Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: LUMBER IS FINALLY MAKING A COMEBACK

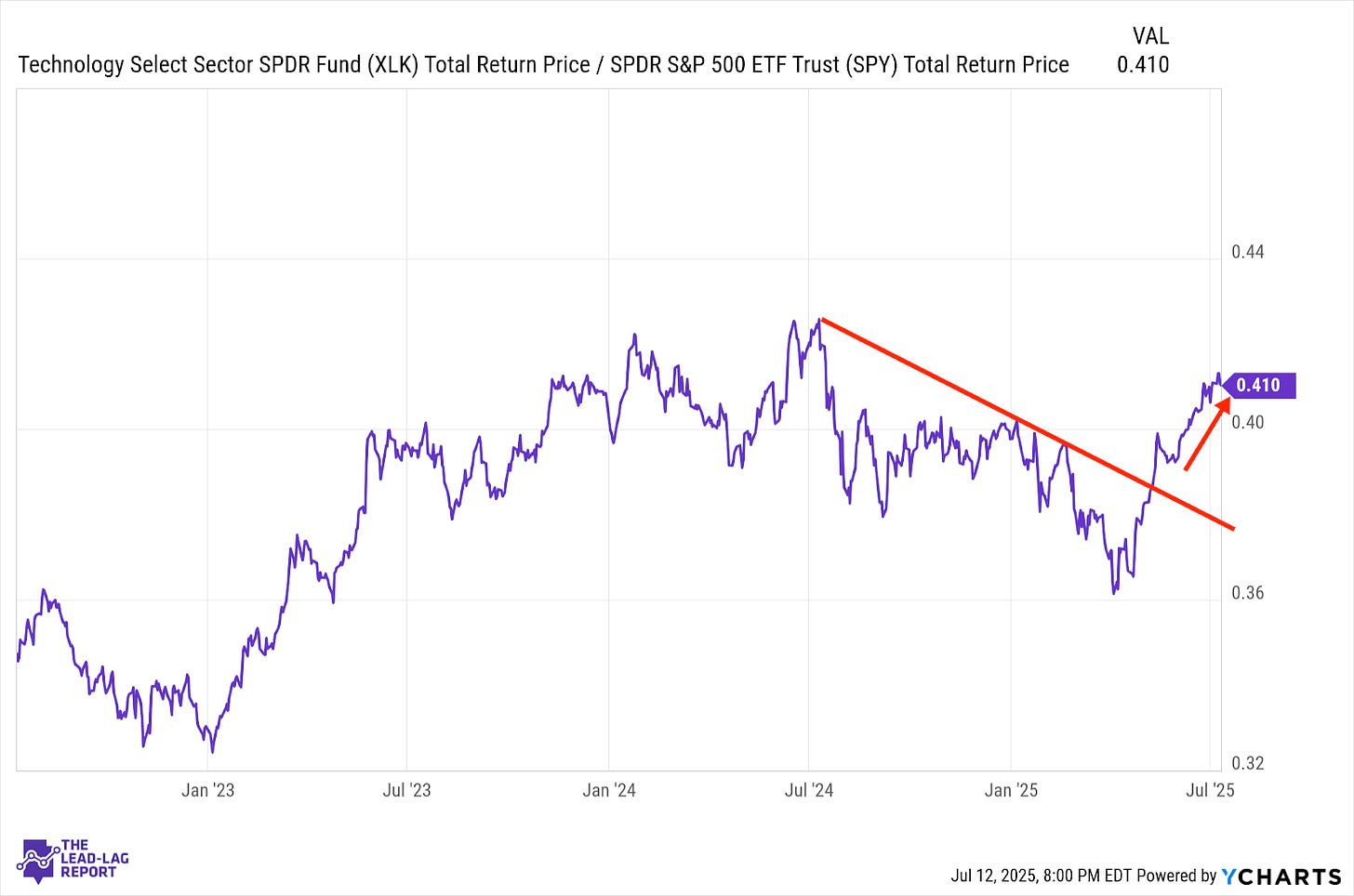

Technology (XLK) – Not Discouraged By Trade Tensions

Ever since its breakout several weeks ago, tech has been steadily outperforming the broader market. Despite occasional road bumps, including trade tensions and geopolitical events, investors have largely digested these events in stride. The latest escalation in the trade war may stall the current uptrend, but the non-reaction by the markets in Monday’s trading suggests investors could handle this one calmly as well.

