Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: GOLD IS THE SAFETY VALVE

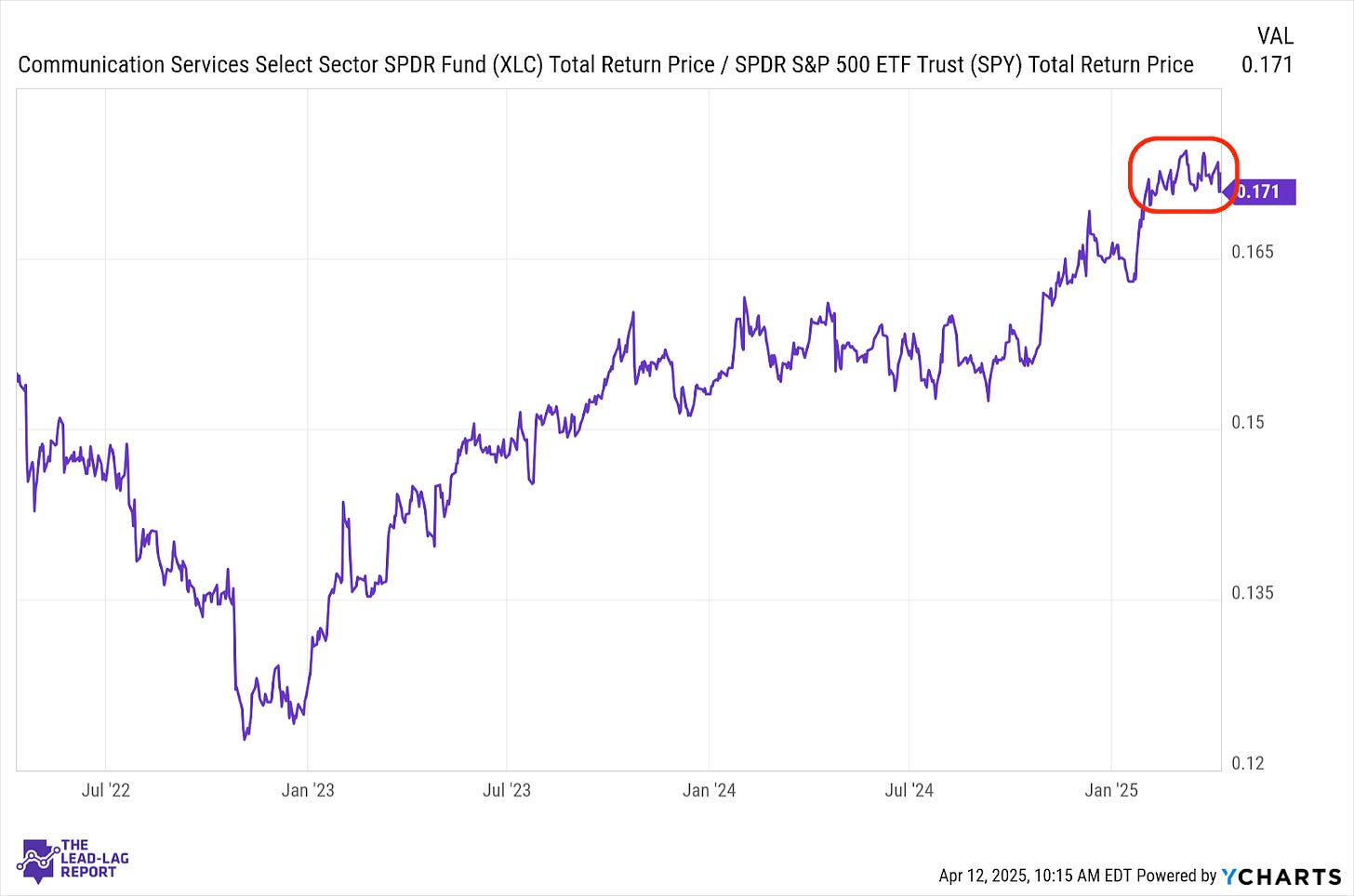

Communication Services (XLC) – Avoiding The Whipsaws

At least relative to the broader market, this sector hasn’t been experiencing the whipsaw ups and downs that many others are. The mag 7, traditional media balance seems to be helping with that. This group used to be tied pretty closely to the performance of growth stocks when the mag 7 was running. Now the two have largely disconnected and it’s become one of the more balanced spots in the market.

