Thematic ETF Showdown: FMKT vs. Traditional Sector Funds

Key Highlights

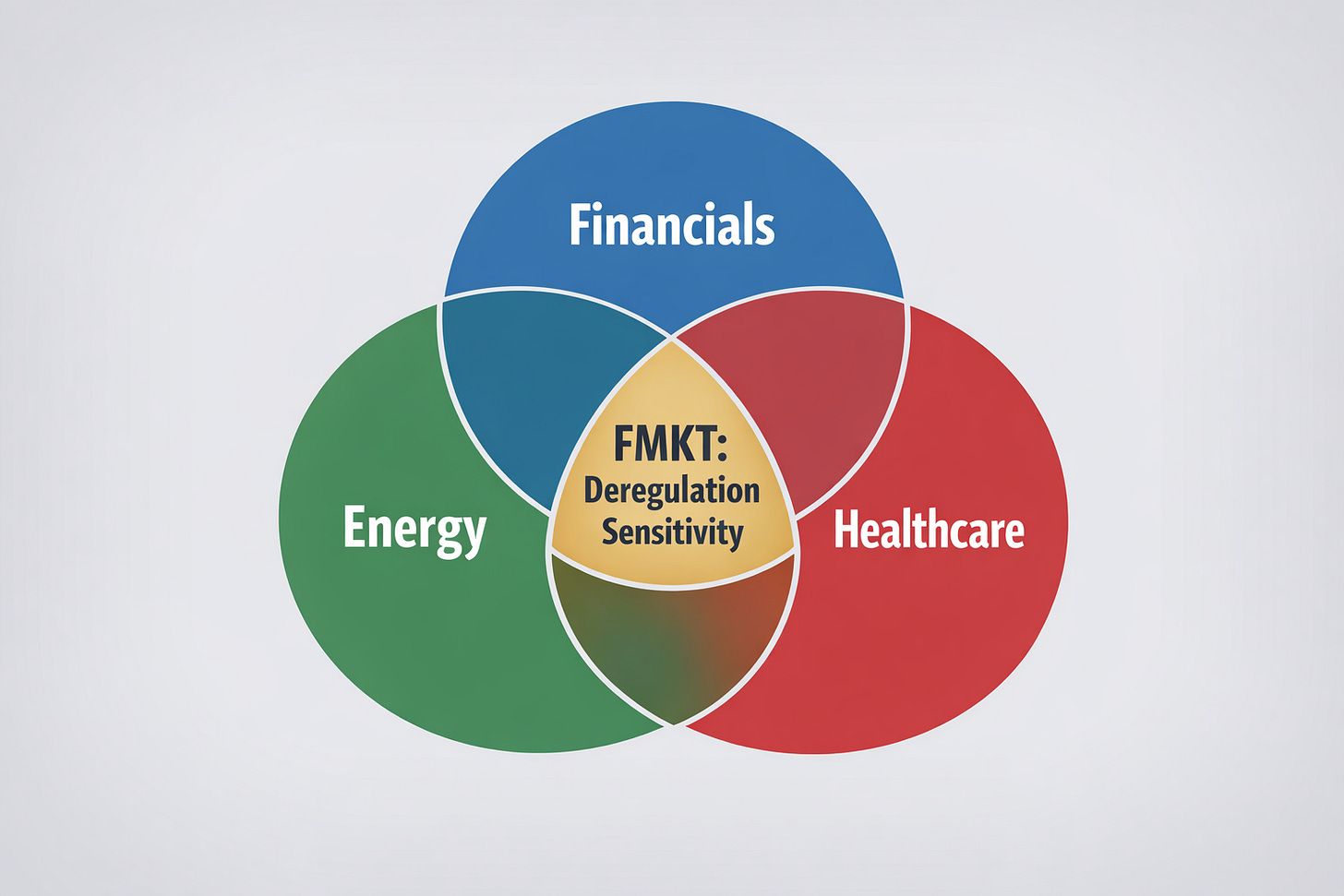

FMKT is designed specifically to capture deregulation as an investment theme, cutting across energy, financials, and healthcare rather than confining exposure to a single sector.

Traditional sector ETFs reflect industry structure, not policy direction, which can dilute the impact of regulatory shifts on returns.

