All four signals are risk-on reflecting broadly positive market sentiment, but market action over the past couple of weeks raises some questions in the short-term. To close out the year, the S&P 500 is more than 3% off of its high, the Nasdaq 100 is below by 5% and the Russell 2000 is off of its high by more than 8%. This isn’t typical of the behavior we usually see in the normally low volatility period around the holidays.

How To Interpret the Signals: Within each strategy, there is a risk-on and risk-off investment recommendation, with the risk-off option being the more conservative of the two. When a particular signal indicates that investors should be risk-off, for example, subscribers should consider investing in the risk-off option and avoiding the risk-on option. The opposite, therefore, would be true when the signal flips to risk-on. In each strategy, you’d always be invested in one option or the other.

Here’s how to read the scorecard for each strategy:

Some of the strategies will be more aggressive than others. The “Leverage For The Long Run” strategy, for example, uses the S&P 500 and 2x-leveraged S&P 500. The more conservative “Lumber/Gold Bond” strategy, however, uses intermediate-term Treasuries and the S&P 500. In every case, a risk-off signal indicates that you should be invested in the more conservative of the two options, while a risk-on signal indicates you should be invested in the more aggressive one.

For a full user's guide on how to interpret each of the signals and how to put them to work in your portfolio, please click HERE.

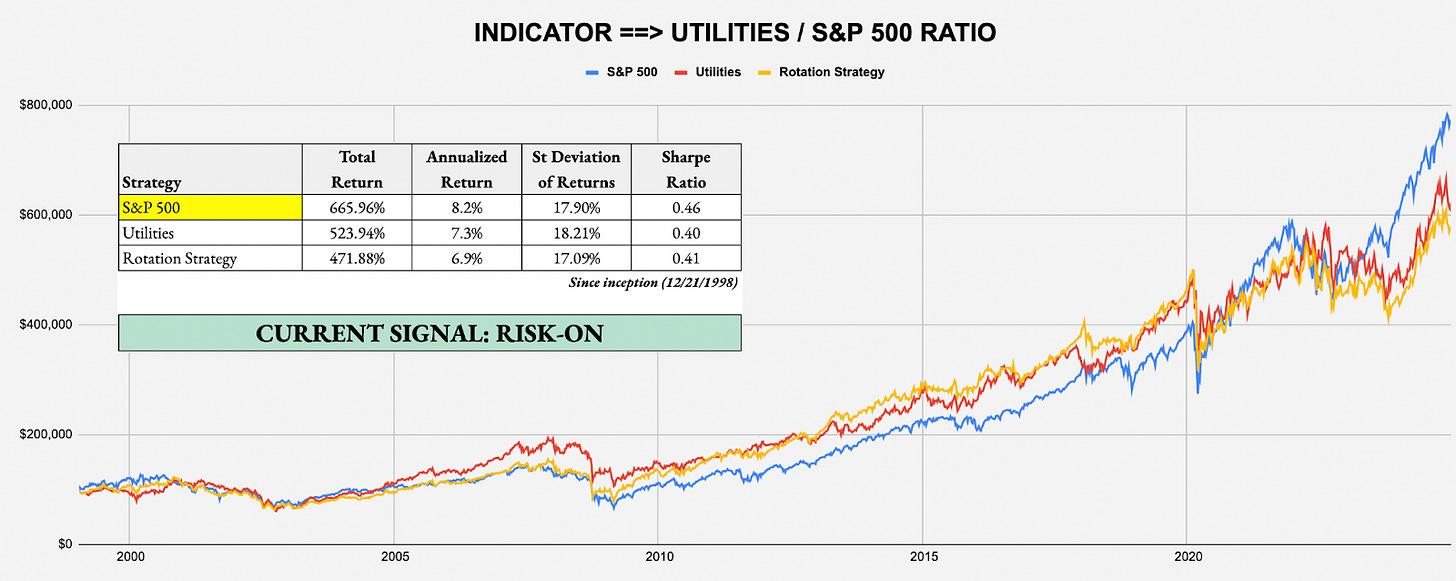

SHORT-TERM SIGNAL: UTILITIES/S&P 500 RATIO

Target Investor: Short-term traders with a higher risk tolerance interested in using an equity momentum strategy to anticipate changes in market risk tolerance.

