Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE MARKET IS BETTING ON A LIQUIDITY BOMB

Technology (XLK) – Obstacles In The AI Race

The big earnings week for the majority of magnificent 7 names was mostly successful, although it did identify some shortcomings in their AI strategies. Microsoft, for example, is still building up capacity to meet demand. AMD is seeing its growth rate slowing and may be falling further behind NVIDIA. AI is clearly the future of these companies, but Q3 earnings demonstrated that there are some bumps in the road.

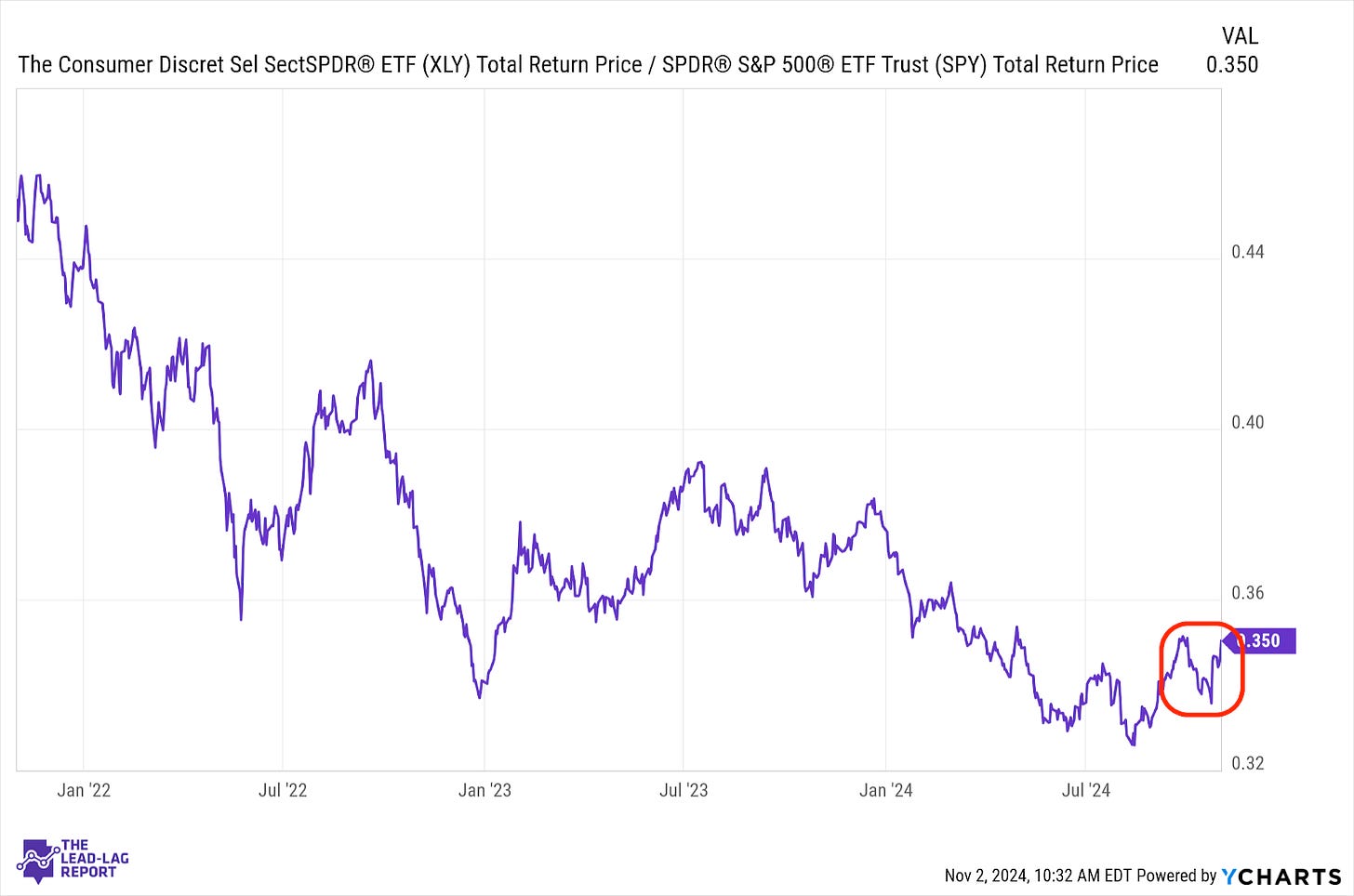

Consumer Discretionary (XLY) – Debt Is Becoming A Problem

The retail environment (at least according to sales and spending figures) is still looking resilient heading into the all-important holiday season. As the election cycle reaches its conclusion, inflation and debt seem to be getting more light shined on them now. Consumer debt levels are still a problem and this sector could quickly turn if this becomes a broader concern for the market.

Communication Services (XLC) – Tech Earnings Bump

This sector finally broke out of its range, but I’m not sure if it’s sustainable. This is perhaps the one group where overconcentation in Alphabet and Facebook can work in its favor if they keep blowing it out in AI. Alphabet clearly provided a lift based on its results, but Facebook was more mixed. If tech valuations start correcting as growth rates moderate, this sector is likely to follow lower.

Financials (XLF) – Another Launching Point

Financial stocks have been cheering higher rates and have become a clear market leader over the past several weeks. This could be the one sector really impacted by the election’s outcome. If Trump wins, it could usher in another period of deregulation that makes it easier for banks to operate and profit. The environment does appear to have improved for this sector and this week could be another launching point.

Treasury Inflation Protected Securities (SPIP) – Waiting Out The Election