Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE RETURN OF HIGHER INFLATION COULD BE A GAME CHANGER

Communication Services (XLC) – Big Disruption

Similar to the story with tech, communication services took a big step back last week. Last week’s January inflation numbers were probably the biggest disruption to the disinflationary narrative that we’ve had since we began moving off of the 9% inflation rate. If we get a second round of inflation here, we’re likely to see a repeat of 2022 - growth, tech and tech-adjacent areas of the market turning into deep underperformers.

Consumer Discretionary (XLY) – Tough Months Ahead

Discretionary stocks had been staging a minor comeback by picking up a tailwind from the tech rally. Last week’s data, however, certainly didn’t do them any favors. Inflation was unexpectedly higher. Retail sales posted their worst monthly decline since Q1 of last year. With consumers’ spending power steadily diminishing, this sector could be facing some tough months ahead.

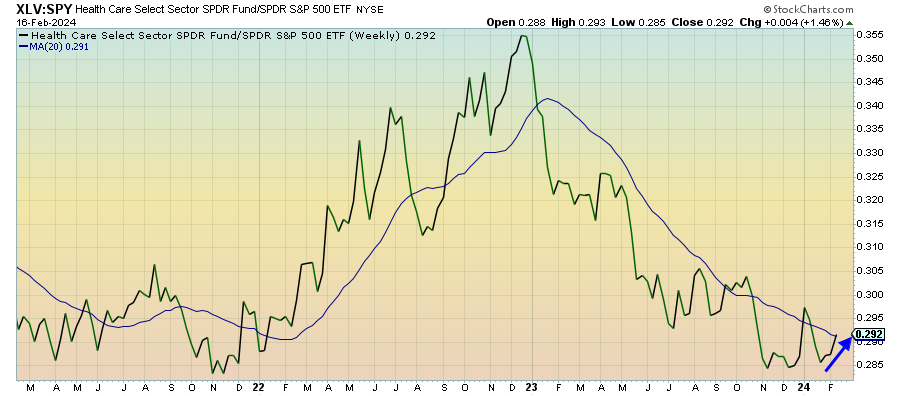

Health Care (XLV) – Leading The Defensives

Healthcare actually started outperforming the market ahead of when other defensive sectors did this month. This sector has been ID’ed as one of the better candidates for outperformance given its financial strength and defensive properties. Seeing that story play out in real time could make the next few weeks interesting if utilities pick up a bid as well.

Industrials (XLI) – Helped By The Hawkish Fed

Cyclicals are seeing some new life as investors rotate back out of growth & tech. In 2022, we saw industrials outperform as the resilient economy narrative helped to offset some of the losses caused by the Fed’s rate hiking cycle. If the data continues failing to support the idea of a significant rate cutting cycle this year, we could see a similar pattern play that helps cyclicals outperform again.