Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The high yield market has shown signs of bending, but it has yet to break. High yield spreads have expanded since the trade war threats started to pick up and investors became genuinely more worried about recession risk in the United States. But even that modest expansion in spreads has turned back lower again. Even in the face of rising inflation risk, recession risk and the potential for a prolonged and expensive trade war, high investors just don’t seem terribly worried about the underlying risks in the debt they’re holding. It makes some sense to at least mitigate some credit risk if entering the junk bond market right now.

The BlackRock Corporate High Yield Fund (HYT) does some of that through credit risk and yield analysis to uncover attractive opportunities. The use of leverage unquestionably increases risk, but the fund’s track record demonstrates that it’s been able to deliver peer group leading returns with a high yield without overdoing it. But is it the right fit in the current marketplace?

Fund Background

HYT’s primary investment objective is to provide shareholders with current income with a secondary objective of capital appreciation. It seeks to achieve its objectives by investing, under normal market conditions, in domestic and foreign high yield securities, including high yield bonds, corporate loans, convertible debt securities and preferred securities which are below investment grade quality. The fund also utilizes leverage in order to enhance yield and total return potential.

The one advantage of HYT is that it’s largely unconstrained, outside of the fact, of course, that it targets the non-investment grade market. That means it invests in U.S. and foreign bonds, fixed rate and floating rate. The latter piece is important because it gives us a tell on how the managers are thinking about interest rate risk.

In recent months, the fund has made a modest decrease to its floating rate exposure. Not a major shift that radically alters the fund’s risk/return profile, but enough to suggest that the managers may be expecting lower rates ahead. Overall, the fund is diversified enough, both globally and in terms of credit quality, that it can qualify as a core fixed income holding. The high yield will no doubt be attractive to income seekers, but so will the relative lack of tail risk factors within the portfolio itself.

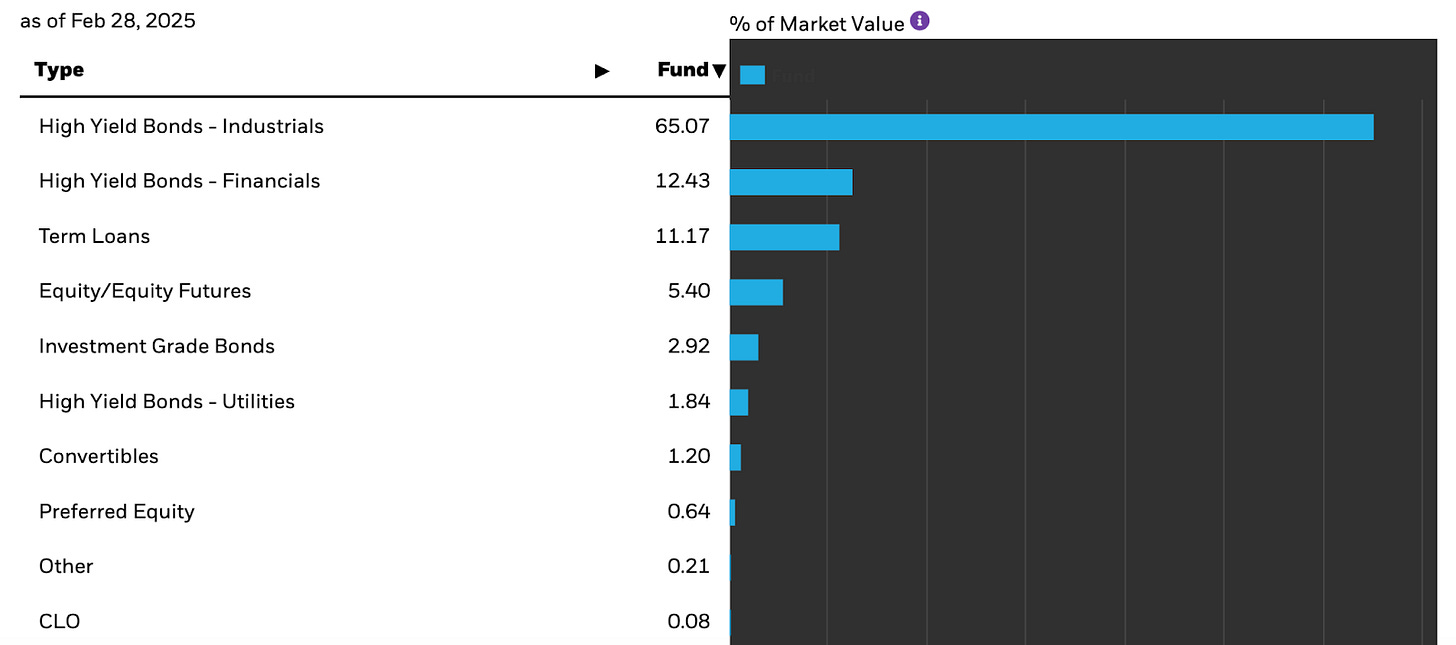

As expected, most of the fund is invested in traditional junk bonds, but the 11% allocation to non-investment grade terms adds a little twist. For the purposes of analyzing the portfolio as a whole, this addition doesn’t really alter the risk/return profile at all. While the fund is a bit concentrated in the industrial sector, the nearly 1200 individual holdings of the fund ensures that there’s no real idiosyncratic risk at play.