Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE UNSTOPPABLE GOLD RALLY

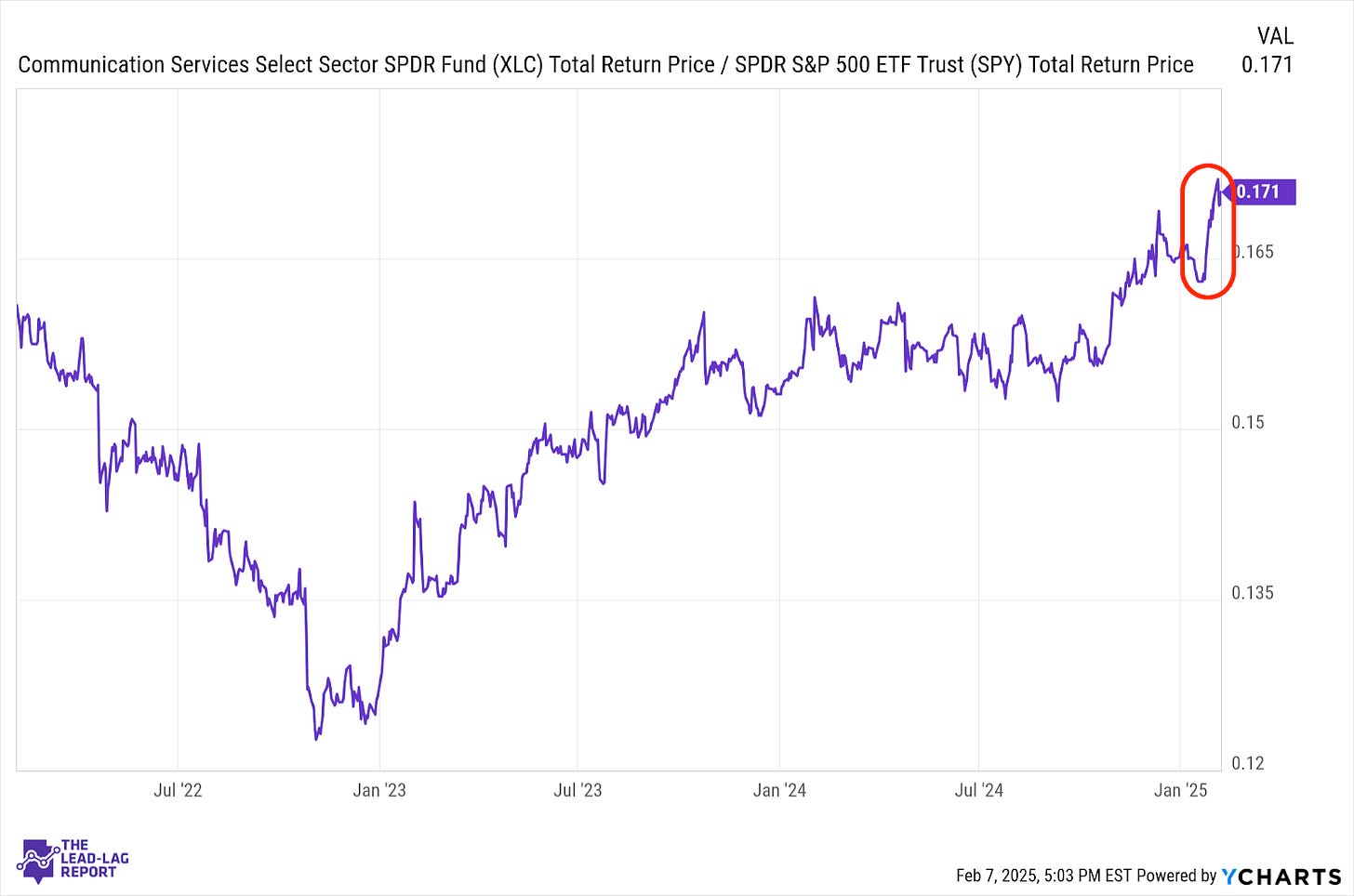

Communication Services (XLC) – The Market Is Still OK With Big AI Spending

The sector’s biggest companies are coming out of this quarterly earnings season with mixed results. Facebook has continued to power higher, but Alphabet delivered lackluster results. The one positive thing for this sector and other big tech names is that investors seem accepting of the idea of continued high capex spend related to AI. DeepSeek may result in a re-evaluation of where the industry is headed, but it also seems like the big spenders are positioned to be the big winners.

