Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

As we enter 2025, the fixed income market may soon become more challenging. Yes, long-term Treasuries are still more than 40% off of their all-time high, so the carnage has been pretty impressive already, but many investors have found solace in high yielders. During that drawdown, junk bonds have actually gained about 30%, a testament to the flood of liquidity that’s been dumped into the system.

That’s come with a downside though. Credit spreads have pushed to nearly all-time lows as investors price out almost any risk within this group. That creates an abnormal risk/reward profile and means investors will need to be much more diligent moving forward.

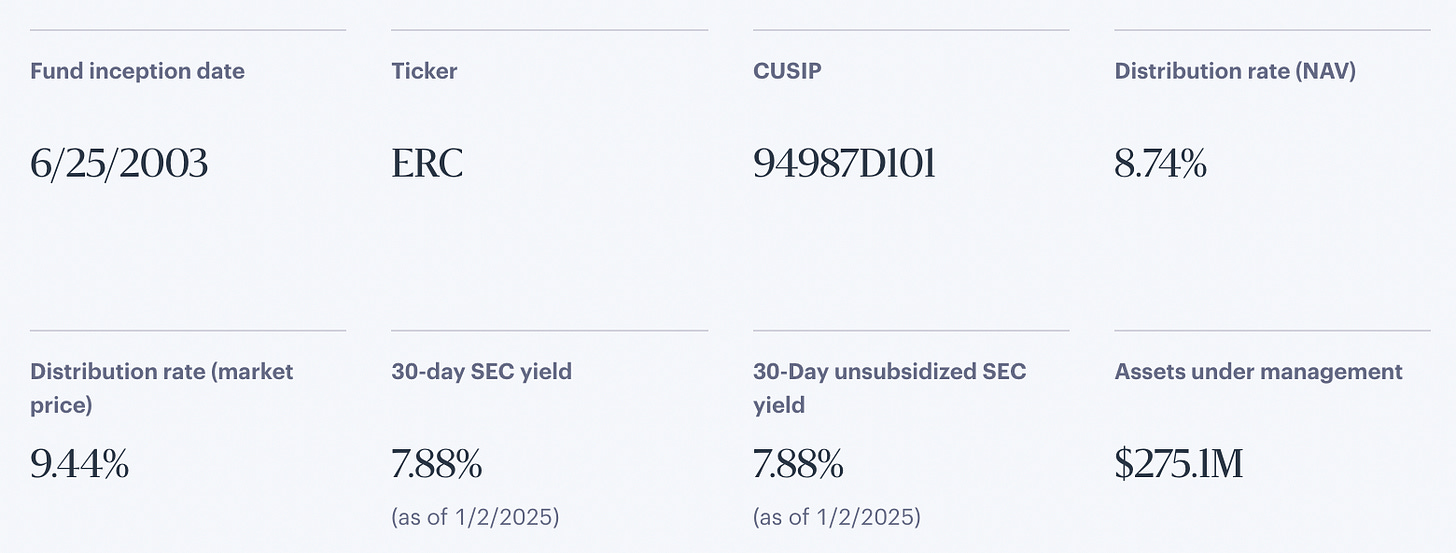

The Allspring Multi-Sector Income Fund (ERC) takes a differentiated approach to fixed income. While it too focuses on the high yield space, it diversifies into foreign bonds, investment-grade notes and mortgage-backed securities in order to mitigate risk and opportunistically improve that risk/reward profile.

Fund Background

ERC seeks to provide a high level of current income consistent with limiting its overall exposure to domestic interest rate risk. Under normal market conditions, the fund allocates approximately 30%–70% of its total assets to a sleeve consisting of below-investment-grade (high yield) debt, approximately 10%–40% to a sleeve of foreign debt securities, including emerging market debt, and approximately 10%–30% to a sleeve of adjustable-rate and fixed-rate mortgage-backed securities and investment-grade corporate bonds. It allocates strategically to a variety of alpha sources through security selection, sector allocation, duration and curve positioning. It uses leverage in order to enhance yield and total return potential.