Current Indicator: Risk-On

Strategy: Beta Rotation - Example: Invest in S&P 500 (SPY) over Utilities (XLU)

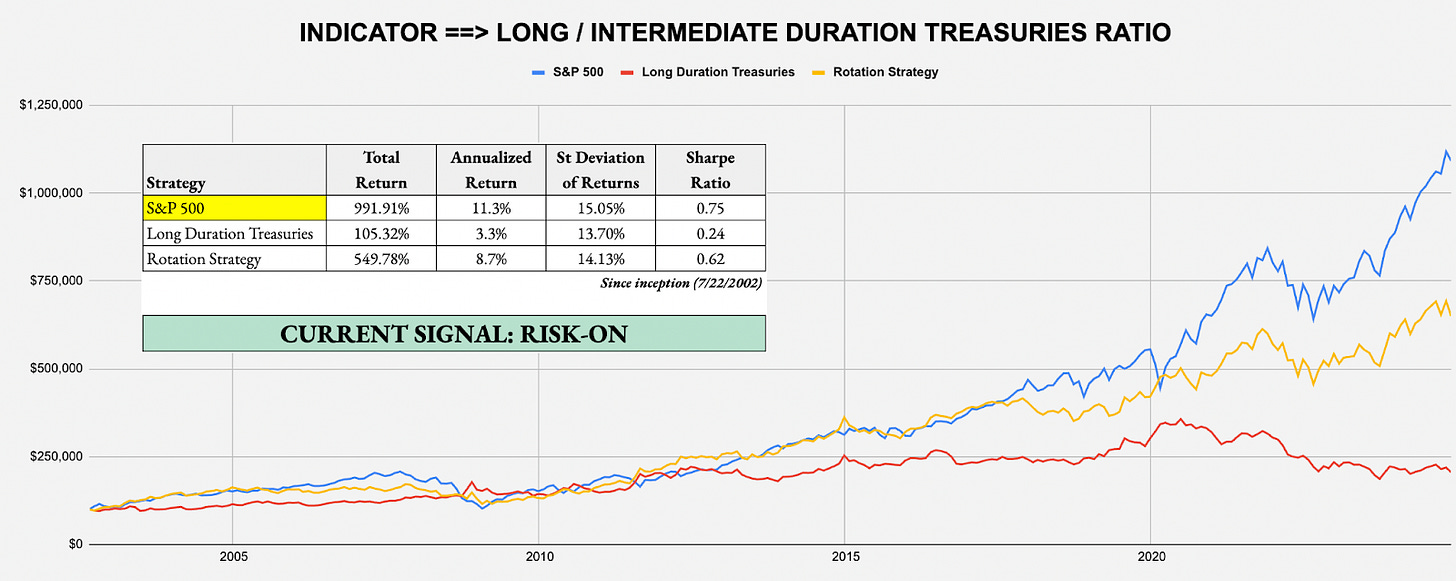

SHORT-TERM SIGNAL: LONG DURATION/INTERMEDIATE DURATION TREASURIES RATIO

Target Investor: Short-term traders with a higher risk tolerance who want to use the activity in the U.S. Treasury market to judge overall risk levels.