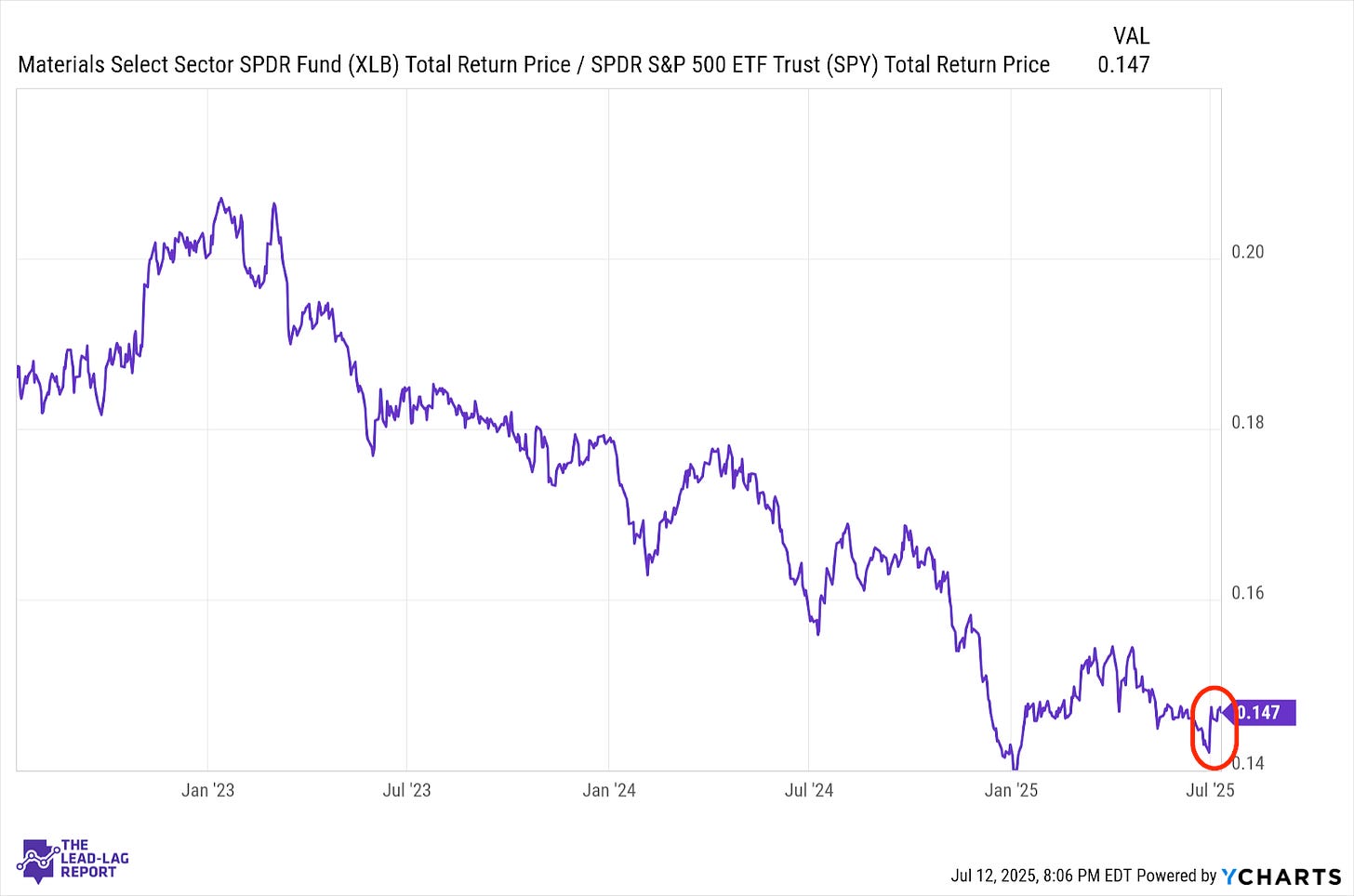

Materials (XLB) – Optimism For Economic Reacceleration

The outperformance of this sector has been a recent phenomenon, but the catalysts for it have been real. With the Trump tax cut package now signed into law, there’s been renewed optimism of an economic reacceleration that could help avoid a recession altogether. There are challenges coming from the labor market and consumer behavior, but cyclicals are still seeing a tailwind here.

