This 9% Yielder Comes With A Solid Strategy & A Recent Distribution Increase

But The Overall Results Just Haven’t Delivered

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

For income seekers, covered call strategies have become a great way to generate high yields while maintaining some upside exposure to equities. Strategies can vary significantly with some trying to maximize yield while giving up most or all share price upside and others overwrite just a portion of the portfolio in order to go the growth plus income route. These became popular during the ZIRP era where there was little yield to be found anywhere, but they still work today while competing with fixed income and other derivative income strategies.

The BlackRock Enhanced International Dividend Trust (BGY) takes the growth and income approach. It aims to be a solid core portfolio holding by focusing on large, well-established international companies and using those positions to enhance the income that it throws off. In an environment where fixed income faces an uncertain future due to the possibility of higher rates, focusing instead on derivative income may be a better way to get your income and growth potential too.

Fund Background

BGY’s primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. It invests at least 80% of its net assets in dividend-paying equity securities issued by non-U.S. companies. It can invest in stocks of any market cap, but intends to invest primarily in large-caps. It also intends to write covered call and put options with respect to approximately 30% to 45% of its total assets.

The modest overlay strikes me as the right balance. Double digit yields are fine if that’s what you’re looking for, but it’s usually not ideal to give up most share price upside potential. This setup allows the fund to generate a 7-8% yield, adequate enough for most high income seekers but also balanced enough that investors can take advantage of bull markets when they happen too. The fund’s strategy of writing calls on individual stocks, not broad indexes, is also a nice touch. It allows the managers to capture the value in specific names, another source of potential alpha.

