Key Highlights

U.S. inflation continues to cool without a sharp deterioration in labor markets, reinforcing expectations that the Federal Reserve will remain on hold near term.¹

Equity leadership is widening meaningfully, with small- and mid-caps outperforming mega-cap technology and signaling healthier market breadth.²

Globally, disinflation is allowing central banks in Europe, the U.K., and parts of emerging markets to pause or pivot, while Japan begins a historic normalization cycle.³

Resilient Growth and a Shifting U.S. Market Narrative

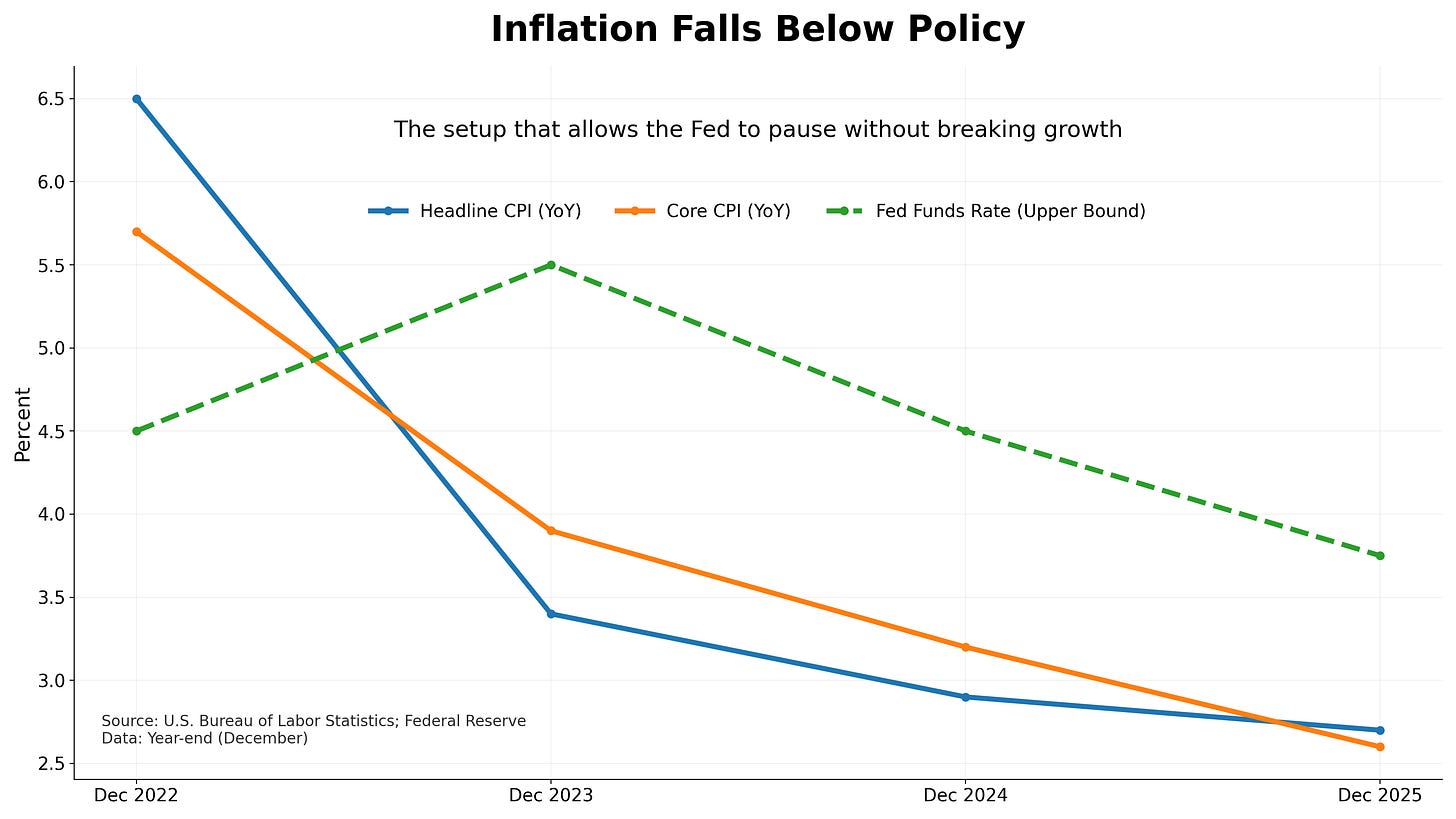

The U.S. economic backdrop entering early 2026 reflects a rare combination of moderating inflation and continued growth. Consumer prices rose 2.7% year over year in December, with core inflation easing further to 2.6%, underscoring how far price pressures have retreated from their post-pandemic peak.⁴ The labor market has softened only modestly, with unemployment hovering near 4.4%, a level consistent with stability rather than contraction.¹

This balance has allowed Federal Reserve officials to step back from aggressive tightening. After cutting rates late last year, policymakers have signaled patience, emphasizing the need to assess incoming data before making additional moves.⁵ Futures markets still price in rate cuts later in the cycle, but stronger-than-expected retail sales suggest the economy retains momentum.⁶

Equities have responded accordingly. The S&P 500 remains near record highs, supported by earnings resilience and declining volatility.⁷ Temporary pullbacks tied to sector-specific news, including technology export restrictions and uneven bank earnings, have been met with renewed buying interest rather than broad risk aversion.²

Bond markets have reinforced this message. Treasury yields have edged lower as inflation expectations stabilize, easing pressure on valuations without signaling recession fears. The yield curve remains inverted, but the inversion has narrowed, suggesting markets are beginning to look beyond the tightening phase.⁴

Rotation Takes Hold as Market Breadth Improves

One of the most important developments of early 2026 has been the broadening of equity participation. After years of dominance by a narrow group of mega-cap technology stocks, smaller and more cyclical companies are regaining leadership. Both small- and mid-cap indices have reached record highs, while the equal-weighted S&P 500 has meaningfully outperformed its capitalization-weighted counterpart.²

This shift reflects several forces. Valuation dispersion widened significantly in prior years, leaving non-mega-cap segments comparatively attractive. As rate pressures eased, investors began reallocating toward sectors tied more closely to domestic growth, including industrials, materials, and selected financials. The result has been healthier internal market dynamics, with gains distributed across a broader range of companies rather than concentrated in a handful of names.

Sector rotation has followed a similar pattern. Cyclical and value-oriented groups have outperformed, while technology has paused after an extended run. Energy and materials benefited briefly from geopolitical headlines and commodity volatility, while defensive sectors quietly attracted flows during periods of equity consolidation.² Importantly, these rotations appear to reflect repositioning rather than wholesale risk reduction. Capital has remained largely within equities, shifting leadership rather than exiting the market altogether.