The latest round of U.S.-China trade discussions may or may not result in some sort of agreement, but the fact that we’re simply moving down this path should help calm the markets. As I’ve noted in the recent past, the market seems to have stopped reacting to short-term developments and is waiting for some type of long-term solution instead. Given that we’ve seen very little in terms of concrete trade details and compromises that would result in a meaningful change in the trade environment, I suspect any kind of “deal” we potentially get this week won’t be a game changer either. Either way, I think this represents a step forward in the sense that the most punitive trade threats are a thing of the past and we might actually move towards something representing a more balanced trade environment.

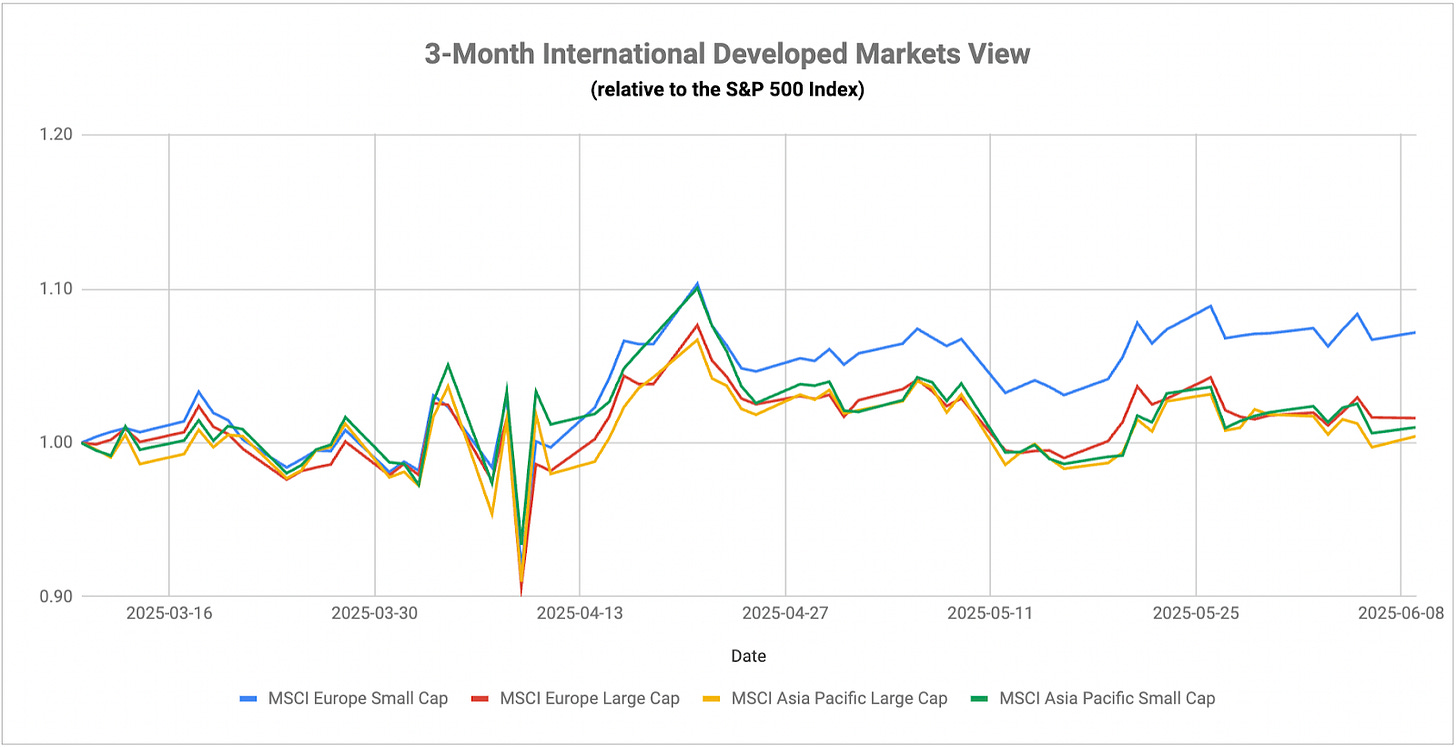

I touched on this a little yesterday, but I’ve been pleased to see the reaction from small-caps over the past few days. It doesn’t show up as much in the small-cap ratio above, but it’s more clear looking at micro-caps. I think that if April low does actually mark the bottom in this recent cycle, there’s a strong case that small-caps could lead the next leg higher. That would largely be a function of the rebound representing a genuine turnaround in sentiment and an improved outlook that could include mitigated recession risk. In an early expansionary narrative, small-caps have traditionally been able to lead the way. With the biggest recession catalyst, tariffs, looking like they may no longer be the risk that was once feared, inflation looking contained (for now) and the labor market remaining resilient, improved breadth in equities could be the next step. Small-caps have been behaving as if that’s the case for the past several days and a continuation of this trend could be important.

