Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

2024 saw a lot of income investors anticipating lower rates throughout the year thanks to a series of Fed rate cuts. While the central bank has lowered the Fed Funds rate by 100 basis points, it’s looking increasingly like the cycle may be ending soon. As it stands right now, the market is only pricing in one additional cut in 2025. That could change as the year progresses, of course, but the chances of an aggressive rate cutting cycle continuing into this year seem low.

That’s good for income investors who may be able to hang on to high yields for longer. T-bill yields seem likely to hover in the 4.0% to 4.5% range for a while, but there’s still opportunities to capture significantly higher yields with modest additional risk. CLOs have become an appealing yield alternative. I profiled the Janus Henderson AAA CLO ETF (JAAA), which currently yields around 6%, a little while back, but if you’re willing to venture a little lower down the credit quality spectrum, it’s sister fund, the Janus Henderson B-BBB CLO ETF (JBBB) is also appealing. Its yield is all the way up to 8% and it doesn’t come with nearly the volatility you’d find in traditional intermediate-term corporate or government bonds.

Fund Background

JBBB provides exposure to floating-rate collateralized loan obligations (CLOs) generally rated from B to BBB in a liquid, transparent manner. It seeks to deliver investors access to securities with low default risk, low correlations to traditional fixed income asset classes and high yield potential.

CLOs work a little differently than traditional fixed income. These are primarily bank loans, which can consist of loans to individuals, small businesses or even large corporations. These loans are packaged into securities and sold to investors. In that way, they’ll look and trade very similarly to senior loan ETFs. They often pay higher yields because they’re considered less liquid and can potentially go south quickly if credit conditions deteriorate.

This portfolio, however, mitigates some of that risk by holding nearly 300 different individual positions with relatively few comprising even 1% of the portfolio. Turnover is moderate, so there is continuous positioning and repositioning to keep up with changing conditions. If you focus on the higher credit tiers within CLO ETFs, you can capture some pretty high yields with only modest additional risk, especially in relation to bond ETFs. The AAA ETF may offer a bit better risk reward profile at the moment, but this fund’s focus on the investment-grade end of the market also looks attractive.

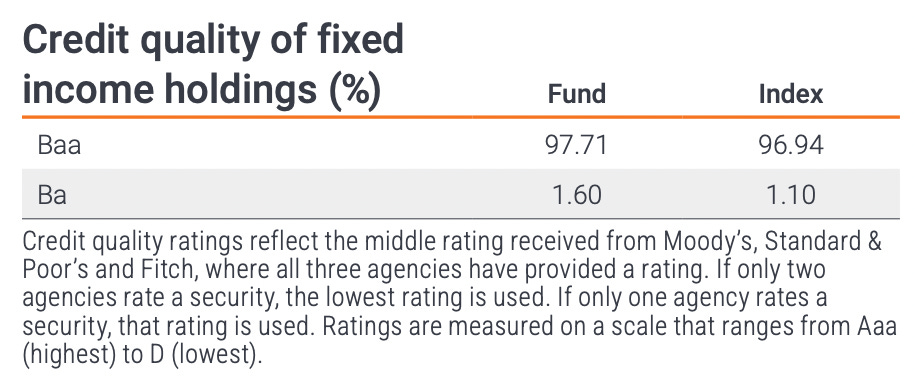

JBBB says it will focus on the B-BBB rating tiers, but in reality the fund is essentially only a BBB fund. That’s actually a really good thing for folks who can remain in investment-grade securities and still capture an 8% yield. There’s always the chance that some of these look more like junk than investment-grade or are at risk of being downgraded, but the fact that this fund is almost entirely BBB at the moment should help quite a bit should credit conditions continue to deteriorate.

Sector diversification within the fund is strong. I particularly like how the top 4 sectors - services, tech, financials and healthcare - all represent very different areas of the economy, enhancing the diversification argument.