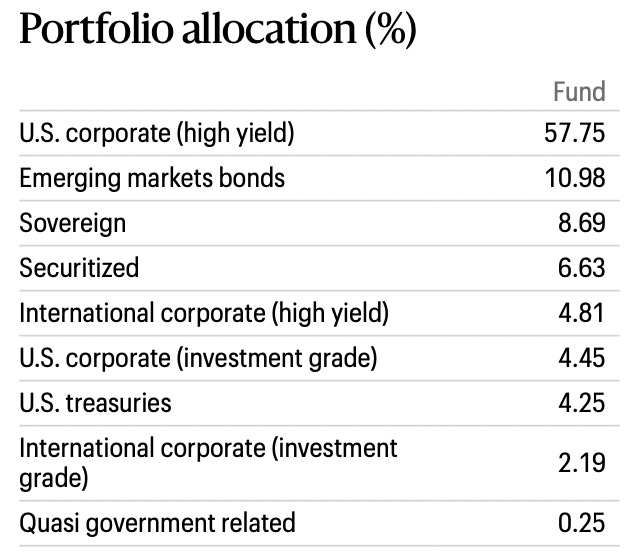

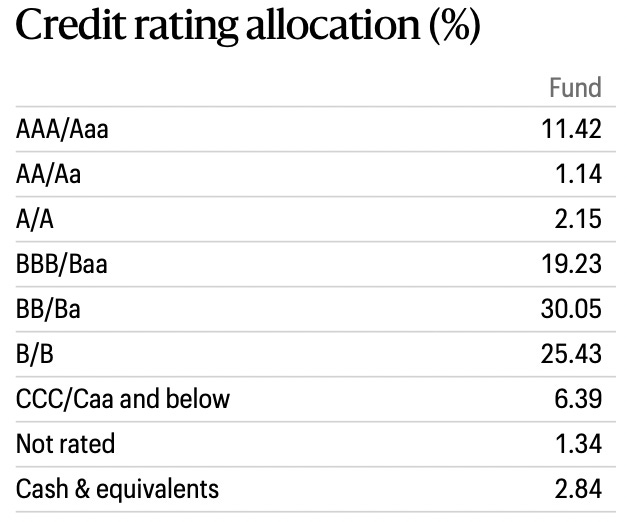

The diversity, obviously, is the key here. Many high yield CEFs dip not just into, but deep into, low quality bonds to boost the yield. ERC has some of that, but it’s much more balanced out than many of its peers. There’s enough of a mix that it probably shouldn’t even be called a high yield fund. It’s really more of an all-quality fund. The exposure to emerging markets bonds has been fruitful over the past year-plus, but it hasn’t been enough to keep the fund in the upper half of its Morningstar category. The leverage has been costly and, while the distribution rate has been attractive, it has done more to increase volatility than anything.

Most of ERC’s portfolio is in the traditional U.S. junk bond sector, although it’s fairly diversified beyond that. Its current foreign component is roughly in the middle of its 10-40% target range, indicating no particular lean in either direction. The overall sovereign debt piece, including U.S. Treasuries, helps to improve the overall risk profile, but its relatively small allocation doesn’t do much to move the needle.

Overall, ERC is roughly ⅔ non-investment-grade debt and ⅓ investment-grade. That feels like a pretty good mix if you want to maximize yield, yet keep volatility under some control in the process. I like that the high yield sleeve isn’t too heavily tilted towards ultra-low grade debt and sticks mostly to the mid- and upper tiers of the credit quality scale. ERC’s investment-grade piece, not surprisingly, allocates heavily into the BBB bucket, as does those of many investment-grade bond funds.

