Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: RISK ASSETS COULD BE STAGING ONE FINAL BLOWOFF

Utilities (XLU) – Hot And Cold Sentiment

As has been the case pretty much throughout 2023, utilities continue to signal that short-term sentiment is very hot and cold based on whatever the latest data point is. CPI and PPI numbers were the catalyst last week and, even though another quarter-point hike from the Fed is likely in a couple weeks, investors are growing more comfortable with the idea that May is probably the end point in the hiking cycle.

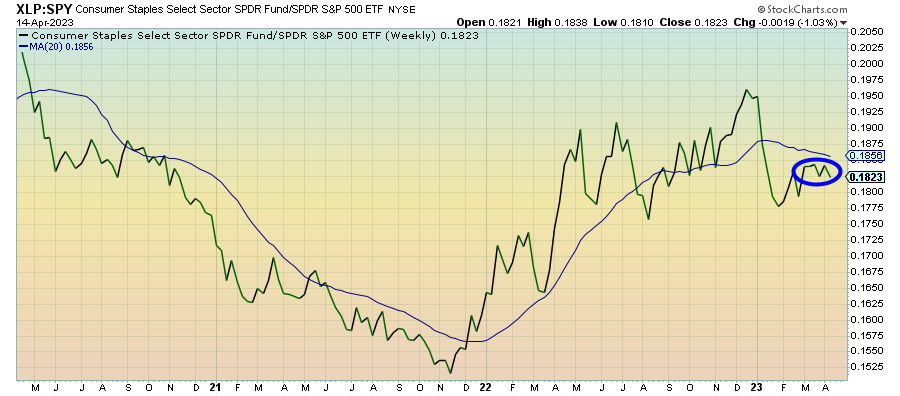

Consumer Staples (XLP) – Consumers Struggling To Pick It Up

Like utilities, consumer staples stocks are all over the place relative to the broader market and failing to provide a definitive signal. The latest pullback in the year-over-year inflation rate (a trend which will probably continue through June) could make consumers feel more comfortable about spending again, but the data has yet to fully support the narrative. Retail sales and consumer confidence levels remain tepid.

Financials (XLF) – Confidence Returning

The bottom in financial stocks looks to be in and the earnings results we got last week from JPMorgan Chase and Citigroup are likely to reinforce investor confidence further. From what we’ve seen, there’s been a lot of shuffling around of deposits, but few liquidity issues beyond the SVB and Signature failures. Commercial real estate risk is likely to continue impacting smaller banks, but the big banks look like they’re in fairly good shape.

Health Care (XLV) – The Defensive Beneficiary

After struggling throughout most of 2023, healthcare is suddenly the hot sector again. With real estate experiencing a notable downtrend, consumer spending still weak and utilities kind of all over the place, healthcare may be the beneficiary of being the defensive sector of last resort. The broad healthcare sector remains an ideal choice for durable & predictable cash flows and could rebound as the year progresses.

Energy (XLE) – OPEC Tinkering Pays Off

OPEC’s recent production cut announcement seems to be serving its purpose of putting a floor under oil prices. WTI crude is back in the low/mid-$80s, a level it hasn’t seen since November. Energy stocks have responded and this may be a trend that continues. OPEC seems to like having oil prices in this range and it may continue tinkering with production cuts/increases to manipulate its trading range.

Communication Services (XLC) – Best Performer Of 2023