Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

In the fixed income world, U.S. junk bonds have been one of the best-performing groups coming out of the 2022 bear market. Maybe less recognized is the performance of emerging markets bonds, which have been similarly successful. These two groups share a relatively similar credit profile - the broadest EM debt indices are about half below investment-grade - so they’re often correlated with each other. The fact that the dollar is careening lower right now might make emerging markets bonds the new favorite of the pair.

The Western Asset Emerging Markets Debt Fund (EMD) is one of the few EM bond funds in the CEF space, but it’s also one of the better ones. Its risk management through diversification and credit quality has produced positive results historically, but leverage and duration risk could pose some challenges.

Fund Background

EMD offers an actively managed, leveraged fixed income portfolio that invests primarily in emerging market debt of sovereign and corporate issuers, denominated in both U.S. dollar and local currencies. It seeks high current income, with capital appreciation as a secondary objective. It also emphasizes team management and extensive credit research expertise to identify attractively priced securities.

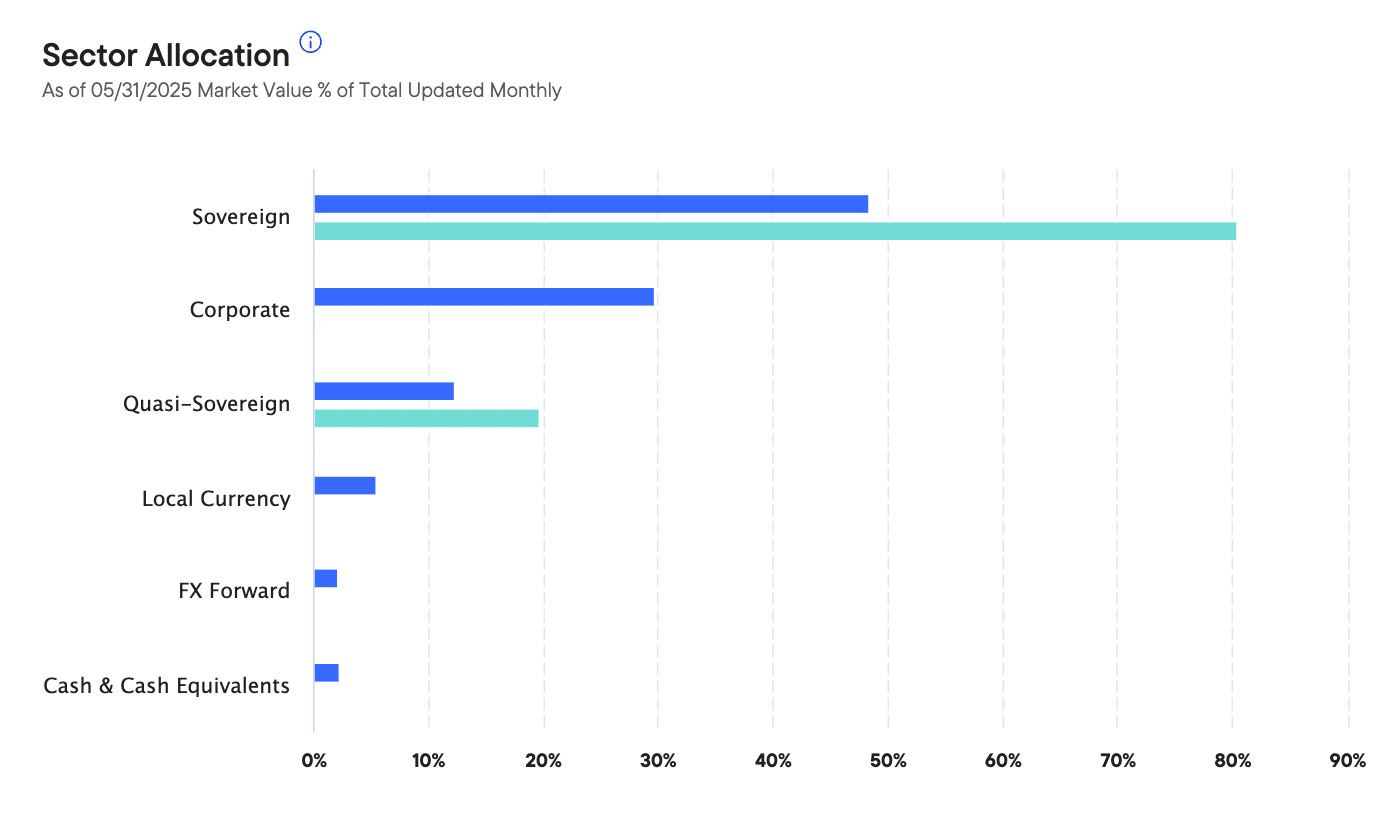

The roughly 25% use of leverage worries me a little given how punitive the cost of overlaying it can be, but I think there’s enough to work with here that still makes EMD worth considering. The largest EM bond funds focus almost exclusively on government & agency debt, so a fund that adds some relatively significant exposure to corporate bonds along with that could be a more unique and comprehensive addition to a fixed income portfolio.