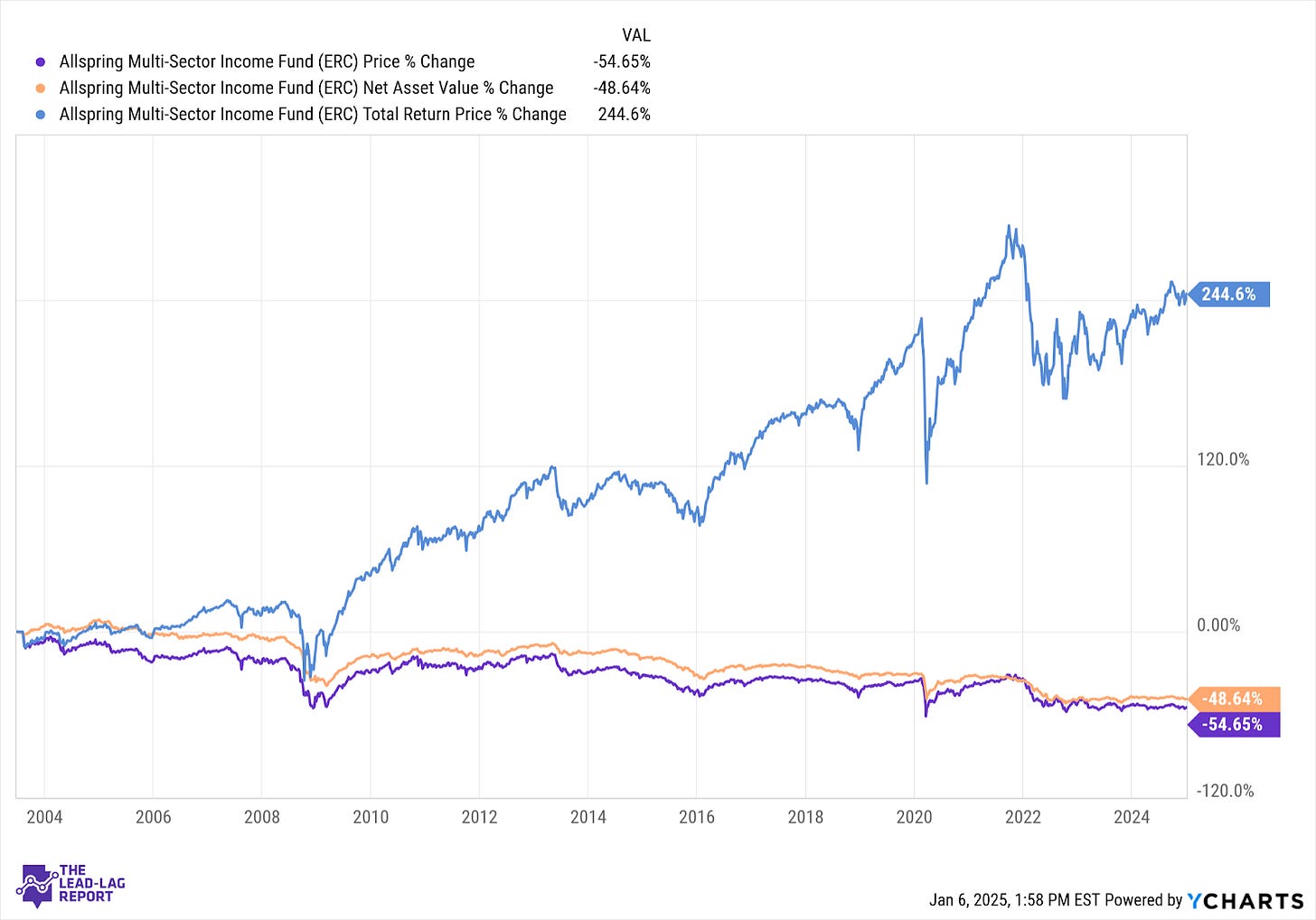

ERC was launched in June 2003. Since its inception, the fund has returned a total of 245%, which translates to about 6% annually.