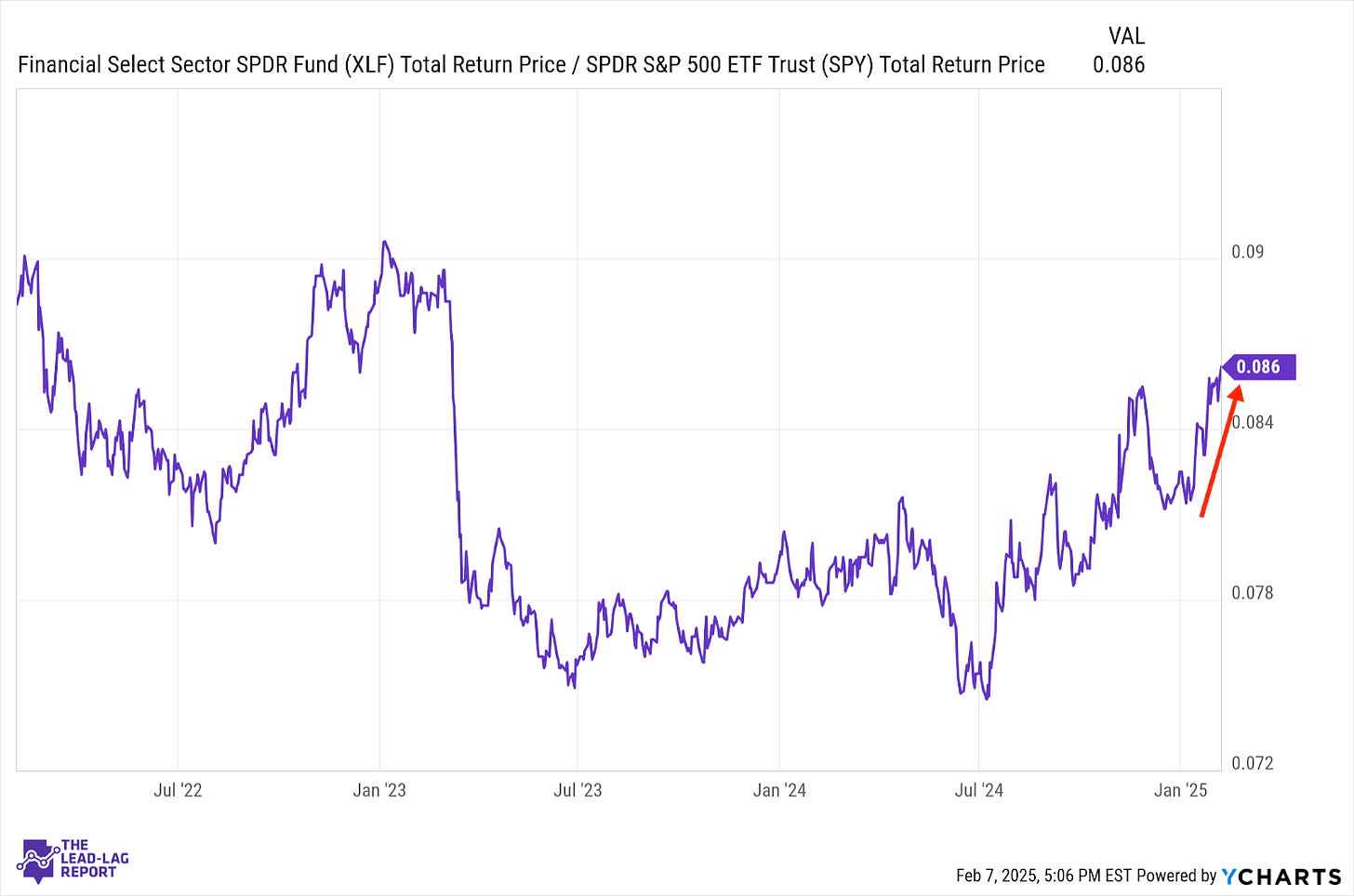

Financials (XLF) – Benefiting From Trump 2.0

This sector is proving to be one of the biggest beneficiaries of Trump 2.0. The slew of executive orders issued thus far emphasize that deregulation is going to continue being a major theme. Banks will be big winners in that kind of environment, while the potential for higher rates on the long end of the yield curve could provide another tailwind.

Materials (XLB) – Commodities Enter The Trade War

With President Trump planning to initiate a 25% tariff on all steel and aluminum imports as commodities become the next target in a global trade war. The reaction in the sector has been pretty muted thus far, but it does follow a period of consolidation it’s experienced over the past several weeks. The market’s reactions to tariffs and trade war developments have become more modest following several immediate walkbacks of planned duties.