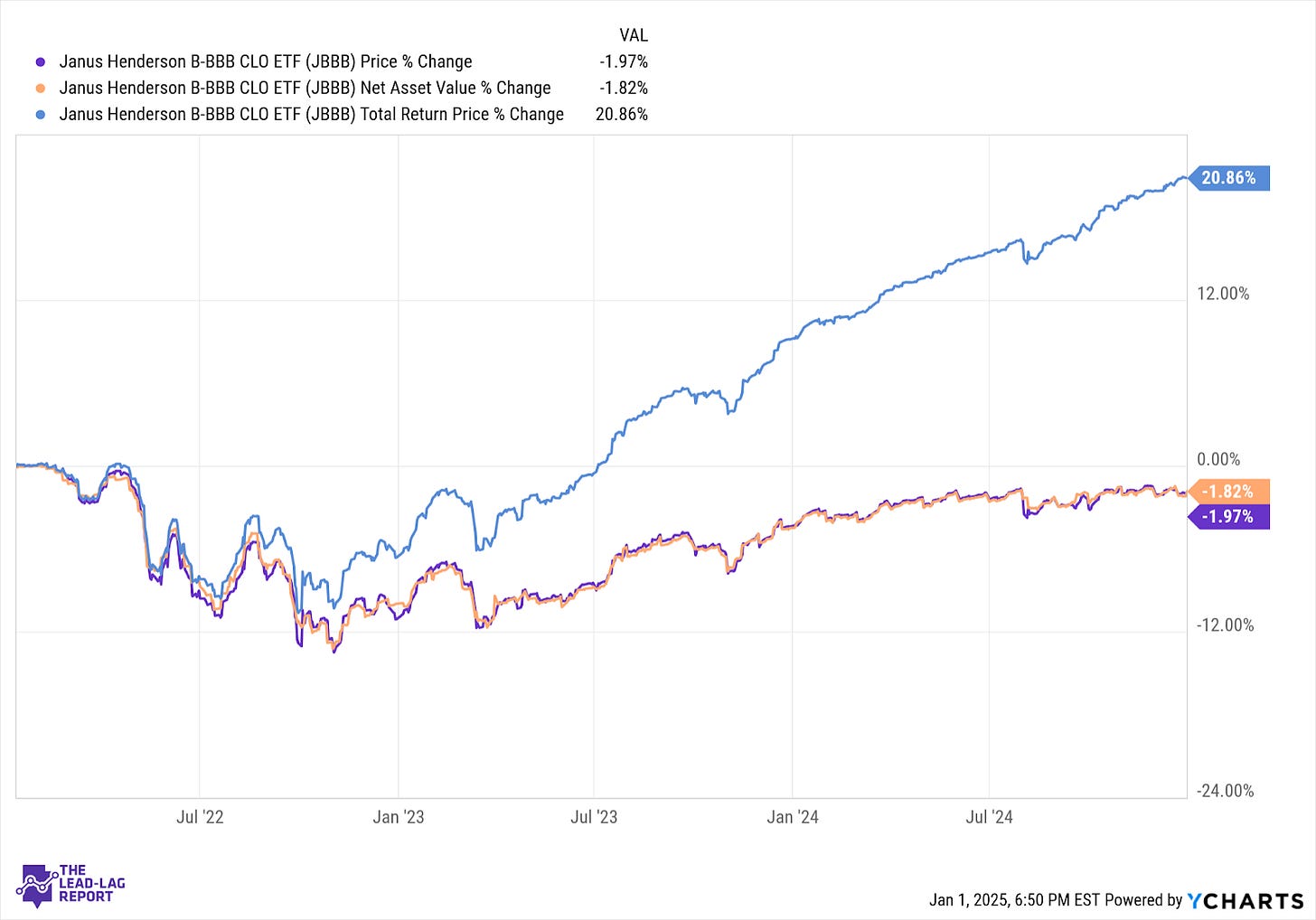

JBBB was launched in January 2022. Since its inception, the fund has returned a total of 21%, which translates to about 6.6% annually.

Most of the fund’s return comes from the income component, but 2022 demonstrates how the credit quality of the portfolio can impact returns. Even though JBBB holds floating rate notes and wasn’t significantly impacted by rising interest rates, credit spreads were expanding throughout the year and resulted in a 13% drawdown. Again, if principal stability is more what you’re looking for, JAAA only experienced a 2% drawdown over the same time frame. What you’re giving up in yield you’re making up in lower volatility.