Overall, the fund’s 2-star Morningstar rating indicates historical below average performance compared to its peer group. Drawdown risk has proven to be a problem under the wrong market conditions. During the COVID pandemic, for instance, ERC experienced a 40% drawdown compared to 20% corrections for both U.S. investment-grade and U.S. junk bonds, not perfect benchmarks I know but illustrative nonetheless. The 50% decline in the NAV over time suggests some problem keeping up with the fund’s fixed percentage distribution policy, something we’ll get into in a moment.

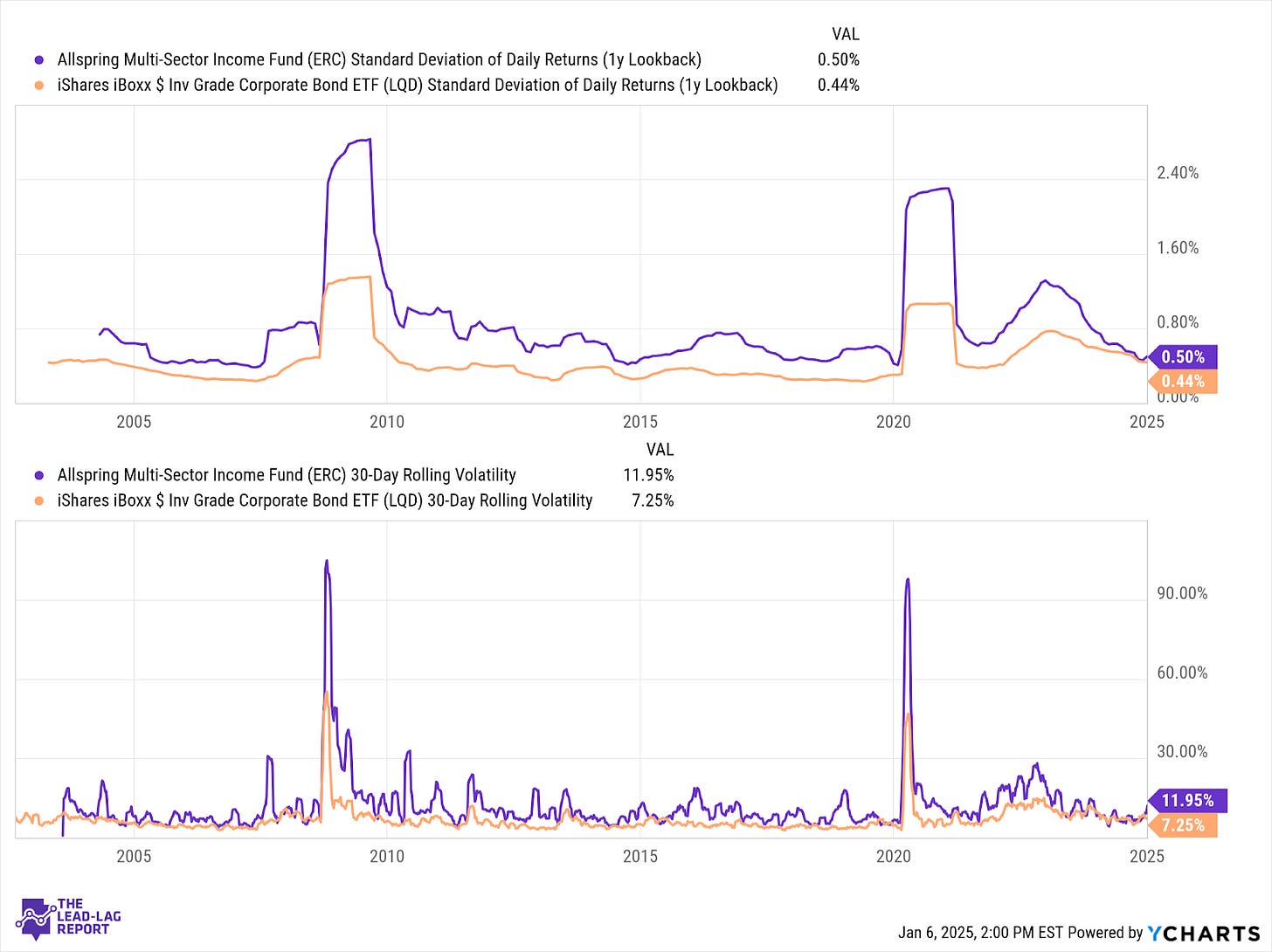

In troubled bond markets, volatility can spike substantially, but under more normal conditions, it’s not as significant as you might expect given its credit quality profile, international exposure and 30% use of leverage. That could actually be somewhat advantageous at times if you can capture enhanced exposure with somewhat limited additional risk, but the fund’s history suggests it hasn’t been able to consistently take advantage of it.

