As U.S. large-caps push to new highs, we’re seeing only minor evidence that the market is broadening out here. Tech is the 2nd best performing sector year-to-date. Momentum, high beta and growth are the best performing factors. Mega-cap growth and large-cap growth are the best performing style boxes. After all the drama around tariffs, the Trump tax bill and geopolitical risks, investors continue to drift back to the areas of the market that have served them well over the past 2-3 years.

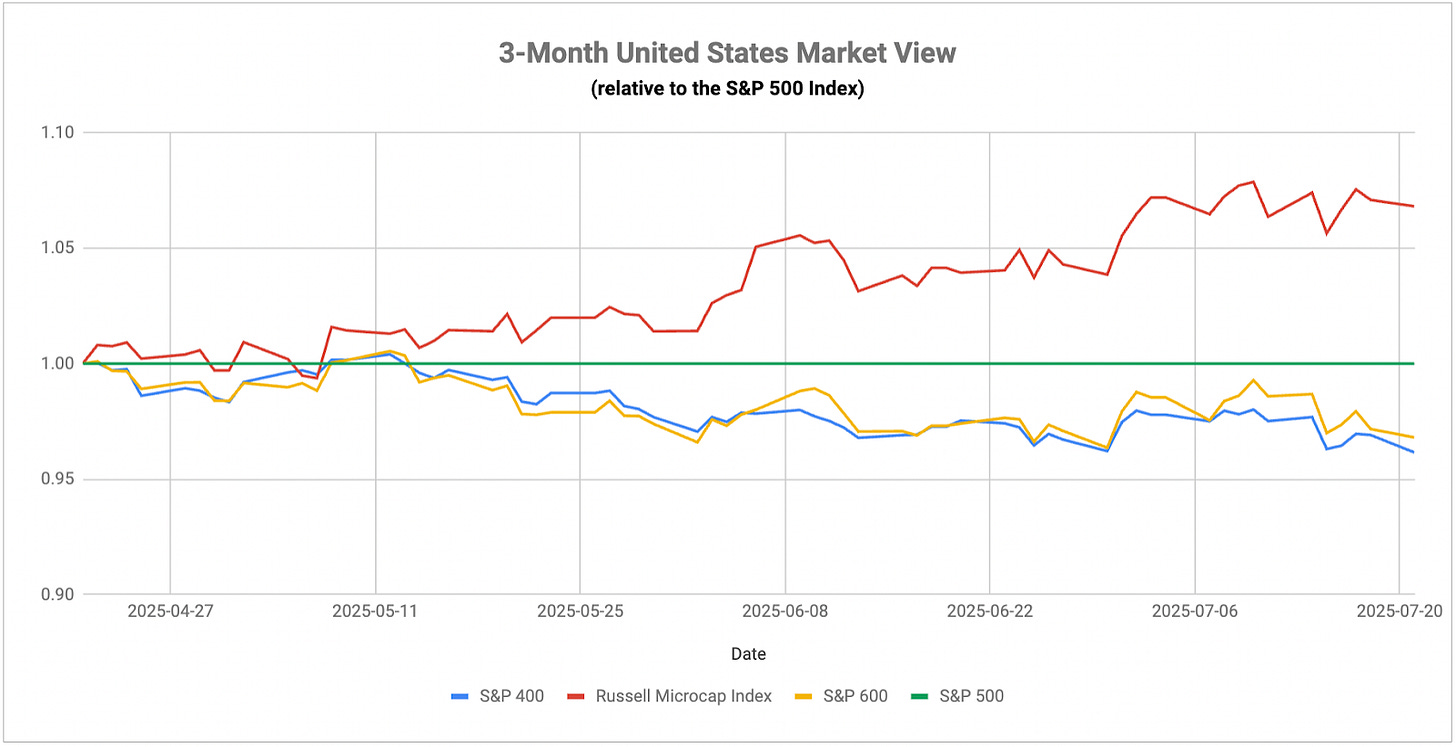

Small-caps, however, have been doing better here. They’re not necessarily beginning to outperform the S&P 500, but they are showing signs of keeping up. What’s interesting is that micro-caps, perhaps the companies most vulnerable to tariffs, high interest rates and inflation, have been leading the market since May. It’s hard to know what to make of this for sure given that there’s no obvious corner of the market supporting it at the moment. Nearly 50% of the biggest micro-cap index is allocated to financials and healthcare, two sectors that have consistently lagged the market over that time. Micro-caps and their 14x P/E ratio would certainly qualify as value, but that factor hasn’t done much either. Perhaps there’s some optimism around an economic recovery/expansion being priced in here, but it’s interesting how it’s been leading the market almost in spite of conditions.

Longer-term Treasuries have been turning more volatile lately, but the trend of yields is pretty clearly lower here. The Trump-Powell battle over control of the Fed certainly makes headlines, but I’m not sure it’s a real risk at this point. It’s very unlikely we’ll see a rate cut at the Fed’s meeting later this month, but there’s a 60% chance (at least according to the futures market) that we’ll get one in September. Either way, the market is still pricing in multiple cuts before year-end. Add in the uncertainty surrounding Trump’s tariff deadline and I think part of the reason we’re seeing yields move lower is a flight to safety pulse. The fact that TIPS have been sharply outperforming the broader Treasury market here, which is likely a function of the tariff deadline, further suggests the idea that the markets may be getting a bit nervous here.

