Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE REAL FLIGHT TO SAFETY HAS YET TO ARRIVE

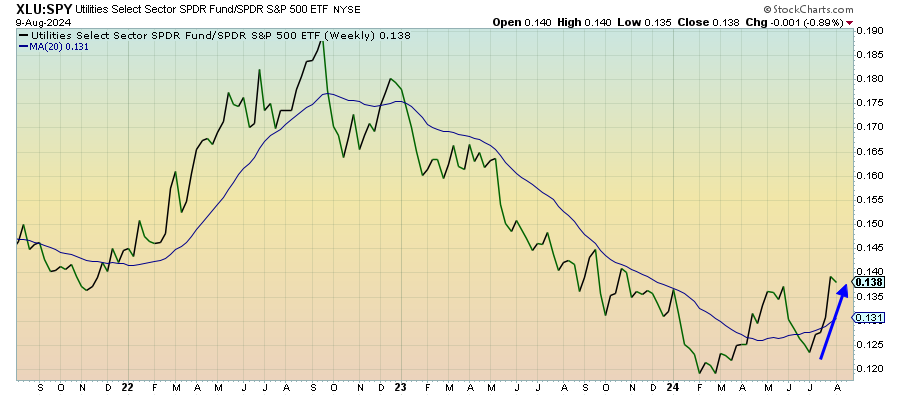

Utilities (XLU) – Risk-Off Still In Control

Despite last week’s modest return to normal conditions, utilities are still one of the strongest signals that risk-off conditions are still in control. In the near-term, volatility is still a threat and it shouldn’t be assumed that the rally that finished last week means the correction is now a thing of the past.

Energy (XLE) – Not Getting Included

Energy stocks are still holding tough here, but there are still genuine concerns about where the demand will come from. At this point, the cartels are still controlling supply, which is helping to hold prices higher. But consumer demand is showing signs of flagging and the big summer travel season is coming to an end. The cyclical rally, to this point at least, hasn’t really included this group.

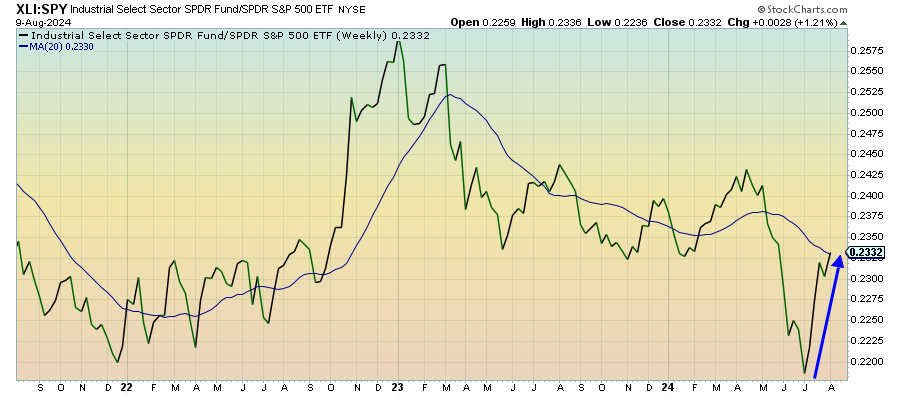

Industrials (XLI) – Maintaining Strength

It could be a telling sign that even in last week’s rebound, it was cyclicals, not tech, that were leading the way. This suggests that there’s still some investor apprehension about returning to previous winners and/or high growth names. There still appears to be a preference towards value and that in and of itself is a bit of a risk-off signal.

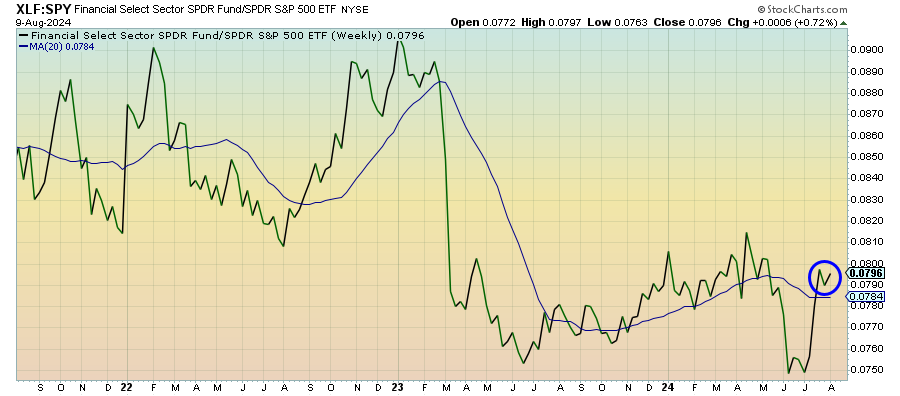

Financials (XLF) – Signs Of Improvement In CRE

Loan demand is proving to be pretty steady here and may even be showing signs of improvement on the commercial side. I wouldn’t by any stretch suggest that the CRE space is showing long-term improvement, but it may be steadying for now. Falling interest rates are certainly providing an assist here.

Health Care (XLV) – Can It Hold Up?