Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE WARNING FROM GOLD IS REAL

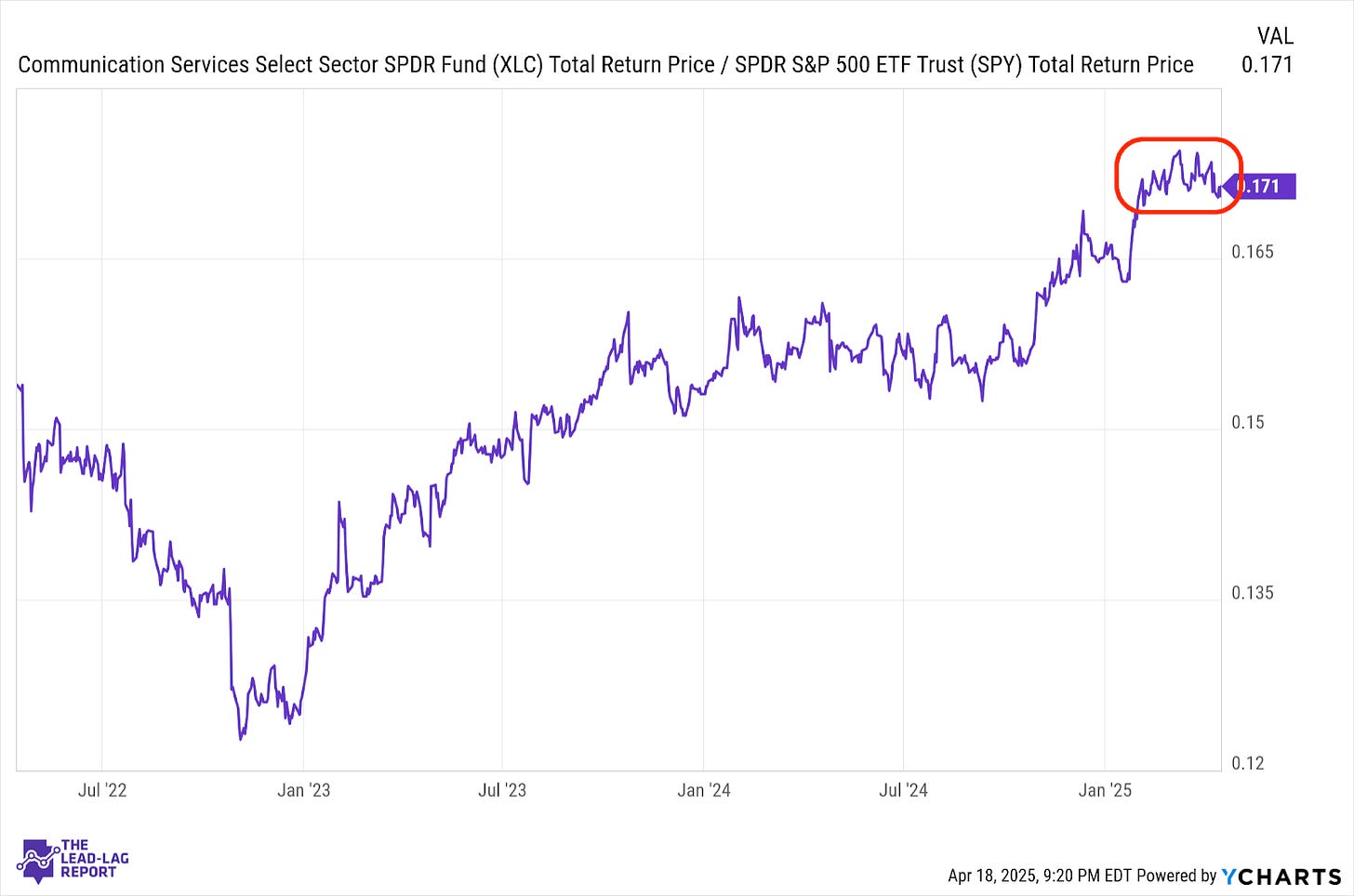

Communication Services (XLC) – The Mag 7 Has Become An Anchor

This sector is holding up relatively well compared to the S&P 500 despite the anchor of its two primary magnificent 7 holdings. While the potential of further AI development is there, we’re likely to see forward guidance start getting revised downward. The possibility of further antitrust litigation, such as what we’re seeing with Alphabet right now, could also become a larger theme later this year as the government takes aim at big tech.