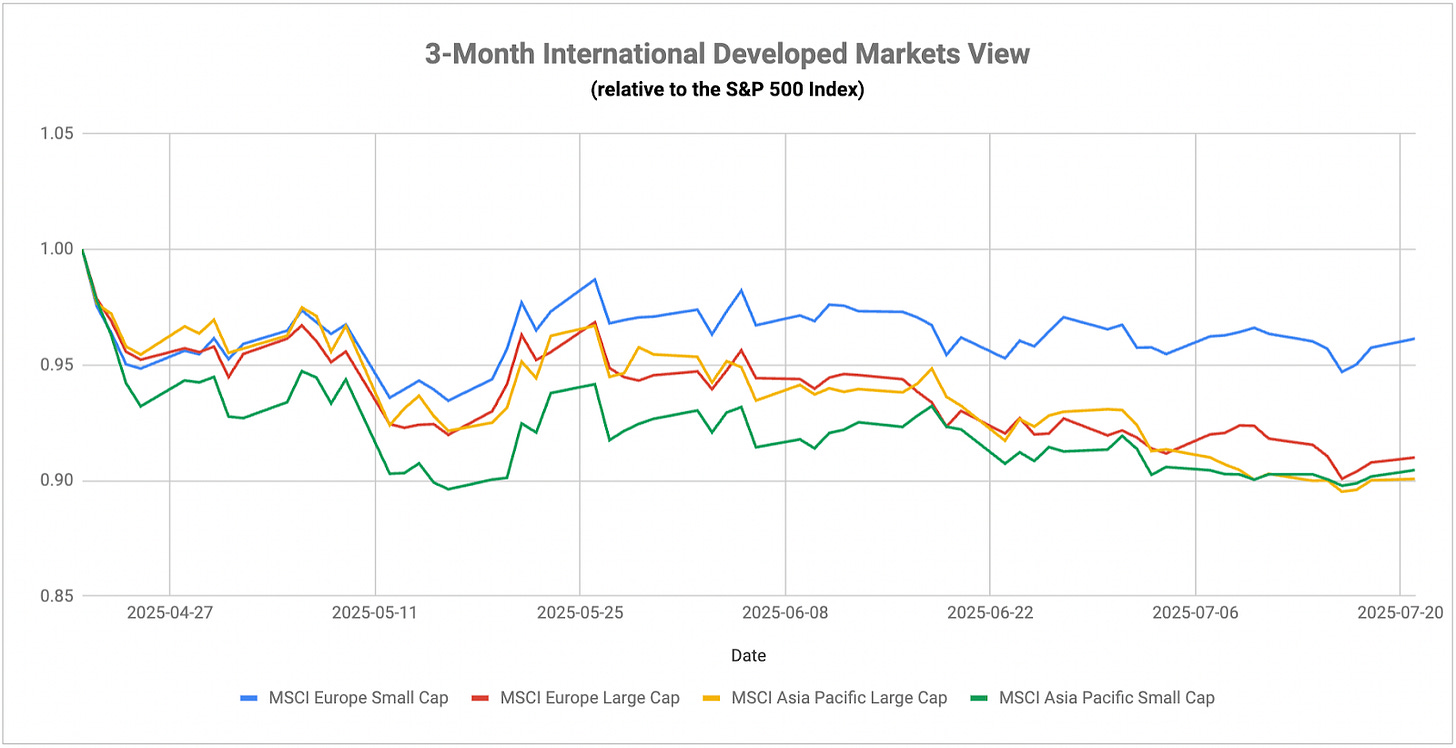

The election results in Japan didn’t really move the markets much in their immediate aftermath, a sign that the outcome was largely expected. It’s worth noting though that Prime Minister Ishiba likely lost seats in Parliament due to the country’s shaky economic situation. As you probably already know, growth has started to turn stagnant while the inflation rate is hovering around 3.5%. Those stagflationary conditions are nearly a worst case scenario for consumers, who are seeing prices grow faster than wages and then get a slowdown in growth in the meantime. Despite the concerns about inflation, the BoJ doesn’t seem to want to shift policy to address it (another hold is expected at their meeting later this month). In the end, the central bank can’t seem to quit the idea that they need to keep policy conditions as loose as possible and keep throwing money at the problem, even though that liquidity seems to still be causing more problems than solutions. Until the BoJ decides to address the inflation issue, the macro backdrop will probably continue to look weak.

The region to watch closest as we approach the August 1st trade war deadline is the European Union. Trump has threatened the Eurozone with 30% tariffs recently, a big increase from the 10-15% he had signaled earlier as part of any trade deal packages. This kind of stiff-arming in order to gain negotiating leverage is pretty common coming from the White House, but signs indicate that the EU might be ready to fight back beyond just reciprocal tariffs. The closer we get to the deadline, the higher the likelihood that no deal will be reached in time. This could be what the market is reacting to within the bond and TIPS market and why European equities continue to languish relative to the S&P 500. This could become a rapidly evolving source of volatility for the market over the next two weeks even though it’s largely been ignoring trade developments lately.