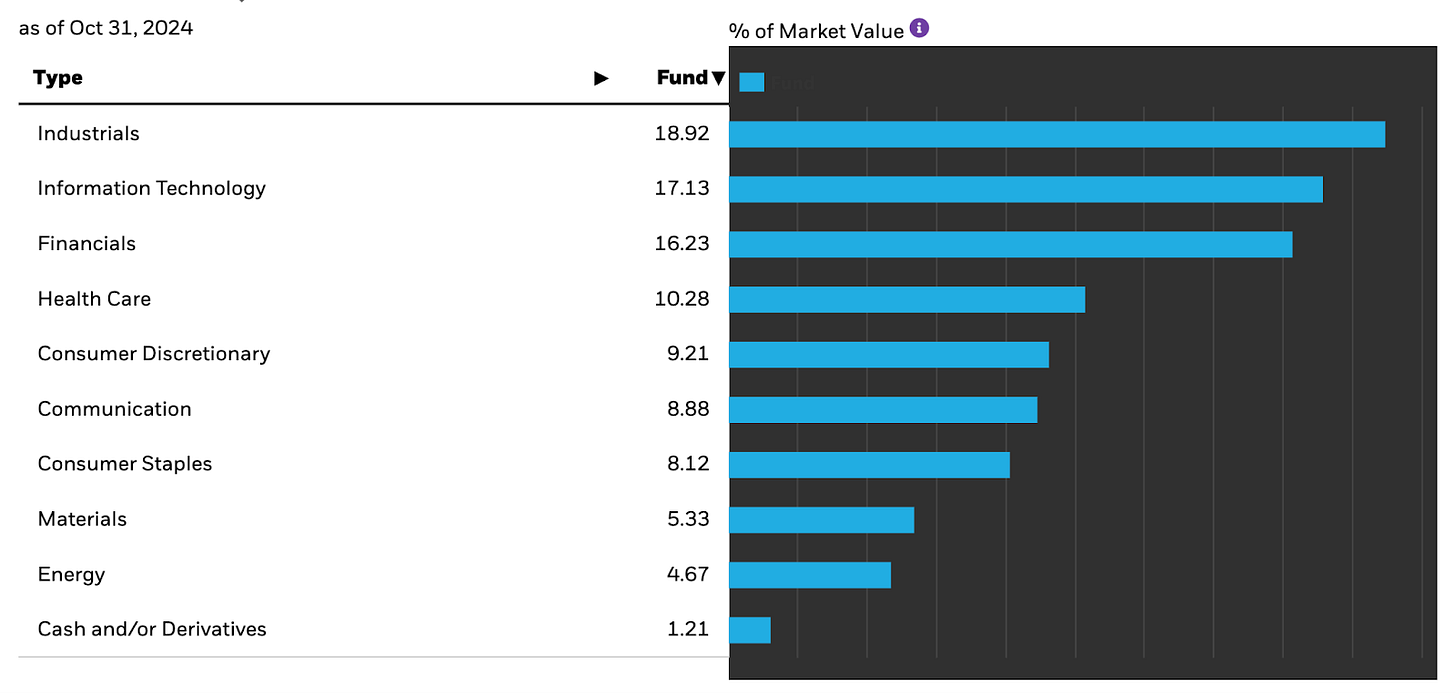

From a sector perspective, BGY is quite diversified. With 8%+ allocations in seven different sectors, the fund isn’t particularly tilted towards the cyclical, growth or defensive areas of the market. The modest lean towards cyclicals with the combined 35% allocation to industrials and financials is consistent with the construction of the global non-U.S. economy. It does, however, have twice the weighting to tech as you’d find in the typical developed market ex-U.S. indices. From a stylistic perspective, that helps give it more of a “growth over value” feel than other comps in this space.

