The Reverse Yen Carry Trade Is Happening

It’s Just Slower & More Controlled This Time

One of my more successful warnings to investors and subscribers over the past couple years has been the reverse yen carry trade.

A brief refresher: For years, traders and institutions have borrowed cheap yen at 0% or near-0% interest rates in order to put the proceeds into higher returning assets, namely U.S. tech stocks and the dollar.

That trade works as long as borrowing rates remain ultra-cheap. The problem today is that those borrowing costs are starting to get more expensive. Traders who were able to access virtually free capital for years are now finding themselves sitting on costly margin positions that they’re potentially being forced to unwind. That forces people to sell dollar-denominated assets, which raises volatility and sends risk asset prices lower in the process.

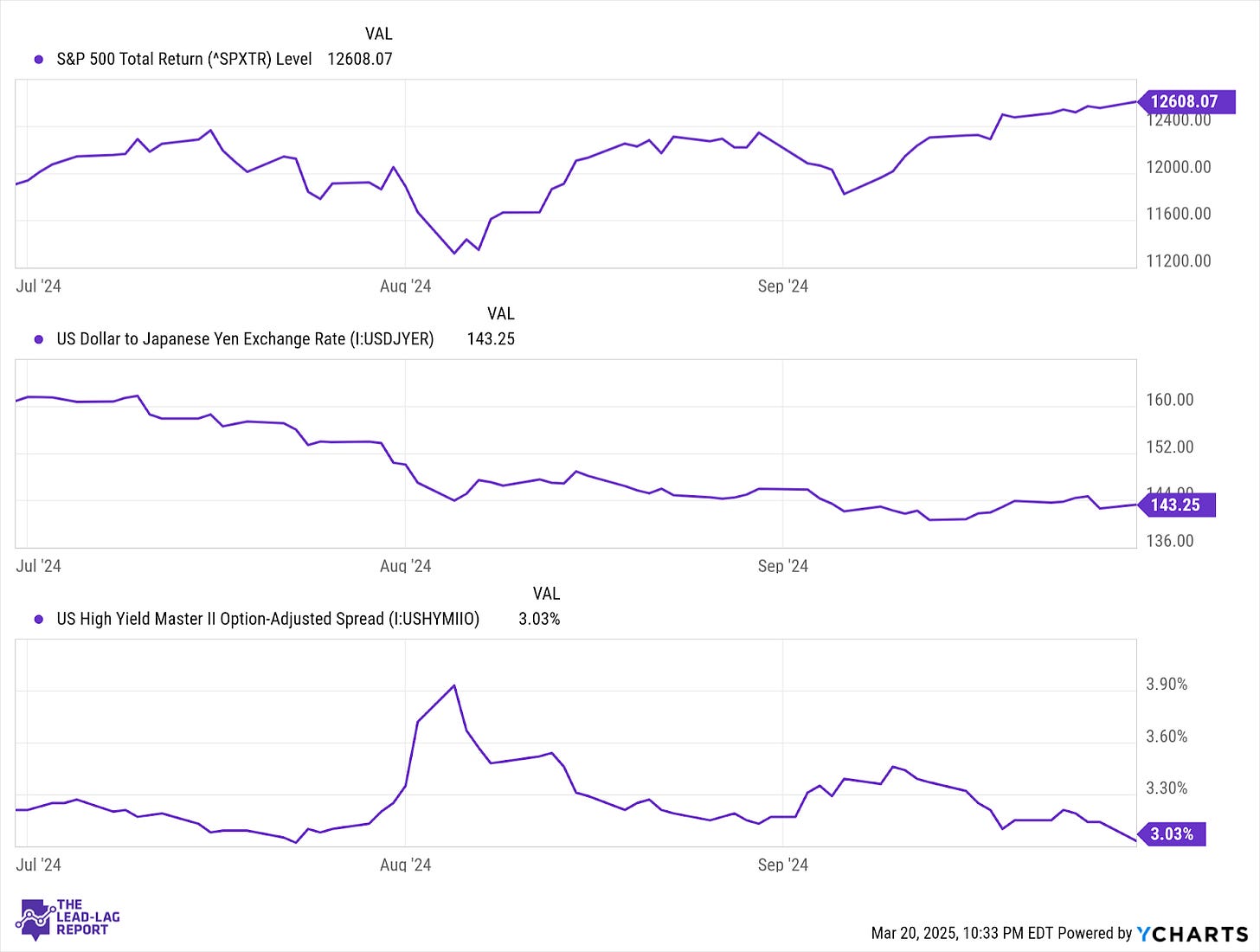

This most famously happened in August of last year. After the Bank of Japan raised rates by a quarter-point earlier in 2024, they caught the markets off guard with a second hike not long after. That triggered a huge rally in the yen that at one point shot the VIX above the 60 level and ignited a roughly 10% correction in the S&P 500.

The subsequent rebound in U.S. stocks may have had investors feel like this event was merely a road bump in an otherwise broader uptrend. After all, investors could lean on the fact that U.S. GDP was still running at a 2-3% annualized clip, inflation was at least under control (even if it wasn’t nearing the Fed’s 2% target) and corporate earnings were generally pretty good.

The problem as I see it is that this situation never actually went away. It never resolved itself in the way that many investors think that it did. Big carry trade unwinds don’t just last a couple of weeks and conditions are suddenly normalized.

It’s Happening Again!

If you look at what conditions were like during the original yen carry trade and what they are now, you’ll see that they’re not all that different.