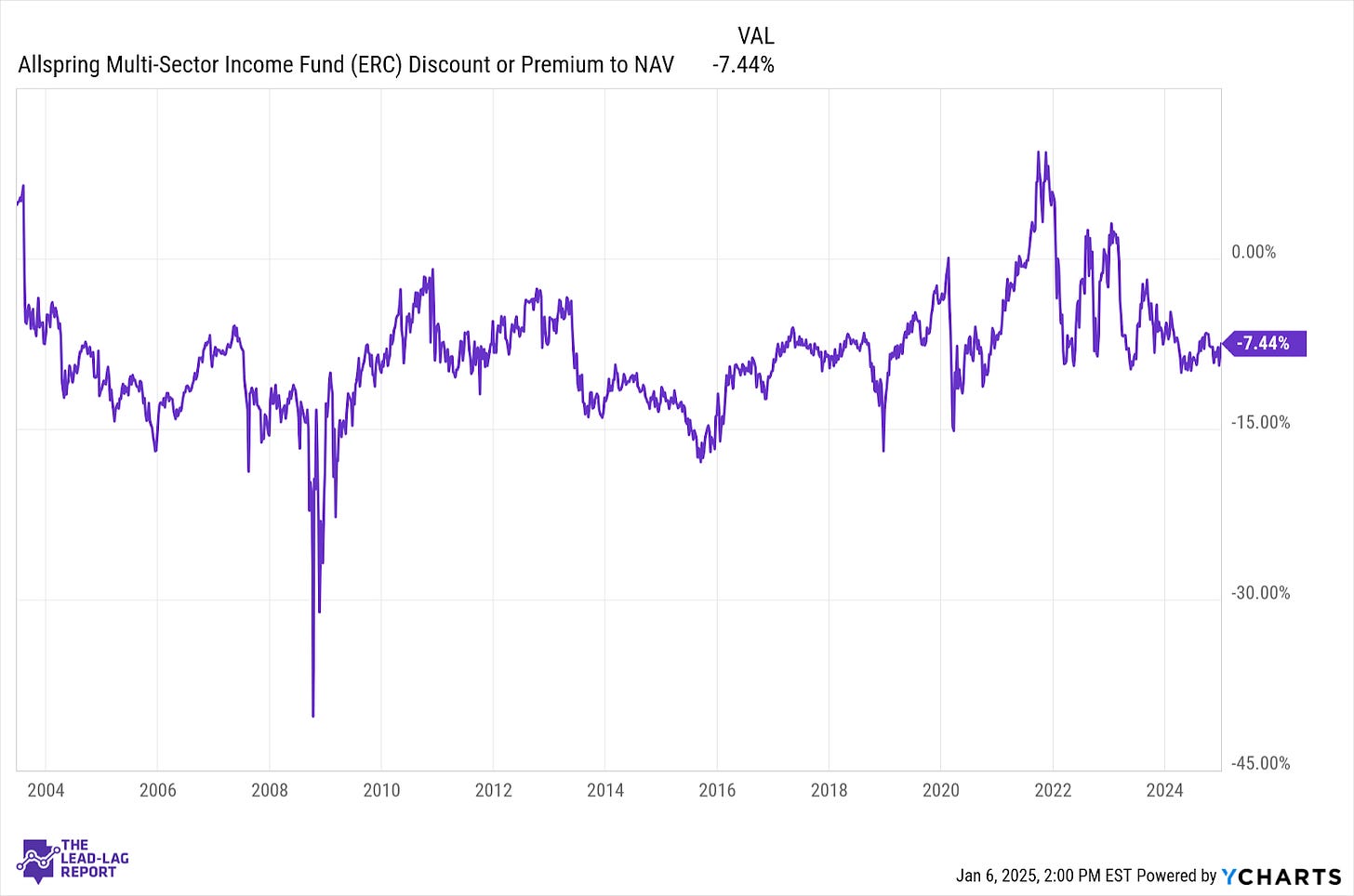

ERC mostly trades at a discount to its underlying NAV, but its historical range hasn’t been too wide. Outside of the post-pandemic period, it has mostly stayed between -5% and -15% with few exceptions. Volatility in the NAV discount has calmed substantially over the past year and that’s helped contribute to the current below average volatility overall. Right now, the discount is near the bottom of its historical 4-5 year range, but not so much that it presents a good value opportunity.

Macro Environment

There’s a lot of different angles with which to approach this fund, but the state of the junk bond market is obviously what’s going to impact it most. Junk bonds, as I mentioned above, have been one of the best performing subgroups of the fixed income market for the past several years. That’s been accomplished on the wings of a lot of government liquidity and a collapse in high yield spreads. That’s been able to keep a lot of credit issuers afloat longer than they probably should have been and lowered yields further than they should be given overall conditions. I would be repeating myself incessantly by saying that the risk/reward tradeoff in junk bonds right now is skewed negatively and I believe that to be the case now. However, those negative conditions have persisted for quite some time and we have yet to see junk bonds experience any kind of meaningful pullback. I don’t think junk bonds can hold on like this forever, but it’s taken longer than I anticipated.

The markets have been anticipating lower bond yields for a while, but now it looks like higher yields are here to stay on both ends of the curve. If the Fed only has 1-2 cuts in it in 2025 (and I wouldn’t be surprised to see a hike considered at some point), T-bill yields might hang around 4% for a while. Long end yields have clearly reacted to a lack of Fed action and the likelihood that inflation will be persistent, if not an outright problem, in 2025. Depending on how that situation progresses, it’s not out of the question that the 10-year and 30-year bonds touch 5% sometime soon. All of this is to say that it’s no longer a given that falling yields will create share price appreciation potential. Yields may be stuck in this range for a while and that’s where security selection is going to play a larger role in outperformance potential. ERC has that and it could be a differentiator moving forward.

