Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: STRENGTH IN DEFENSIVES & GOLD SUGGESTS CRASH POTENTIAL

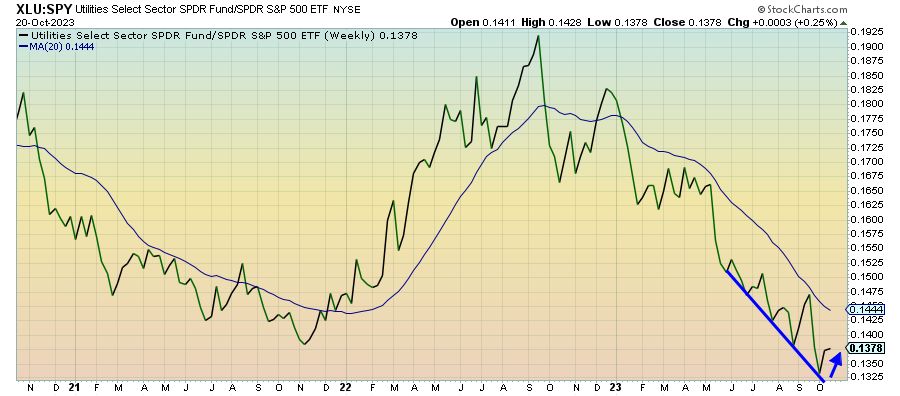

Utilities (XLU) – The Dynamic Has Changed

Even as the longer-term utilities signal remains risk-on (for now), short-term sentiment has definitely swung back in this sector’s favor. For months, utilities were moving somewhat independently from other peer sectors, including consumer staples. Over the past couple weeks, that dynamic has changed. All of the traditionally defensive equity sectors & strategies are confirming the move in utilities, which suggests this rally may have legs.

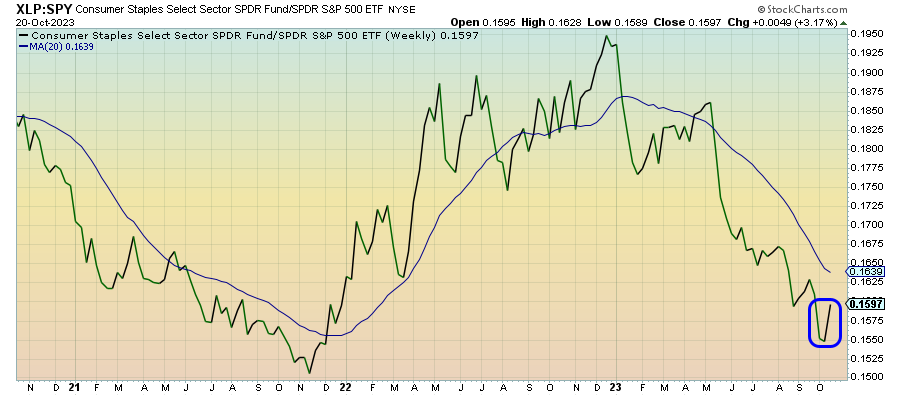

Consumer Staples (XLP) – Finally Confirming Risk-Off Sentiment

For most of 2023, consumer staples have failed to confirm most short-term defensive shifts within the equity markets. That’s changed in a big way over the past couple weeks. I’ve said in the past that this was the one sector that needed to begin confirming the moves in other defensive strategies before we could really say they had the potential to be sustainable. We’re getting that now and that could be a bad sign for risk assets.

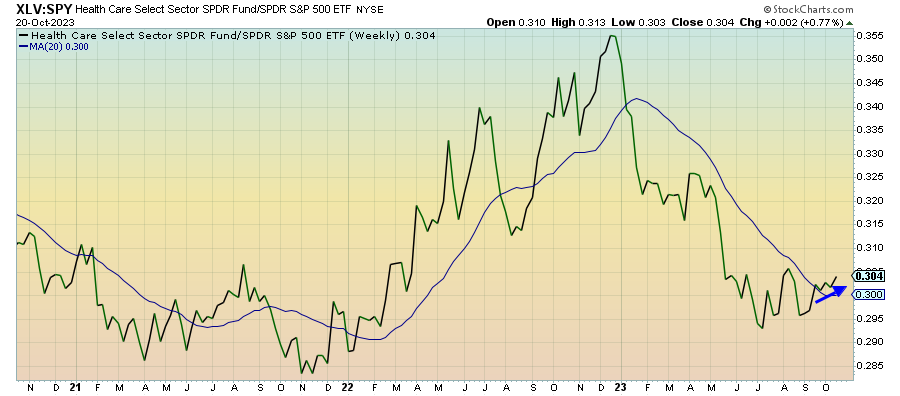

Health Care (XLV) – Leading The Defensive Equity Shift

The one thing I’ve been watching for closely throughout the current risk-off turn is confirmation from equities and it looks like we’re finally getting it. Healthcare has been trending higher for weeks, but now it’s being joined by consumer staples, utilities, low volatility and dividend stocks. Combined with the big move in gold we’ve gotten lately, this is looking like a pretty decisive sentiment change in the markets.

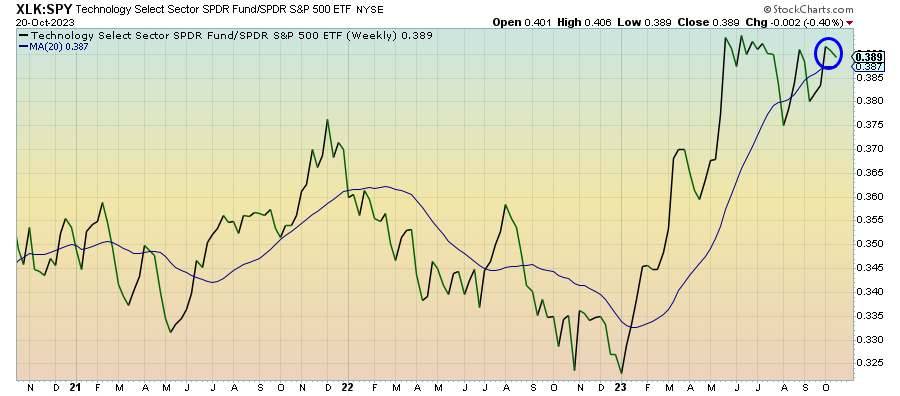

Technology (XLK) – The Quasi-Safe Haven

Growth hasn’t quite lost its momentum yet, but it is struggling to find direction. The tech sector is a good representation of that. It’s experiencing a lot of volatility and choppy up and down direction, but little conviction in either direction. To many, large-cap tech is like a quasi-safe haven sector and that could be part of the reason it’s holding up here as other non-defensive areas of the market struggle.

Communication Services (XLC) – Big Earnings Focus