Overall, we’ve seen a perhaps unsurprising rebound in the soft data, aka the sentiment and optimism readings. After diving around and just around Liberation Day, small business optimism and consumer confidence have recovered, fueling much of the rally we’ve seen in equities over the past several weeks. The one thing that has yet to budge is inflation expectations. Those are still quite high, although we’ll get the next batch of data on this, CPI and PPI this week. Annualized inflation rates are expected to move higher from the April number, but this could be the first big test to see whether or not the Trump tariffs have been having a tangible effect on prices. Even if there’s an unexpected uptick, the market might choose to minimize it if there’s progress on trade talks that would suggest any price spike is temporary.

Special Announcement

Looking for a fresh take on value investing? ITAN helps investors modernize their U.S. value allocations, providing exposure to innovative, intangible-rich companies at attractive prices.

Learn more by visiting the ITAN Website or contacting the Sparkline Team.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Sparkline Capital. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Sparkline Capital and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

Treasury yields look like they might be stabilizing a bit here. Long-term Japanese bond yields have come down sharply in the past couple weeks and that could be easing some nervousness enough to bring investors slowly back into the government bond market. This is one of those cases where global fixed income stability could help the Treasury market as well. There are still a lot of questions to be answered about whether some companies can sustain their tenuous fiscal positions and help manage bond market risk.

The United Kingdom is emerging as a potential trouble spot for the global labor market. The annualized rate ticked up to 4.6% in April, up from a cycle low of 3.6% and the highest level since 2021. The rate of those unemployed for at least 6 and 12 months also rose, while wage growth moved sharply lower for the 2nd straight month. Of course, this raises the odds of another rate cut by the BoE, which has already cut four times in the past 12 months. May’s rate cut was already a split decision by the central bank, so it may have trouble passing another cut in June, but further cuts are squarely on the table later this year. A lot could depend on the direction of inflation once we get a better sense of the economic impact of the Trump tariffs. Either, the U.K. economy looks like it’s heading in the wrong direction.

Elsewhere in the Eurozone, inflation appears to be under control, but growth is becoming a problem. The May CPI reading came in slightly below expectations at 1.9% thanks to a drop in energy prices. The core rate is still an above target 2.3%, but that’s a noticeable drop from the 2.7% from the previous month. Services PMI, however, indicated a contraction in activity, coming in below the breakeven 50 level. Overall, this feels like it could be temporary. Sentiment has certainly improved on the tariff front. Households and businesses may be inclined to ramp up activity in the coming months if they feel that tariff tension has been mitigated.

Japanese bond yields have finally turned lower following some better-than-expected demand out of the latest bond auctions. This should provide a much needed dose of stability to the bond market. The BoJ has indicated that they’re likely to continue running down the balance sheet, but Governor Ueda didn’t rule out the possibility of ramping up asset purchases again if conditions warrant. Next week, we’ll get the May inflation number. Japanese inflation has been stuck at 3.6% or higher in each of the past three months and the BoJ undoubtedly wants to see progress back towards its 2% target.

Trade discussions between the U.S. and China will remain the headline event of the week. As mentioned above, it seems unlikely that we’ll see any kind of market-moving developments, but any kind of compromise should send the message to the markets that conditions are improving. Chinese stocks are up over 17% since the end of last week, so the market doesn’t seem to be terribly worried about the trade situation. The one issue that could develop over the longer-term is how many companies have altered their supply chains to account for the trade war. China is primarily an exporter nation and there could be economic impacts even without the excess tariffs if companies have shifted to neighboring countries, including Vietnam and India, for their supplies.

India seems to be plowing ahead full steam on its growth initiatives. Last week, it cut its benchmark rate by 50 basis points to 5.5% (the market was expecting a 25 basis point move). The RBI noted with the cut that it wanted to grow at an 8% annual rate going forward. The country’s inflation rate has dropped to just over 3%, so there should, in theory, be some flexibility to loosen conditions in that scenario, but 8% is a tall order. That would require a roughly 2% quarterly growth rate, something the economy hasn’t achieved since Q3 2023. Indian stocks have risen modestly this year as investors digest the country’s slowing growth rate, but this kind of target raises inflation risk in a regime dominated by tariffs and trade tensions.

