This Fund-of-Funds CEF Is A Little Weird

But Does The 12% Yield Make It Worth It?

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

It seems like we haven’t seen it much over the past couple of years, but the traditionally negative correlation between stocks and bonds looks like it’s finally returning. Whether it’s due to growing concerns about inflation risk, the rally in gold or simply investors being in a risk-on mood, the idea of diversification within a portfolio may start making sense again. While a lot of investors prefer to pick and choose their investments to construct a portfolio to their liking, sometimes the fund-of-funds approach can make some sense. Being able to buy an all-in-one product can be appealing to those who don’t want to do the research themselves.

That’s the strategy of the RiverNorth Opportunities Fund (RIV). While the double-digit yield will probably be the attention grabber for many, it needs to be asked whether or not this fund has the right kind of diversification. It tilts heavily towards the bond side and not just the traditional corporate bonds. Even its equity sleeve focuses on an asset class that largely fell out of the news cycle a while ago. It has an interesting composition and the use of leverage on top of it makes it that much more important to look under the hood.

Fund Background

RIV seeks total return consisting of capital appreciation and current income. The fund employs a tactical asset allocation strategy primarily comprised of closed-end funds, exchange-traded funds, special purpose acquisition companies (SPACs), and business development companies (BDCs). RiverNorth implements an opportunistic investment strategy designed to capitalize on the inefficiencies in the closed-end fund space while simultaneously providing diversified exposure to several asset classes. The fund also utilizes leverage to enhance yield and total return potential.

SPACs, which are basically empty shell corporations designed specifically with the goal of merging with another company in order to bring it to the public markets, haven’t really been a thing since 2021. Their inclusion in RIV is relatively modest, so it’s unlikely to be a heavy portfolio influencer, but the fact that they’re being included still suggests the fund’s manager still sees some potential in them.

The use of closed-end funds to capture discounts isn’t unusual and it’s not even unique within the fund-of-funds space. It does create some alpha opportunities, but it does require a degree of trading in order to lock in that extra value. With a turnover rate of 50%, there may be enough activity going on to do that and the fund does have a fairly good track record. The usual combination of holdings though means you really have to understand these markets to capitalize.