Current Indicator: Risk-On

Strategy: Tactical Risk Rotation - Example: Invest in S&P 500 (SPY) over Long-Duration Treasuries (VLGSX)

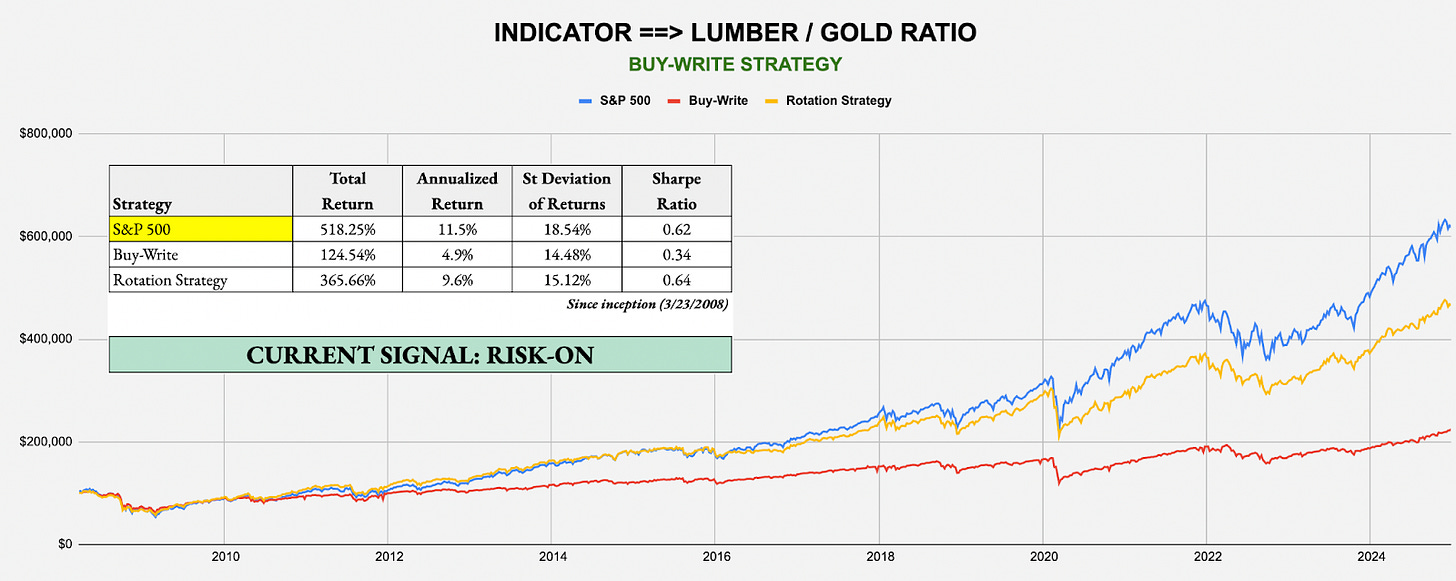

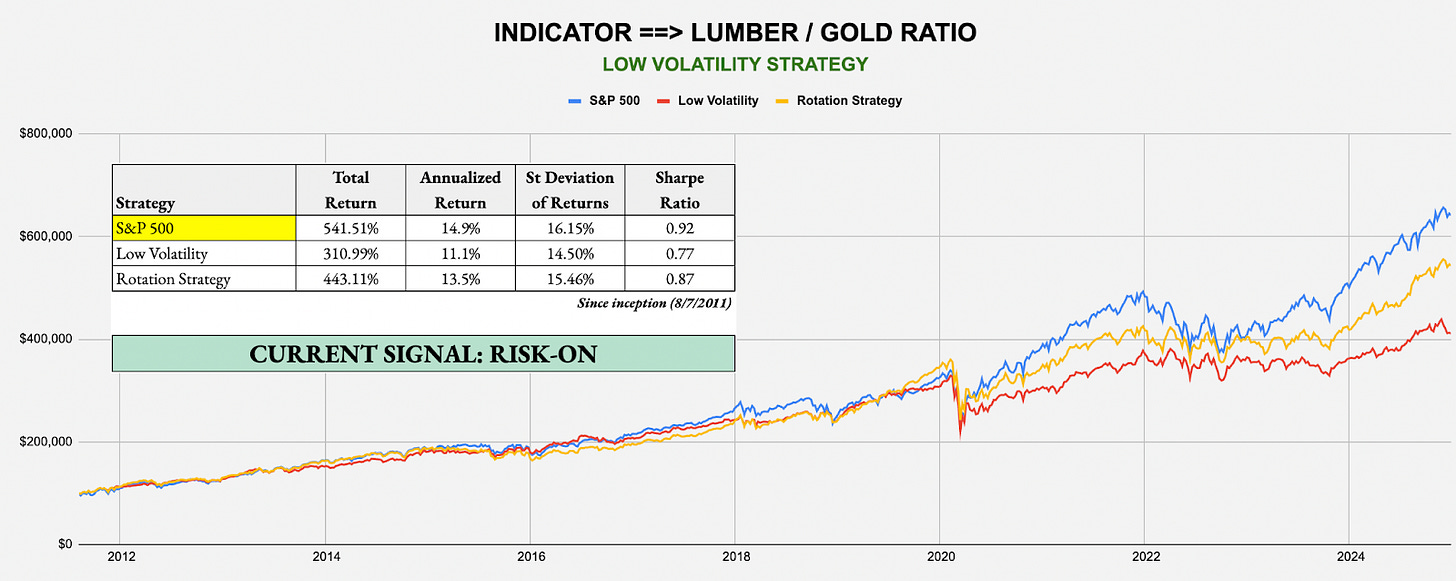

INTERMEDIATE-TERM SIGNAL: LUMBER/GOLD RATIO

Target Investor: Short- and long-term investors willing to trade more frequently using the classic cyclical vs. defensive asset comparison.

Current Indicator: Risk-On

Strategy: Lumber/Gold Bond - Example: Invest in S&P 500 (SPY) over Treasuries (GOVT)

Strategy: Lumber/Gold Buy-Write - Example: Invest in S&P 500 (SPY) over Buy-Write (PBP)

Special Announcement

Looking for a smart way to invest in emerging markets? Many ETFs claim to deliver EM growth. The challenge is actually delivering on the true investment potential of these fast-growing economies.

Meet the Rayliant Quantamental Emerging Market ex-China Equity ETF (RAYE).

The Rayliant RAYE ETF combines quantitative and fundamental insights, seeking to capture growth opportunities across emerging markets outside of China. Designed for today’s dynamic global economy, RAYE is an active approach that seeks to add meaningful alpha while avoiding the common pitfalls associated with passive approaches.

Explore the latest RAYE Fact Sheet HERE.

The Rayliant RAYE ETF offers:

Targeted Emerging Market Exposure: Access growth opportunities in emerging markets ex-China, guided by data-driven insights and local expertise.

Dynamic Factor-Based Strategy: The fund adjusts to prevailing economic conditions, focusing on quality fundamentals, growth, and sentiment to capture performance.

Risk Management: A systematic approach seeks to reduce volatility and mitigate common emerging markets risks, aiming to provide a more resilient investment option.

Rayliant RAYE ETF is where institutions, financial advisors, and informed investors look for intelligent emerging market exposure – without China.

Discover how RAYE can strengthen your portfolio today at funds.rayliant.com/raye.

Important Information

Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume.

These Funds may trade securities actively, which could increase its transaction costs (thereby lowering its performance) and could increase the amount of taxes you owe by generating short-term gains, which may be taxed at a higher rate.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Carefully consider the fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the fund’s summary or full prospectus, which may be obtained by visiting funds.rayliant.com. Please read the prospectus carefully before investing.

