The Low Duration Tilt Is Nice

But This 10% Yielder Doesn’t Bring Enough To The Table

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

With inflation coming in hotter than expected, the Fed looking more and more unlikely to cut rates anytime soon and the yen on the verge of collapse, the bond market is starting to become more volatile. I’m firmly of the belief that the short-term range on Treasury yields could be very wide. They could shoot much higher if inflation persists and/or the Bank of Japan uses its Treasury stockpile to save the yen. Conversely, they could go much lower if stocks eventually break and the flight to safety trade finally kicks in. The possible range of outcomes this year is quite large.

That’s why it may be a good time for investors to consider managing some risk. If you’re still searching for yields of 8%+, you’re obviously going to need to take some risk to make that happen, but there are ways to mitigate it. That’s why I’m taking a look at the Franklin Limited Duration Income Trust (FTF) today. While it invests primarily in the junk bond market, it reduces by more than half the duration risk that exists in many other closed-end bond funds. It won’t eliminate all sources of risk obviously, but it might be ideal for the current environment where yields could go either way.

Fund Background

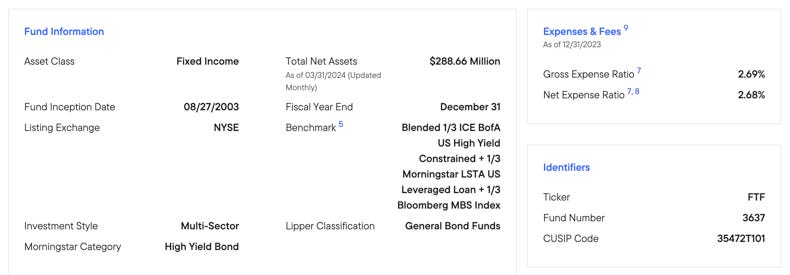

FTF seeks to provide high current income, with a secondary objective of capital appreciation by investing primarily in high yield corporate bonds, floating rate corporate loans and mortgage- and other asset-backed securities. The fund’s goal is to provide relatively high yield while maintaining a relatively low correlation to interest rates. The fund also utilizes leverage in order to enhance yield and total return potential.

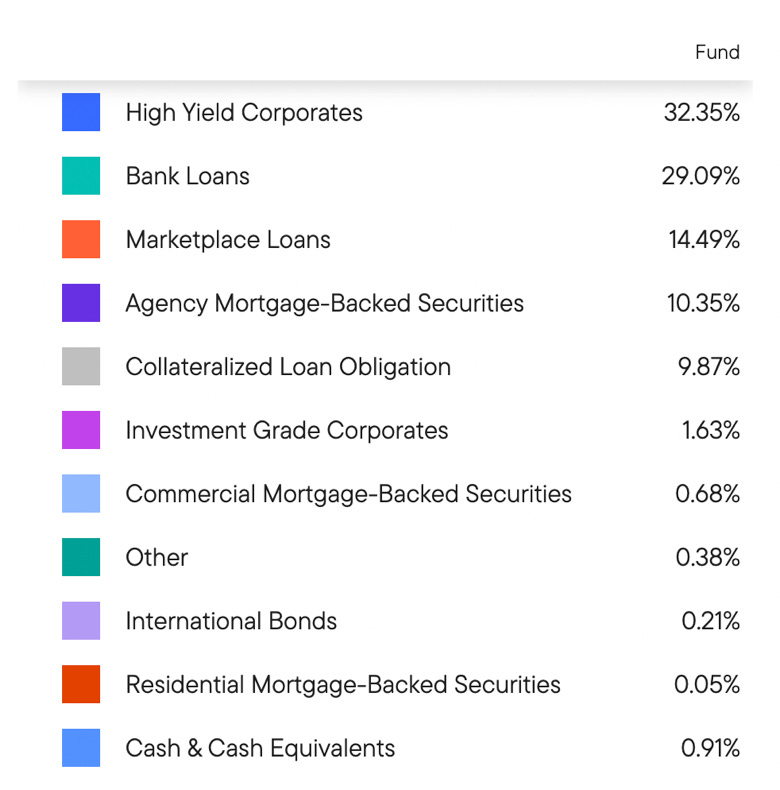

You can see by the fund’s benchmark that this fund invests quite broadly across the fixed income marketplace, but it’s the limited interest rate exposure that’s the draw. Currently, the portfolio has a duration of just under 1.5 years. It’s important to remember that this is still a high yield fund (that uses leverage), so volatility will still be high and it’ll be exposed to credit event risk as much as any high yield portfolio. The 2.68% expense ratio is largely a function of the high cost that comes with using leverage.

Overall, diversification is a plus, but it’s mostly still centered in the non-investment grade category. Traditional high yield bonds are responsible for the biggest allocation, but typically lower-grade bank loans are right there too. Marketplace loans, which are essentially peer-to-peer loans and CLOs often come with low credit ratings as well. Mortgage-backed securities could be especially risky in this market considering rising interest rates and the pressures building in the housing market. Investment-grade exposure is very modest.