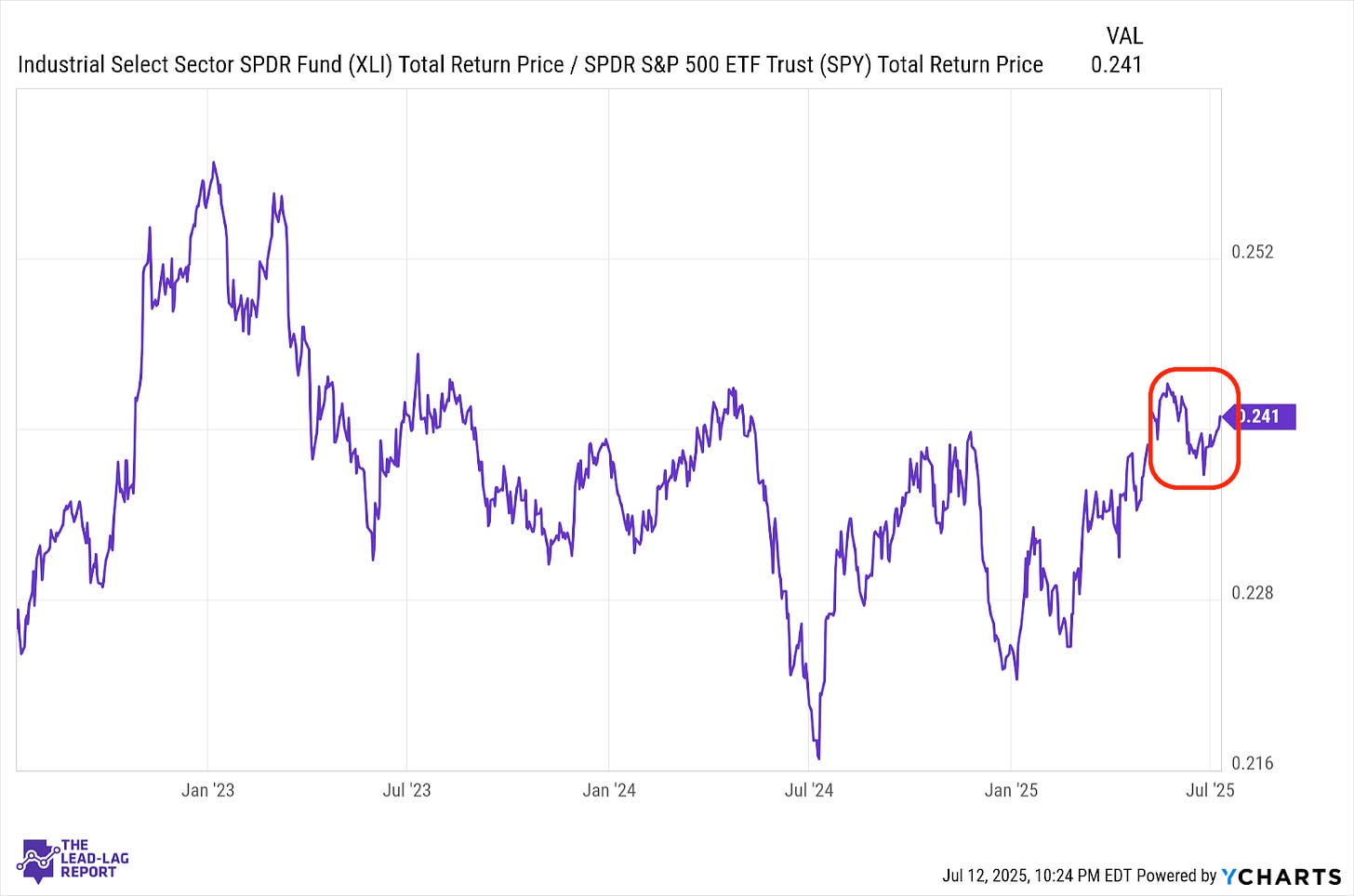

Industrials (XLI) – Tax Bill Tailwind Winning Out

Industrials have managed to reverse their recent downtrend and take advantage of cyclicals moving back into favor. The trend, however, feels tenuous. Trade tensions could quickly turn this ratio lower depending on how much worse they become, but the potential benefit that could come to corporations from the Trump tax bill is winning out for the time being.

Long Bonds (VLGSX) – Rising Risk Of Volatility

Long bond yields had been falling steadily throughout June, but recent events have turned yields north again. There are a number of potential factors at play. Fed timing is usually an issue. There’s also the potentially inflationary impact of newly threatened tariffs and general risk-on sentiment. This week’s CPI data may also be a bond market mover. Overall volatility risk has been rising.