Corporate bonds account for about 30% of the portfolio, which provides a mix similar to that of the U.S. Agg index. I’m a fan of funds that provide more of an all-in-one solution that makes it easier for investors, although you also have to make sure the mix is right.

There are 15 countries represented within the portfolio with at least 2% allocations, so geographic diversification is quite broad.

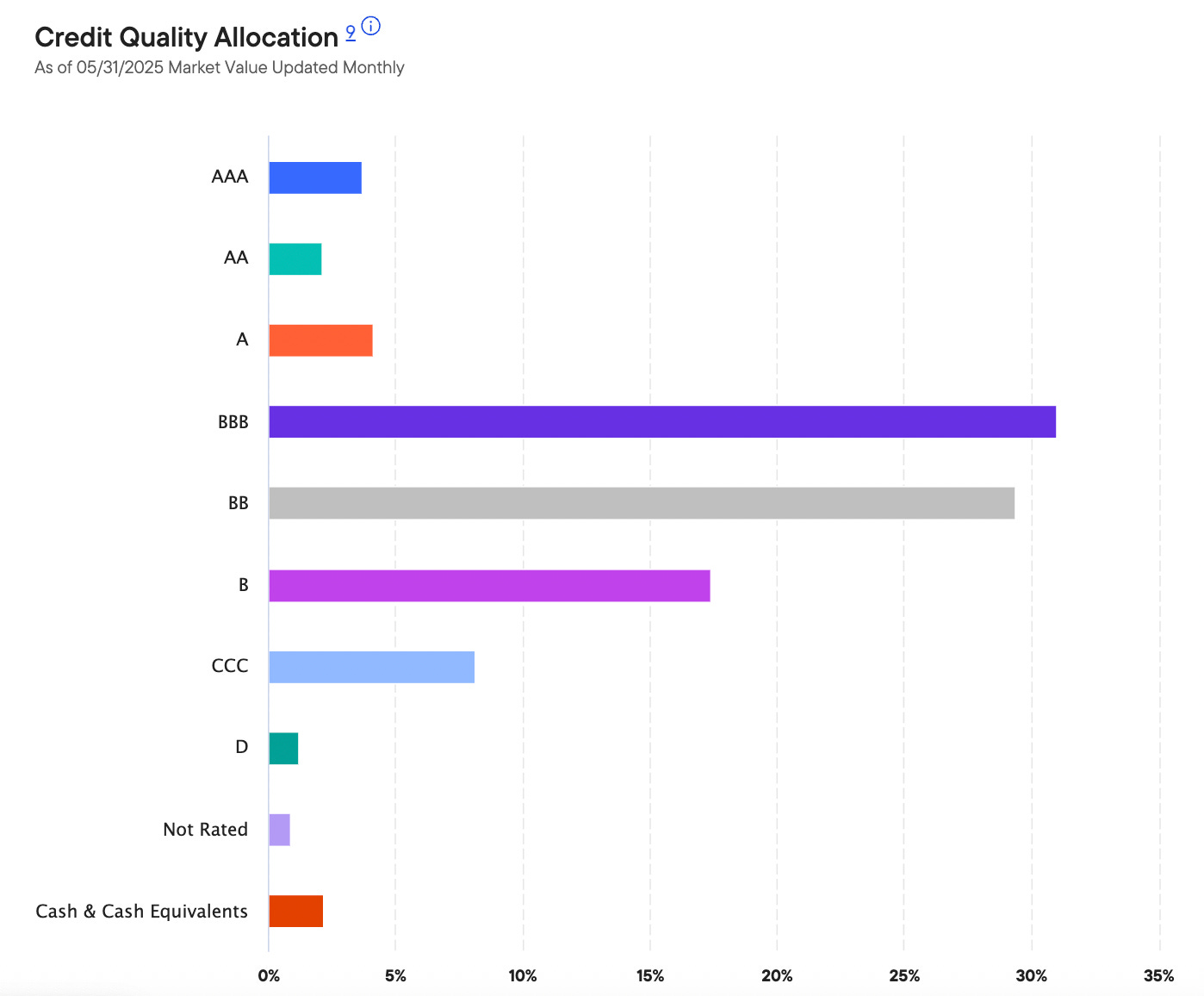

EMD still maintains that roughly 50/50 split between investment-grade and junk that we see in other portfolios. The 30% allocation that’s going to the BBB-rated sleeve makes me a little nervous because that’s the group that could easily slide down into the junk tier, especially if tariffs and high interest rates finally take a toll.