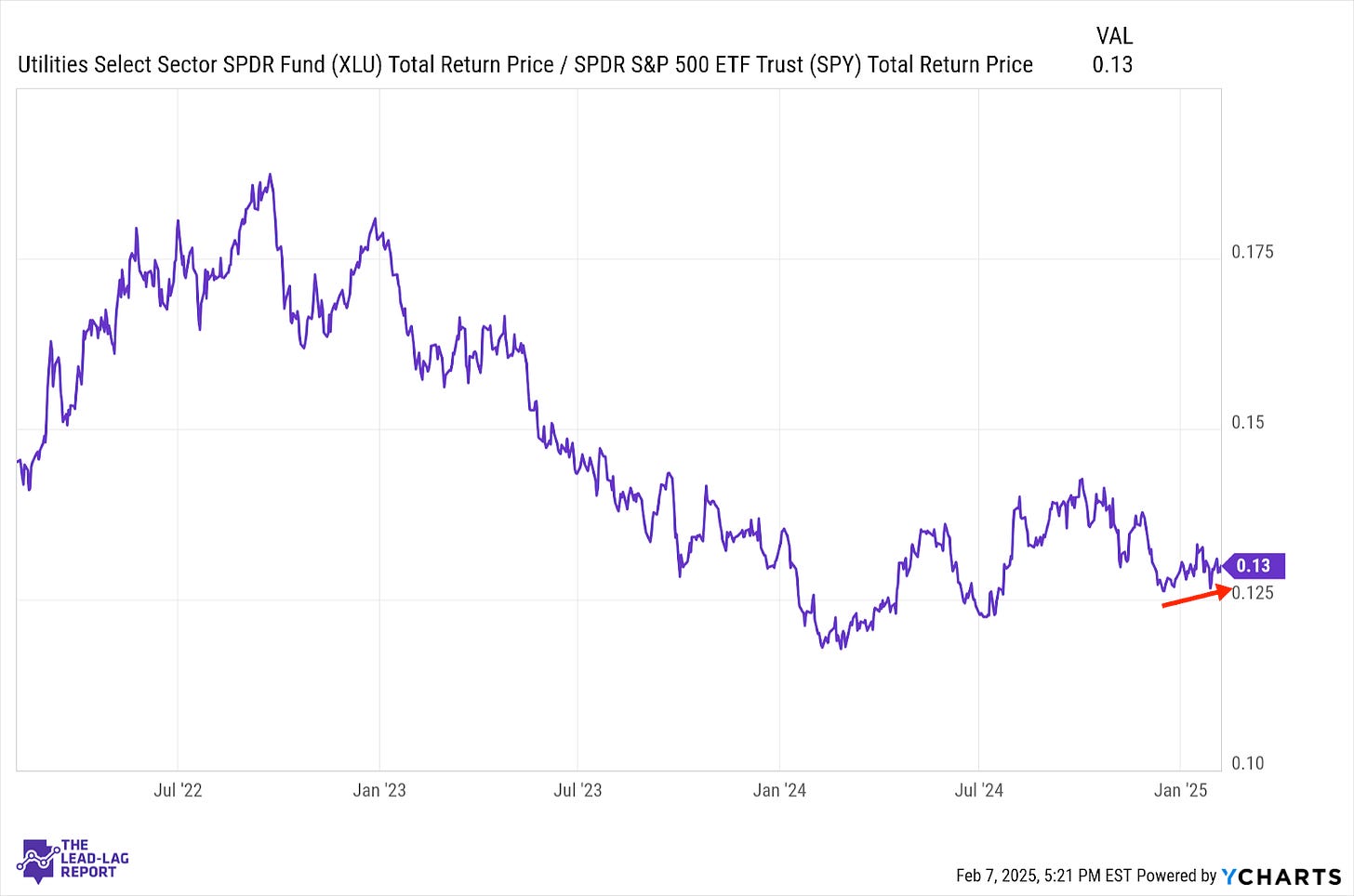

Utilities (XLU) – Challenges Ahead

This is another example of a sector demonstrating choppy performance, but an intact uptrend. The fact that this is happening in conjunction with healthcare’s outperformance is a firmly cautious sign for U.S. equities. Equities overall are still near their highs, so we’re still in the midst of seeing this play out, but it could very well be a predictive signal of challenges ahead.

