Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE RETURN OF THE UNLOVED

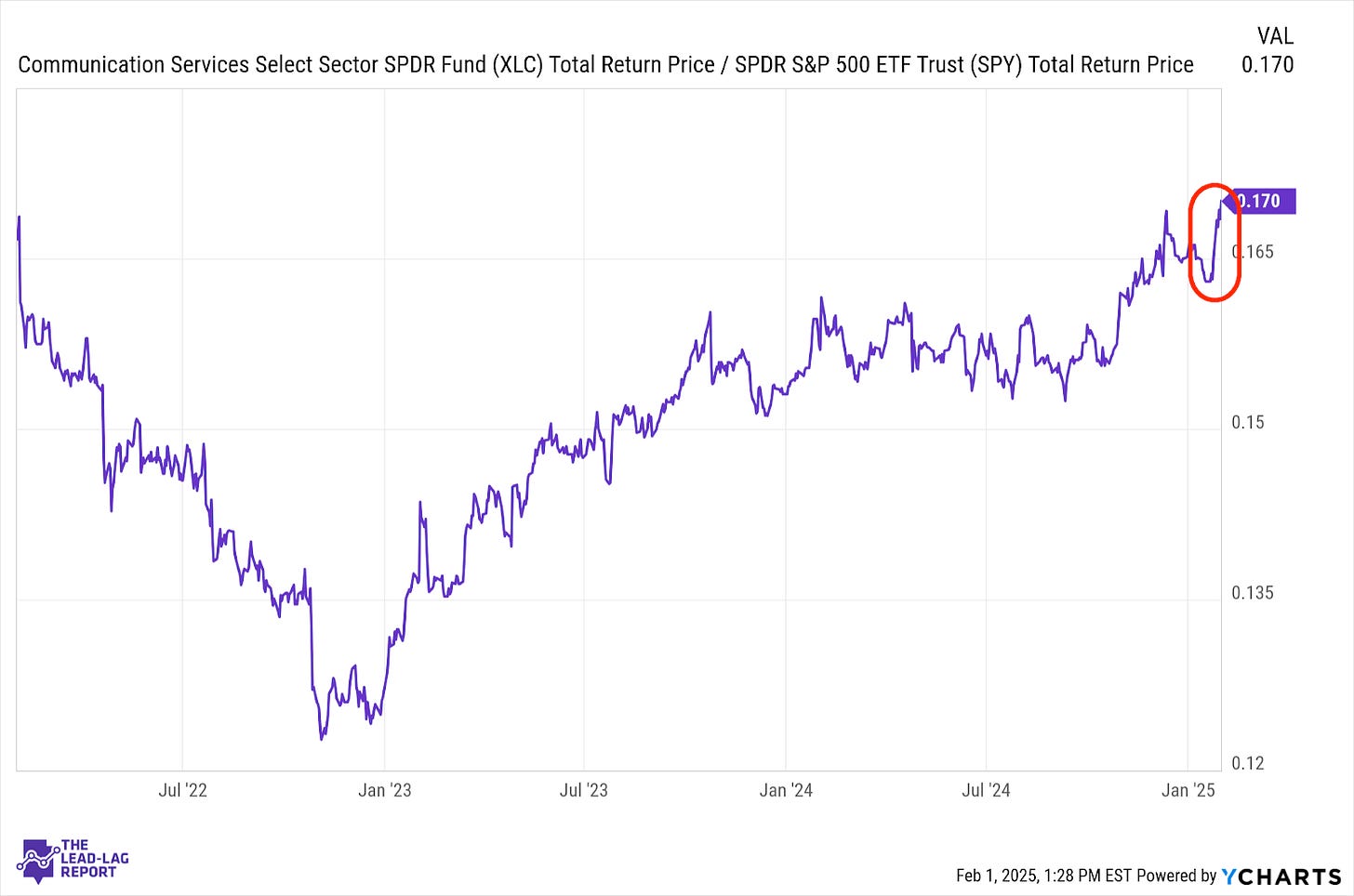

Communication Services (XLC) – Is Capex Spending Not Such A Bad Thing?

Figuring out what’s actually being valued in the AI space right now is getting tougher. DeepSeek caused equities to question the value of AI spending. Yet Facebook in its recent earnings announcement guided capex spending higher in 2025 and the stock rallied hard. We’ll see if Alphabet sends a similar message this week, but capex spending hasn’t yet been the negative that it could have been.