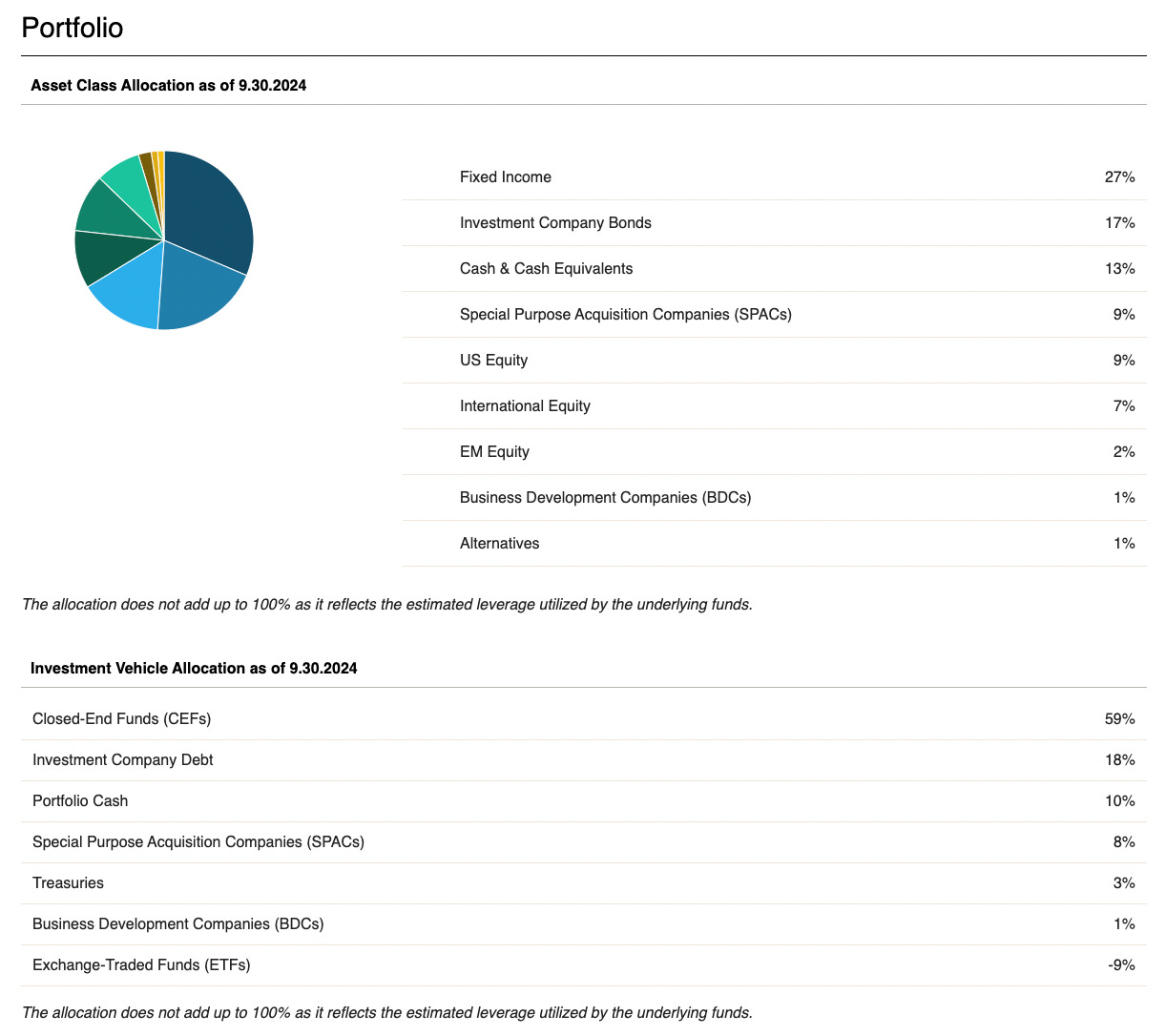

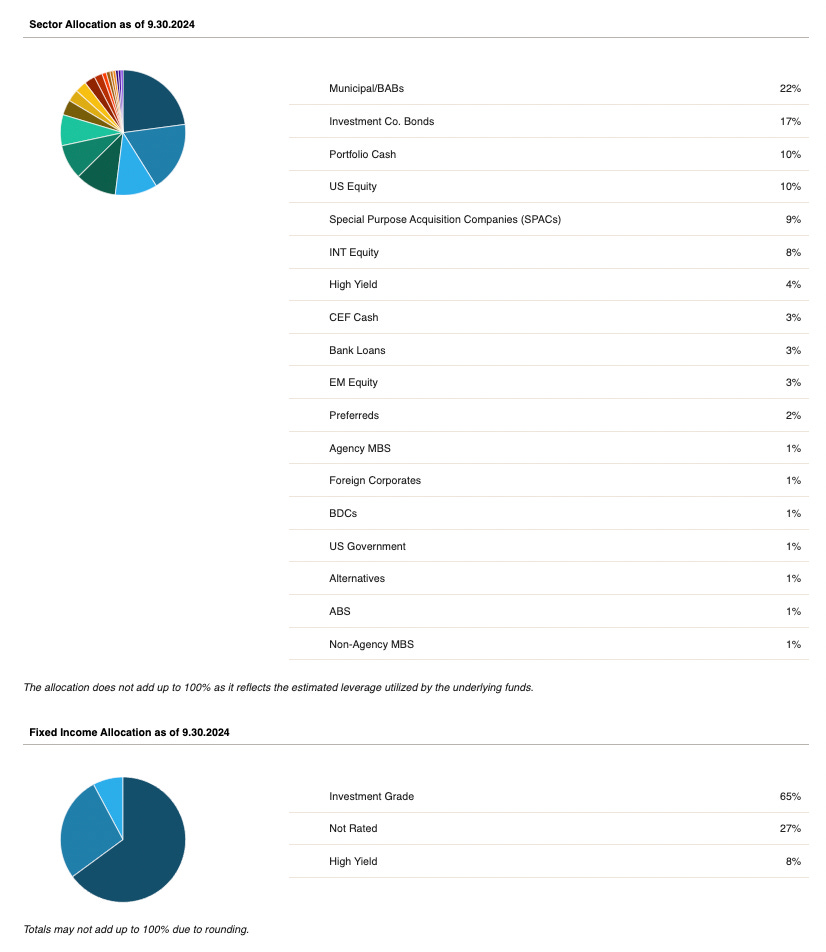

It’s pretty clear that the majority of this fund is invested in other closed-end funds and those CEFs are heavily tilted towards the fixed income side. There’s nothing wrong with that, although I do have some issue with the 13% cash position. If you’re paying a total expense ratio (leverage cost included) of nearly 4%, you want your money to be deployed, not sitting on the sidelines. The equity position is relatively small (only about 20% unless you want to include the 9% SPAC holdings in that bucket). In the traditional fund world, RIV might be categorized as a “conservative asset allocation” fund, but there’s too much going on here to really call it that.