Deregulation rarely benefits all companies equally, and FMKT aims to identify firms with the highest sensitivity to falling compliance costs.

The strategy carries distinct risks, as regulatory momentum can stall or reverse, but it offers a focused way to express conviction in a freer-market policy environment.

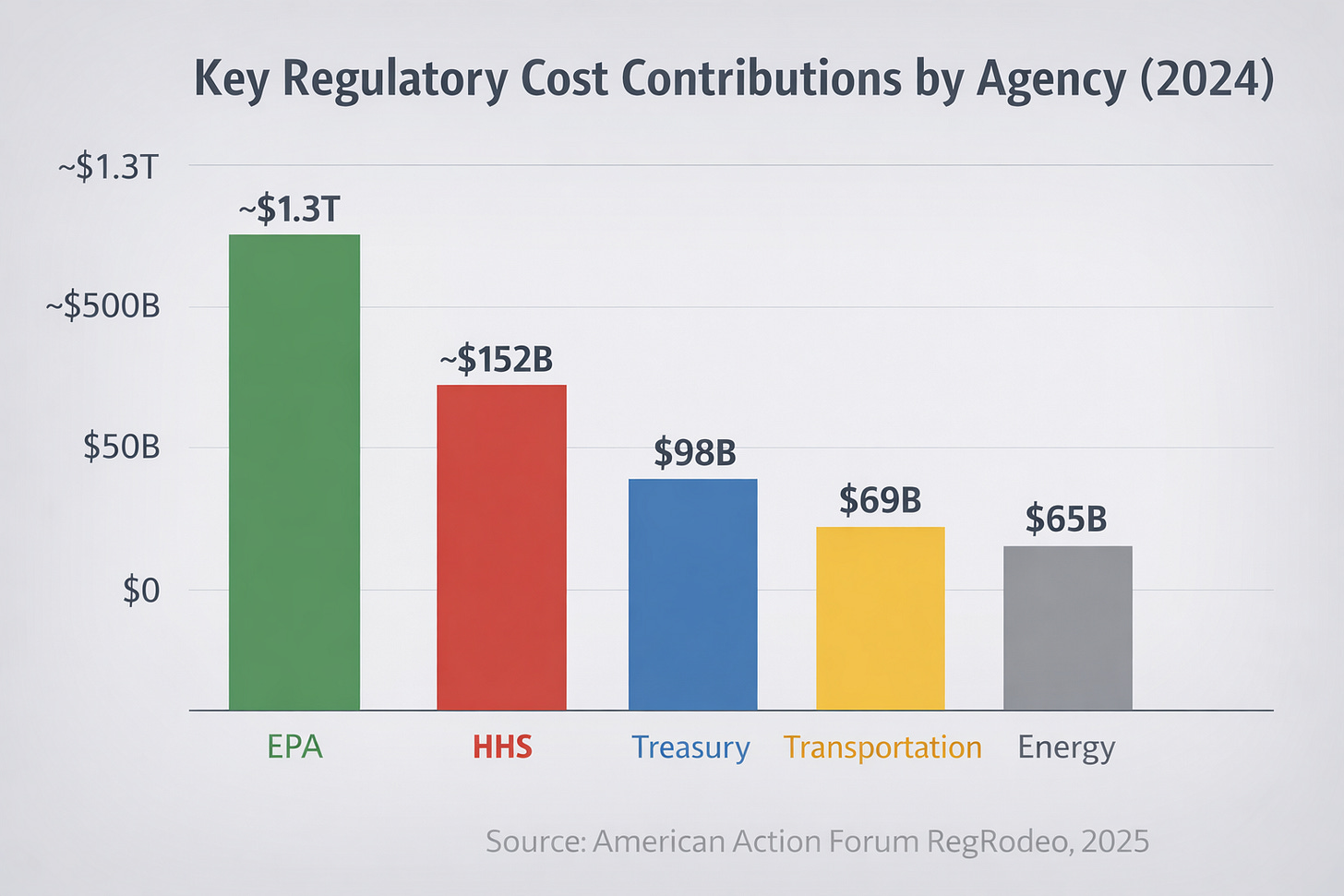

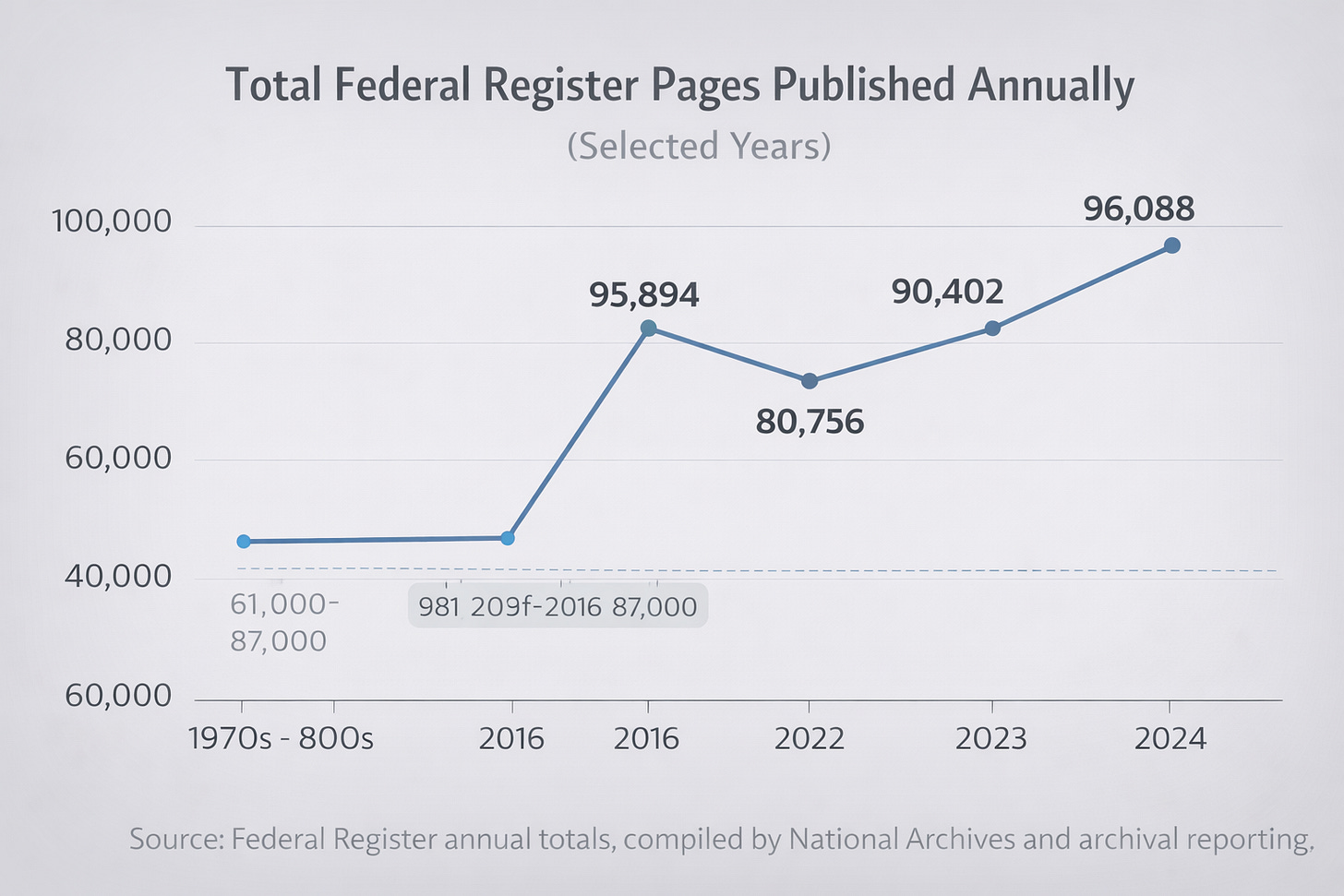

Periods of regulatory change tend to create both uncertainty and opportunity. When Washington begins rolling back rules, the effects rarely remain isolated within a single industry. Banks may face lighter capital or reporting requirements. Energy producers can benefit from faster permitting. Healthcare operators might see administrative burdens eased. Each shift raises a familiar question for investors: how should portfolios be positioned when deregulation becomes a dominant macro force?