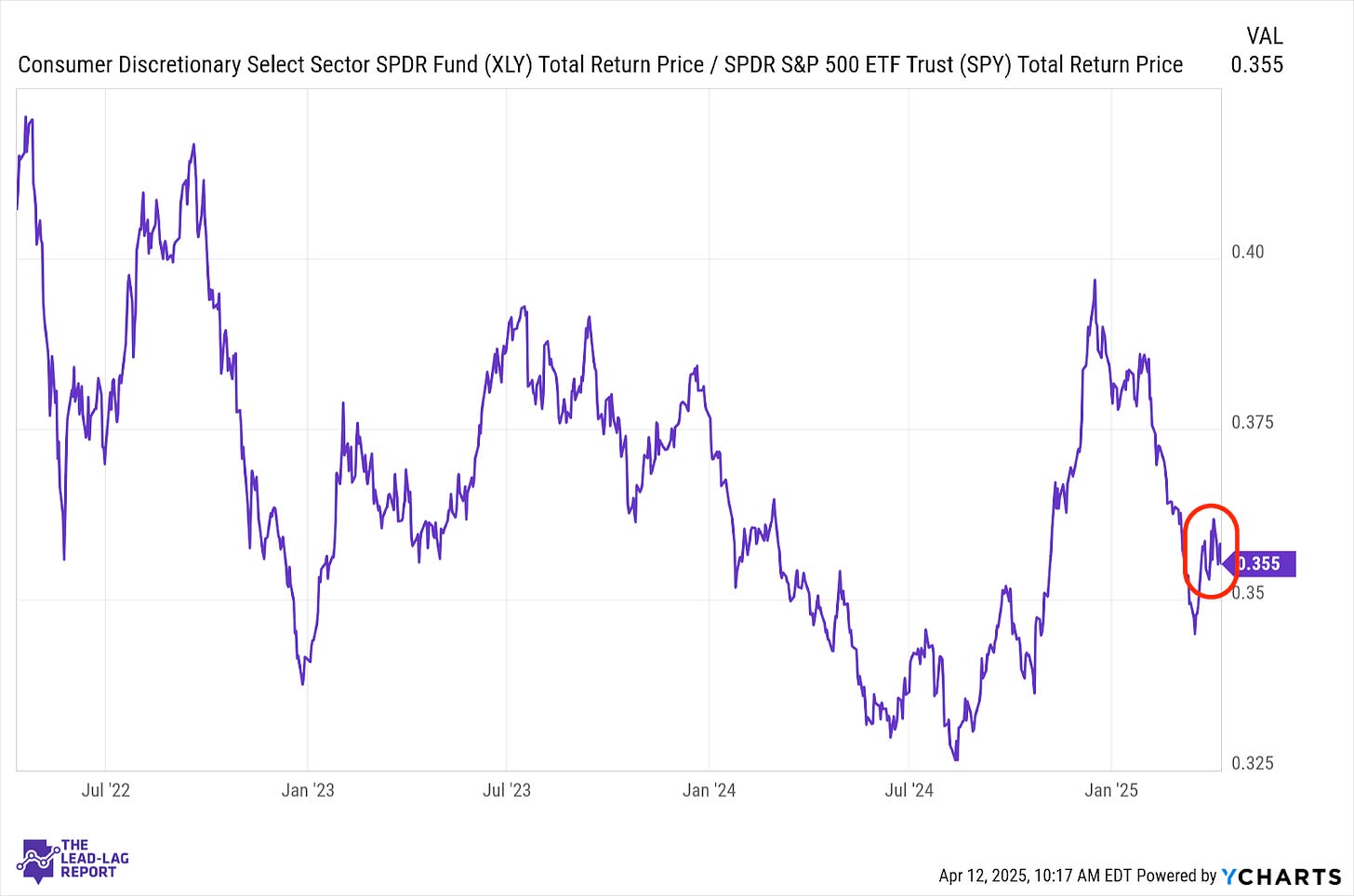

Consumer Discretionary (XLY) – Extra Volatile

Consumer discretionary stocks were a big outperformer on Wednesday following the tariff suspension, but by week’s end lagged the S&P 500 by a fairly wide margin. That’s probably a good sign that this sector will remain especially volatile as long as the VIX is elevated. It shouldn’t be surprising either. Even a scaled back tariff policy with a 100%+ tariff rate on China will have a significant impact on the retail space.