The funds are distributed by SEI Investments Distribution Co.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Rayliant. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Rayliant. and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

Strategy: Lumber/Gold Low Volatility - Example: Invest in S&P 500 (SPY) over Low Volatility (SPLV)

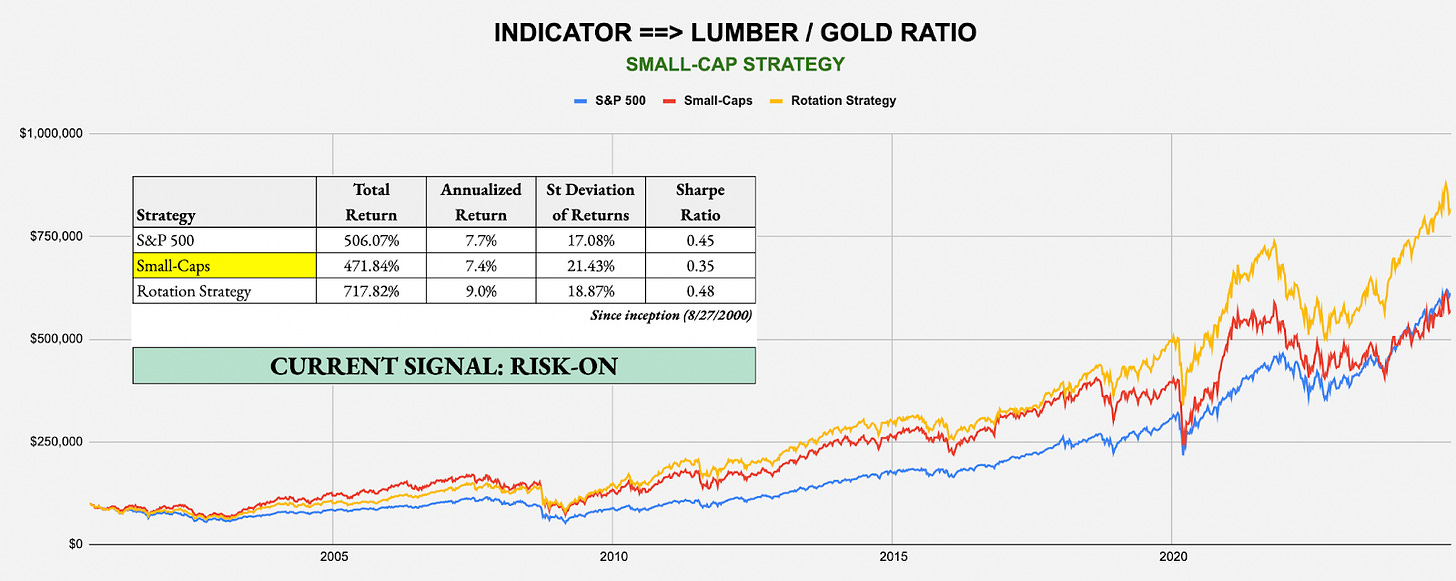

Strategy: Lumber/Gold Small-Cap - Example: Invest in Small-Caps (VSMAX) over Large-Caps (SPY)