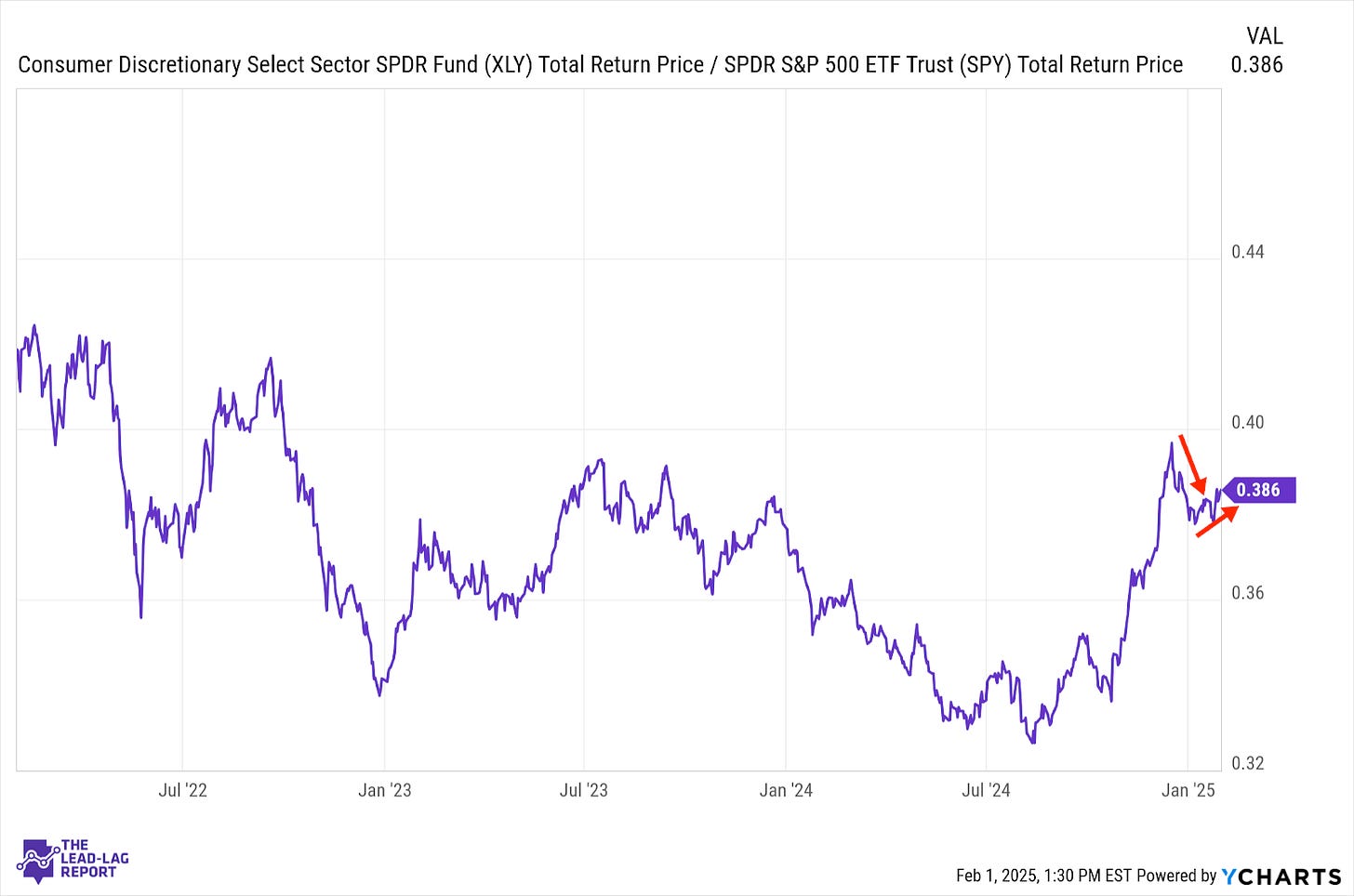

Consumer Discretionary (XLY) – Need To Withstand Tariffs

Retail sales and consumer spending remain sturdy and, at a high level, show little sign of weakness. After a turbulent period following a hawkish Fed message, consumer stocks have been doing comparatively well once again. We’ll soon see how this strength can hold up in the face of high tariffs, which will serve to decrease consumer purchasing power.

Financials (XLF) – Volatility Is High And Likely To Remain That Way

Relative to the S&P 500, financials are not far from the level they were pre-regional bank crisis nearly two years ago. The path has already been choppy up to this point and is likely to remain that way given the back & forth nature of tariff threats and the volatility in yields. The banking sector, however, has had a generally solid Q4 earnings season thus far and the push for further deregulation should be a tailwind.