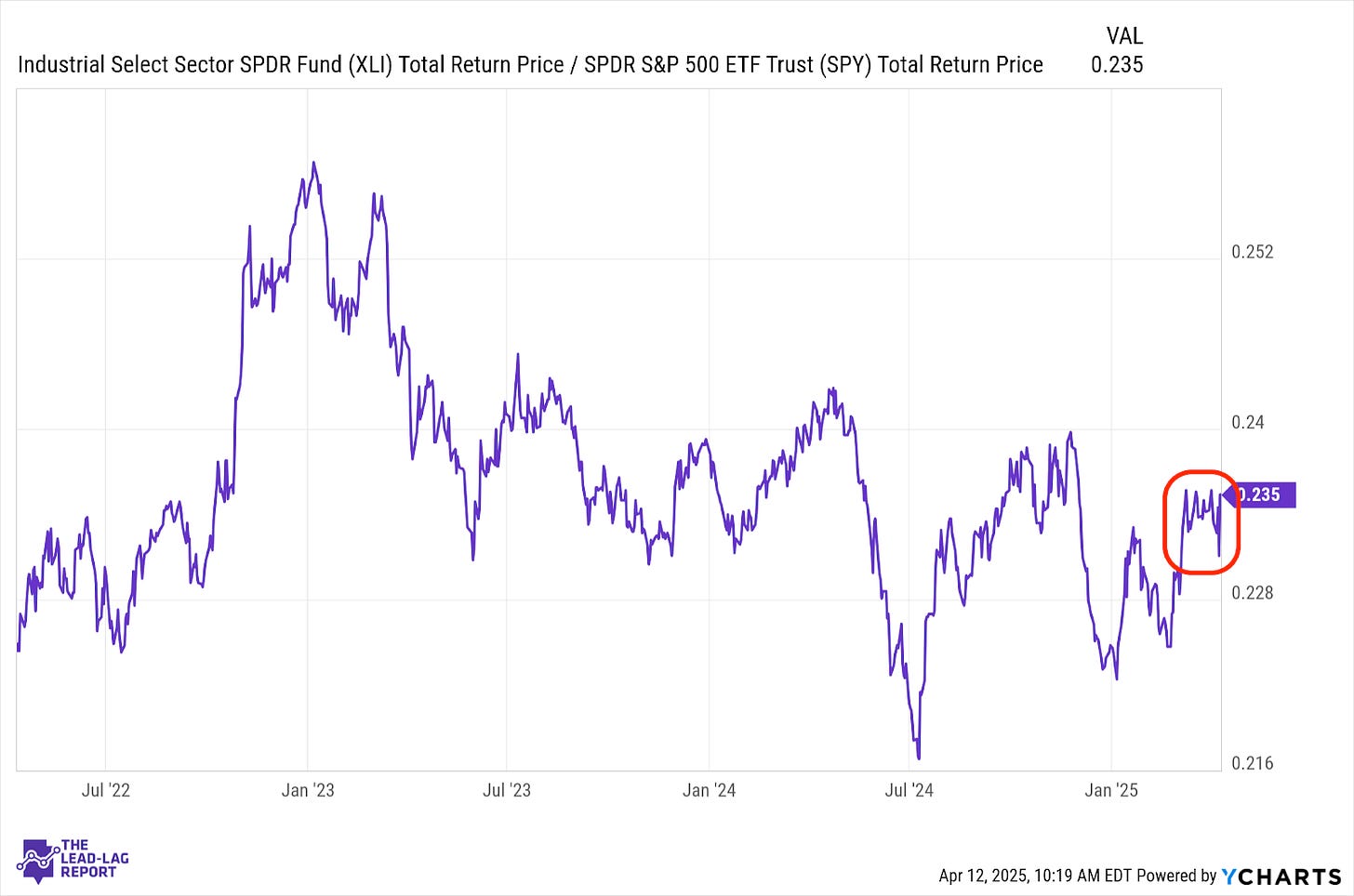

Industrials (XLI) – The Market Still Isn’t Satisfied

Volatility in cyclicals turned noticeably higher as the market continues to try to figure out the country’s economic and policy path. Short-term volatility in economically sensitive areas of the market should be expected at this point until trade war escalation steadies, if not eases. The pausing of tariffs on most trading partners is a good first step, but a still-elevated VIX and a further pullback following the announcement suggests the market still isn’t satisfied.

