This 8% Yielder Looks Positive In The Short-Term

But The Long-Term Is Questionable

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The corporate bond market has finally begun to shift. For most of the past two years, junk bonds were able to consistently outperform Treasuries despite growing risks in the commercial credit markets and the fact that risk was being vastly underpriced. Those days appear to be ending. Junk bonds are now badly underperforming the broader bond market and spreads have started to widen considerably. No longer is reaching for yield the easy thing to do. Now, investors need to carefully calculate the risk/reward tradeoff in the fixed income market.

The BNY Mellon High Yield Strategies Fund (DHF) may be more advantageously positioned for this market. Its focus on diversifying credit risk, targeting global income opportunities and limiting interest rate risk could provide greater exposure to some of the more untapped areas of potential when compared to other high yield funds. Anything that mitigates risk in the bond market right now should be worth considering.

Fund Background

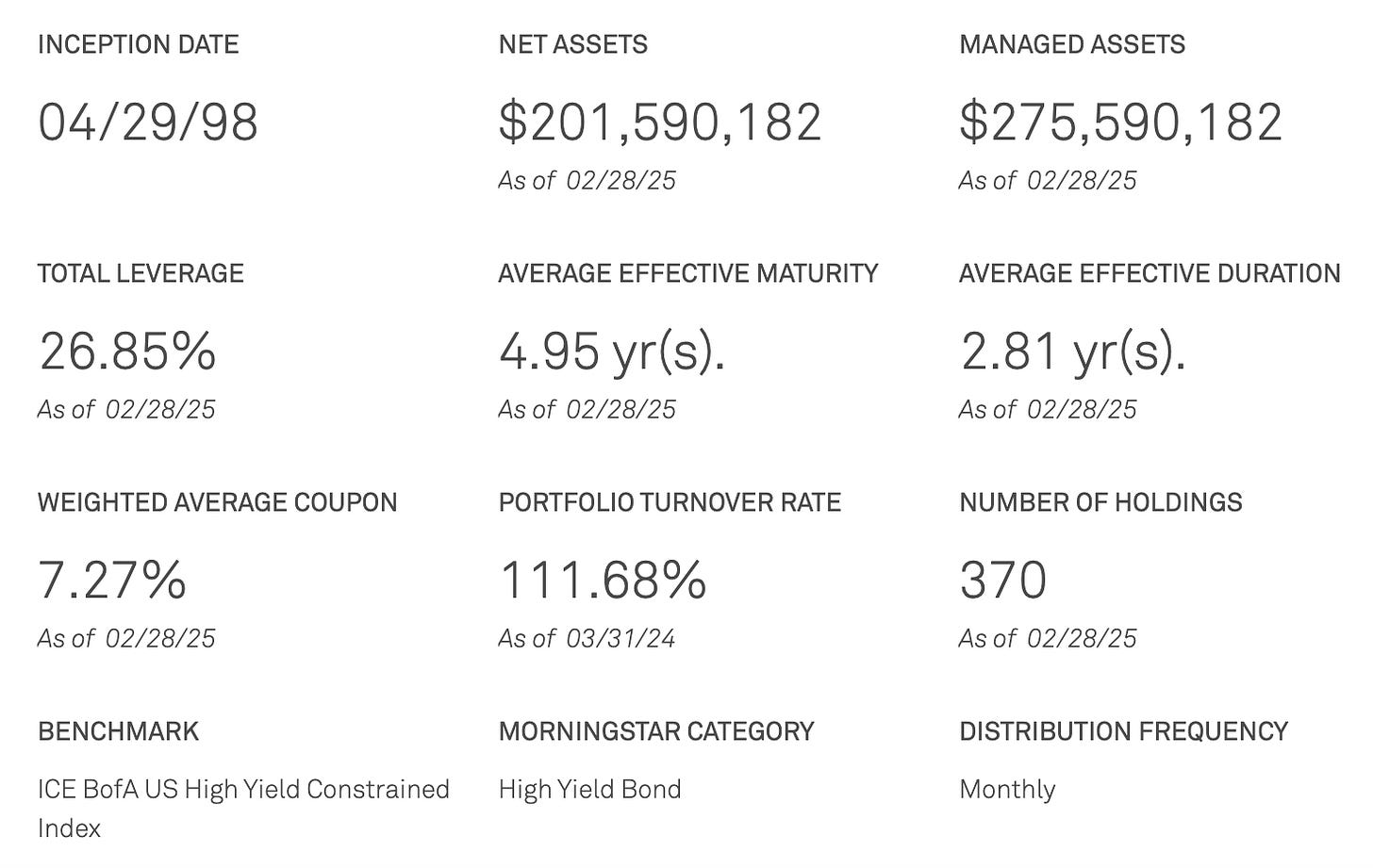

