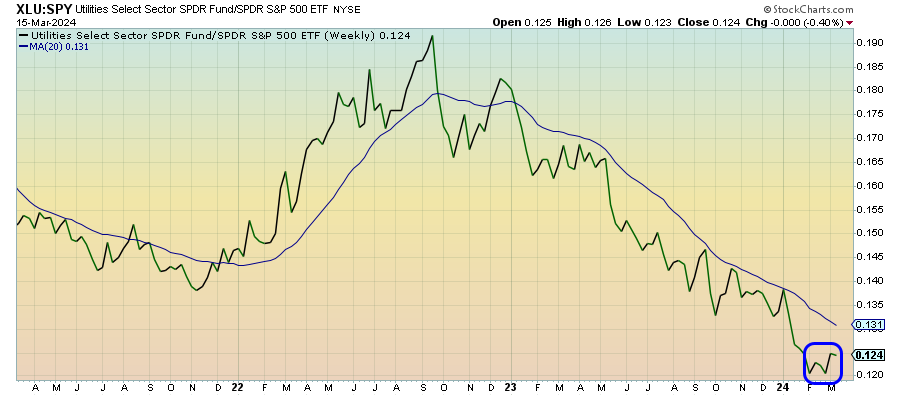

Utilities (XLU) – Hanging On Despite Rate Spike

The cyclical reflation trade seems to be picking up strength here, but utilities aren’t giving up. In the big picture, utilities look like they can hang on for another couple weeks or more as lagged effects continue to work their way in. In recent months, higher interest rates have been a negative for debt-heavy utilities, so the fact that they held up as well as they did during the spike in long-term yields is telling.

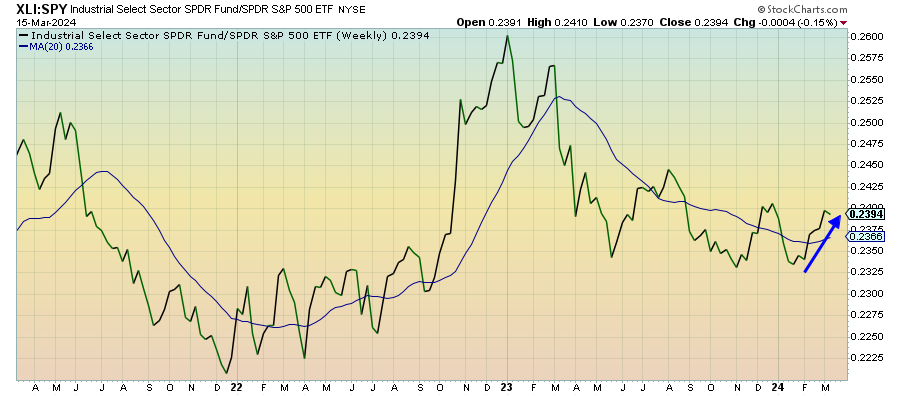

Industrials (XLI) – Reflation Equals Rally

Positive growth plus higher inflation plus higher interest rates could actually work in the favor of cyclicals and investors seem to agree. Traditional industrials have done well, but it’s been the more sensitive, the better in this sector. Cyclicals are still making progress relative to tech & growth and that trend could continue if rates remain elevated longer-term.

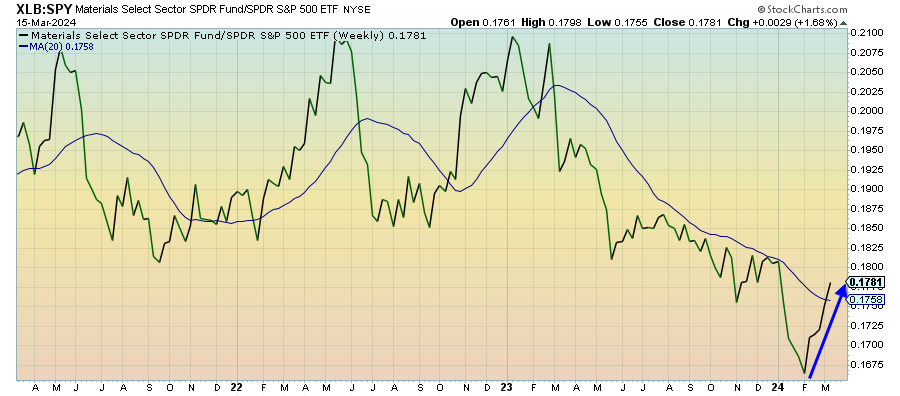

Materials (XLB) – Commodity Prices Finally Picking Up

Commodities prices took off last week on the combination of an improved demand outlook along with potential supply shortage in certain pieces of the market, including copper. Materials stocks had been rallying hard on the prospect of a reflation trade, but they’re now getting rising commodity prices to help back it.

Financials (XLF) – Rate Volatility Creates Uncertainty

Financials continue to get pulled higher in this cyclical rally even though the overall backdrop remains in question. While higher interest rates should, in theory, be a positive catalyst for bank bottom lines, the volatility in interest rates, which could be exacerbated this week by the Fed, create a bit of an uncertain outlook in the short-term.

Energy (XLE) – Signs Of Life