A trade deal between the U.S. and China was supposed to be one of the things that would mark a return to normalcy for the markets and maybe even ignite the next leg of the bull market. Even though we got one this week (who knows what’s actually a part of the deal, but it’s not likely to be a game changer), the market again largely shrugged it off.

If investors are settled on their view of the trade war, it’s time for them to find the next catalyst.

For many, it’ll probably be the Fed and the never-ending game of “will they, won’t they”. The market has been preparing itself for a continuation of the rate cutting cycle that began back in September 2024, but has gotten little cooperation from Jerome Powell and company. The Fed Funds rate has been lowered by 100 basis points in the past year, but there have been no rate cuts in 2025. The calendar keeps getting pushed back as inflation has remained sticky.

I think the catalyst will be something different. I’m looking at the Japanese yen, its relationship to the dollar and long-term Treasury yields.

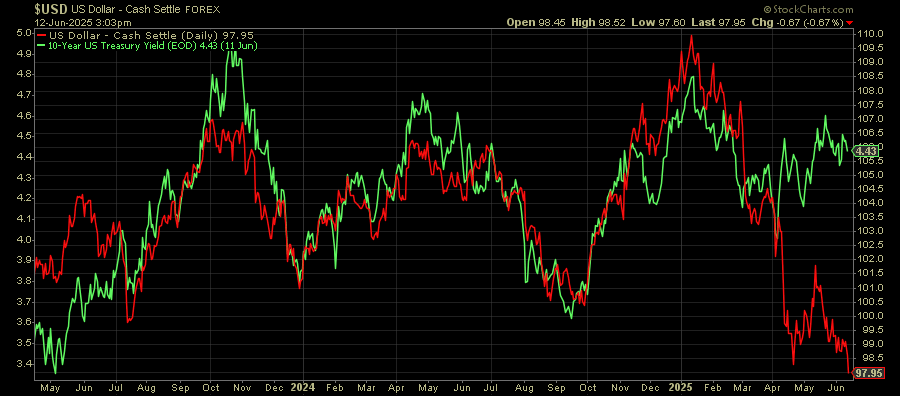

Yields and the dollar typically have a pretty durable relationship. When yields rise, the dollar tends to strengthen as investors look to boost their returns. Recently, however, that’s turned into something much different.

That correlation has clearly disintegrated. The 10-year yield has made a modest move higher, but the dollar continues to fall. As I write this, the dollar just hit a 3-year low and who knows where the bottom is.

The impetus is likely the concerns around the “One Big Beautiful Bill”. If it passes, it’s probably going to end up adding trillions to the national debt and balloon annual budget deficits to $1 trillion+ for the foreseeable future. Deficit hawks have sounded the alarms and this in conjunction with Trump’s tariff threats have eroded confidence in some dollar-denominated assets.

The yen is having its own issues. Japan’s combination of 0% growth in Q1 and an inflation rate hovering around 3.5% creates a stagflationary threat that could roil the entire global market. Weakness in the dollar, however, has masked some of that risk, at least as it shows up in the dollar/yen exchange rate.

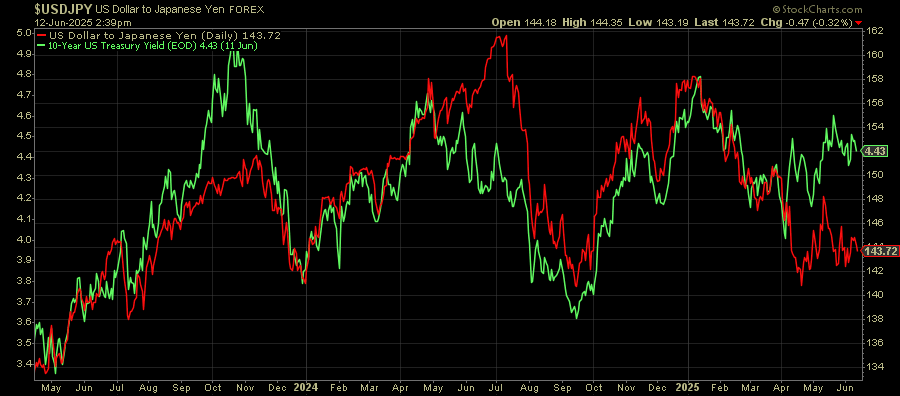

You probably know that I’ve been watching the yen closely for some time. When I recently put the dollar/yen rate against the 10-year Treasury yield, an interesting pattern emerges.

This just over the past 2+ years and reflects the generally positive, but sometimes disconnected relationships between the dollar, yen and yields.

In particular, there are three disconnects that got out of hand fairly quickly and mean-reverted even faster to get the relationship back in line.

H2 2023 - The Fed’s focus on QT and a persistently hawkish outlook helped to spike rates on the long end of the curve. To recapture the trend, either yields needed to plunge or the dollar needed to strengthen. Turns out the dollar fell, but yields fell faster, bringing the relationship back in line.