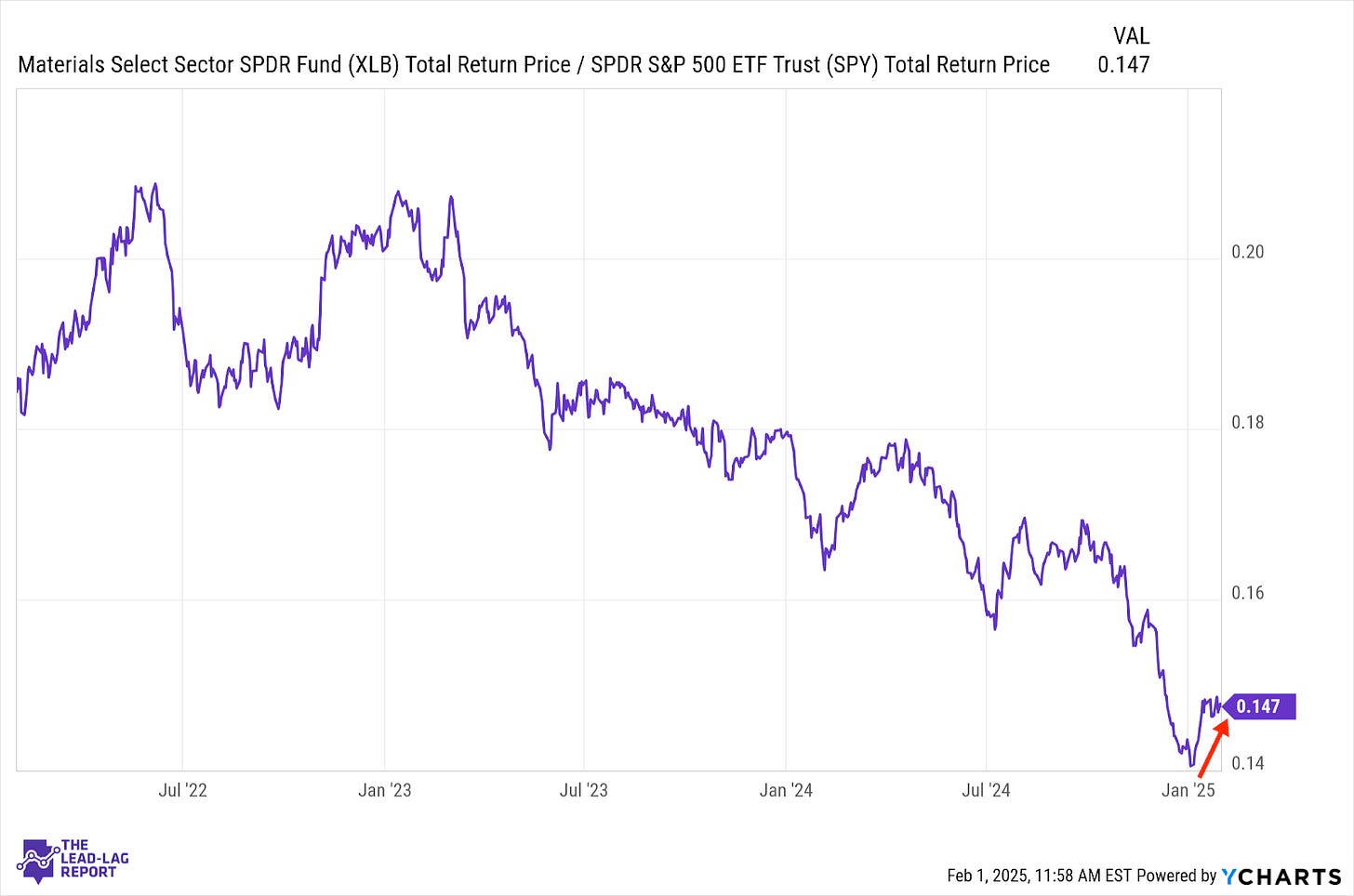

Materials (XLB) – Canadian Tariffs Will Hurt

January’s momentum has taken a pause and the possibility of a trade war isn’t going to help. The Canadian tariffs could hit this sector particularly hard as a lot of auto manufacturing happens north of the border (and lumber is likely to be a tariff target). The market is pricing tariffs as a definite economic growth risk and cyclicals don’t tend to perform in those kinds of environments.