In terms of volatility, JBBB behaves very similarly to BKLN, which invests in a broader universe of bank loans all across the credit spectrum. At the moment, JBBB yields about 1% more than BKLN, so it would be the more favorable of the two in terms of credit quality and yield (at least at the moment). Volatility is also roughly ⅓ that of LQD, a traditional investment-grade corporate bond ETF. It mitigates risk through lower interest rate risk despite the fact that it has a lower overall credit profile.

Special Announcement

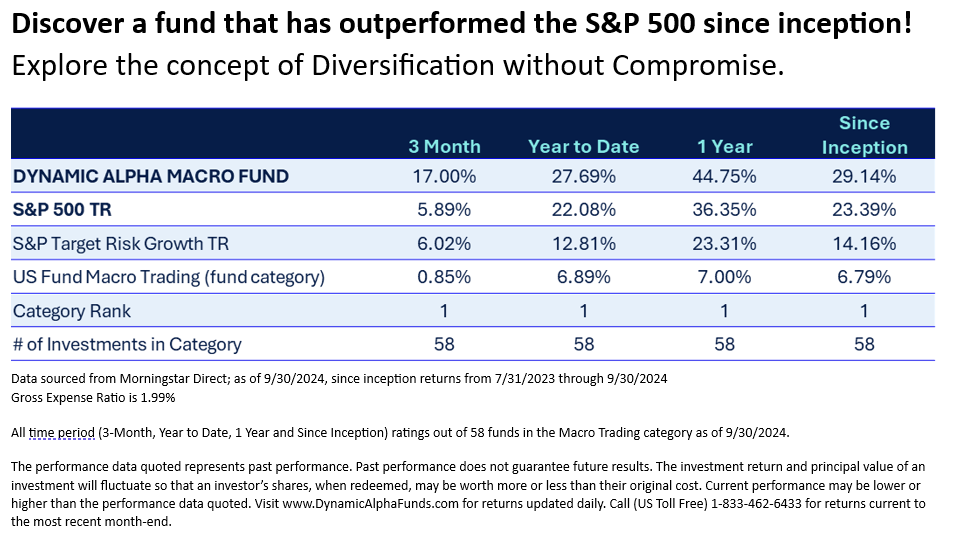

Alternatives often get a bad rap for consistently underperforming the equity markets. Non-correlation is great, but it must also perform…

Enter the Dynamic Alpha Macro Fund (DYMIX).

The Dynamic Alpha Macro Fund (DYMIX) blends two non-correlated strategies: a fundamental global macro approach and a diversified portfolio of U.S. equities. This combination aims to capture returns and minimize risk, and is designed to be an all-weather solution even in unpredictable conditions.

View our Q3 Fact Sheet HERE.

Dynamic Alpha Funds provide:

· Targeted Exposure: Gain access to over 40 liquid markets — including equities, bonds, currencies, and commodities.

· Dynamic Rebalancing: The ability to invest both long and short can help generate alpha and reduce drawdowns during market downturns.

· Diversification: By harnessing non-correlation, we strive to outperform the S&P 500 while managing risk.

Dynamic Alpha Funds is where institutional investors, portfolio managers, and sophisticated individuals come to add true diversification. Learn more about how DYMIX can help protect and grow your portfolio at DynamicAlphaFunds.com.

Disclosures:

All statements provided are for informational purposes only and do not guarantee future performance. No investment product or strategy is guaranteed to generate a profit or prevent a loss.

Request A Prospectus: Investors should carefully consider the investment objectives, risks, charges and expenses of the Dynamic Alpha Macro Fund prior to investing. This and other important information can be found in the Fund’s prospectus and summary prospectus. To obtain a prospectus, please call 1-833-462-6433 or access online at https://regdocs.blugiant.com/dynamic-alpha-macro/ . The prospectus should be read carefully prior to investing.

Important Risks: Investing in mutual funds involves risk, including loss of principal. Risks specific to the Dynamic Alpha Macro Fund are detailed in the prospectus and are linked here: https://dynamicalphafunds.com/performance-2/ . For a complete description of risks specific to the Fund, please refer to Fund’s prospectus.