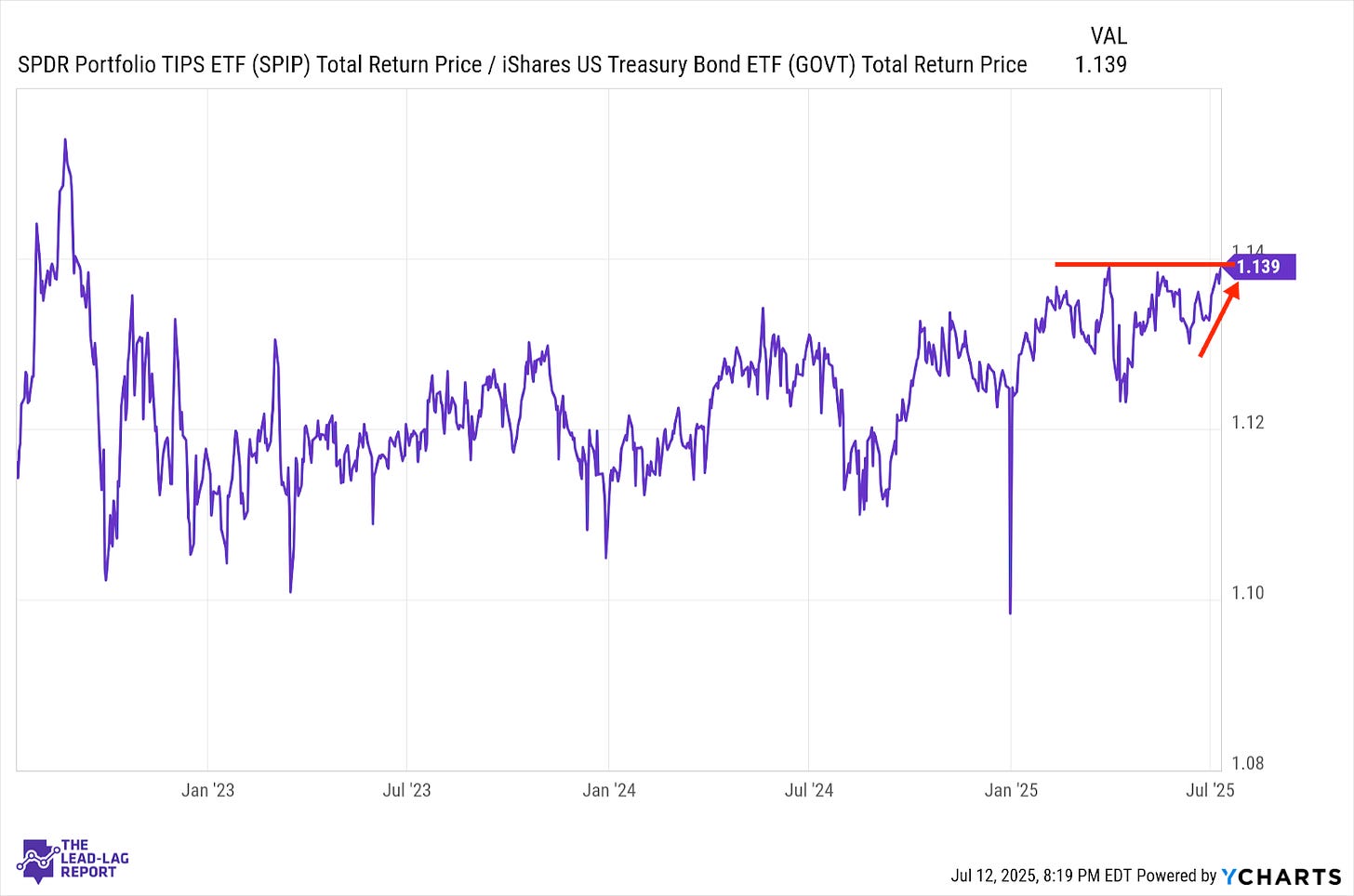

Treasury Inflation Protected Securities (SPIP) – Slight Uptrend Developing

There has been a slight uptrend developing in inflation protection, but it’s a minor one. It would be easy to say that escalating tariff risk would be the primary catalyst, but given the equity market’s relatively muted reaction, that might not be the case. I mostly see inflation expectations being largely settled here and any changes in this ratio being largely attributed to normal market fluctuations.