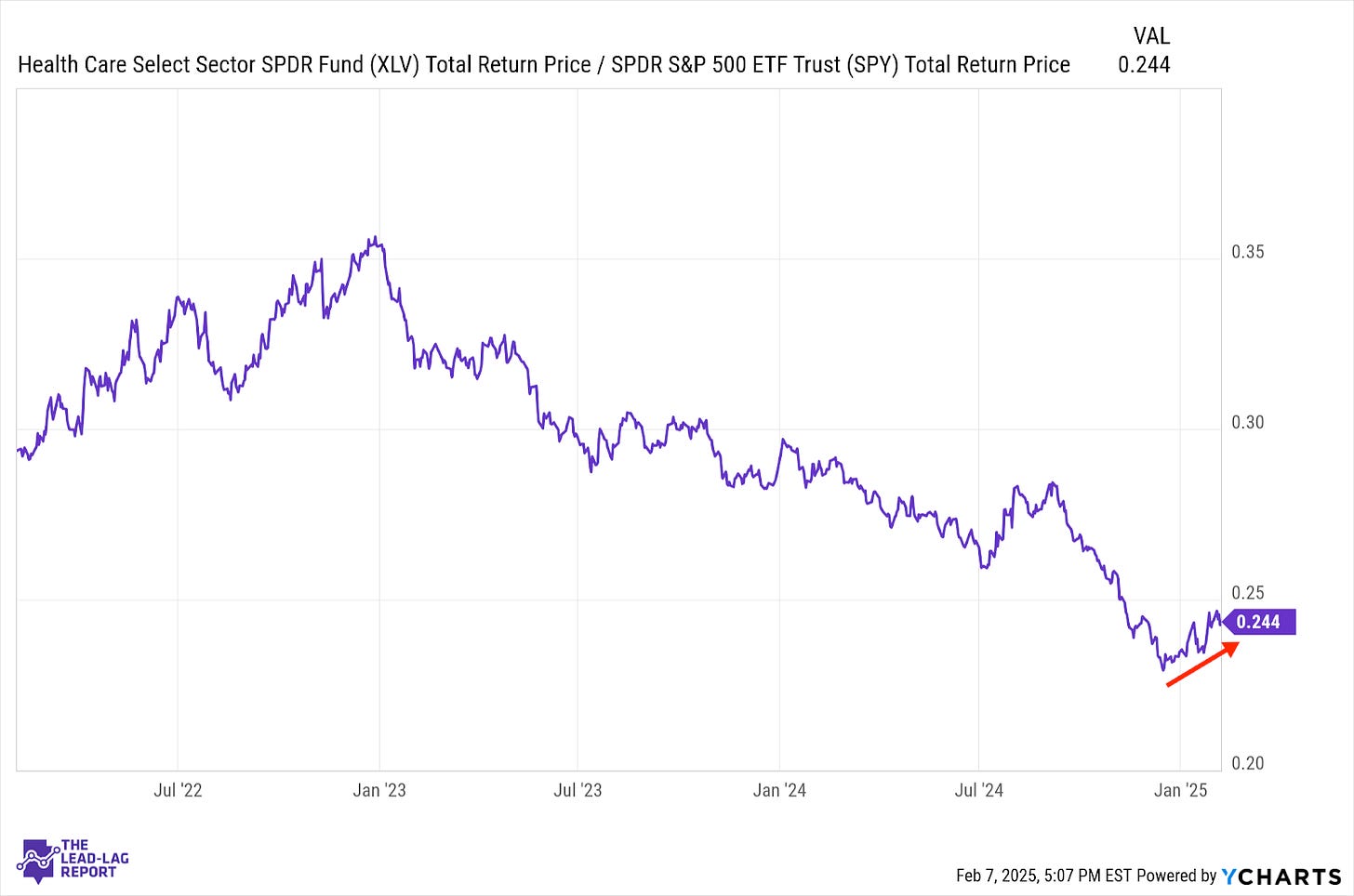

Health Care (XLV) – Extending Its Roll

While there’s been some choppiness along the way, healthcare continues its recent roll relative to the S&P 500. There’s been such a mix of outperforming and underperforming sectors so far this year that it’s been tough to get a consensus read on the market. Even though the major averages are still at or near highs, extended outperformance from healthcare has traditionally been bad news for U.S. stocks more broadly.

Long Bonds (VLGSX) –Rallying In Spite Of Inflation Risks

Treasuries are definitely following gold in indicating a defensive undertone in this market. Yields moved higher following last week’s payroll report, but the overall trend is lower yields in spite of stronger inflation worries. We’ll see if these steel & aluminum tariffs will stick. If so, it could raise the stakes a bit, but rising Treasuries are usually a signal that investors are growing worried about the economy and the market.