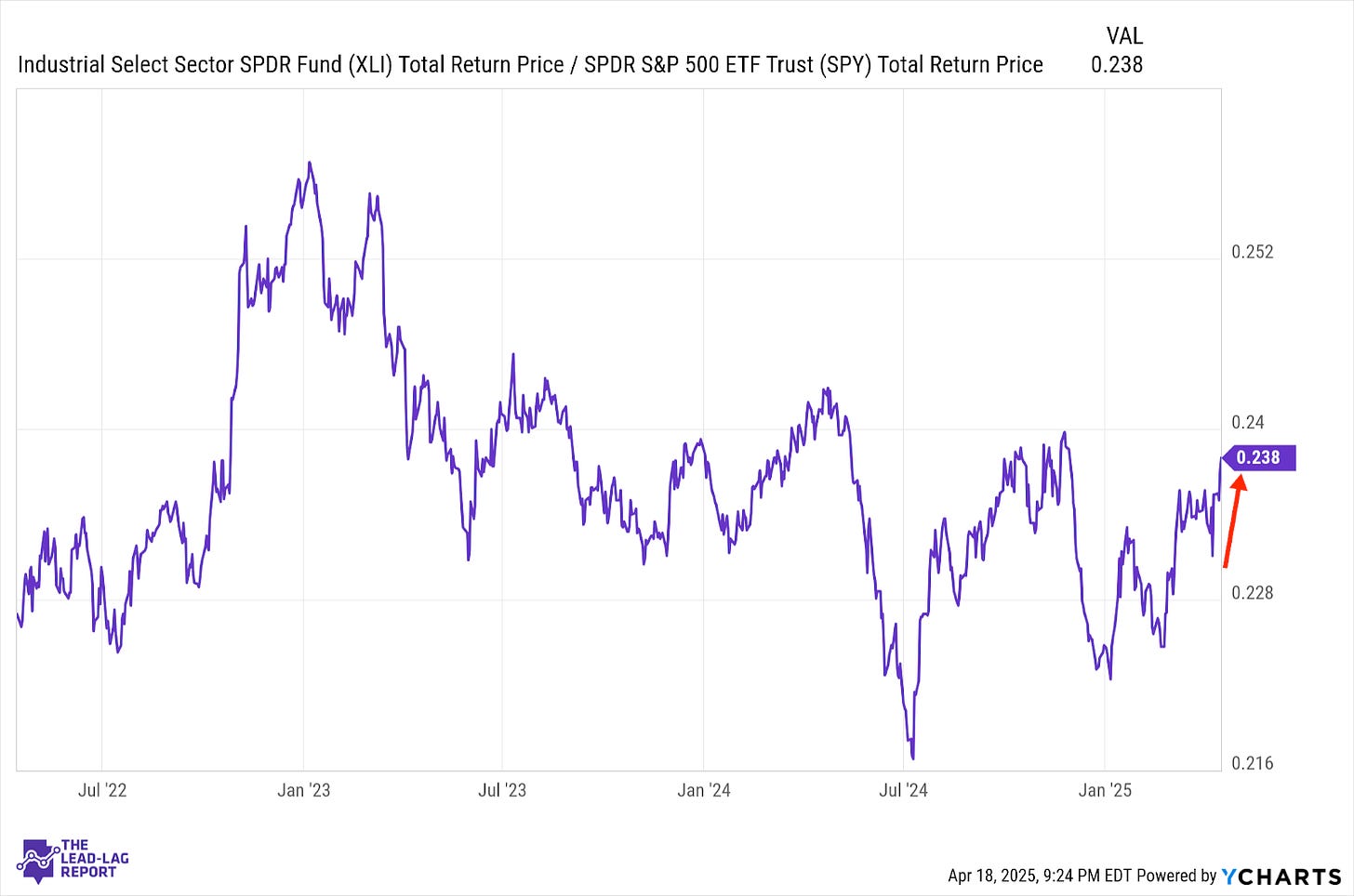

Industrials (XLI) – Clear Deterioration Is Coming

Cyclicals have seen a bit of a rebound in recent days, but their behavior has been choppy at best. We’re seeing a clear deterioration in economic expectations and plans for industrial expansion. The trade war, even for those companies with the flexibility to alter their supply chains, is going to have a continued negative impact on manufacturers and we’re likely to start seeing that play out in the data coming in the weeks ahead.

Financials (XLF) – Multiple Factors Leading To Outperformance

The financials sector continues to build on its months-long uptrend, managing to outperform the broader market despite conditions. There could be a few reasons for this. Big banks have done a good job of diversifying their revenue streams and may be less exposed to the lending market. Banks have likely already begun tightening lending standards, which improve loan quality. Plus, there’s the thesis that higher rates lead to better margins.

