Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: UTILITIES, GOLD AND TREASURIES CREATING THE RISK-OFF TRIPLE PLAY

Utilities (XLU) – Firm Risk-Off Element At Play

Utilities took a minor breather last week amid the return of tech & growth stocks, but the momentum is far from broken. There are many theories as to what’s driving such outperformance while the S&P 500 and Nasdaq 100 are hitting new highs - electricity demand for AI, lower interest rates, a shift to defense. Utilities have been moving higher with the participation of multiple defensive assets throughout this run and suggest that there’s a definite risk-off element at play here.

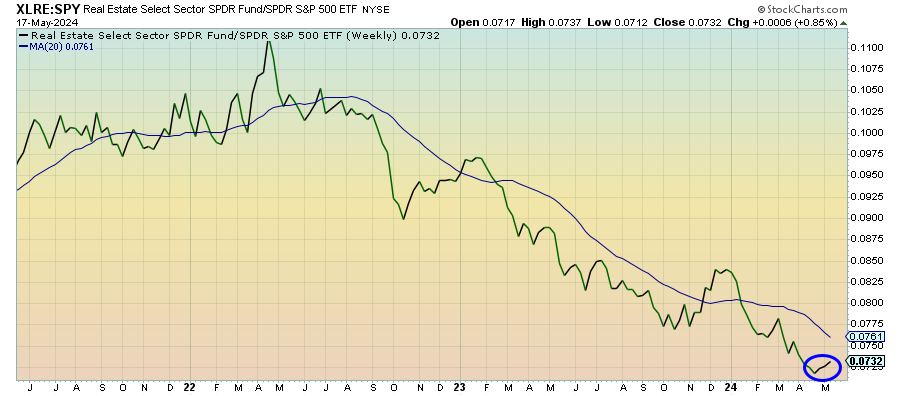

Real Estate (XLRE) – Making A Nice Little Run

Real estate is doing what it’s been doing over the past several months, responding to changes in interest rates. Investors took away a dovish message from last week’s inflation data and that gave REITs the motivation to move higher. Quietly, real estate is putting together a nice little run here and could actually get a high level sentiment boost should China actually make some progress in rescuing its own real estate sector.

Technology (XLK) – An Opening To Run

After lagging for much of 2024, tech is suddenly coming back to life. The combination of lower interest rate expectations and a moderating inflation picture has generally been a solid recipe for tech outperformance and that’s exactly what we’re seeing here. In order to continue this run, we’ll need to see some evidence that inflation is stagnating, not turning higher again. Since we won’t get another round of CPI data for another several weeks, there is an opening for tech to keep doing well.

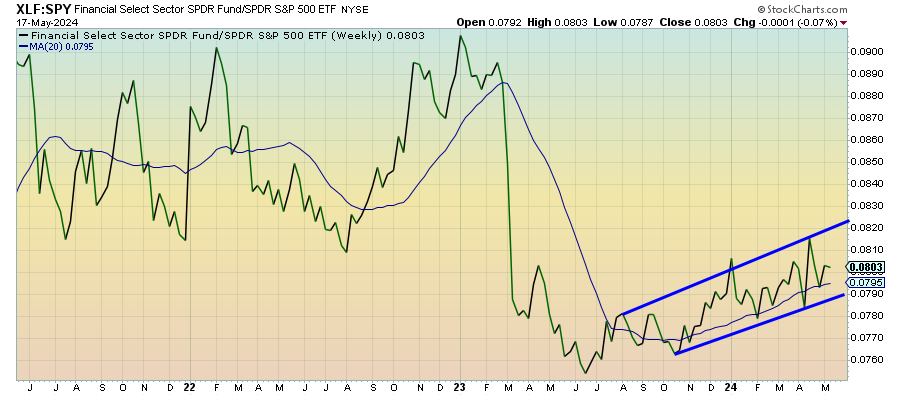

Financials (XLF) – Betting On Rate Cuts

Financials have been one of the more durable equity market leaders for roughly 8 months now, although they’re still nowhere near where they were relative to the S&P 500 before the regional bank crisis. This looks a lot like a play on interest rates where investors are betting that the Fed is going to come through sooner than later on rate cuts. That outlook is questionable given inflation trends.

Small-Caps (VSMAX) – Outperformance Has Stalled