Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Are we in an up market? Are we in a down market? The answer to that question and overall sentiment seem to change on a daily basis thanks to the inconsistent messaging from the White House regarding trade policy. As we’ve seen over the past few weeks, investors have not taken kindly to the prospect of a prolonged and costly trade war. Risk remains high and the sharp ups & downs in both stock & bonds are the trademark of a market dominated by volatility, not one demonstrating a firm trend in either direction. Most signals suggest we’re still in a risk-off market and that means a focus on defense.

For those looking to stick with equities, that could mean choosing dividend stocks over growth. For income seekers, that could mean using this volatility to capture a little extra yield in options income strategies. If you want to combine both of these in a single product, consider the BlackRock Enhanced Equity Dividend Trust (BDJ). By using a covered call strategy on top of a portfolio of large-cap dividend payers, it could be a good way to approach the market in a defensive way.

Fund Background

BDJ’s primary investment objective is to provide current income and current gains with a secondary investment objective of long-term capital appreciation. It seeks this by investing in common stocks that pay dividends and have the potential for capital appreciation. On top of that, it utilizes an option writing strategy to enhance distributions paid to shareholders.

BDJ is an interesting option in this market for investing in equities. Covered call strategies aren’t unusual, including in the CEF space, but one that targets dividend stocks first is more unique. The dividend stock exposure should dial down volatility a bit compared to the S&P 500. Layering a covered call strategy on top of that (BDJ writes calls on single stocks and currently has about a 50% overlay) probably reduces risk a bit more, although you’re taking some upside off the table.

Those two factors combined could reduce some volatility while boosting one’s portfolio yield. In a time where the VIX has routinely hovered in the 30s & 40s and who knows what’s happening next in trade policy, that’s not the worst path to consider.

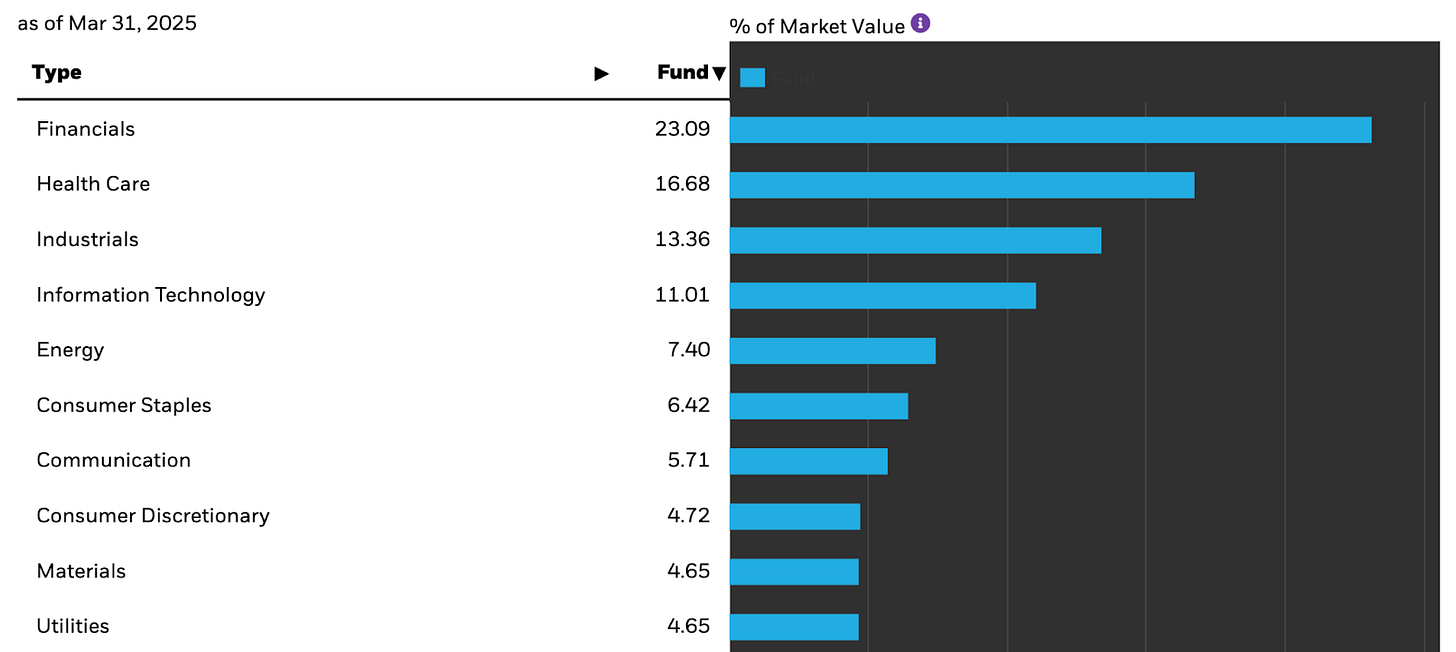

BDJ’s sector allocation actually deviates from those you’ll find in many other dividend ETFs. It overweights cyclicals in the portfolio, especially financials & industrials, but underweights more traditionally defensive sectors, such as consumer staples and utilities. It also underweights tech (which has a surprisingly significant contribution to the dividend stock universe). It’s not as defensive as you might like, but it has a greater focus on yield.

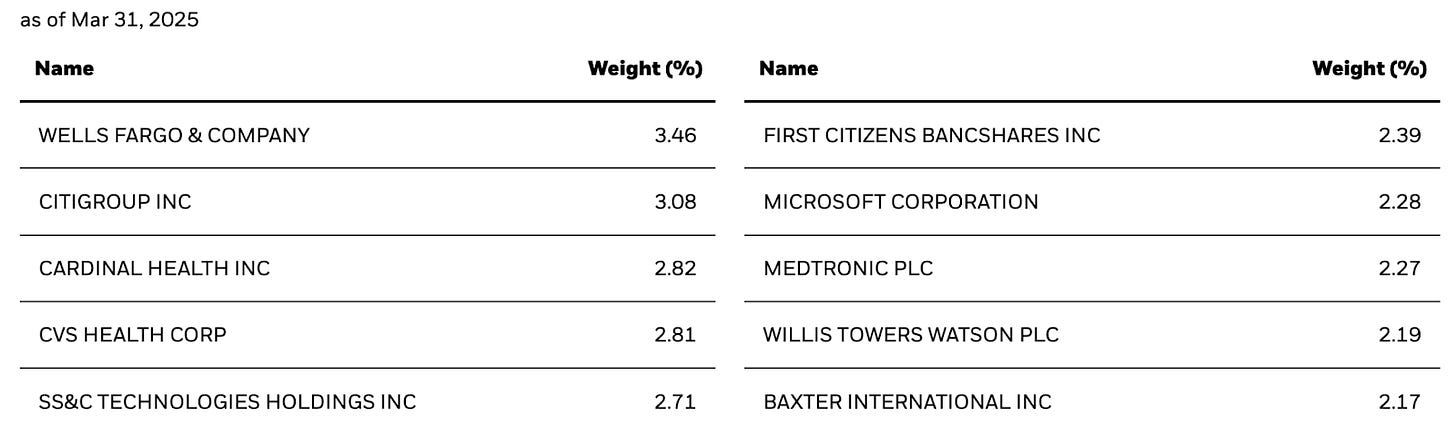

There’s plenty of financial sector exposure right at the top of the portfolio with two of the world’s biggest banks. Healthcare represents the fund’s 2nd largest sector holding and accounts for four of the top 10 individual holdings. And there’s Microsoft in there for good measure, a 20-year dividend grower even though it still yields less than 1%.