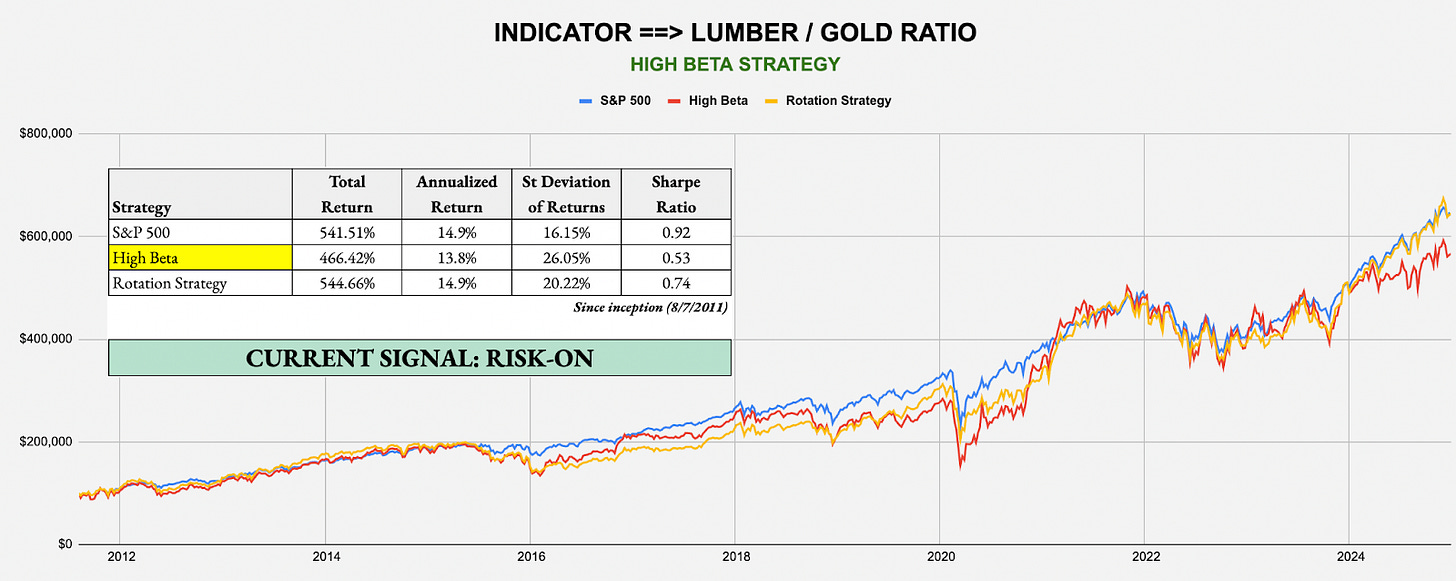

Strategy: Lumber/Gold High Beta - Example: Invest in High Beta (SPHB) over S&P 500 (SPY)

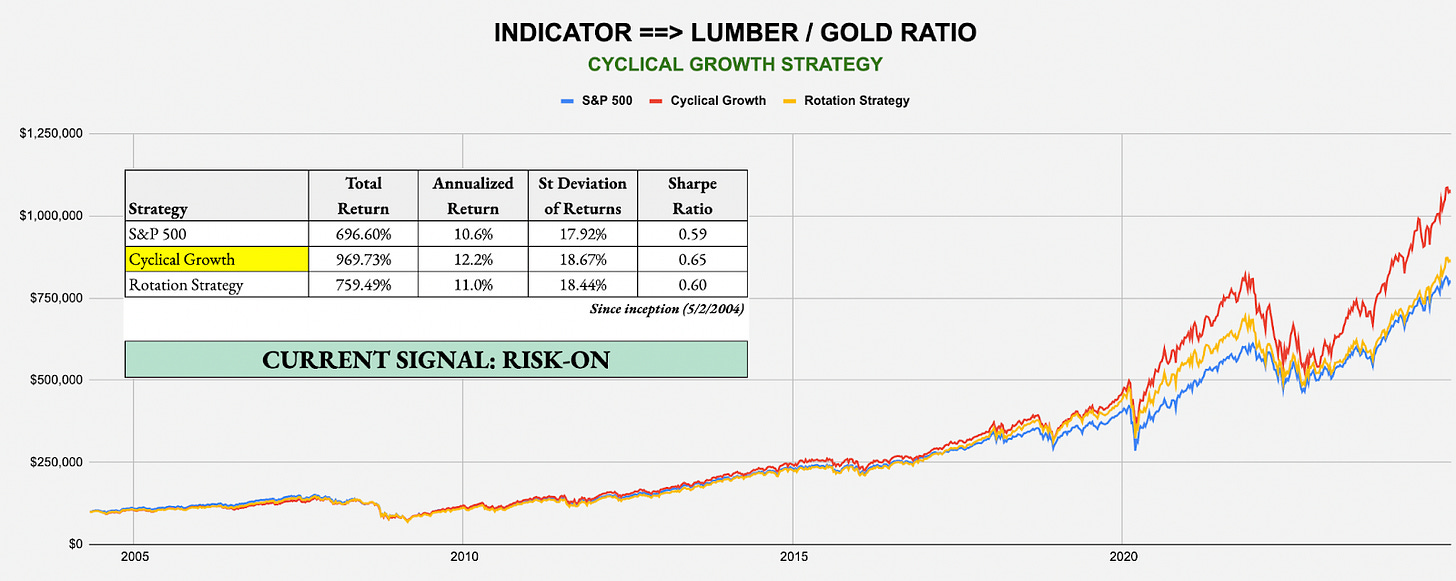

Strategy: Lumber/Gold Cyclical Growth - Example: Invest in Growth (VUG) over S&P 500 (SPY)