Historically, the default response has been sector-based investing. Energy, financials, and healthcare ETFs have long served as tools for capturing regulatory tailwinds within specific industries. A newer alternative has emerged in the form of the Free Markets ETF (FMKT), a thematic strategy built around deregulation itself rather than any one sector. This distinction highlights a broader investment debate: broad sector exposure versus targeted policy-driven positioning.¹

A Thematic Approach to Deregulation

FMKT was launched to address a gap in the ETF landscape. While many funds hold companies affected by regulation, few are explicitly designed to benefit from deregulation as a primary investment driver. The fund is actively managed and focuses on U.S.-listed companies whose earnings, margins, or growth prospects are meaningfully shaped by regulatory costs. Its portfolio typically spans energy, financials, healthcare, and select services businesses that share this common trait.²

Rather than weighting companies by market capitalization, FMKT emphasizes regulatory sensitivity. This allows the portfolio to include firms that may be overlooked in traditional sector ETFs but could experience outsized benefits when compliance burdens ease. The underlying logic is straightforward: if regulatory costs fall, operational flexibility improves, and profitability can rise. Even incremental policy changes can have meaningful financial consequences for companies operating close to regulatory constraints.³

Sector ETFs, by contrast, are constructed to mirror industry composition. Their goal is representation, not selectivity. This difference becomes more apparent when comparing how each approach behaves across heavily regulated sectors.

Energy: Sensitivity Versus Scale

Energy is among the most regulated segments of the U.S. economy. Environmental standards, drilling permits, transportation approvals, and emissions rules all influence capital allocation and project timelines. A traditional energy ETF provides broad exposure to the sector, often dominated by large, integrated oil and gas companies with diversified operations.

These firms benefit from deregulation, but the marginal impact can be limited. Large producers typically have compliance infrastructure already in place, which reduces the effect of incremental rule changes. Smaller or more specialized energy companies, by contrast, often feel regulatory constraints more acutely. Faster permitting or relaxed restrictions can materially alter their growth outlook.

FMKT reflects this distinction by emphasizing energy companies whose business models are highly sensitive to regulatory shifts. Instead of defaulting to the largest firms, the fund can tilt toward producers or developers for whom deregulation meaningfully changes economics. Traditional energy ETFs emphasize diversification and stability through scale. FMKT emphasizes selectivity and policy leverage.⁴

The choice between these approaches depends on whether investors believe deregulation primarily benefits incumbents or unlocks opportunity for more regulation-sensitive players.

Financials: Who Really Gains From Looser Oversight?

Since the global financial crisis, regulation has shaped nearly every aspect of banking and financial services. Capital requirements, reporting rules, and compliance obligations have altered competitive dynamics across the industry.

Broad financial sector ETFs are typically dominated by large banks, insurers, and payment networks. These firms are often better equipped to absorb regulatory costs and, in some cases, benefit from higher barriers to entry. Deregulation still helps them, but the relative gains may be modest.

FMKT attempts to identify financial companies for which regulatory relief can materially affect margins or growth. This includes businesses such as brokerages, exchanges, or smaller institutions that operate under heavy compliance burdens without the scale advantages of global banks. When reporting requirements are simplified or capital rules adjusted, these firms can see immediate operational benefits.⁵

Sector ETFs capture aggregate financial performance. A deregulation-focused strategy attempts to isolate where policy changes have the greatest economic impact. That distinction becomes especially important when regulatory reform is unevenly applied.

Healthcare: Finding Opportunity Beneath the Surface

Healthcare is often viewed as resistant to deregulation due to safety and quality oversight. Yet administrative complexity remains one of the sector’s defining characteristics. Billing rules, staffing mandates, reporting requirements, and approval processes all contribute to elevated operating costs.

Traditional healthcare ETFs are heavily weighted toward pharmaceutical manufacturers and medical device companies. These firms tend to be well-equipped to navigate regulatory systems and may be less sensitive to marginal policy changes. Their performance is often driven more by product cycles than administrative reform.