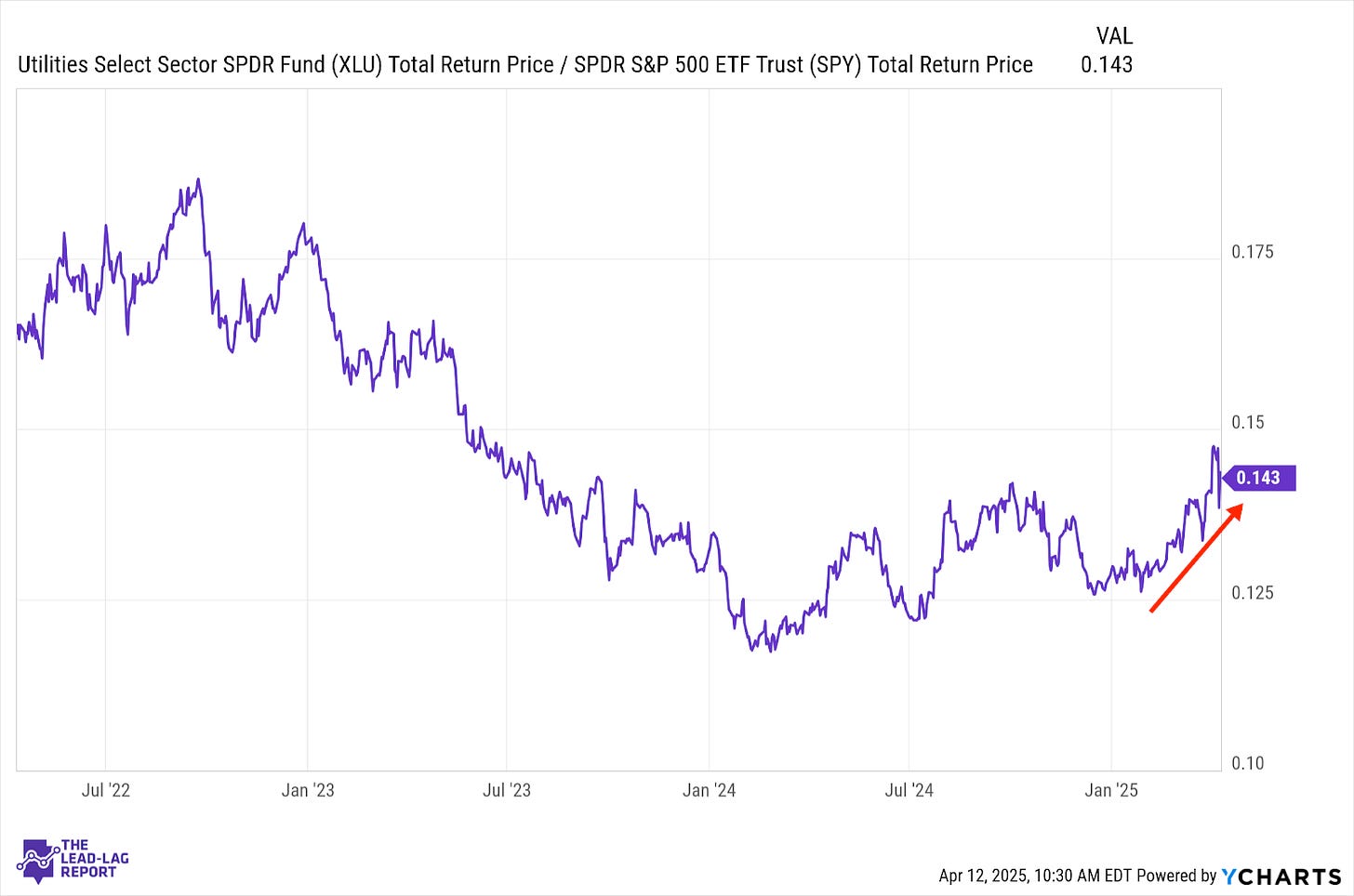

Utilities (XLU) – Risk-Off Sentiment Still In Control

In an overall positive week for U.S. stocks, utilities trailed, which is to be expected. Looking at the chart, the outperformance trend is still intact, although it’s looking a little vulnerable. With Treasuries getting pushed around by geopolitics, the 6% gain in gold strongly suggests that risk-off sentiment is still in control here.

Consumer Staples (XLP) – Ignore The Short-Term Volatility