We discussed Build America Bonds when breaking down GBAB in this space last week and we see that they’re the top sector holding in this fund as well (note: BAB bonds are essentially taxable munis, so there’s minimal federal tax benefit despite the name). Only a small piece of the fixed income sleeve falls into the junk bond category and even that resides in the higher rating classifications. The investment-grade bucket actually has a pretty positive profile with just 30% of assets in the BBB-rated bucket and the remainder in the AAA-A rating classifications. The ~30% use of leverage helps to ratchet up the volatility, but the core portfolio positioning isn’t terribly aggressive.

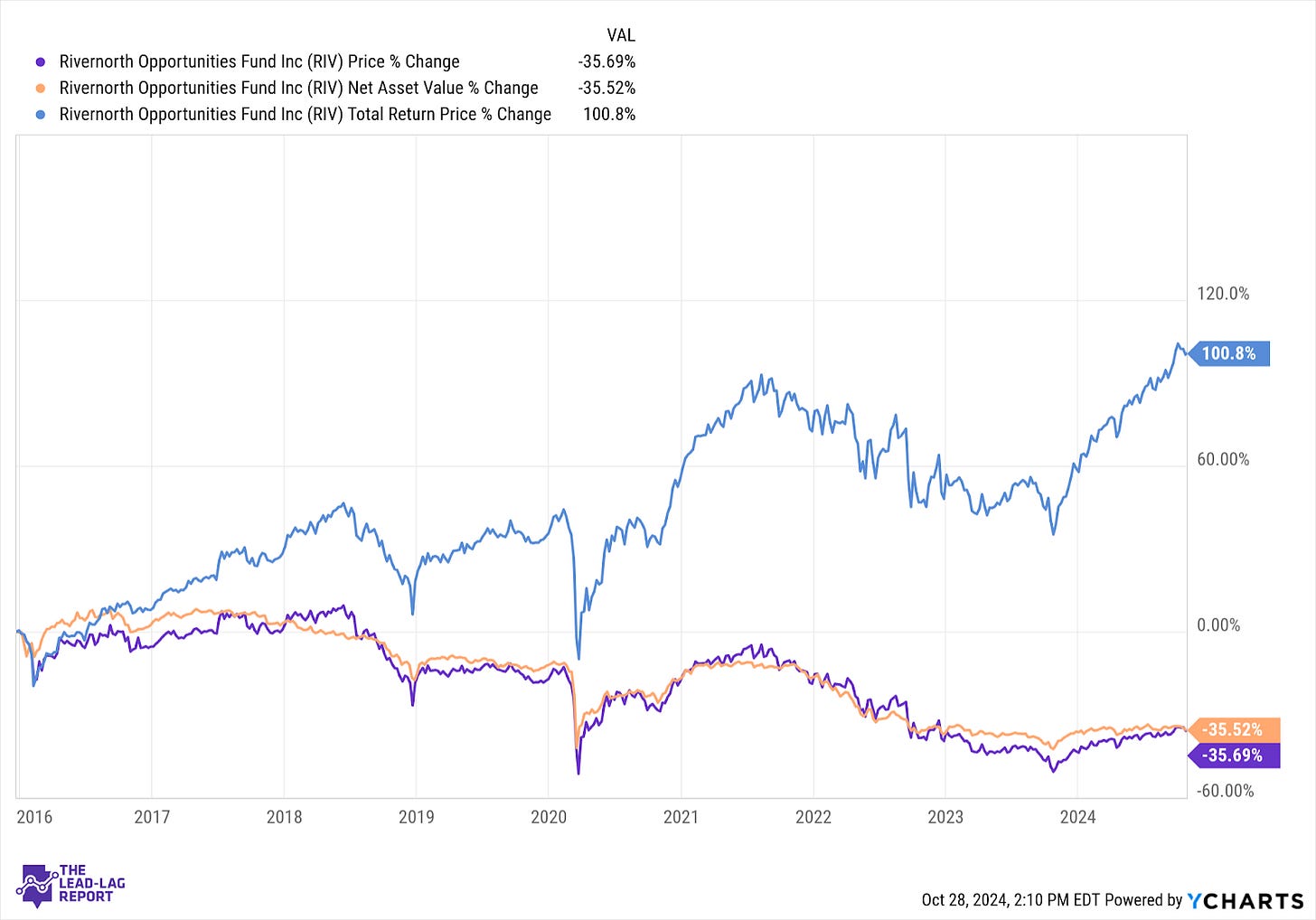

RIV was launched in December 2015. Since its inception, the fund has returned a total of 101%, which translates to just over 8% annually.

