Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE FED TURNS SMALL-CAPS INTO AN INTERESTING ASSET CLASS AGAIN

Technology (XLK) – Justifying Valuations

Technology shares declined last week as the sector continues to face valuation issues. It’s also showing signs of weakness after the extended rally at the start of the year. The sector is currently trading at elevated levels, a pattern similar to those observed before previous corrections. At the same time, firms continue to face scrutiny regarding their returns on AI investments. The market will now consider whether the recent shift away from tech leadership will speed up or if upcoming earnings can validate the high valuations.

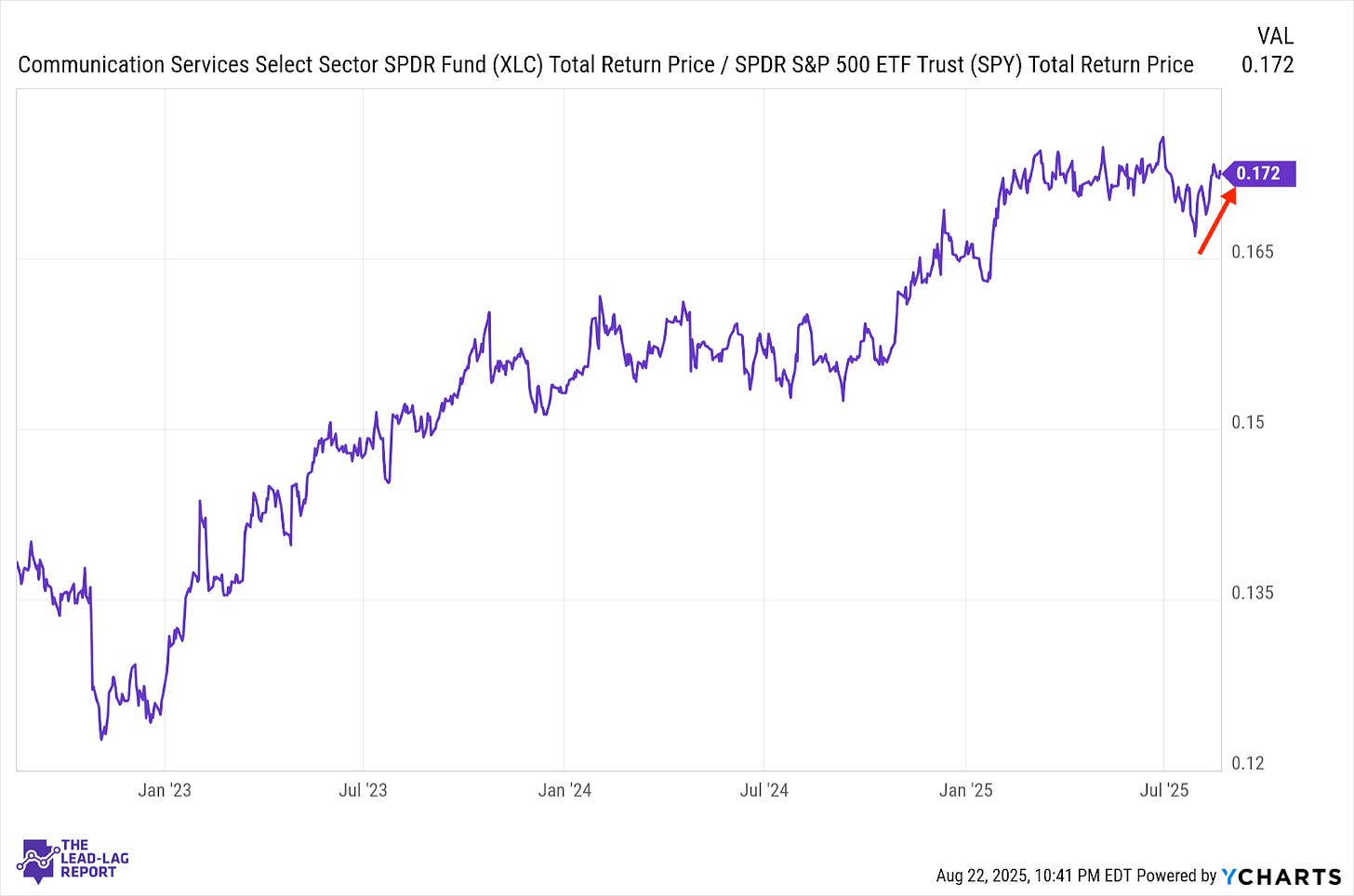

Communication Services (XLC) – Lack Of Clear Direction

Communication services have experienced significant volatility after a period of sideways movement. With the recent price action, the sector is getting back into its consolidation pattern. Major players like Meta and Alphabet are under scrutiny over AI investment returns. However, the defensive holdings provide some counterbalance in unfavorable conditions. The industry finds itself caught between growth and the threat of regulatory setbacks, resulting in a lack of clear direction, either upward or downward.