FMKT takes a narrower view by focusing on operators, distributors, and service providers where regulatory costs directly affect profitability. Changes to staffing mandates or reporting requirements can have immediate financial consequences for these businesses. Recent regulatory rollbacks affecting healthcare administration highlight how policy decisions can meaningfully alter cost structures for certain operators.⁶

This approach carries risk, as healthcare regulation is politically sensitive and subject to reversal. Yet even temporary relief can provide lasting advantages, such as improved margins or expanded capacity. FMKT’s strategy reflects the belief that these inflection points matter for investors willing to look beyond headline healthcare narratives.⁷

Weighing the Trade-Offs

The comparison between FMKT and traditional sector ETFs ultimately comes down to philosophy. Sector funds emphasize breadth, representation, and resilience. FMKT emphasizes selectivity, thematic conviction, and sensitivity to policy direction.

The potential upside lies in capturing asymmetric benefits from deregulation. When regulatory burdens fall, companies that were previously constrained can experience meaningful improvements in efficiency and profitability. Markets often anticipate these changes, rewarding firms positioned to benefit before reforms are fully implemented.⁸

The risks are equally clear. Regulatory momentum can slow or reverse due to political, legal, or social pressures. A thematic fund concentrated on deregulation is inherently more exposed to these dynamics than broad sector ETFs. Investors are effectively taking on policy risk alongside market risk.⁹

For many portfolios, this need not be an either-or decision. FMKT can function as a satellite allocation alongside core sector or market exposure. It offers a way to express a view on policy direction without abandoning diversification.

A Broader Perspective

FMKT represents a different way of organizing equity exposure. Rather than grouping companies solely by industry, it focuses on a force that cuts across sectors: regulation itself. In doing so, it highlights how government policy can shape corporate outcomes in ways traditional classifications often obscure.

For investors who believe the current environment favors lighter regulation and increased market flexibility, FMKT provides a coherent framework for acting on that view. Traditional sector ETFs remain valuable tools, but they are not designed to isolate policy-driven effects. FMKT fills that gap by making deregulation an explicit investment theme.¹⁰

The decision to allocate ultimately depends on conviction. Deregulation alone does not guarantee higher equity prices, and fundamentals still matter. Yet when policy change aligns with operational leverage, the impact can be meaningful. FMKT’s thesis rests on that alignment, offering investors a focused lens through which to view the evolving relationship between markets and regulation.

Consider FMKT. I believe in it. I wouldn’t have launched the fund if I didn’t.

Footnotes

Tidal Investments LLC, “Tidal Investments Launches the Free Markets ETF (FMKT),” Business Wire, June 10, 2025.

DJ Shaw, “New ETF Targets Companies Poised for Deregulation Relief,” ETF.com, June 11, 2025.

Free Markets ETF, “Fund Overview and Investment Rationale,” accessed December 29, 2025.

State Street Global Advisors, “Energy Select Sector SPDR Fund Holdings,” accessed December 28, 2025.

State Street Global Advisors, “Financial Select Sector SPDR Fund Holdings,” accessed December 28, 2025.

U.S. Department of Health and Human Services, “Final Rule Repealing Federal Nursing Home Staffing Mandate,” December 2025.

State Street Global Advisors, “Health Care Select Sector SPDR Fund Holdings,” accessed December 28, 2025.

Michael A. Gayed, “FMKT and the Deregulation Optionality Trade,” Lead-Lag Report, December 29, 2025.

Dan Goldbeck, “2025: The Year in Regulation,” American Action Forum, January 9, 2026.

Free Markets ETF, “Why Deregulation Matters to Equity Markets,” accessed December 29, 2025.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-994-4004 or visiting www.freemarketsetf.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

FMKT is distributed by Foreside Fund Services, LLC.

Find full holding details and learn more about FMKT at

http://www.freemarketsetf.com.

Holdings are subject to change.

Deregulation Strategy Risks.The Fund’s strategy of investing in companies that may benefit from deregulatory measures entails significant risks, including those stemming from the unpredictable nature of regulatory trends. Deregulation is influenced by political, economic, and social factors, which can shift rapidly and in unforeseen directions. Changes in government priorities, political leadership, or public sentiment may result in the reversal of existing deregulatory policies or the introduction of new regulations that could adversely affect certain industries or companies. Further, while the Fund invests in companies expected to benefit from deregulatory initiatives, not all of these companies may achieve the expected advantages, whether fully, partially, or at all. The actual impact of deregulatory measures may vary widely depending on a company’s specific operational, financial, and competitive circumstances. Companies may also face challenges adapting to new regulatory environments, or their competitive positioning may be undermined by other market factors unrelated to deregulation. These risks could negatively affect the performance of the Fund’s portfolio.