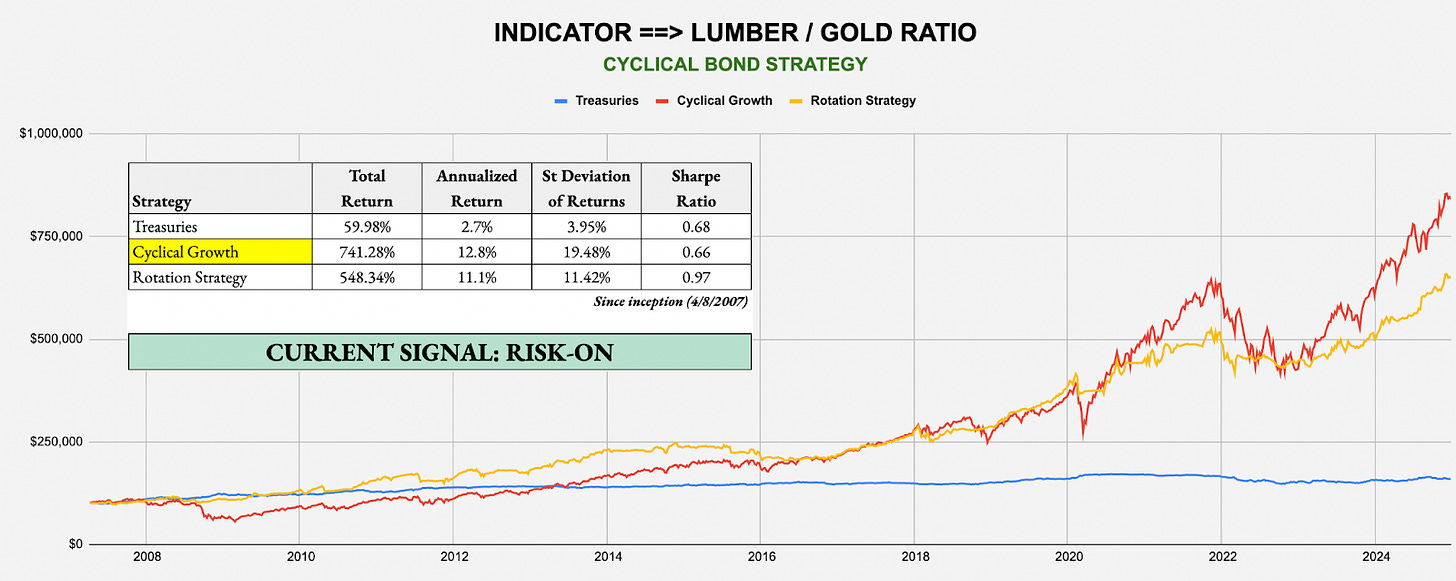

Strategy: Lumber/Gold Cyclical Bond - Example: Invest in Growth (VUG) over Treasuries (GOVT)