Distribution Policy

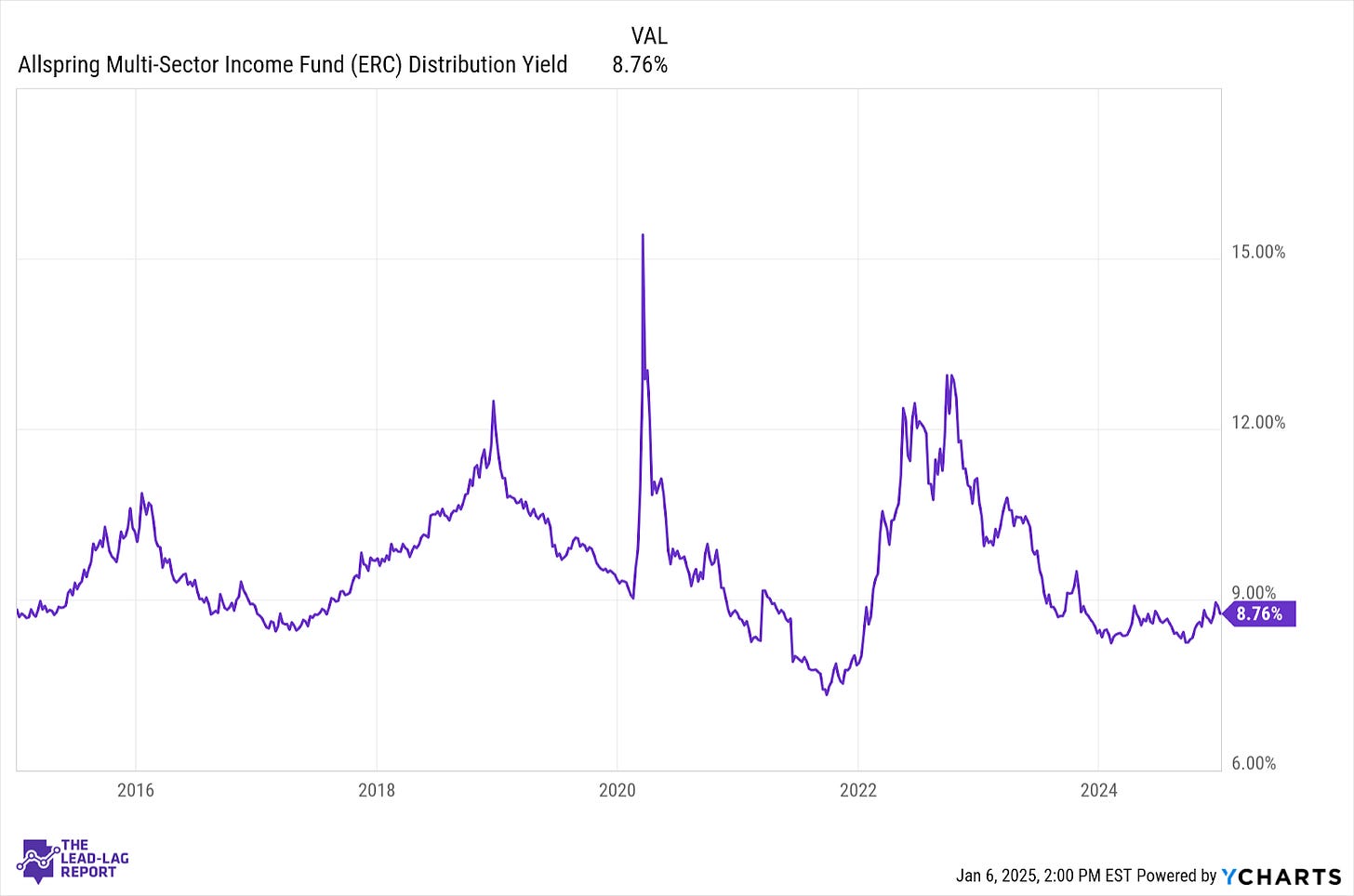

ERC maintains a fixed monthly distribution policy that has it paying out a fixed percentage of net assets annually. The policy currently pays an annual minimum fixed rate of 8.75% based on the fund’s average monthly NAV per share over the prior 12 months. This percentage was increased from 8% in November 2024.

