The Housing Inflection Point

How Rate Cuts and Pro-Supply Policy Could Ignite the Next Surge in U.S. Homebuilders

Key Highlights

Builder confidence has softened, but resale supply remains tight, reinforcing structural imbalance.

A credible rate-cut cycle could reduce incentive pressure and stabilize margins.

Pro-supply policy initiatives may improve permitting timelines and capital efficiency.

Select XHB constituents offer land optionality, liquidity, and operating leverage to a demand rebound.

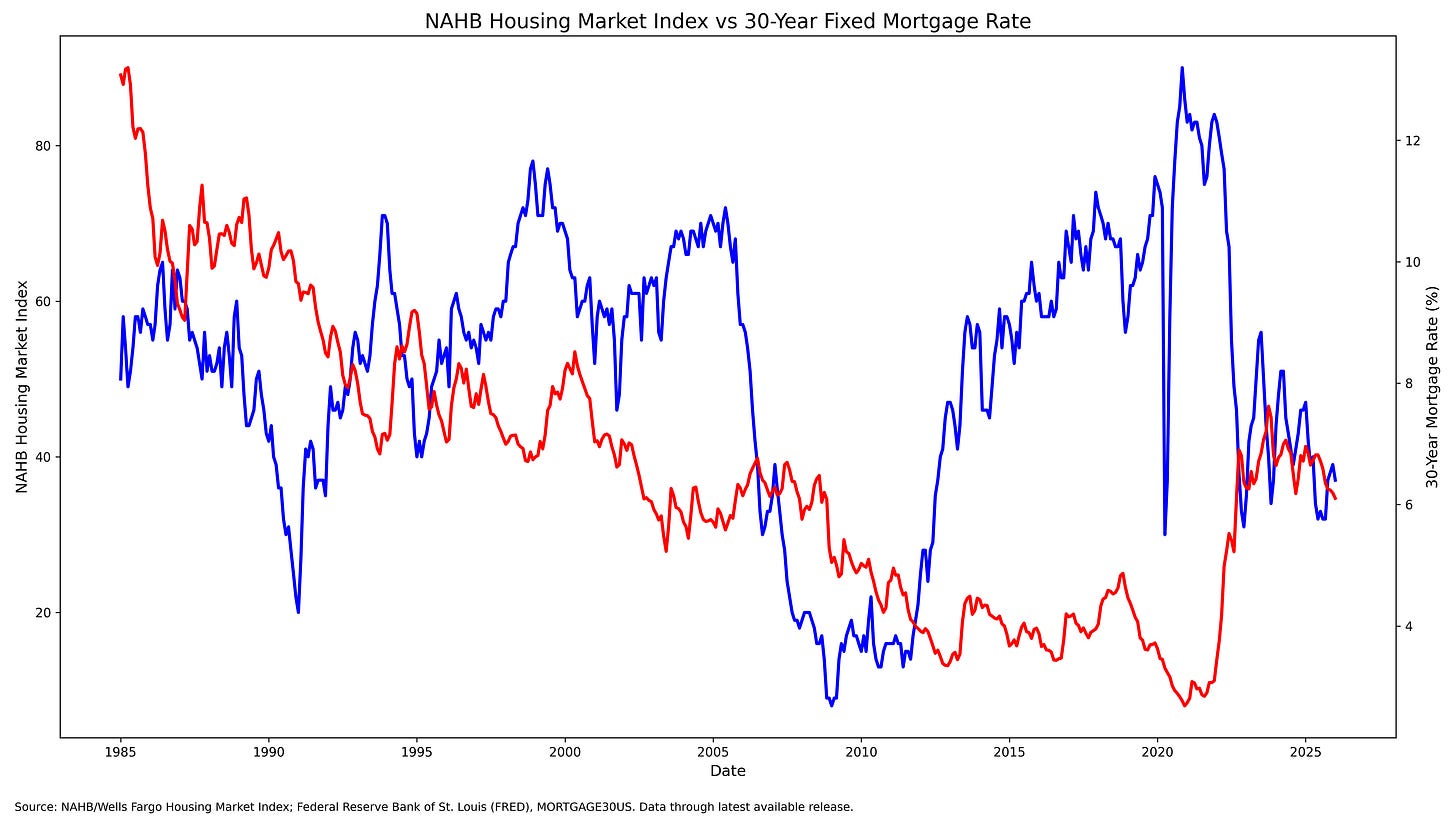

U.S. housing enters 2026 with mixed signals. The NAHB/Wells Fargo Housing Market Index fell to 37 in January, reflecting weaker buyer traffic and subdued expectations.¹ Builders are pacing starts carefully and relying on incentives to maintain orders.