Relationship Disclosure: Advisors Preferred, LLC serves as Advisor to the Dynamic Alpha Macro Fund, distributed by Ceros Financial Services, Inc., Member FINRA/SIPC. Advisors Preferred and Ceros are commonly held affiliates. Dynamic Wealth Group, LLC serves as Subadvisor to the Fund is not affiliated with the Fund’s advisor or distributor.

©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Dynamic Alpha Funds. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Dynamic Alpha Funds. and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

Macro Environment

It looked like CLO ETFs were going to be in a comparatively poor position if interest rates were to fall significantly throughout 2025. Lower rates would create a capital gain opportunity for fixed rate securities that CLOs largely wouldn’t enjoy and that put the group at risk of underperforming. Now that the Fed looks like it will cut rates very little, if at all, CLOs and floating rate notes are back on the table as a competitor over the next 12 months.

It’s easy to look at JBBB and JAAA and conclude that the 6-8% yields combined with comparatively lower risk make them a clear choice in the fixed income space. It’s important to point that there’s a reason why these products offer higher yields despite any similarity in credit profiles. Bank loans are typically much less liquid than traditional bond portfolios and that lack of liquidity creates risk. In times of normal market conditions, that may not mean as much if volatility is contained. When conditions turn uglier, that lack of liquidity can make these products underperform badly. We saw this during the junk bond crisis of the mid-2010s when some of the securities held within funds had to be sold for pennies on the dollar because they had to raise capital quickly to meet investor redemption requests. Fixed income volatility can create a serious imbalance between buyers & sellers and that can lead to steep losses in lower-grade CLOs and junk bonds.

I fear we may be heading into this type of environment. Credit defaults are at multi-year highs. Delinquency rates are also rising. Within the past month or so, credit spreads have begun rising again. All of this suggests that the fixed income market may become vulnerable to a pullback soon. Even though JBBB focuses on the lowest rung of the investment-grade ladder, we saw in 2022 that a double digit pullback is certainly possible. If credit spreads start to widen significantly in the coming year, JBBB is vulnerable.