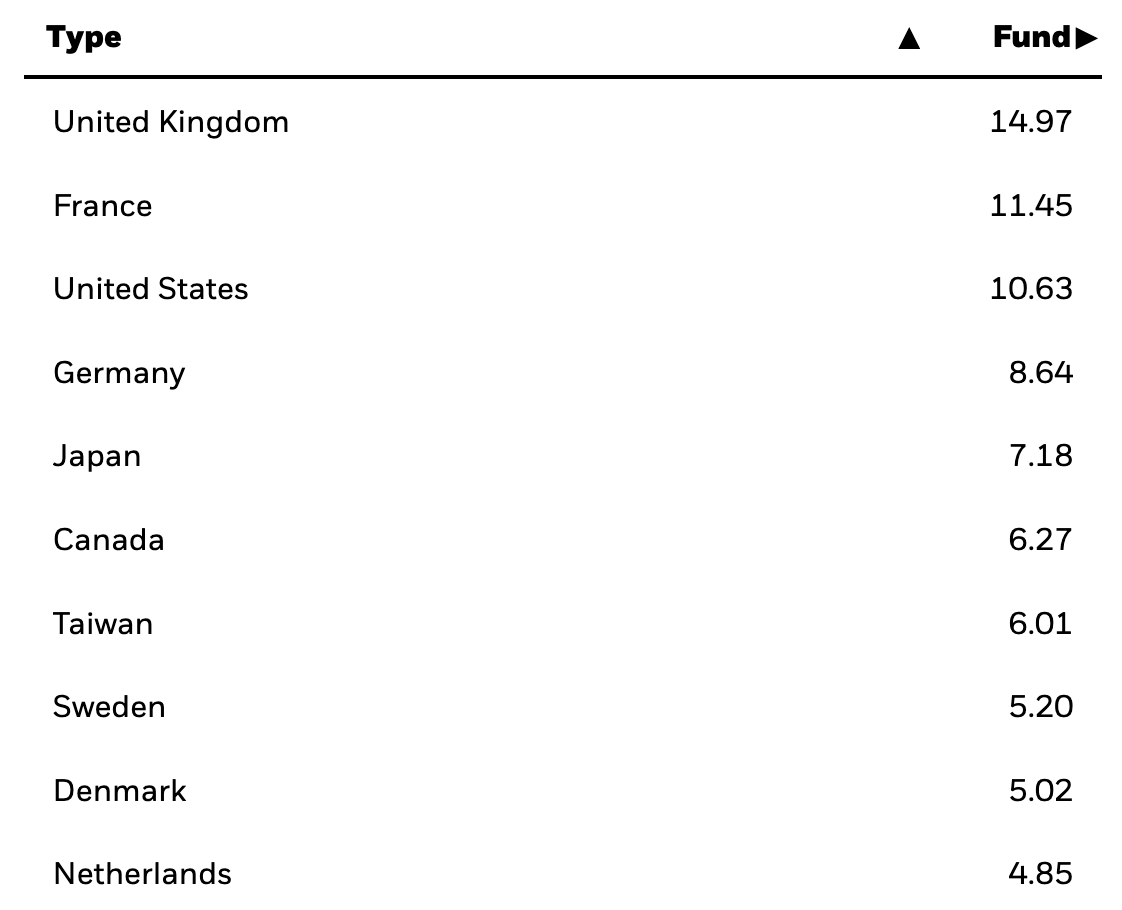

Same thing goes for geographic diversification. I’m not sure why there’s a 10% allocation to U.S. stocks in this portfolio when it clearly states in the fund’s mandate that it’s to focus on non-U.S. companies. This makes it a bit more of a global fund than a pure international one, although the typical global fund usually has a U.S. allocation of around 60-65%. A 10% allocation doesn’t nearly put BGY in this category, but it’s a curiosity nonetheless.

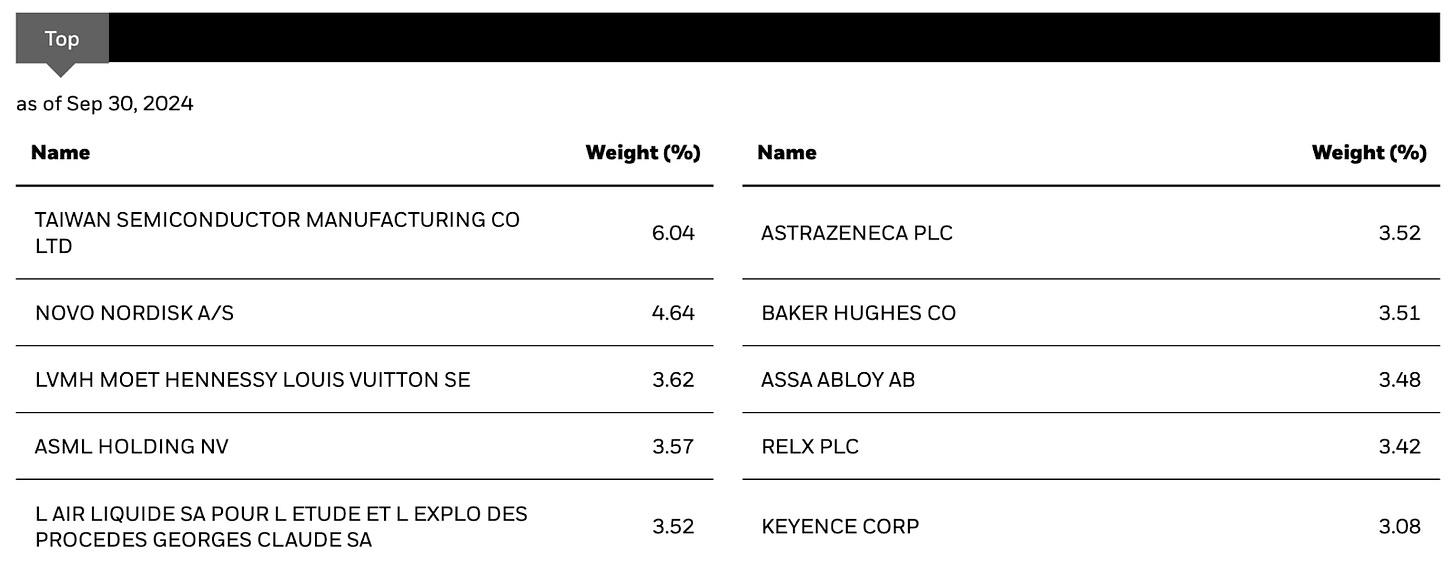

The top 10 holdings include a number of names that investors will be very familiar with. Even though you can get upwards of a 3-4% yield just by investing in a generalized portfolio of international dividend payers, many of the names here don’t come close to paying out that level of income. That’s not really a major consideration since the vast majority of income will be generated by those options. The durable and mature nature of these companies should limit some potential volatility. From a covered call perspective, that limits the income that the options can earn to some degree, but the relative stability might be more important.

BGY was launched in May 2007. Since its inception, the fund has returned a total of 56%, which translates to just under 3% annually.