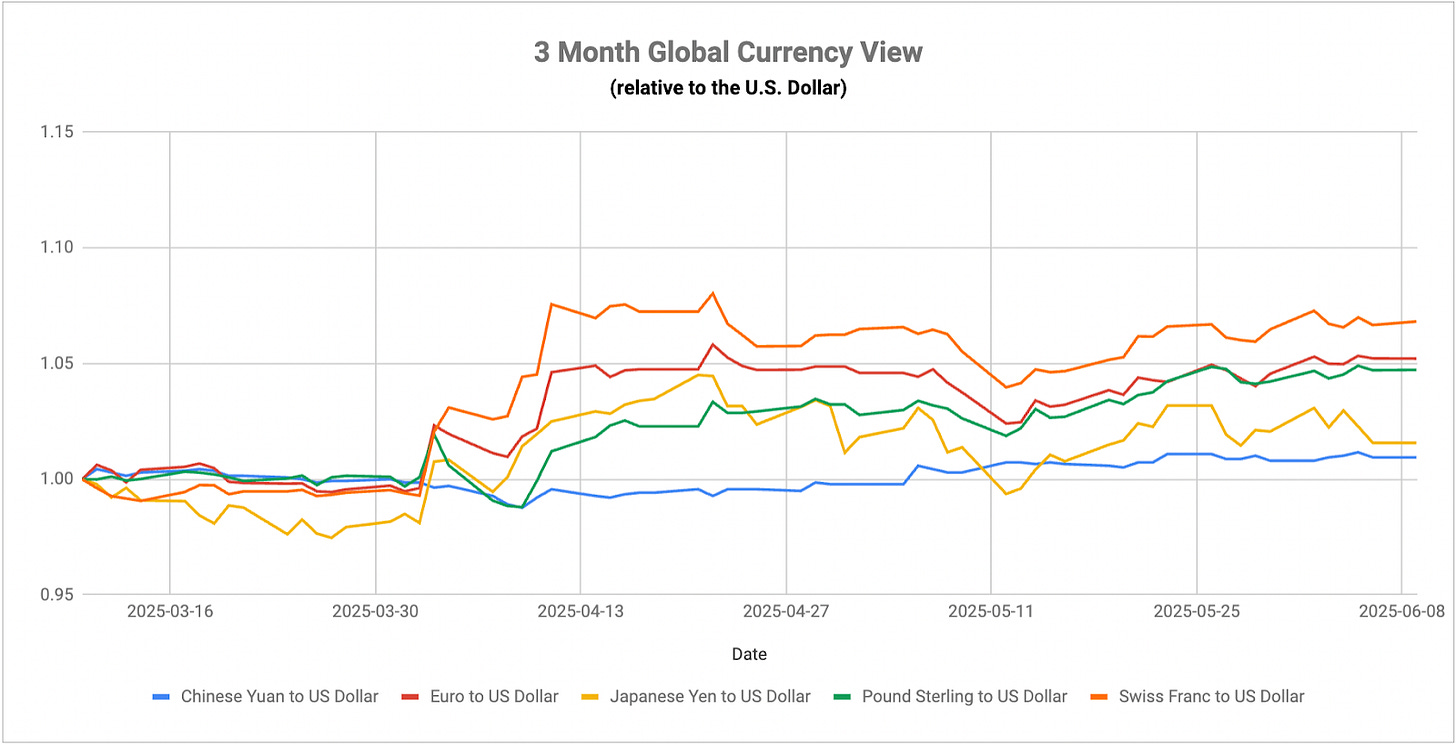

The dollar continues to struggle here, basically selling off into any short-term strength. If Treasury yields continue to stabilize here or even move lower as inflation risk eases, there could be another short-term bounce, but sentiment is working against the greenback at the moment. The tariff, trade, debt and deficit narratives have quieted somewhat as the U.S.-China talks take center stage and that could help create a short-term floor for the dollar.

The yen is holding steady for the time being, but there are a lot of moving parts here. The BoJ seems content to keep rates where they are and run down the balance sheet in the hopes that inflation can moderate on its own. I think the pulse here is still to fuel growth, which means the central bank may not be terribly inclined to hike.

The British pound has begun to pull back amid the latest data indicating a weakening labor market. The euro and the Swiss franc have largely held steady even as the ECB leans towards trimming rates further.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.