The overall theme of the U.S. equity market might be “what was working before isn’t working now”.

If you’re looking for a specific catalyst to blame for the recent correction in stocks, tariffs are always a good choice. So is inflation risk and slower global growth. As much as anything, the real culprit has been a massive shift away from anything that might be viewed as risky or expensive. Look no further than the magnificent 7 stocks, which are collectively down about 14% year-to-date and more than 18% from their all-time highs. Investors don’t care about paying premium prices when growth is solid and the outlook is healthy (it doesn’t hurt to have the AI boom sitting in the background). But when those conditions start to go away, so does previous market leadership.

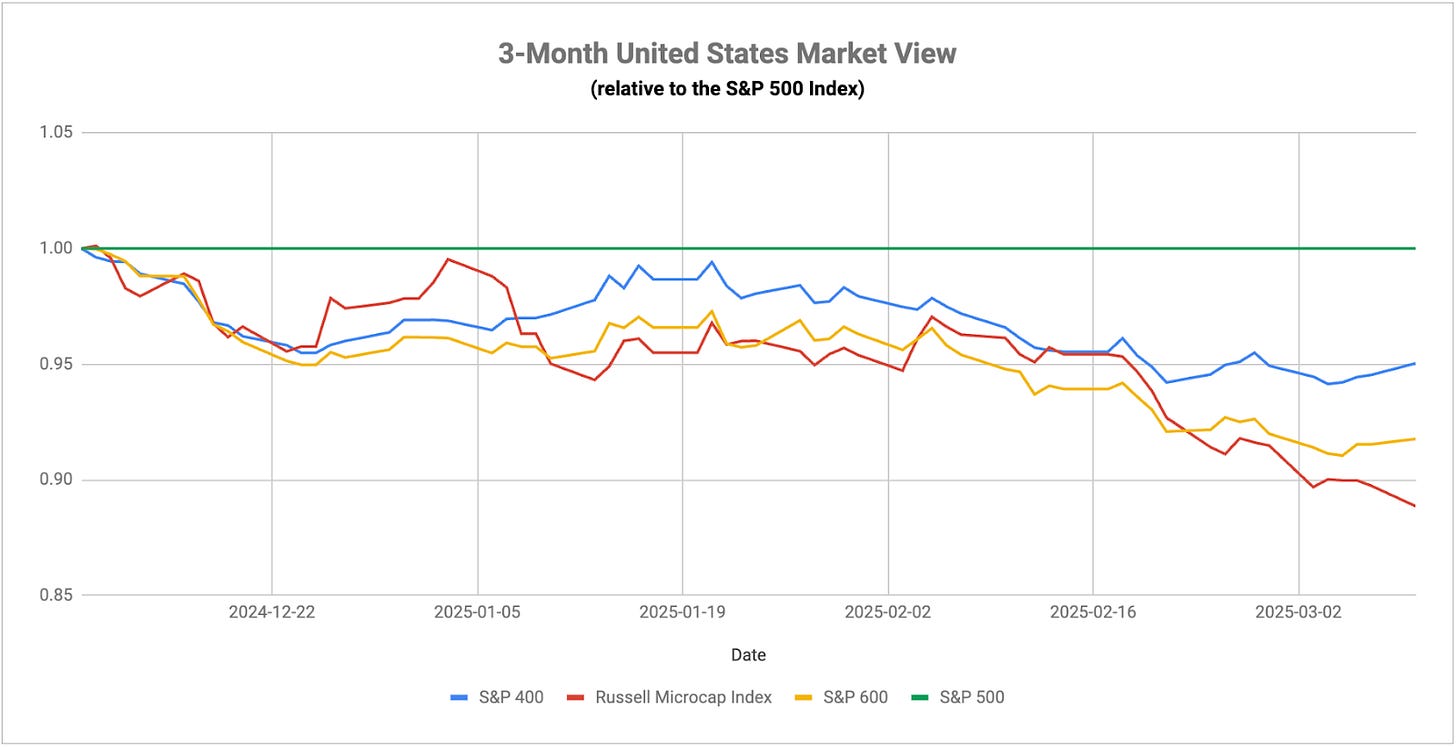

If you look at the market today, there’s still a heavy preference for large-caps in the S&P 493. The three sectors where the cap-weighted versions are trailing the equal weight versions right now are technology, consumer discretionary and communication services. These are three top-heavy sectors led by mag 7 names and confirms that this group is doing the most damage to bring the market down. Conversely, cap-weighting is leading in every other sector, suggesting that investors still want to stick with bigger, more established names here and continue to shun small-caps. This is fairly typical bear market behavior where investors get as defensive as possible within equities before they pivot over to bonds.

Another example of this is the correction in bitcoin. Post-inauguration, bitcoin was trading around $105,000. Now it’s at $82,000. The maxis said that the establishment of a strategic bitcoin reserve was going to send crypto (again) to the moon. Instead, bitcoin sold off because it was only going to be seeded with existing holdings, not new purchases. Investors are, in a major way, dumping risk in their portfolios. The continued escalation in the global trade war serves to fuel more volatility, but investor risk appetite is a big reason why it’s continuing.

On the tariff front, Trump seems to be getting more and more agitated as other companies respond with their own retaliatory tariffs. This is getting dangerously close to a situation where Trump is more interested in “winning” by pounding other countries with higher tariff rates than considering the true economic impact of this policy. Look at any sentiment reading or the direction of the equity market and it’s clear that people understand that tariffs are bad for inflation and the success of Powell’s soft landing. It’s that sentiment, I believe, that’s really driving what’s going on in the market more than the economic impact itself.

Plus, in the background we’ve got further deteriorating credit conditions. The year-over-year change in revolving credit just went negative. The last two times that happened were during the COVID recession and the financial crisis. Given the presence of higher rates, a slowing economy and further inflation likely ahead, it’s tough to see that number making a big turnaround anytime soon. In addition, subprime auto delinquency rates just hit 30+ year highs. Conditions are already challenged and they’re likely about to get worse.