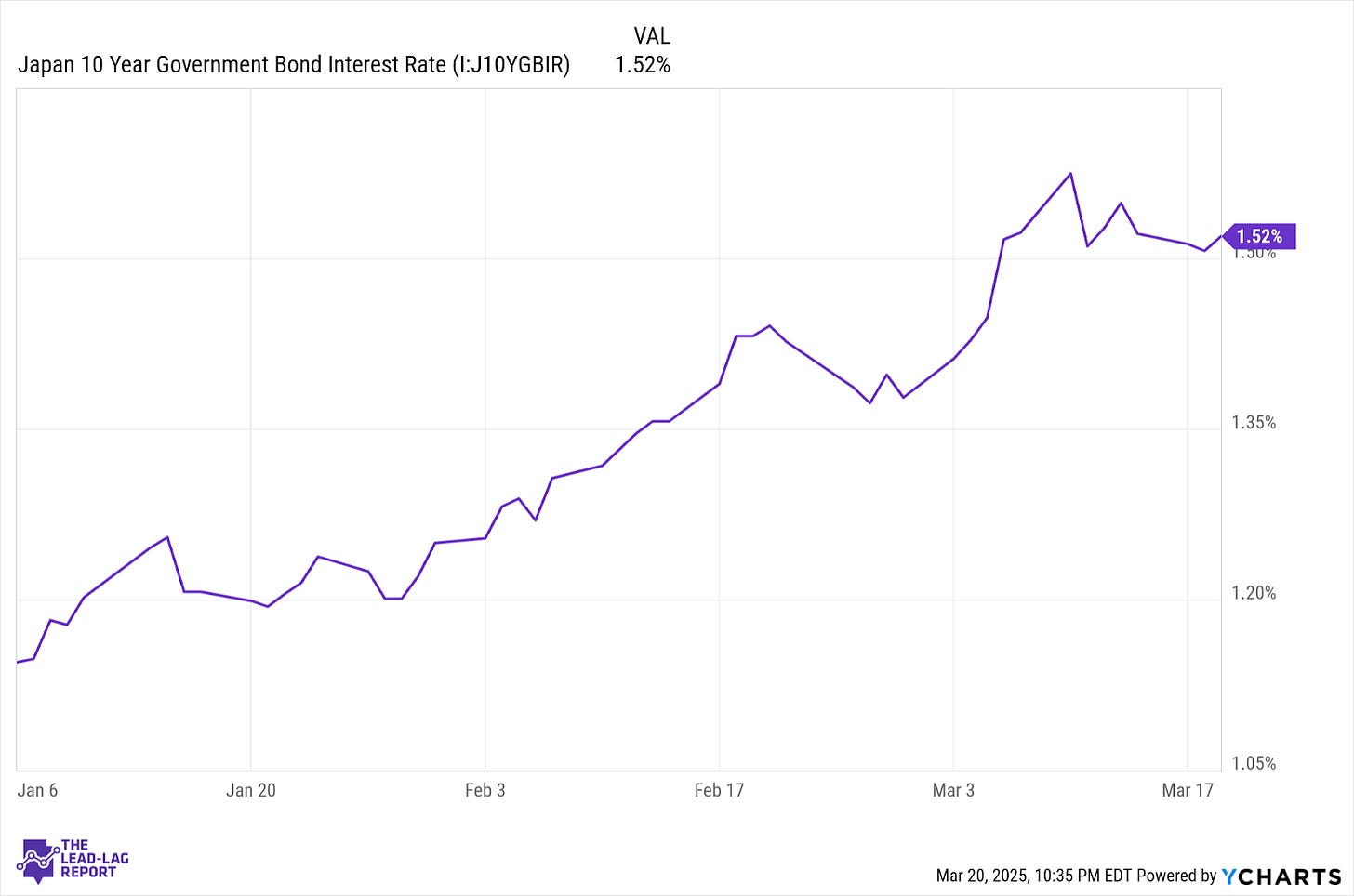

The yen is strengthening again. Long-term JGB yields are moving steadily higher. The Bank of Japan is still trending towards moving rates higher over the next 12 months. The Fed is likely going to be able to move rates lower at some point over the next 12 months.

This is the same forward-looking view that existed prior to the last carry trade reversal.

Whether the market realizes it or not (and with all of the attention right now going to tariffs and foreign trade policy, it may not), the second reverse yen carry trade is already in process. It’s just happening much slower this time around.

