Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE UTILITIES BREAKOUT SUSTAINS DESPITE THE TECH REBOUND

Utilities (XLU) – Risk-Off Trend Still Intact

Utilities experienced a minor setback last week, but the fact that this sector and consumer staples were middle of the road performers suggests that last week wasn’t a decisive risk-on move. This sector has gotten off to another strong start this week, so the risk-off conditions signaled by utilities outperformance appear to still be intact. As usual, participation from other defensive sectors would provide further confirmation.

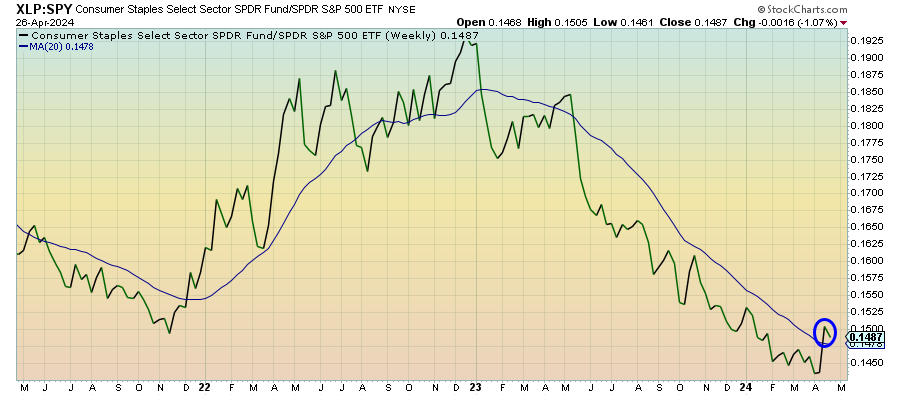

Consumer Staples (XLP) – Notoriously Stubborn

For now, the big spike we saw in this ratio earlier has turned out to be a one-hit wonder. I do, however, think that the macro case for this sector actually improved last week. Anytime inflation starts to trend higher, growth slows and the currency market grows stable (especially among the biggest currencies in the world), investors are likely to eventually begin migrating to safer havens. In the equity market, that’s this sector although it’s been notoriously stubborn to participate lately.

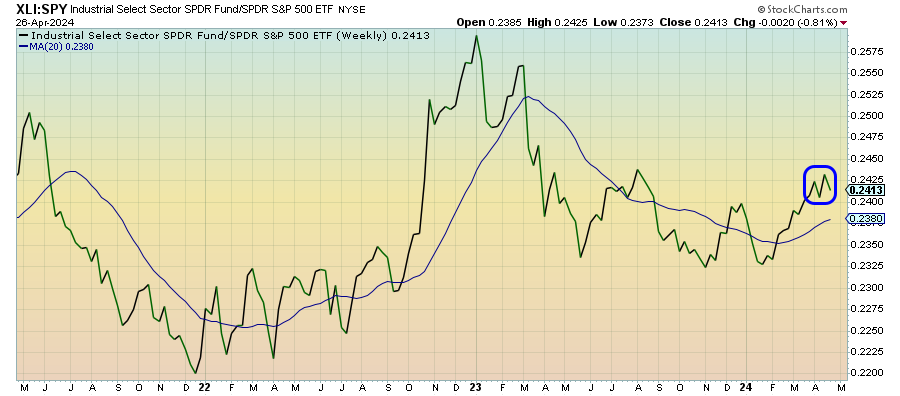

Industrials (XLI) – Ready To Step Up?

The straight-line outperformance of cyclicals looks like it’s finally starting to hit some road bumps. Tech has struggled and defensive sectors, outside of utilities, have mostly failed to keep up with the market, so that opens the door for cyclicals to regain their leadership. The resurgent inflation narrative and, more importantly, the unexpectedly disappointing Q1 GDP reading leaves me wondering if industrials are ready to step up again.

Materials (XLB) – Geopolitics Is The X Factor