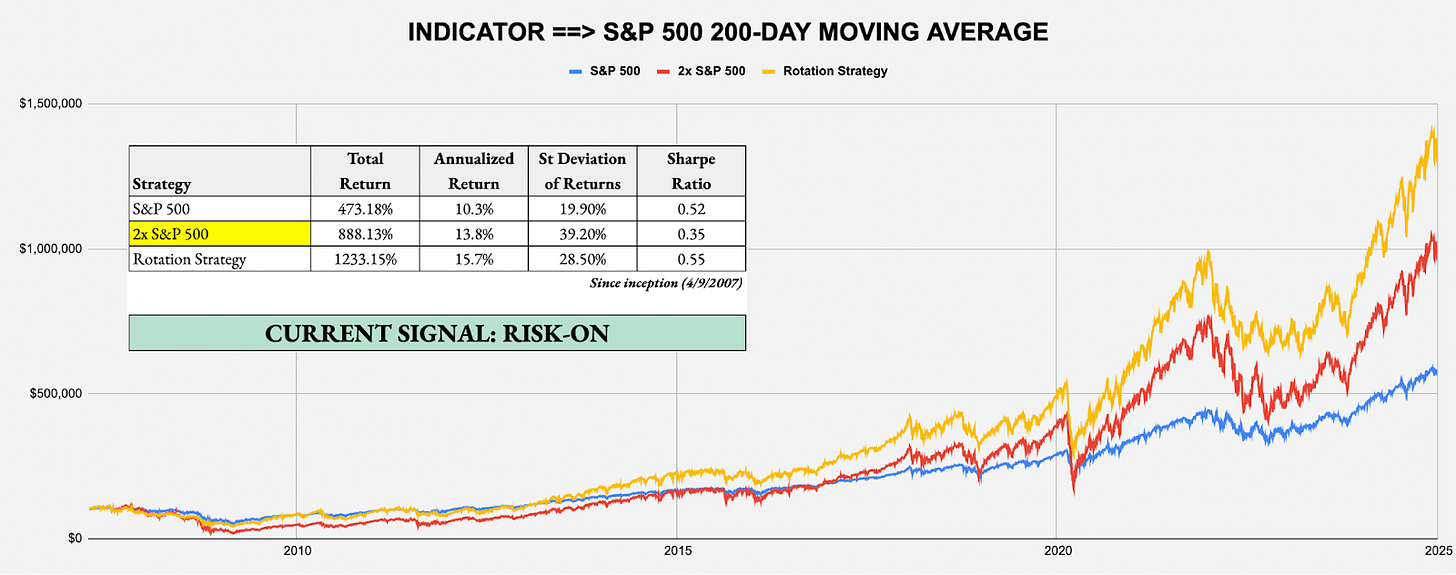

LONG-TERM SIGNAL: S&P 500 200-DAY MOVING AVERAGE

Target Investor: Long-term investors with a higher risk tolerance willing to move to an aggressive strategy when the signal flips to risk-on.

Current Indicator: Risk-On

Strategy: Leverage For The Long Run - Example: Invest in 2x-Leveraged S&P 500 (SSO) over S&P 500 (SPY)

About the Signals: The above trade signals and allocations are taken directly from each of the four award winning white papers I authored, which can be individually read at https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=2224980. The underlying commonality across all risk-on/off signals and backtested strategies from these papers is the same: what matters isn’t being up more, but rather being down less. Each strategy historically has significantly outperformed through the avoidance of major drawdowns and volatile periods. The signals can change often from week to week, so it’s important to keep checking The Lead-Lag Report for updates. While not every trade and not every signal will be right, cumulatively over time, the identification of conditions that favor an accident in the stock market can help you slow down entering the storm, even if no one knows the exact mile marker where a crash might occur.

CONCLUSION

But I had warned about a potential December surprise. It just came in the form of an unexpectedly hawkish tone from the Fed. That’s important though because it will have ramifications for potentially all of 2025. The markets had been counting on monetary policy support from the Fed and now it looks like they’ll get little, if any, help from the central bank.

That’s also resulted in a bit of a shakeup in the bond market that’s worth monitoring closely. We know that long bond yields have been trending higher for more than a month, but credit spreads are starting to follow. Not to the level of concern, mind you, but enough that it could be signaling the start of something bigger. If credit spreads, especially on the high yield side, begin normalizing, that’s likely to drag down all risk assets and potentially usher in a larger flight to safety trade. Gold may have been signaling this all along.