Key Highlights

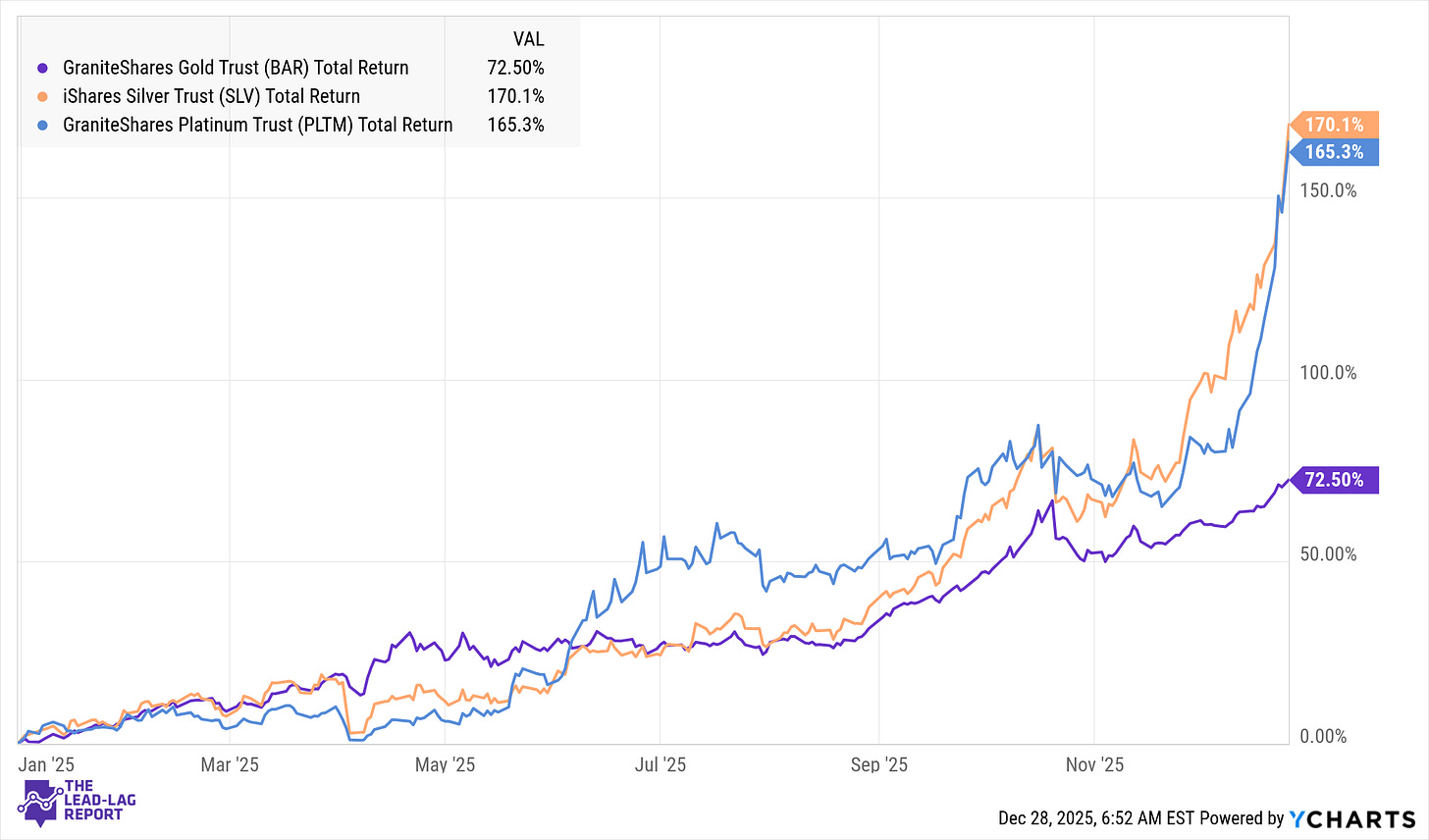

Precious metals ended 2025 at record highs, with silver and platinum dramatically outperforming gold as industrial demand collided with falling real yields and renewed safe-haven flows.