Underlying Digital Assets ETP Risks. The Fund’s investment strategy, involving indirect exposure to Bitcoin, Ether, or any other Digital Assets through one or more Underlying ETPs, is subject to the risks associated with these Digital Assets and their markets. These risks include market volatility, regulatory changes, technological uncertainties, and potential financial losses. As with all investments, there is no assurance of profit, and investors should be cognizant of these specific risks associated with digital asset markets.

● Underlying Bitcoin and Ether ETP Risks: Investing in an Underlying ETP that focuses on Bitcoin, Ether, and/or other Digital Assets, either through direct holdings or indirectly via derivatives like futures contracts, carries significant risks. These include high market volatility influenced by technological advancements, regulatory changes, and broader economic factors. For derivatives, liquidity risks and counterparty risks are substantial. Managing futures contracts tied to either asset may affect an Underlying ETP’s performance. Each Underlying ETP, and consequently the Fund, depends on blockchain technologies that present unique technological and cybersecurity risks, along with custodial challenges in securely storing digital assets. The evolving regulatory landscape further complicates compliance and valuation efforts. Additionally, risks related to market concentration, network issues, and operational complexities in managing Digital Assets can lead to losses. For Ether specifically, risks associated with its transition to a proof-of-stake consensus mechanism, including network upgrades and validator centralization, may add additional uncertainties.

●Bitcoin and Ether Investment Risk: The Fund’s indirect investments in Bitcoin and Ether through holdings in one or more Underlying ETPs expose it to the unique risks of these digital assets. Bitcoin’s price is highly volatile, driven by fluctuating network adoption, acceptance levels, and usage trends. Ether faces similar volatility, compounded by its reliance on decentralized applications (dApps) and smart contract usage, which are subject to innovation cycles and adoption rates. Neither asset operates as legal tender or within central authority systems, exposing them to potential government restrictions. Regulatory actions in various jurisdictions could negatively impact their market values. Both Bitcoin and Ether are susceptible to fraud, theft, market manipulation, and security breaches at trading platforms. Large holders of these assets (”whales”) can influence their prices significantly. Forks in the blockchain networks—such as Ethereum’s earlier split into Ether Classic—can affect demand and performance. Both assets’ prices can be influenced by speculative trading, unrelated to fundamental utility or adoption.

● Digital Assets Risk: Digital Assets like Bitcoin and Ether, designed as mediums of exchange or for utility purposes, are an emerging asset class. Operating independently of any central authority or government backing, they face extreme price volatility and regulatory scrutiny. Trading platforms for Digital Assets remain largely unregulated and prone to fraud and operational failures compared to traditional exchanges. Platform shutdowns, whether due to fraud, technical issues, or security breaches, can significantly impact prices and market stability.

● Digital Asset Markets Risk: The Digital Asset market, particularly for Bitcoin and Ether, has experienced considerable volatility, leading to market disruptions and erosion of confidence among participants. Negative publicity surrounding these disruptions could adversely affect the Fund’s reputation and share trading prices. Ongoing market turbulence could significantly impact the Fund’s value.

● Blockchain Technology Risk: Blockchain technology underpins Bitcoin, Ether, and other digital assets, yet it remains a relatively new and largely untested innovation. Competing platforms, changes in adoption rates, and technological advancements in blockchain infrastructure can affect their functionality and relevance. For Ether, the dependence on its proof-of-stake mechanism and smart contract capabilities introduces risks tied to network performance and scalability. Investments in blockchain-dependent companies or vehicles may experience market volatility and lower trading volumes. Furthermore, regulatory changes, cybersecurity incidents, and intellectual property disputes could undermine the adoption and stability of blockchain technologies.

Recent Market Events Risk. U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including uncertainty regarding inflation and central banks’ interest rate changes, the possibility of a national or global recession, trade tensions and tariffs, political events, war and geopolitical conflict. These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets, despite government efforts to address market disruptions.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

. Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso, Tactical Rotation Management, LLC, SYKON Asset Management, Point Bridge Capital, or ACA/Foreside.