The market seems to finally be calming down somewhat. The most aggressive of trade war escalations between the United States & China appear to have hit a peak with no further increases to tariff rates. The rhetoric looks like it’s slowed down and Trump has begun backing off some of his most potentially impactful tariffs. The walkback of tariffs on Chinese semiconductors and electronics has improved Wall Street’s mood and we’ve seen investors begin retesting the waters on risk assets, including equities and junk bonds.

The problem remains that we don’t know if this will last a day, a few weeks or longer. Trump has gone from levying individual countries to individual sectors. While the White House announced the exemption on semiconductor tariffs, Trump said just days later that while they may not be a part of “reciprocal” tariffs, they’re going to be a part of an alternative tariff plan. For now, electronics and autos seem to have gotten a break, but semiconductors and pharmaceuticals are back to being targets. This kind of whiplash and instability in trade policy is likely going to prevent volatility levels from returning to historically normal levels on a consistent basis.

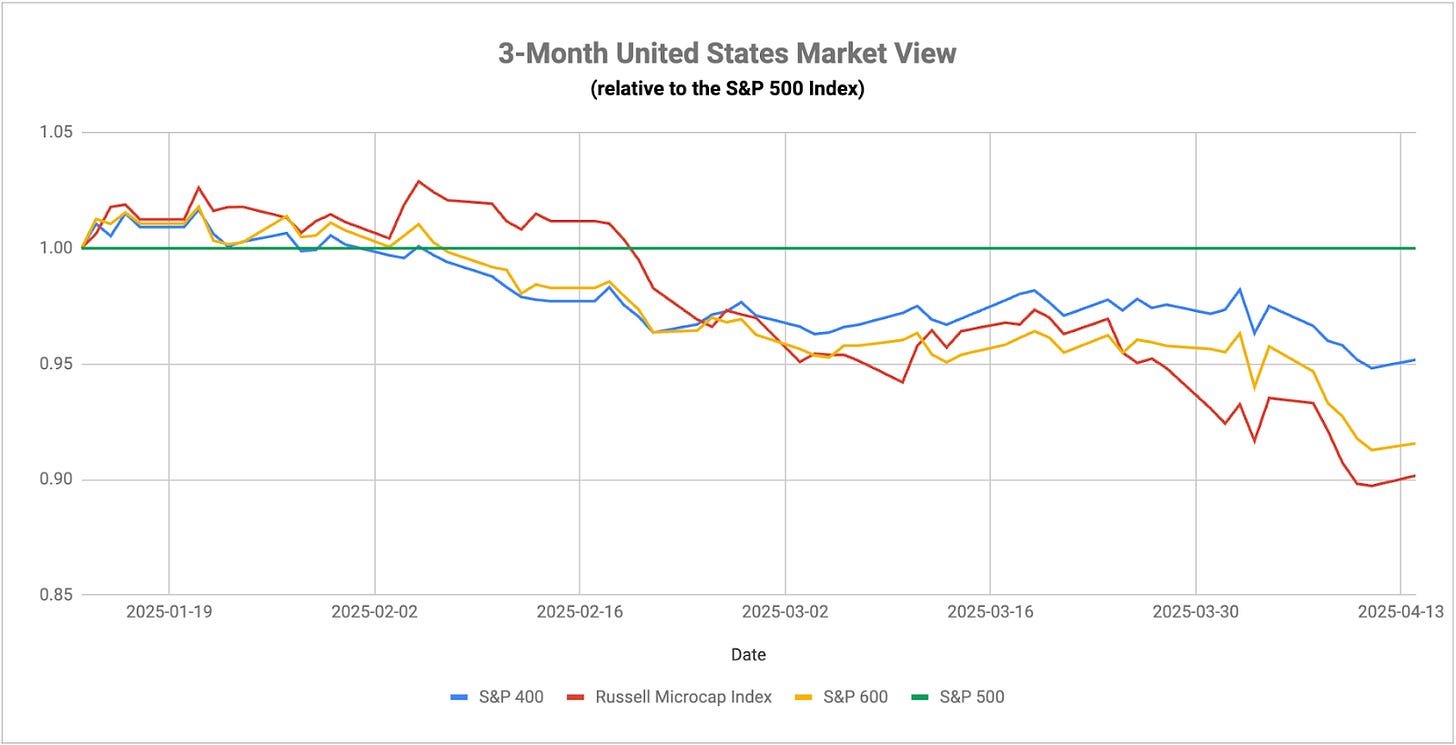

In volatile environments, such as the current one, it’s important to look at what the signals are telling us. In short, utilities are in an uptrend relative to the S&P 500, signaling risk-off. Small-caps, which are likely to get hit especially hard in the Trump tariff regime due to the lack of flexibility to adjust, have been consistently trailing large-caps, signaling risk-off. Lumber is plunging while gold is soaring, signaling risk-off. Treasuries and the dollar are at least stabilizing here, giving them a better opportunity set moving forward to act like risk-off assets again. The VIX is still in the upper 20s as I write this, about 50% above historical norms and the range where bad stuff tends to happen. Enjoy the short-term bounces, which are common in bear markets, because most of the signals are still indicating that risk-off conditions are in control.