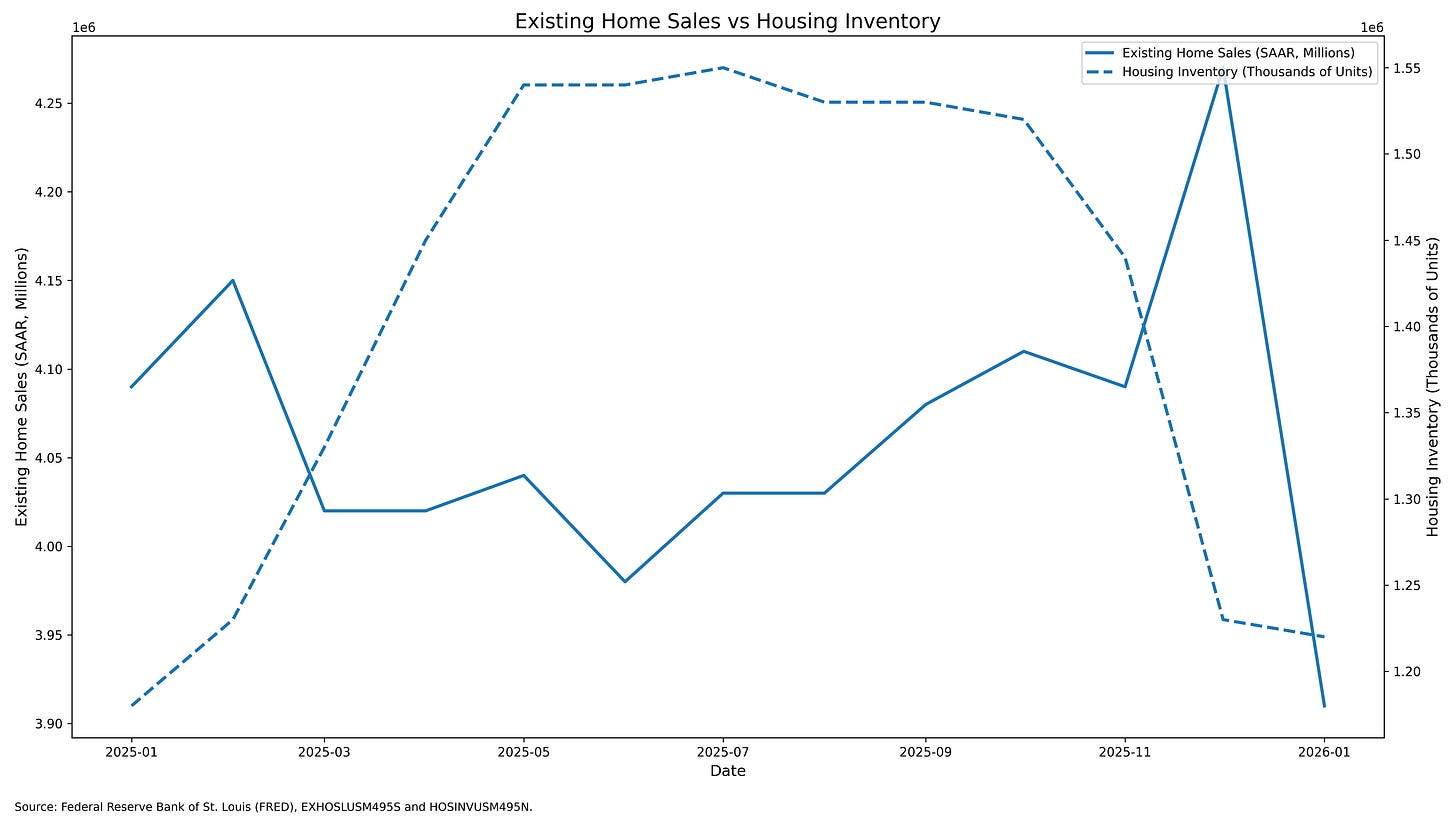

Meanwhile, existing-home sales declined 8.4% in January to a 3.91 million seasonally adjusted annual rate, with inventory near 1.22 million and the median price reaching a January record.² Tight resale supply persists, in part because homeowners with low mortgage rates remain reluctant to sell. Federal Reserve commentary has acknowledged the “lock-in” dynamic limiting move-up supply.³

That combination creates asymmetry. If rates fall, affordability improves while resale supply likely remains constrained. Builders can deliver inventory into that gap.

Policy developments add another catalyst. A January 2026 executive order targets federal support connected to large institutional purchases of single-family homes while carving out build-to-rent communities and directing further agency guidance.⁴ Separately, legislative proposals aimed at streamlining permitting and incentivizing zoning reform remain active in Congress.⁵

Within the State Street SPDR S&P Homebuilders ETF (XHB), five builders stand out for balance sheet strength, land strategy, and valuation: D.R. Horton (DHI), Lennar (LEN), PulteGroup (PHM), NVR (NVR), and Toll Brothers (TOL).⁶ XHB trades at a mid-teens multiple, below the broader market, underscoring its cyclical pricing.⁷

Incentives Now, Operating Leverage Later

Recent Census Bureau data show permits near 1.4 million SAAR and starts near 1.25 million, with single-family permits around 876,000.⁸ Builders are cautious.

Margins reflect elevated incentives. Mortgage-rate buydowns have compressed profitability across the industry. If base rates decline, those incentive costs shrink, allowing margin recovery even before pricing power improves.

Structural supply constraints remain. Tight resale inventory and demographic demand continue to support long-term housing fundamentals.³ Policy efforts that shorten permitting timelines could improve capital efficiency and land turns.

Land optionality is critical. Builders controlling lots through option agreements rather than outright ownership can scale production upward without carrying excessive land risk.

Five Builders With Rate Sensitivity and Balance Sheet Flexibility

D.R. Horton (DHI)