Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

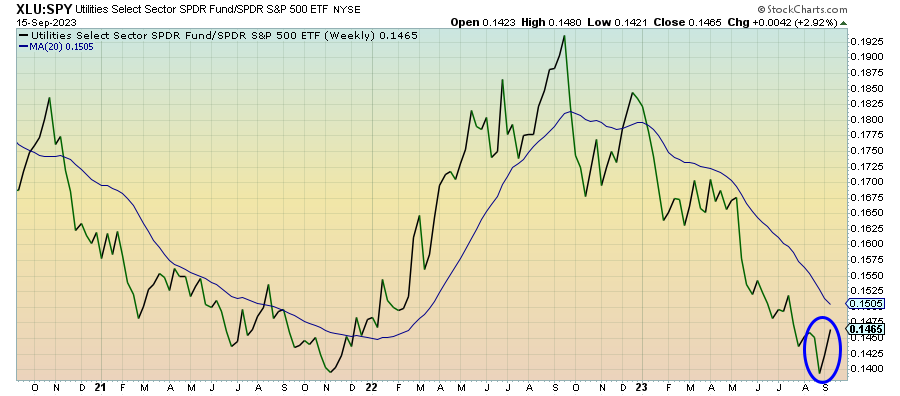

LEADERS: THIS COULD BE THE BIG MOVE FOR UTILITIES!

Utilities (XLU) – Don’t Ignore The Signs

The past two weeks have easily been the most powerful move for utilities of 2023. The problem is that it’s still unclear whether this is an oversold bounce or a genuine shift in market sentiment. Utilities remain the worst performing sector year-to-date, there is a lot of catch-up to do and we have yet to see confirmation from Treasuries. Still, moves this aggressive tend to come with heightened volatility & risk, so they shouldn’t be ignored.

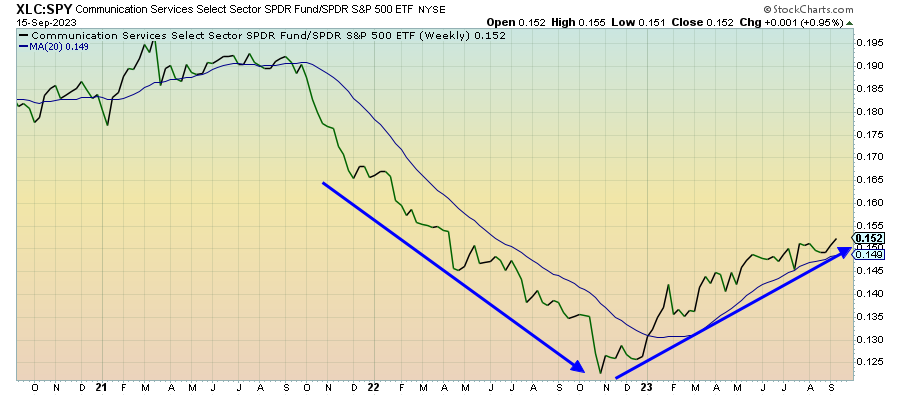

Communication Services (XLC) – Weaker Than It Looks

While tech and growth have had their ups and downs this year, communication services has been the most reliably uptrending sector of the market. With Facebook and Google controlling nearly half of this sector (and up 150% and 55%, respectively, this year), it’s easy to see why it’s doing so well. It’s a good thing too. The equal weight version of this sector is only up 12% this year versus a 41% gain for the cap-weighted XLC. A good return, but nearly as strong as it might seem.

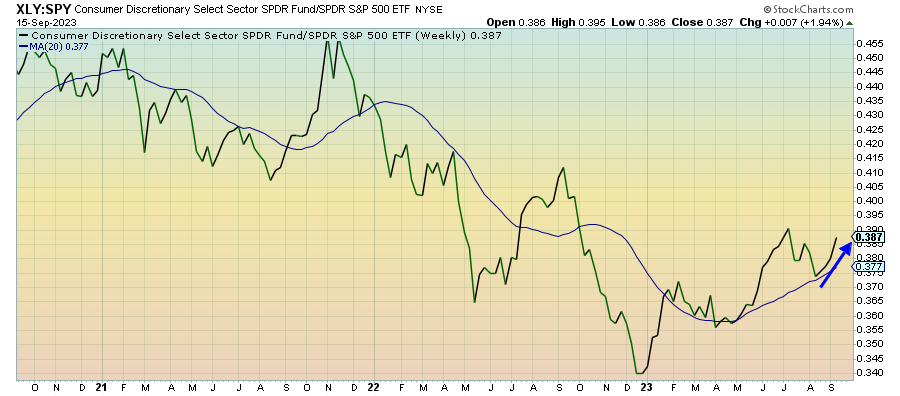

Consumer Discretionary (XLY) – The Consumer Is Ready To Break

This sector got a boost last week from a reasonably good August retail sales report, but it was largely due to higher gas prices and paying more at the pump. Given the confluence of negative consumer data right now - rising credit defaults and shrinking savings levels - it’s easy to imagine a world where consumer spending dries up pretty quickly and this sector turns lower.

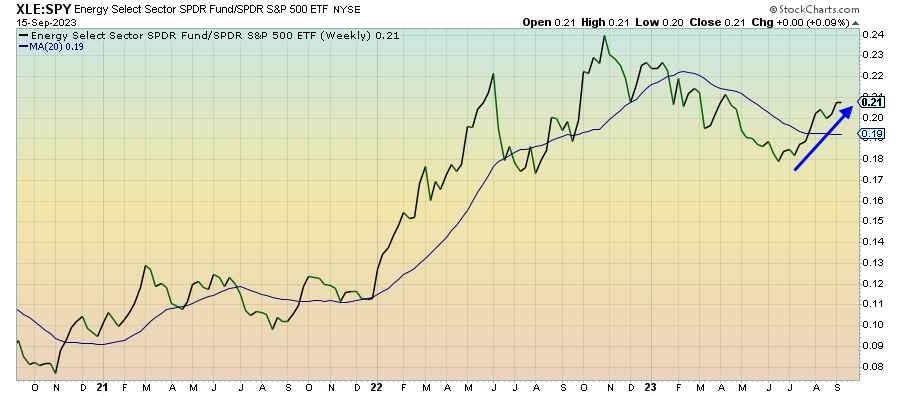

Energy (XLE) – Oil Producers Controlling Supply

Energy prices keep heading higher and, while they could very well level off here, it seems unlikely they’ll head back down meaningfully in the near-term. The major world oil producers seem satisfied with choking off supply to get the oil prices they want and that won’t change at least until well into 2024. That’s a net positive for energy stocks, but not so much for the consumer.

Financials (XLF) – Thankful For A Fed Pause