A couple of other observations:

Don’t pay as much attention to the current data coming in because it’s already outdated. The drop in inflation and the stability in manufacturing are all coming from March readings, before the tariff tantrum took place. Expect larger, probably negative, moves in the near future.

Bank earnings have mostly been solid, but all of the big banks are expecting trouble for the rest of 2025. Credit availability is likely to start shrinking as we progress further into the year and that’s going to add additional pressure to the current slowdown.

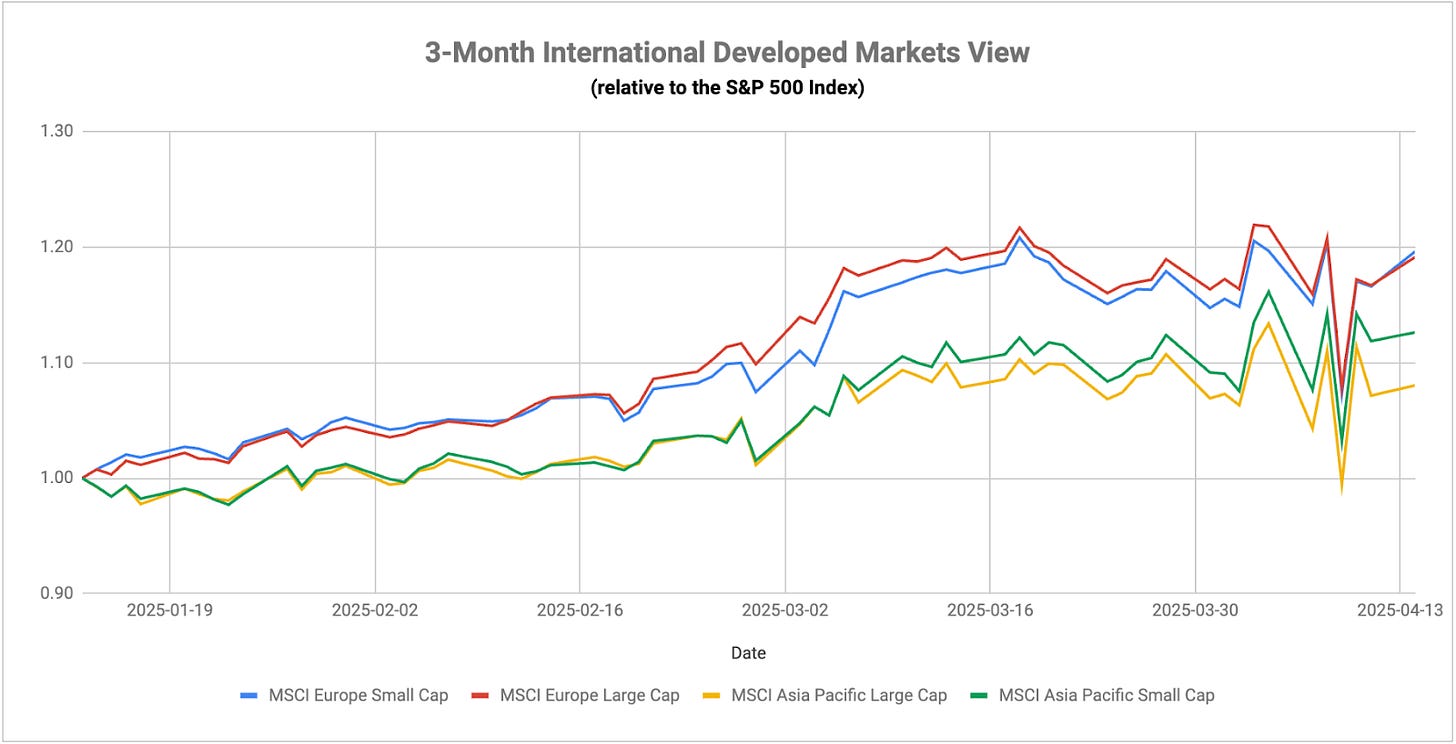

International stocks were enjoying a firm uptrend relative to U.S. stocks when the latter was entering a slowdown period but the former was seeing some expansion potential. That opportunity set seems to be in the past for now as the Trump tariffs have put the entire world at risk of a slowdown. Volatility, as you can see in the chart above, has been much above average for weeks and has only recently begun to stabilize. Asia, not surprisingly, has continued to underperform as they’ve been more of a target on trade. Value has become less of a delineator lately as investors use the geopolitical cooldown period as a reason to slowly move back into risk assets.