DHF’s primary investment objective is to seek high current income. The fund will also seek capital growth as a secondary objective, to the extent consistent with its objective of seeking high current income. The fund uses a global strategy for expanded opportunities in the U.S. and Western European credit markets. It also utilizes leverage to enhance yield and total return potential.

DHF has a few things going for it. The duration of under three years could be advantageous of yields start whipsawing up and down as the tariffs/slowdown debate weighs on the market. The fund’s size should ensure a reasonable degree of liquidity and turnover rate of just over 100% suggests that the fund’s managers are doing the work to enter and exit positions as needed.

On the flip side, leverage is not our friend in this market. At a minimum, it becomes very costly to implement given current high rates and, at worst, it can actually exacerbate losses in an already down market.

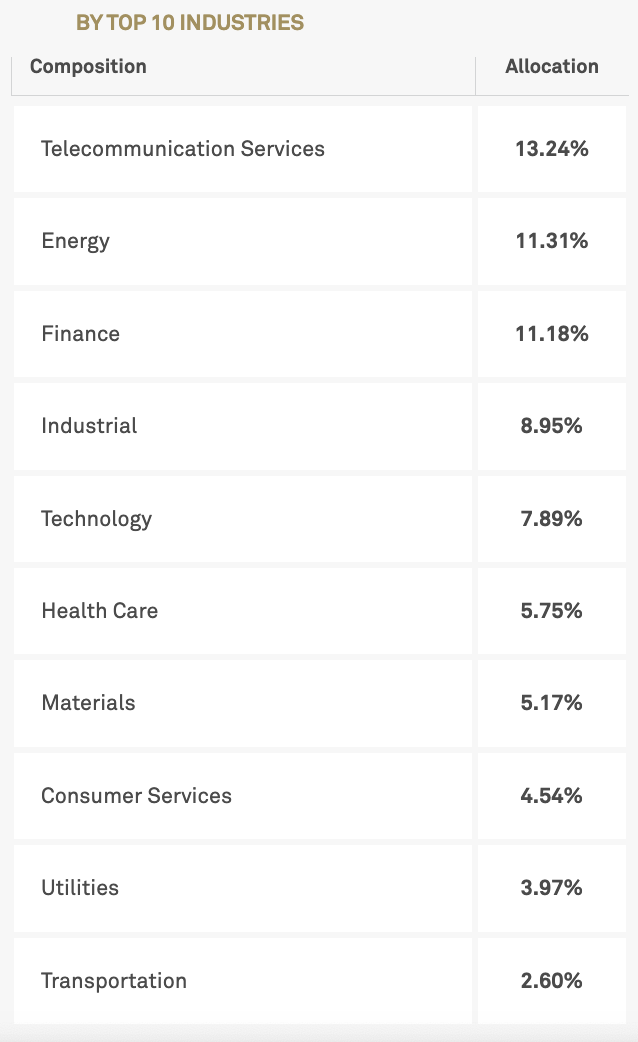

The fund is fairly well diversified with only three sectors getting a double-digit allocation and none of them getting even 14%. There’s a good spread here of traditionally defensive and cyclical issuers, while tech is comparatively underweighted. Fixed income is diverse under normal conditions, but this fund in particular looks like it’s hitting the right spots currently while avoiding the troubled one.