Every week, we'll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Financial sector investing has taken an interesting turn in recent months. While major banks and insurers have rallied on the prospect of interest rate cuts, smaller and regional financial companies tell a different story. Business Development Companies (BDCs) face increasing scrutiny over their loan quality as middle-market borrowers navigate economic uncertainty. Meanwhile, mortgage REITs remain caught between competing forces. Potential rate relief could improve their interest rate spreads, but housing market concerns and yield curve dynamics continue to create headwinds for the sector. This bifurcated performance creates both risks and opportunities for investors willing to look beyond traditional financial stocks.

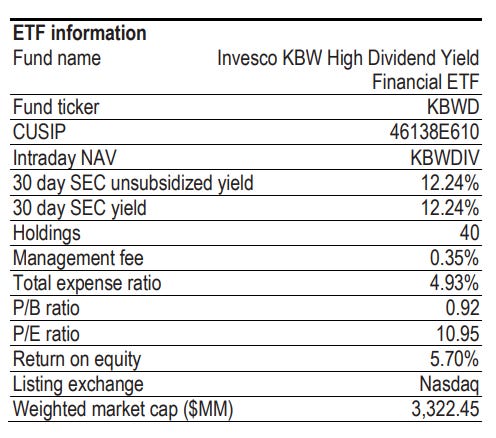

The Invesco KBW High Dividend Yield Financial ETF (KBWD) offers exposure to precisely these higher-yielding corners of the financial sector that most mainstream funds either underweight or ignore entirely. With its impressive double digit yield, this fund concentrates on mortgage REITs and BDCs rather than conventional banking giants. Does this specialized approach offer genuine value for income-focused investors or does the eye-catching yield mask underlying risks that could undermine total returns in the current environment?

Fund Background

KBWD tracks the KBW Nasdaq Financial Sector Dividend Yield Index, which selects financial companies primarily based on their dividend yields. The fund invests at least 90% of its assets in publicly traded financial stocks from the index, with quarterly rebalancing to maintain its focus on the highest-yielding securities within the financial sector universe.

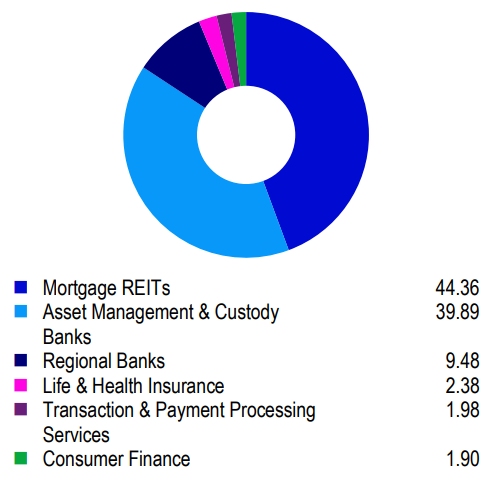

The fund's dividend-focused methodology creates both distinctive strengths and notable vulnerabilities. By targeting the highest-yielding financial stocks, KBWD generates income far beyond what traditional financial sector ETFs deliver. This approach naturally steers the portfolio toward smaller, non-traditional vehicles, such as mortgage REITs and BDCs as opposed to banks or conglomerates. However, this concentration comes with elevated interest rate sensitivity and economic cycle vulnerability that mainstream financial ETFs largely avoid. The systematic quarterly rebalancing helps maintain yield consistency but can create sector concentration risks if certain subsectors dominate the high yield landscape.

KBWD's asset allocation reveals its fundamental difference from conventional financial sector funds. While most financial ETFs heavily weight major banks and insurers, this fund concentrates on mortgage REITs (approximately 44% of assets) and BDCs (roughly 36% of holdings). Smaller allocations to asset managers and specialized lenders make up the remainder. This specialized subsector focus creates a portfolio designed almost exclusively for income generation at the potential expense of higher interest rate sensitivity. Investors should recognize they're effectively making a targeted bet on interest rate sensitive, higher yielding financial niches.