The Income Stream Of This 13% Yielder Is Improving

But The Total Package Is Incomplete

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The fixed income market is certainly getting a little more complicated. The days of being able to capture a high yield from junk bonds with almost no credit risk priced in appear to be ending. Treasuries are rallying in their strongest move in at least six months. Anything with above average risk has been underperforming as investors pivot towards safer assets. It’s a market broadening that we really haven’t seen since the latter part of 2022. That means investors may need to be a little more selective and a little more discerning in which fixed income products they’re looking to add.

One area that’s held up is emerging markets debt. These markets might finally have a comparatively better short-term outlook than the United States as they bounce off of a bottom and come with relatively good value. One fund that’s smaller and a bit under the radar is the Morgan Stanley Emerging Markets Domestic Debt Fund (EDD). Its focus is almost exclusively on sovereign debt and the modest & flexible use of leverage allows it to remain opportunistic. The 11% yield is certainly eye-catching, but attractive yields usually warrant a deeper look under the hood.

Fund Background

EDD seeks a high level of current income with a secondary investment objective of long-term capital appreciation by investing in a range of sovereign, quasi-sovereign and corporate debt securities in emerging markets. To help achieve its objective, the fund combines top-down country allocation with bottom-up security selection. It also uses leverage in order to enhance yield and total return potential.

The combination top-down/bottom-up security selection is attractive and should help the fund in targeting better opportunities. As mentioned earlier, it’s pretty much targeting only government securities, so investors may miss out on a significant segment of the fixed income market (focusing on U.S. government bonds and avoiding U.S. corporate bonds over the past few years, obviously, yielded some pretty poor results). In that sense, there’s a lack of diversification that some investors might prefer.

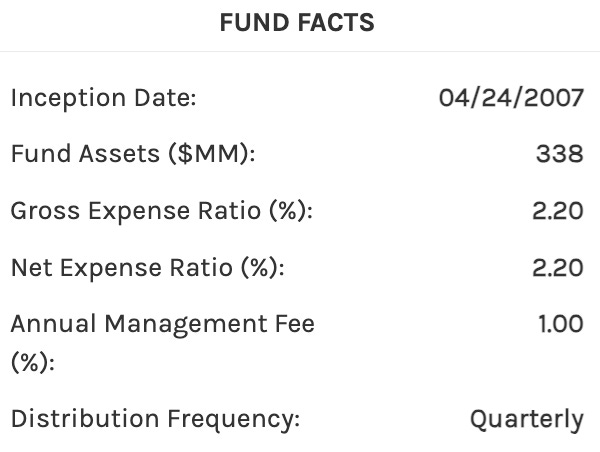

The fund uses 17% leverage currently, which is kind of a nice middle ground in that it’ll make a difference, but it won’t be extremely difficult to get your money’s worth. The quarterly distribution schedule will likely turn off some looking for monthly income. International fixed income funds tend to pay less frequently due to the volatility of when payments are received.