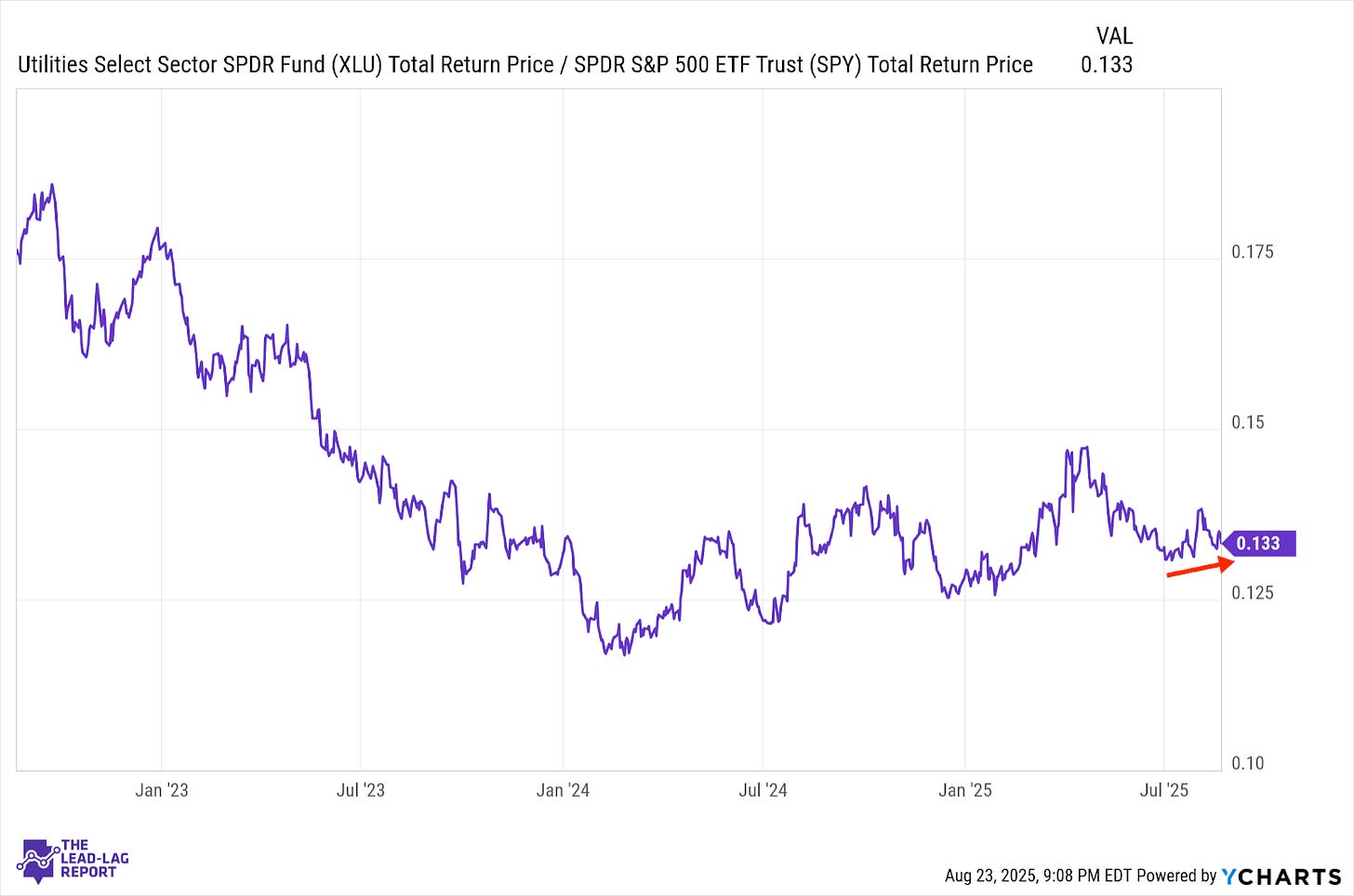

Utilities (XLU) – Still Need Lower Bond Yields

In recent weeks, utility stocks have performed relatively well as investors seek stability amid increasing market uncertainty. Lower long-term bond yields and a positive regulatory climate in many areas may continue to benefit these rate-sensitive stocks. The sector's defensive characteristics may lead to further leadership if economic data worsens or volatility increases.

Long Bonds (VLGSX) – Good For Duration

Long bonds have seen gains in recent sessions as domestic yields fell due to weaker-than-anticipated economic reports and preparations for central bank policy decisions. Inflation expectations are stable, and labor data indicate moderation rather than a downturn, which supports duration. As institutional investors rebalance after a long period of equity over performance, this technical support should provide some cushion for the long end of the curve.

Treasury Inflation Protected Securities (SPIP) – Expectations Easing

TIPS continue to perform relatively well as investors still factor in some inflation pricing, even though it has been reduced in segments. Recent tariff developments present a potential upside risk to the inflation forecast, and changes in commodity prices contribute to the high uncertainty in price expectations. The breakeven inflation rate indicates that market expectations are relatively cautious, but TIPS will protect portfolios against unexpected inflation surprises.