Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The election of Donald Trump in the United States has improved market optimism that some of his economically-friendly policies could give a longer-term jolt to risk assets. While the initial market reaction to the election results has been mostly retraced, there are a few asset classes that have continued to move higher.

One of those is junk bonds. The potential for tax cuts and added liquidity could end up lifting the floor of some of the market’s riskiest bonds. The problem, of course, is that high yield spreads are already near all-time lows and could limit any further upside for this group. And if Japan and China continue to deteriorate, it’s easy to see risk premiums repricing pretty quickly.

The AllianceBernstein Global High Income Fund (AWF) is the kind of diversified, risk-managed portfolio that could reduce portfolio volatility in times like these where the tail risks are increasing. While the markets are focusing almost entirely on upside potential, managing towards downside protection might be more useful right now.

Fund Background

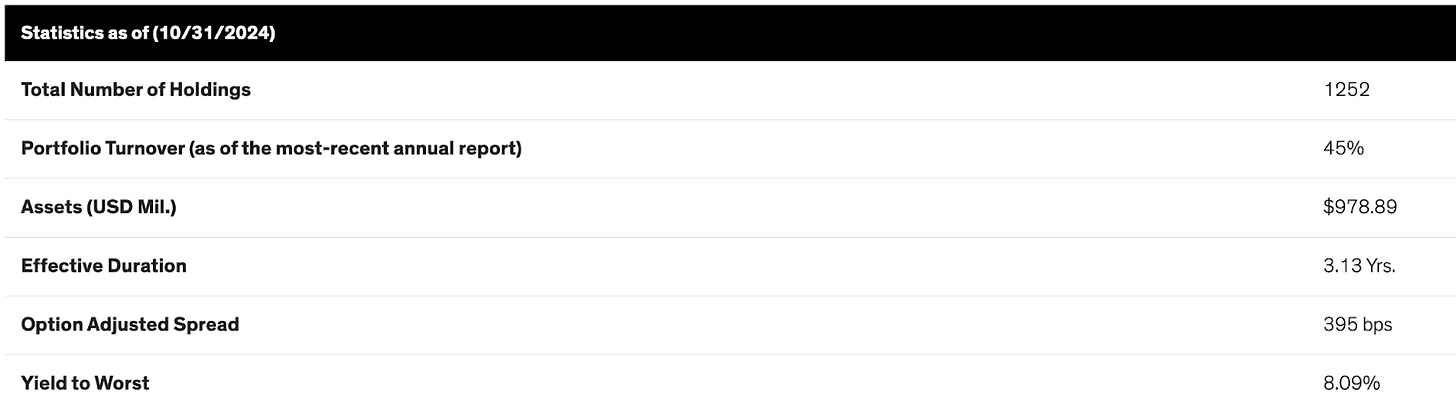

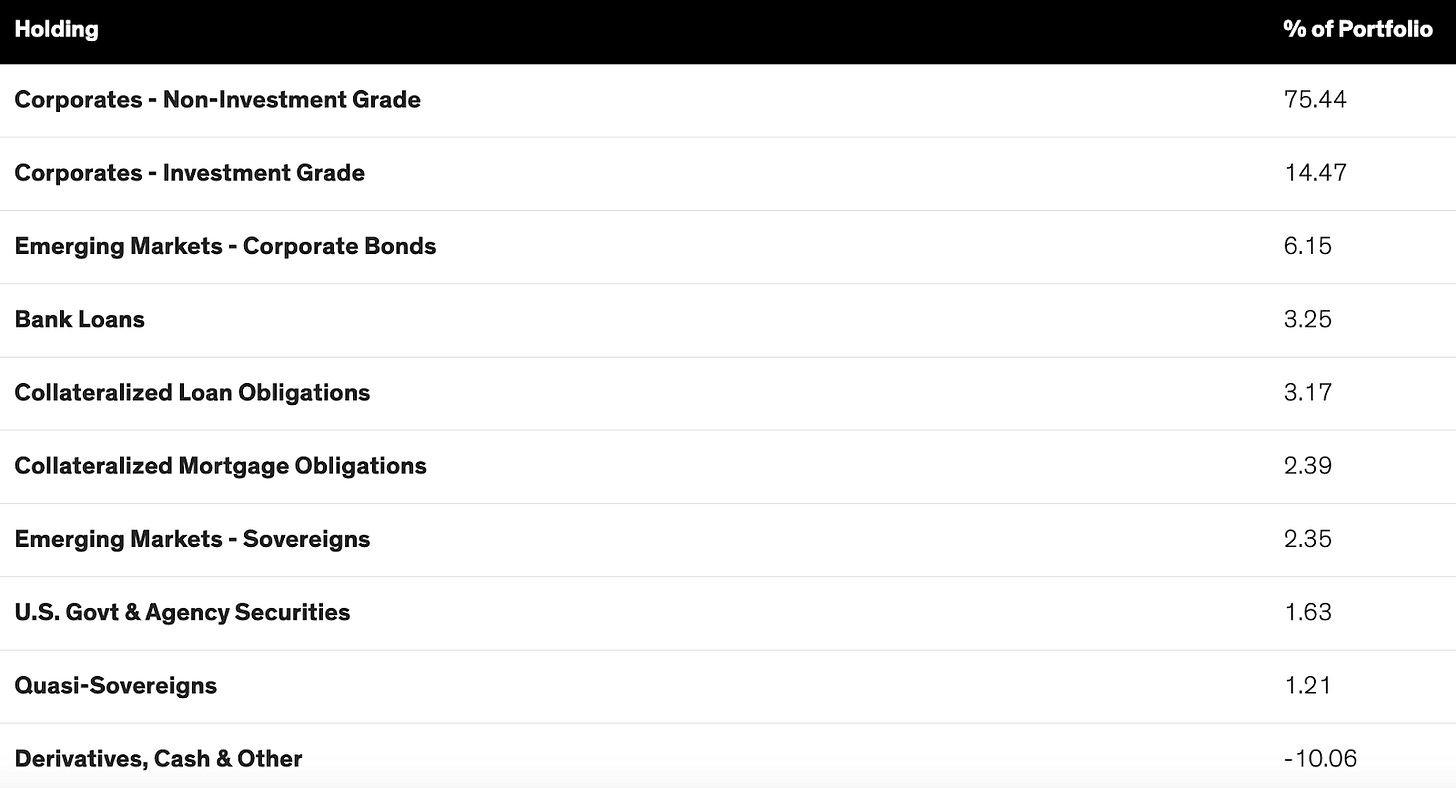

AWF seeks high current income, and secondarily-capital appreciation. It invests primarily in corporate debt securities from U.S. and non-U.S. issuers, as well as government bonds from both developing and developed countries. Under normal market conditions, it invests substantially in lower-rated bonds, but may also invest in investment-grade and unrated debt securities. Its global multi-sector approach allows a favorable balance of risk and return potential compared with a single-sector portfolio. The fund also utilizes leverage to enhance yield and total return potential.

While AWF focuses more on non-investment grade bonds, there’s enough diversification here both geographically and across the fixed income space to consider it as kind of an unconstrained bond fund. The risk management piece might be its biggest advantage. I like its combination fundamental/quantitative approach as it helps minimize the chances of performance chasing. Its current 7% yield isn’t as high as you’ll find in other CEFs, but the balance between yield and quality is attractive.

The 75% allocation to junk bonds is consistent with its overall mandate, but I like the diversification beyond that majority holding. There’s enough in the investment-grade category to make a difference and the inclusion of emerging markets bonds offers exposure to one of the better-performing groups within the fixed income space right now. The non-junk securities don’t necessarily qualify as “high” quality, but they do provide an important balance and a slightly different risk/reward profile.