Summer 2024 - Widening interest rate differentials (the BoJ kept rates near zero at the time) flooded the yen carry trade. The BoJ signaled an intention to keep policy conditions loose and the yen plunged. The correction, of course, happened with the yen carry trade unwind that sent the yen sharply higher again to bring it back to the mean.

2025-Present - As mentioned earlier, the lack of faith in the dollar and government bonds, thanks to tariffs, the prospect of new debt and a Moody’s downgrade, have created the latest disconnect. It has yet to correct.

If history is any guide, that leaves one of two outcomes possible to bring this relationship back in line. Either the dollar needs to strengthen or Treasury yields need to drop.

My bet is that it’s the latter.

Special Announcement

The Infrastructure Capital Small Cap Income ETF (SCAP) –– Monthly Distributions* – Targeting Smaller Companies with Strong Earnings and Dividends

Income and High Yield – SCAP invests in Small Cap Companies that seek to pay dividends and high-yielding preferred stocks of Small Cap Companies and can utilize modest leverage in an effort to deliver attractive yields.

Value Investing – Stock selection is based on a multi-factor proprietary approach that focuses on profitable companies trading at attractive valuations relative to both the sector and the small cap universe as a whole. We believe an emphasis on value investing is important when investing in small companies to limit risks inherent in investing in unprofitable, development stage companies.

Differentiated Small Cap ETF – SCAP utilizes active management, covered call writing, and broad sector diversification with an income focus.

Small Company Exposure– SCAP invests at least 80% of its assets in securities of small-capitalization companies and defines small-capitalization (“Small Cap”) companies as those companies with a market capitalization that is within or below the range of companies in the Russell 2000®.

Fixed Monthly Dividend* – Plan for the future with stable and recurring dividends you can anticipate and potentially capture value through monthly dividend.

Sector Diversification – SCAP aims to diversify Small Cap risk by investing across major sectors, while maintaining reasonable position sizes. For example, unlike many of its peers, SCAP is currently underweight the Healthcare, Pharmaceuticals, Biotechnology sectors, which can have higher relative risk profiles with respect to smaller companies.

Performance from Inception – Please see the fact sheet or fund’s web site for performance.

DISCLOSURE

The information presented represents our subjective belief and opinions and should not be construed as investment advice. Past performance does not guarantee future results. *Infrastructure Capital Advisors expects to declare future distributions on a monthly basis. Distributions are planned, but not guaranteed, for every month. For more information about each Fund’s distribution policy, its 2025 distribution calendar, or tax information, please visit the Fund’s web site for more information. The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index; it measures the performance of the small-cap segment of the US equity universe.

FUND RISKS

Investors should consider investment objectives, risks, charges, and expenses carefully before investing. For a prospectus with this and other information about the Infrastructure Capital Small Cap Income ETF, please visit each respective fund page here www.infraCapfund.com/scap. Please read the prospectus carefully before investing. For more information about the Funds, Funds’ strategies or InfraCap, please reach out to Craig Starr at 212-763-8336.

SCAP Exchange Traded Fund (ETF): Investing involves risk, including possible loss of principal. An investment in the Fund may be subject to risks which include, among others, investing in equities securities, dividend paying securities, utilities, small-, mid- and large-capitalization companies, real estate investment trusts, master limited partnerships, foreign investments and emerging, debt securities, depositary receipts, market events, operational, high portfolio turnover, trading issues, active management, fund shares trading, premium/discount risk and liquidity of fund shares, which may make these investments volatile in price. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates which may negatively impact the Fund’s returns. Small and Medium-capitalization companies, foreign investments and high yielding equity and debt securities may be subject to elevated risks. The Fund is a recently organized investment company with no operating history. Dividends are not guaranteed and may fluctuate. Please see prospectus for discussion of risks. Diversification cannot assure a profit or protect against loss in a down market. SCAP is distributed by Quasar Distributors, LLC.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Infrastructure Capital. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Infrastructure Capital and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

The current debt/deficit situation doesn’t look like it’s going to change soon. I’m guessing the Trump tax bill eventually finds a way to pass. Trump talked just this week about setting unilateral tariff rates in the near future. Those three things won’t be dollar-positive.

That leaves Treasury yields as the lever most likely to move. If tariffs become an issue again or the Trump bill becomes a source of worry for the markets, there could be a flight to safety trade that pushes sentiment from equities to fixed income. We didn’t see it play out earlier this year because Japan and China were dumping Treasuries into the market, but it has a better chance of happening this next time around.

That might only pull the 10-year down to around the 4% level, but that could be enough to generate a 5-10% return for long bonds.

I’ve argued that the yen could be a big driver of what comes next precisely because of its relationship to the dollar and the fixed income market. The dollar/Treasury yield correlation is one signal that’s flashing a warning right now. History says it’s about to correct again.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.