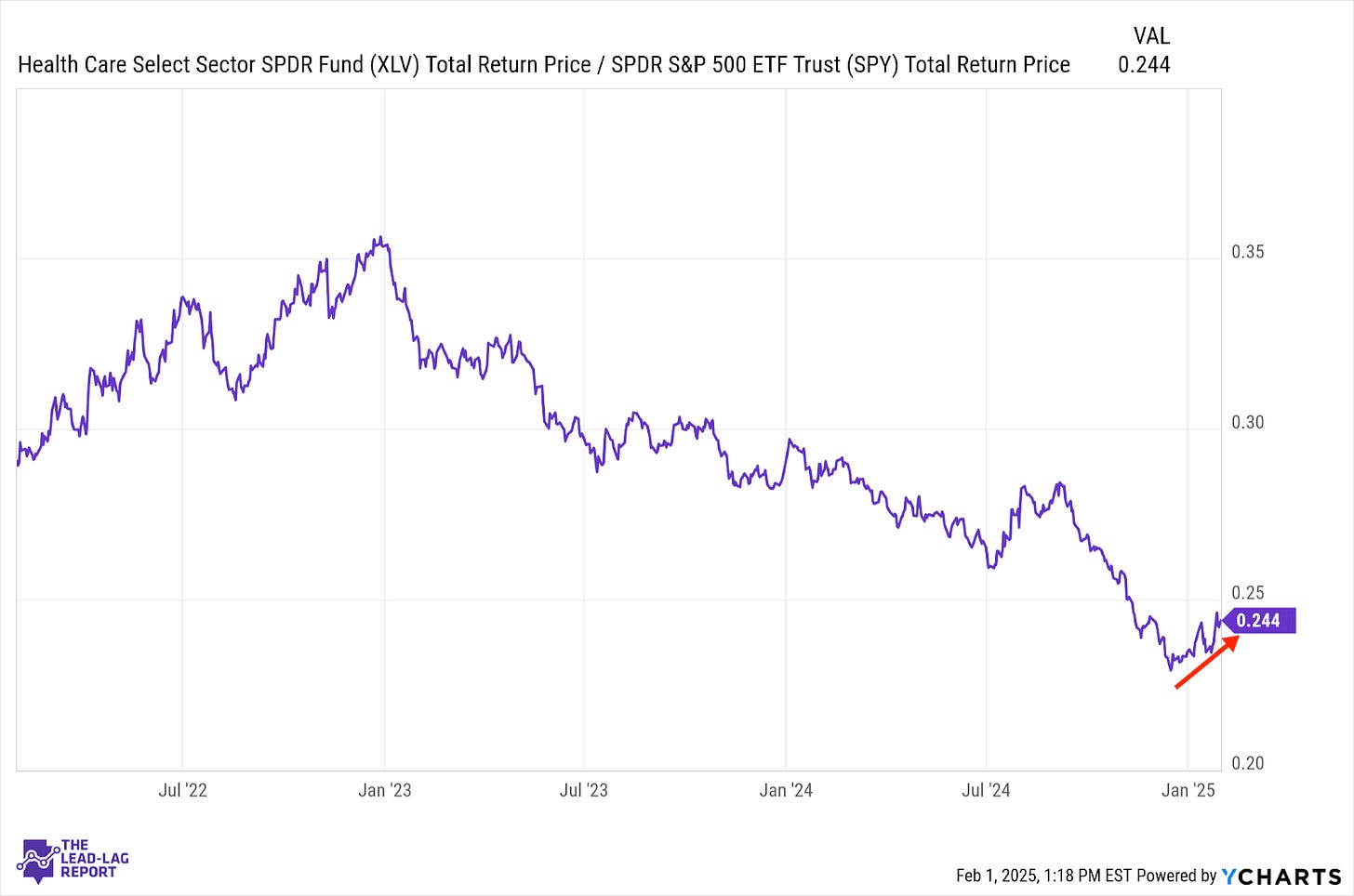

Health Care (XLV) – Investors Shouldn’t Be Ignoring This

Healthcare has quietly been putting together its best run in at least six months and is the best performing sector year-to-date. This sector traditionally has been pretty reliable in reflecting current conditions and sentiment. With the backdrop of inflation, tariffs and the AI/tech unwind, I don’t think investors should be ignoring what it means when this group is leading.

Small-Caps (VSMAX) – The Valuation Unwind