Equities and hard assets rallied simultaneously, an unusual combination that reflects optimism around monetary easing alongside persistent macro and geopolitical uncertainty.

Economic signals diverged into year-end, with strong backward-looking growth data contrasting sharply with weakening consumer confidence and rising sensitivity to policy risk.

Markets increasingly priced a shift toward easier monetary conditions in 2026, pressuring the dollar and supporting non-yielding assets despite elevated equity valuations.

The year closed with risk appetite intact but hedging behavior elevated, suggesting investors are participating in upside while quietly preparing for volatility ahead.

The final full trading week of 2025 delivered a striking message across global markets. Risk assets continued to grind higher into year-end, yet safe havens simultaneously surged to historic extremes. Precious metals led the charge, with silver and platinum posting explosive gains that eclipsed even gold’s already impressive rally. The coexistence of record equity prices and parabolic moves in hard assets underscores a market grappling with optimism about monetary easing while quietly hedging against structural and geopolitical risk.

Precious Metals Take Center Stage

Precious metals were the undisputed stars of the week. Silver vaulted past $77 per ounce, setting a fresh all-time high after a sharp late-week surge. Platinum followed suit, climbing to roughly $2,450 per ounce and marking its strongest weekly advance on record. Gold, while comparatively restrained, still pushed to new highs near $4,550 per ounce, reinforcing the broader flight toward real assets. Palladium joined the rally, reaching its highest level in nearly three years.¹

Silver’s performance was particularly notable. Unlike gold, silver sits at the intersection of monetary hedging and industrial demand. Strong consumption from solar panels, electrification infrastructure, and advanced electronics has collided with persistent supply constraints, amplifying price pressure as investors seek inflation protection.² That dual role has increasingly distinguished silver from traditional safe havens, allowing it to outperform even as risk appetite remains intact elsewhere.

Platinum’s rally reflects a similar dynamic. Years of underinvestment in mine supply have left the market vulnerable just as industrial demand rebounds, particularly from automotive catalysts and emerging hydrogen applications.³ With inventories already tight, investor inflows compounded the move, producing a powerful momentum-driven surge.

The macro backdrop has been highly supportive. Expectations for Federal Reserve rate cuts in 2026 have firmed, Treasury yields remain subdued, and the U.S. dollar softened modestly over the week. Those conditions reduce the opportunity cost of holding non-yielding assets while improving purchasing power for foreign buyers.⁴ Layered on top of monetary dynamics, renewed geopolitical uncertainty provided an additional catalyst, reinforcing demand for assets perceived as durable stores of value.

Equities Extend the Santa Claus Rally

Equity markets quietly advanced despite holiday-thinned trading volumes. All three major U.S. indexes finished the week higher, with the S&P 500 briefly touching a new intraday high before consolidating into Friday’s close. The week’s gains added fuel to expectations of a traditional Santa Claus rally carrying into early January.⁵

Sector leadership was telling. Materials stocks outperformed, buoyed by surging metals prices and strong gains among mining equities. Energy stocks lagged as oil prices slid, while consumer discretionary shares showed mild softness following a further deterioration in consumer confidence. Market breadth remained constructive, with advancing stocks narrowly outpacing decliners and a steady stream of new 52-week highs.

Individual equity stories still managed to break through the seasonal calm. Target shares jumped following disclosure of a sizable activist stake, while Nvidia edged higher on strategic developments tied to its AI licensing business. In Europe, equities hovered near record levels, supported by easing financial conditions and strong performance in healthcare after Novo Nordisk received U.S. approval for a weight-loss treatment.⁶

Despite limited volatility, the underlying message was clear: investors remain willing to embrace risk, particularly with policy easing increasingly in focus.

Macro Signals Point in Opposite Directions

Economic data released during the week offered mixed signals. U.S. third-quarter GDP growth was revised higher to a robust 4.3 percent annualized pace, reflecting strong consumer spending and export activity.⁷ At the same time, the Conference Board’s consumer confidence index fell for a fifth consecutive month, reaching its lowest level since April. Respondents cited concerns about employment prospects, inflation, and broader economic uncertainty.⁸