Junk Debt (JNK) – Still The Class Of Fixed Income

With some volatility along the way, junk bonds remain the class of the fixed income market. Their leadership within the space, not surprisingly, has shallowed up a bit, but the catalysts for a continued run are there. The Trump tax bill should be a net positive for corporations, especially for those whose financial situations need a boost, and current risk-on sentiment fueled by an impending series of rate cuts from the Fed should also help.

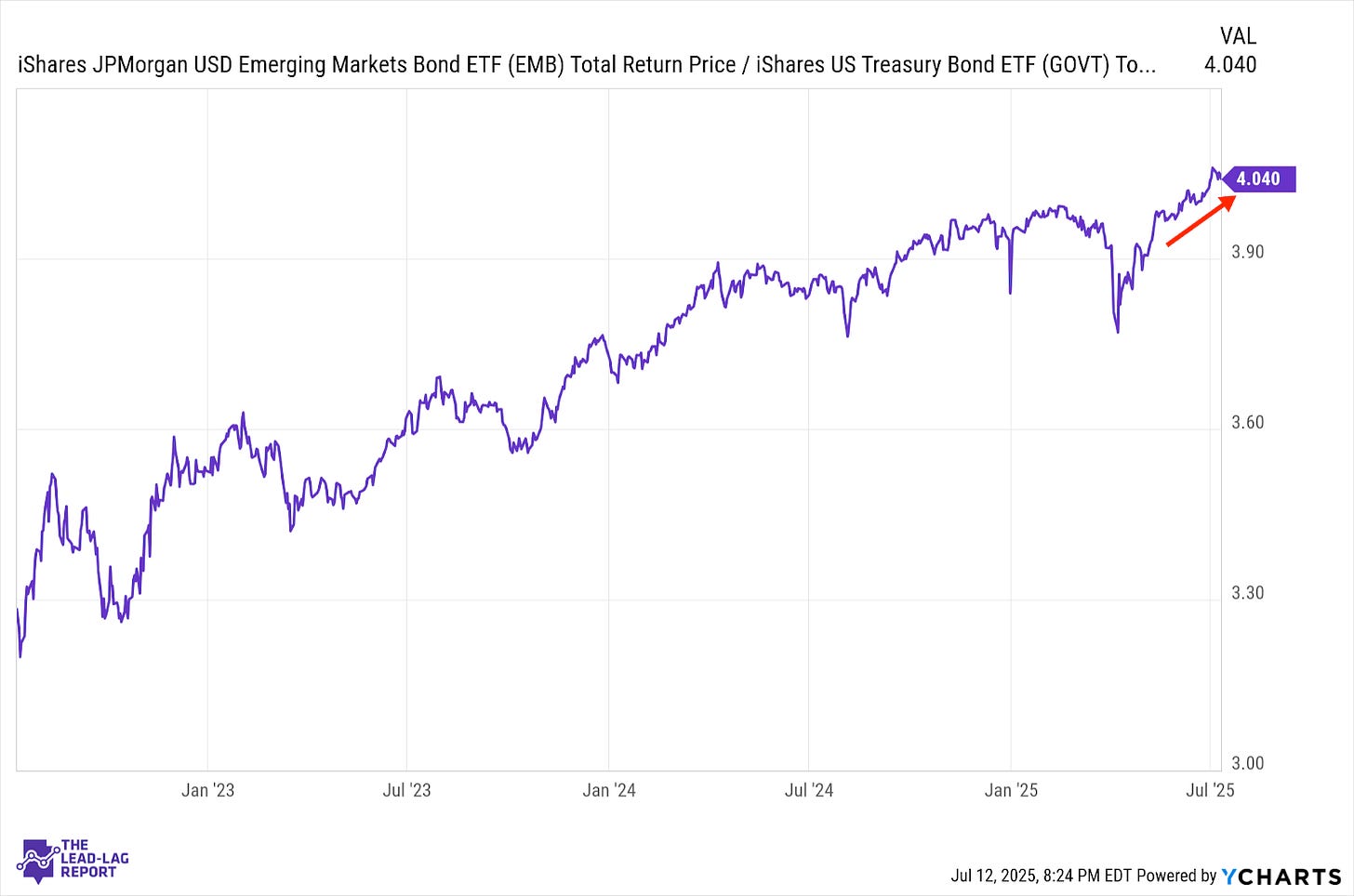

Emerging Markets Debt (EMB) – Watch The Dollar’s Reversal

If U.S. junk debt has been one of the leaders in the fixed income market, EM debt has been there right alongside it. It’ll be interesting to see what happens here if the dollar continues to perk up as it has over the past couple weeks. The dollar’s slide has been a big driver of outperformance in international bonds and a reversal of the greenback could trigger a slide here.