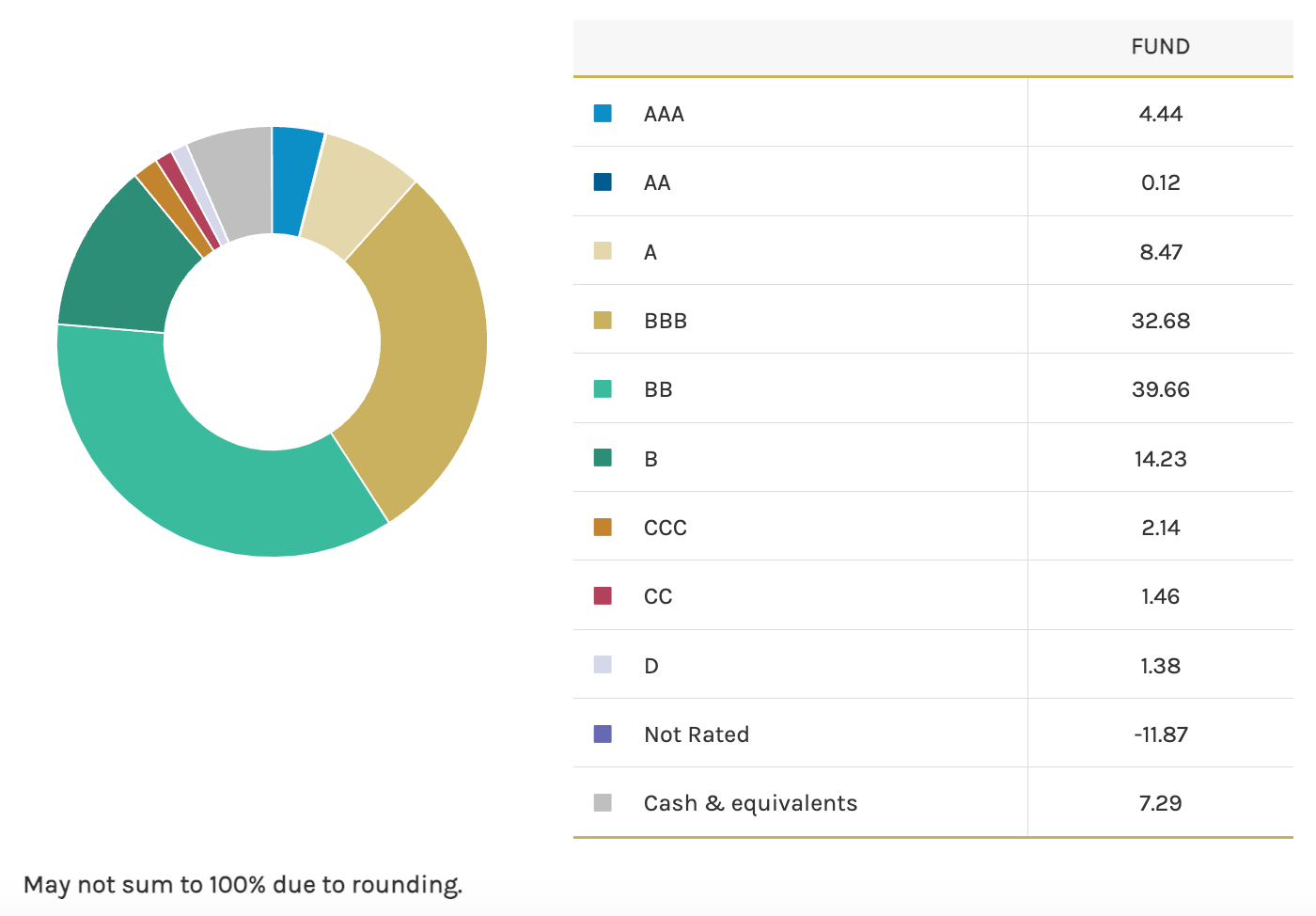

Emerging markets debt tends to be lower rated because, well, their economies are emerging. It’s not a bad mix though since nearly half of the fund’s assets are rated investment-grade. Most of it is in the BBB-rated category though, which means it could teeter on the edge of sliding into the junk category if conditions start to deteriorate.

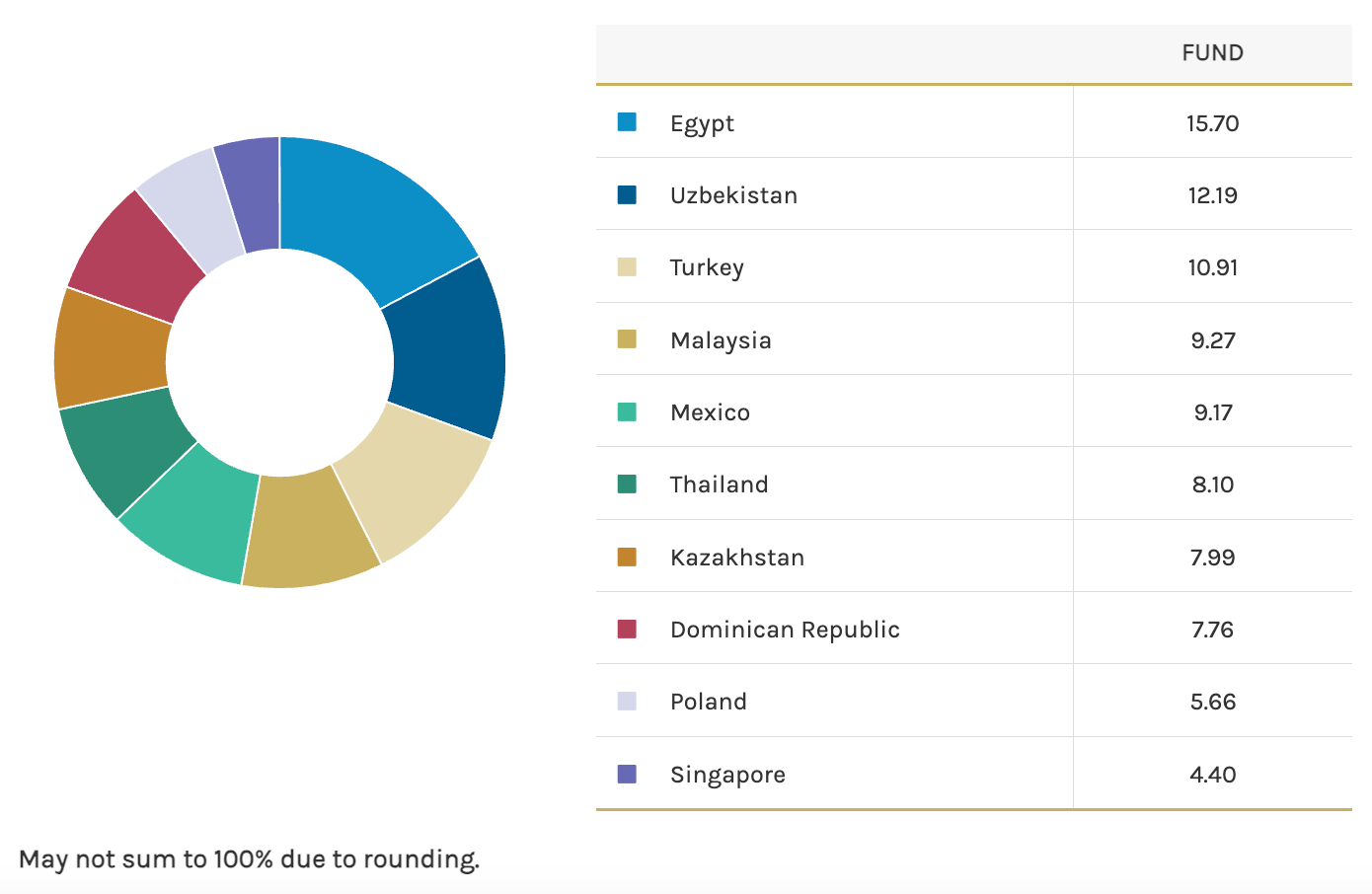

Compared to a broadly diversified emerging markets debt fund, EDD is much more concentrated geographically. On a cap-weighted basis, the largest country holdings would be Turkey, Saudi Arabia, Brazil and Mexico. Only two of those appear in EDD’s top 10 country holdings and the ones that replace it at the top, including Egypt and Uzbekistan, certainly qualify as more risky. Most of the remaining top country holdings are relatively well-established economies, but there is an added layer of potential risk here.