It’s tough to categorize this fund given its unusual allocation, but considering that it’s heavily skewed towards the fixed income side, this looks like a fairly good return (at least on an absolute basis). The 35% decay in the fund’s NAV presents a red flag in terms of distribution stability and we’ll see in a moment that it has had a negative impact. Income seekers will certainly appreciate the high yield and total returns have been pretty solid, but you never like to see overdistribution in a fund.

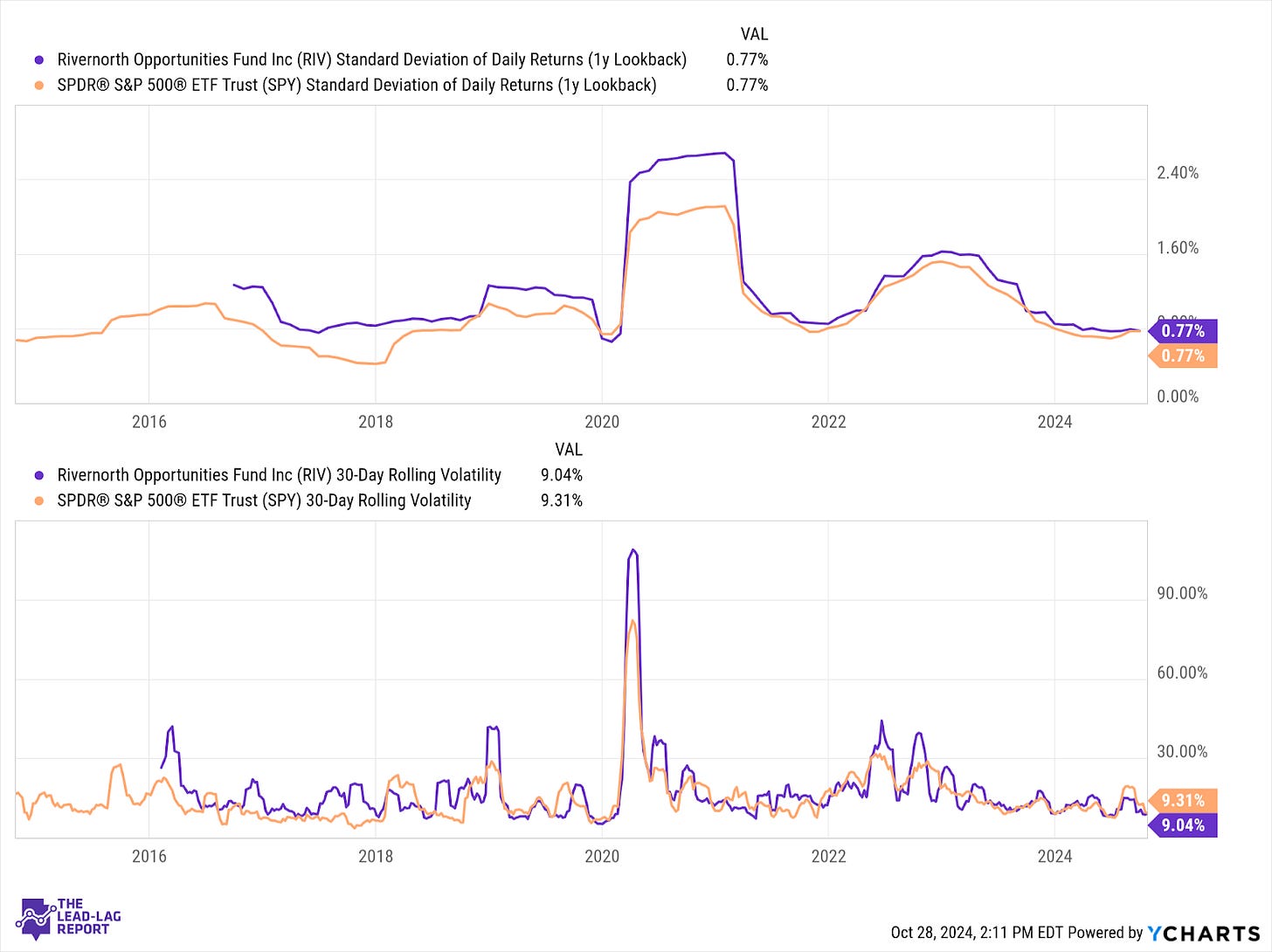

Here’s why I emphasized “on an absolute basis” just a moment ago. The risk level of RIV is comparable to that of the S&P 500 even though only about 20% of the portfolio is in equities. You can thank the use of leverage for that as well as the inherent risk involved in SPACs, but a fairly volatile discount/premium to NAV has certainly added to it.