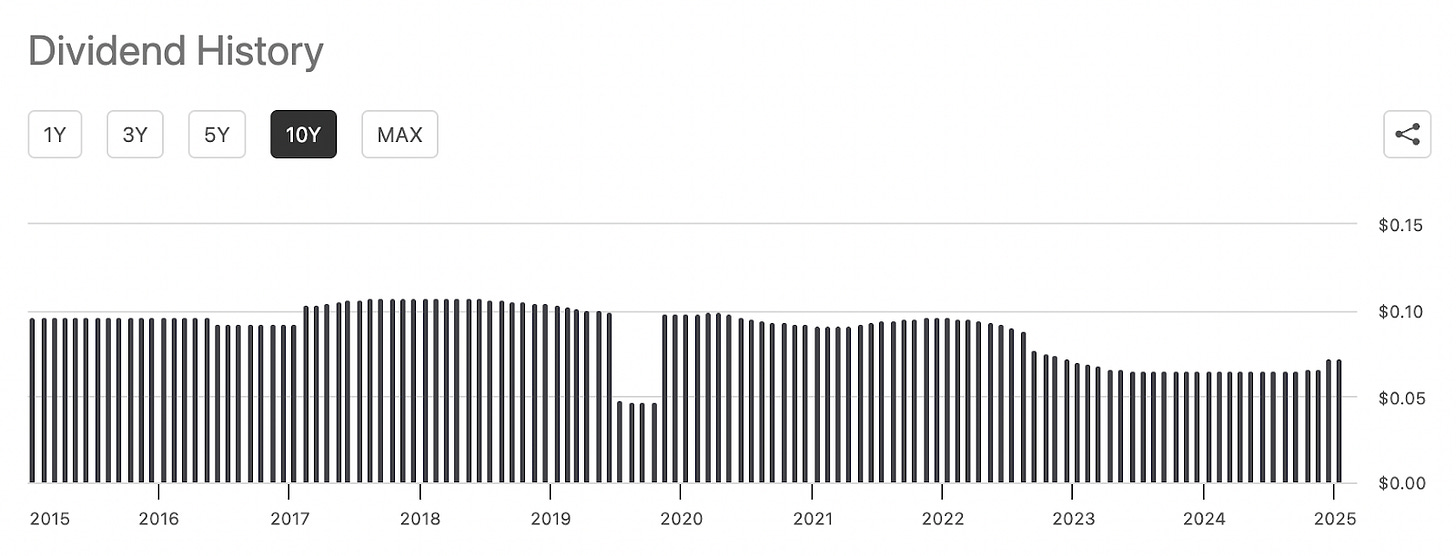

Volatility in the bond market has made the trailing 12-month yield look more wild than the monthly distributions have been. The fact that the fund uses NAV history over the prior 12 months adds a degree of stability to the month-over-month payouts and makes the historical distribution chart look much better.

While the stability is a plus, the fact that the distribution continues to trend lower is somewhat concerning, especially in an environment where lower grade debt has actually been moving higher. Yes, not all of the fund is invested in U.S. high yield and that’s certainly contributing, but the longer-term decline isn’t encouraging. The uptick to start 2025 is a good thing, but given the weakness in background macro conditions, I think another distribution decline could be in the works.

Advantages

The variety of holdings within the fund - government & corporate, investment-grade & junk, U.S. & foreign - should be beneficial over the long-term. Only a narrow subset of fixed income has done well in recent years, but the balance in ERC should help manage both risk and returns in the future.

The managed percentage distribution plan helps promote stability in the month-over-month payouts and eliminates the possibility of a more significant out-of-the-blue distribution cut at some point in the future.

Volatility actually looks pretty reasonable given how some of the fund is invested and the use of leverage.

Disadvantages

The use of leverage by the fund has been costly (the fund’s expense ratio is north of 3%) and hasn’t really helped with performance. Results have been below average for most of the fund’s life.

There’s some evidence that the 8.75% distribution rate may not be sustainable over the long-term. Granted, a move by the fund to increase the rate from 8% to 8.75% suggests at least some degree of confidence in its ability to maintain it, but there’s also the potential that it’s being done to make the fund look more attractive and draw in assets.

Conclusion

I like how the fund is constructed and how it includes securities from a number of areas of the fixed income market. I think that’s generally beneficial over the long-term and could help mitigate some downside risk should any particular area of the market go south.

However, there’s no real evidence that the fund can be even an average performer (it’s well in the bottom half of its peer group over every major time frame). The portfolio and the yield may look reasonable, but it ultimately comes down to performance. For a bit of diversity, I think ERC offers some benefits. For performance, however, it might be better to look elsewhere.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.