Distribution Policy

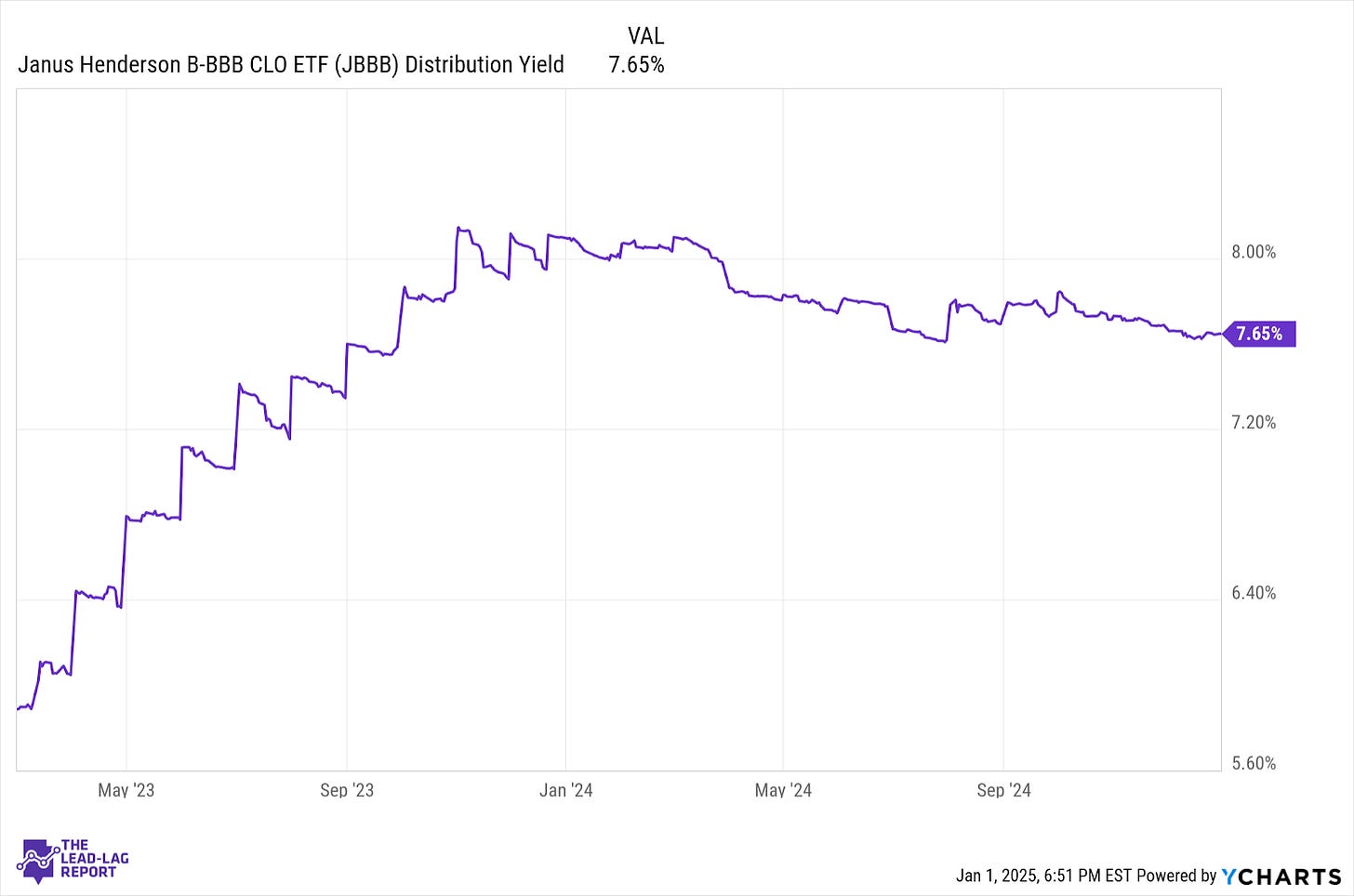

JBBB maintains a flexible monthly distribution policy that pays income as it’s received. Its most recent monthly distribution was $0.0336 per share, which would translate to $0.403 per share annually. At current share prices, that translates to a forward-looking yield of 8.2% (if that distribution level were to be maintained).

JBBB has been able to hold that 7-8% distribution yield level pretty consistently since its launch. The yield began to slide lower as the market anticipated a series of rate cuts ahead, but I think the annualized yield will begin stabilizing around the 8% mark so long as the Fed keeps rates steady.

Recent monthly distributions have been at roughly the same level they’ve been over the past 18 months with some volatility along the way. These distributions, of course, would be vulnerable to a decline should the Fed enter into a larger rate cutting cycle. Given that this looks more unlikely at this point, JBBB could be a steady source of income over the next year.

Advantages

Compared to senior loans, JBBB currently offers a higher yield for comparable risk. Compared to investment-grade bonds, you get nearly double the yield for a fraction of the volatility. From a yield/volatility tradeoff standpoint, few fixed income asset classes would compare to CLOs at the moment. JAAA might have an even better tradeoff if you’re willing to sacrifice some yield.

CLOs looked like they could be underperformers during a Fed rate cutting cycle due to the variable rate nature of its holdings. Now that the Fed might hold rates relatively steady throughout 2025, JBBB looks like it has an opportunity to outperform again.

Disadvantages

The biggest challenge to holding JBBB at the moment is how it could respond if credit conditions continue to worsen. You could argue that they’re already bad, they’re just not priced into the market. If that mean-reverts and credit spreads shoot higher, CLOs, especially lower rated ones, could get hit hard. The BBB rating of this portfolio could mean it doesn’t get hit quite as hard as it could, but illiquid fixed income has a history of turning ugly under the wrong conditions.

Conclusion

If you can capture an 8% yield with a fixed income security that comes with the volatility of roughly a 3-year Treasury note, it almost has to at least be considered. Especially if that security is rated investment-grade. Yield seekers are very likely to find this to be a more than acceptable yield-to-volatility tradeoff.

If bond market conditions remain in their current state, JBBB is likely to be just fine. But there’s 10%+ drawdown potential if things start to turn. That means JBBB is probably worth at least a look with part of your fixed income portfolio, but maybe not as a cornerstone for it.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.