Utilities (XLU) – Becoming One Of The Better Risk-Off Themes

Utilities and defensive equities, in general, are and have been indicating steady risk-off conditions for months. With Treasuries failing to act as a reliable risk-off indicator due to U.S. and foreign manipulation, utilities might be one of the market’s better signals right now. Getting confirmation from other defensive equity themes throughout this current stretch has added to confidence.

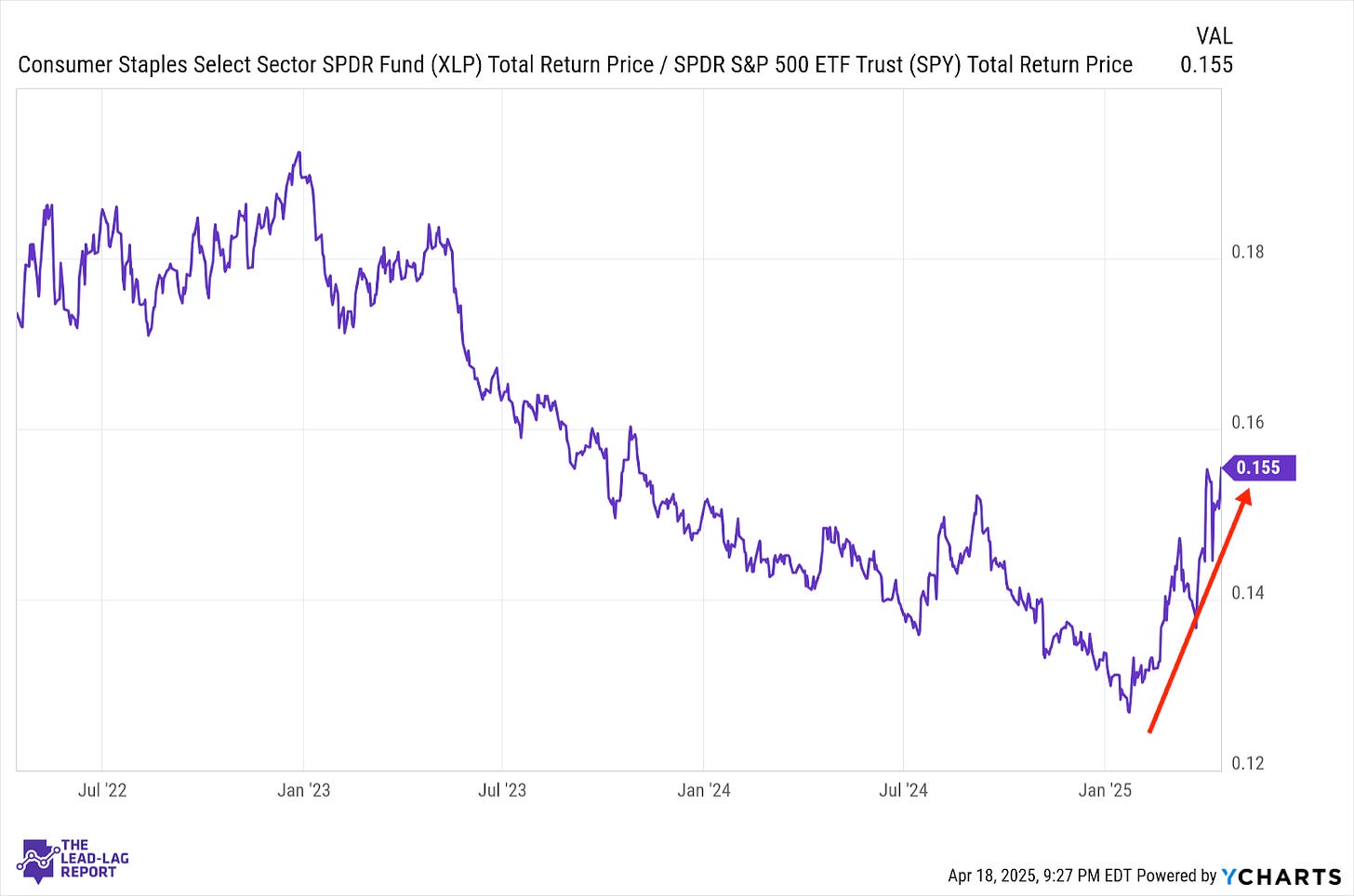

Consumer Staples (XLP) – The AI Rally Gets Undone

Even though the trade war continues to generate a lot of uncertainty about what’s ahead for retail, staples have been decisively reflecting the market’s current sentiment. This ratio sitting at a multi-year high now means that a lot of the gains made during the AI boom for tech stocks have been undone.

Health Care (XLV) – Becoming A Tariff Target