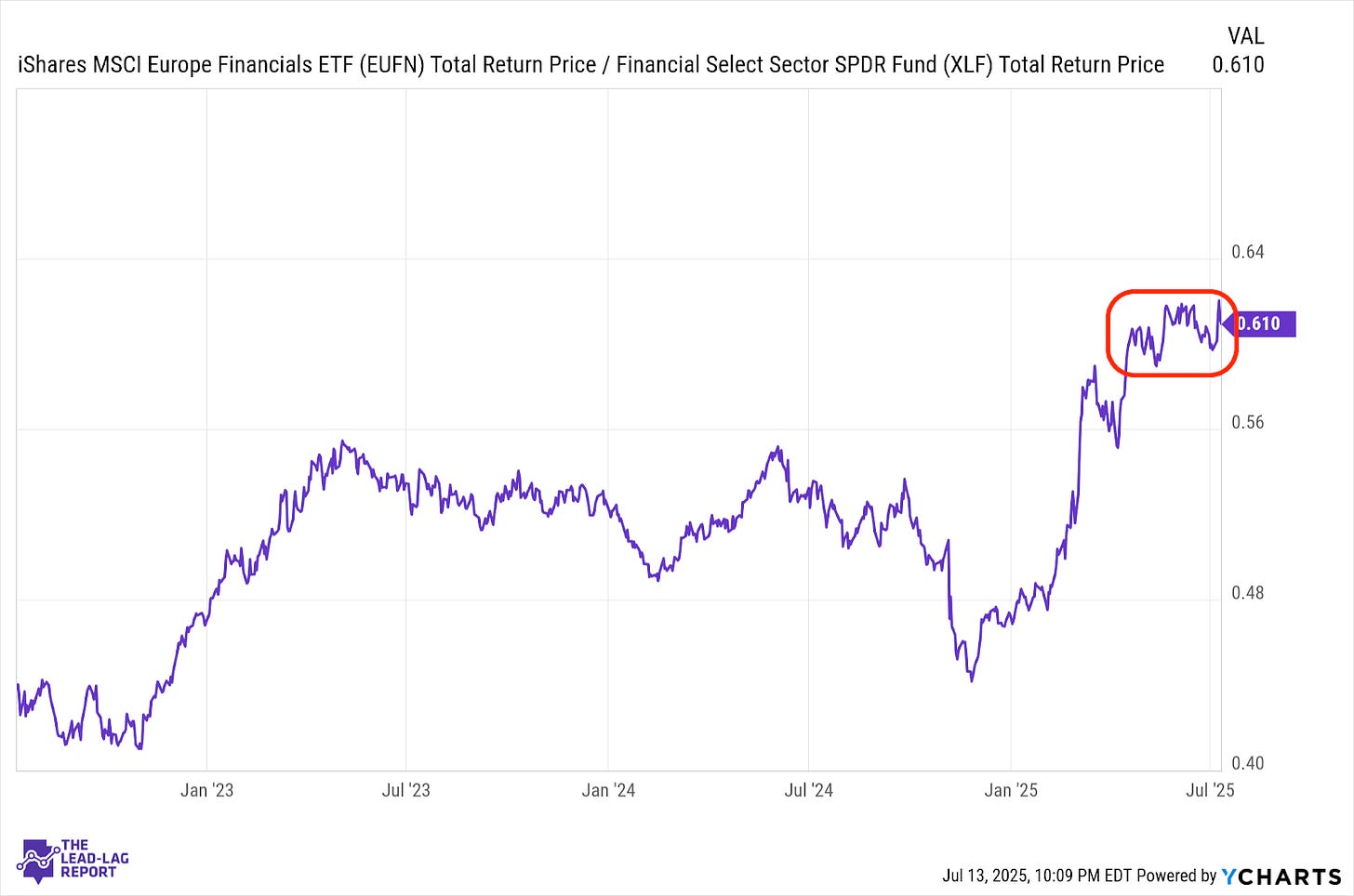

European Banks (EUFN) – Due For A Pause

Financial stocks have turned into laggards globally with no real leadership either domestically or internationally. European banks got a relative short-term boost from the recent Trump tariff announcement, but I’m not sure that’s going to hold up longer-term. With the ECB’s rate cutting cycle likely on hold for the time being, the sector may be due for a pause.

Lumber (LUMBER) – The Uptrend Continues