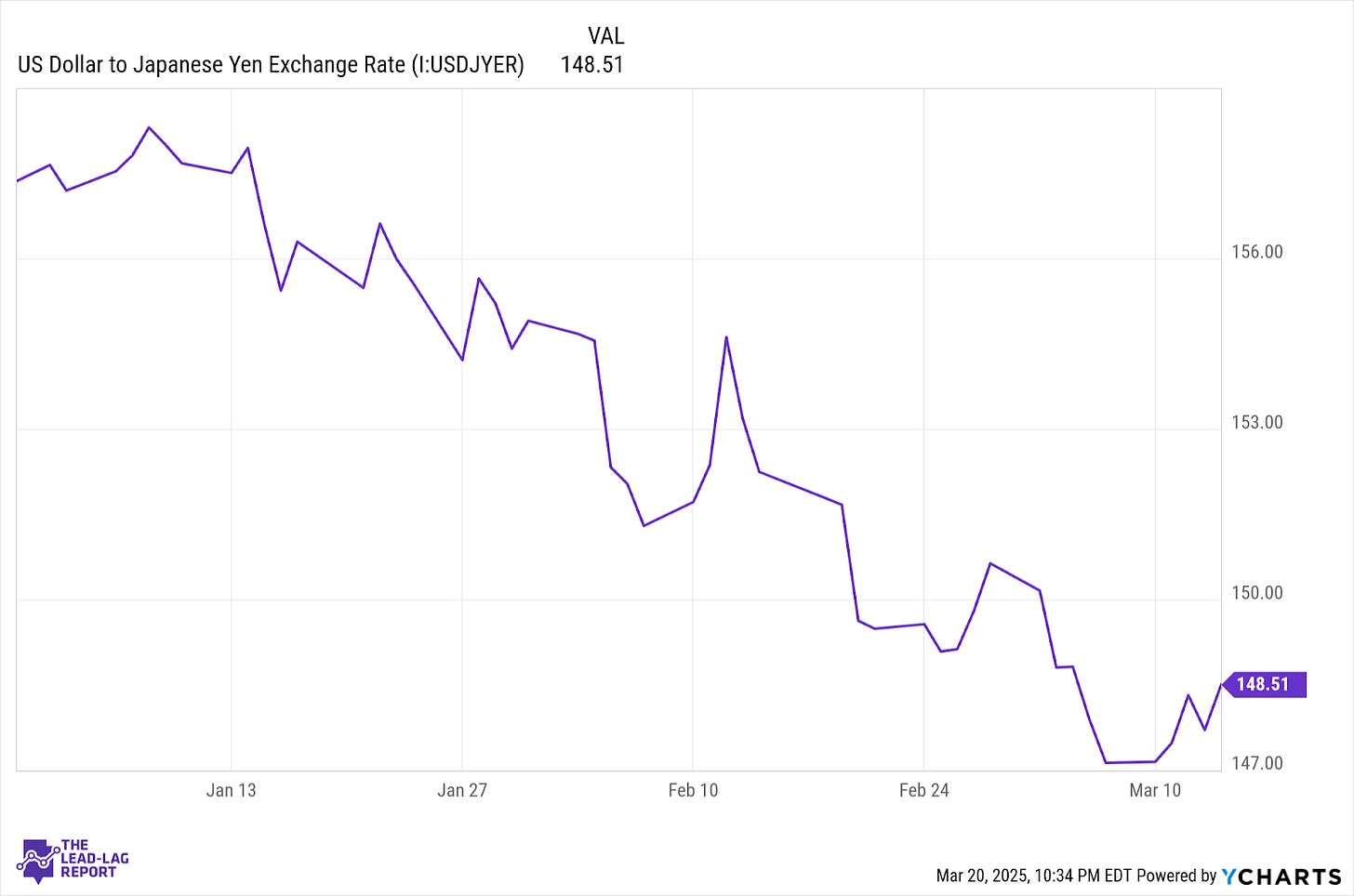

Let’s look at the current yen chart.

While it hasn’t necessarily been rallying sharply, it’s been rallying steadily. In fact, it’s right now squarely in the range of where it was triggering a pullback in U.S. stocks in the 2nd half of last year. And it’s not all that far from where the yen peaked back in September.

Now let’s consider where government bond yields are at.

The 10-year yield continues to climb higher and close the interest rate differential on comparable 10-year U.S. Treasury yields. That’s going to continue fueling strength in the yen that may continue into the later stages of 2025. And as long as the yen continues to strengthen, whether it’s quickly and slowly, that’s going to keep unwinding any outstanding carry trade that’s still out there. And it’s probably a lot.

And finally, let’s take a look at the chart for the S&P 500.

The rise of the yen preceded the current pullback in the S&P 500 by several weeks, but it’s definitely correlated with it. You can argue that the current correction in stocks is being heavily influenced by the anticipated growth slowdown in the U.S. and the headwinds that could come from tariffs. It’d be pretty easy to make that argument.

One of my arguments about why the reverse carry trade is so dangerous is how quickly it can snowball. It’s even more dangerous today considering the macro conditions that are developing in the background.

But here’s the question I’m waiting on the answer for:

If a reverse yen carry trade that trims 10% off of the S&P 500 can occur with…

solid GDP growth

contained inflation

Japan rates at 0.5% in the background

…how bad can this version of the reverse yen carry trade get with…

the U.S. likely printing negative GDP growth in Q1

inflation ticking higher

a global trade war

Japan yields & inflation both moving higher in the background

Final Thoughts

The second reverse yen carry trade is in progress. Because it’s happening slowly and steadily instead of sharply and suddenly, it hasn’t been getting nearly the same attention. With geopolitics and a global trade war dominating the market narrative, investors are missing the damage that this has helped to contribute to the current decline and the risk that they’re still being exposed to.

The market is plenty capable of correcting on its own given the fears associated with tariffs and slowing economic growth. If you add people being forced to sell their U.S. equity holdings in order to close out their short yen positions on top of that, it’s easy to see how a bad situation quickly becomes worse. And it’s already happening.

Japan is still the real risk.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

How do you estimate/validate the idea that there is still a lot more carry trade on? Can you share how you come up with that?