To Cut Or Not To Cut

The Preponderance Of Evidence Suggests Rate Hikes Should Be On The Table

Today, I want to talk about one chart. Just one. But one that I think demonstrates how the Fed doesn’t have a good handle on the current economic situation and could very well just make things worse.

As expected, the Fed held interest rates steady in the 4.25-4.50% band for the 4th straight meeting. The Dot Plot indicated expectations for two cuts prior to year-end (reminder: the Dot Plot is notoriously inaccurate), which would be most likely to come in September and December, if they come at all.

Donald Trump has been taking personal shots at Jerome Powell for months in an effort to force him to lower interest rates by 100 basis points or more. It’s a self-motivated move designed to improve business prospects in the short-term, something which has long been his goal, at the expense of longer-term inflation risk.

Here’s the thing though. While the headline inflation rate hovers at 2.4%, higher than the Fed’s 2% target but not egregiously out of line, the core rate is still at 2.8%. More than that, the services inflation rate is still at 3.7%. This is more than enough evidence to suggest that inflation risk is still not contained and the Fed might be well served to keep monetary conditions restrictive until those latter figures cool down a bit.

Yet no one in the market is pricing in even the slightest chance that the Fed could need to raise rates.

To be clear, the Fed probably will cut rates here soon and they probably won’t even consider raising rates for at least the next several quarters. But the data is disconnected enough right now that there’s a legitimate case building for why the Fed should consider hiking.

Here’s the chart.

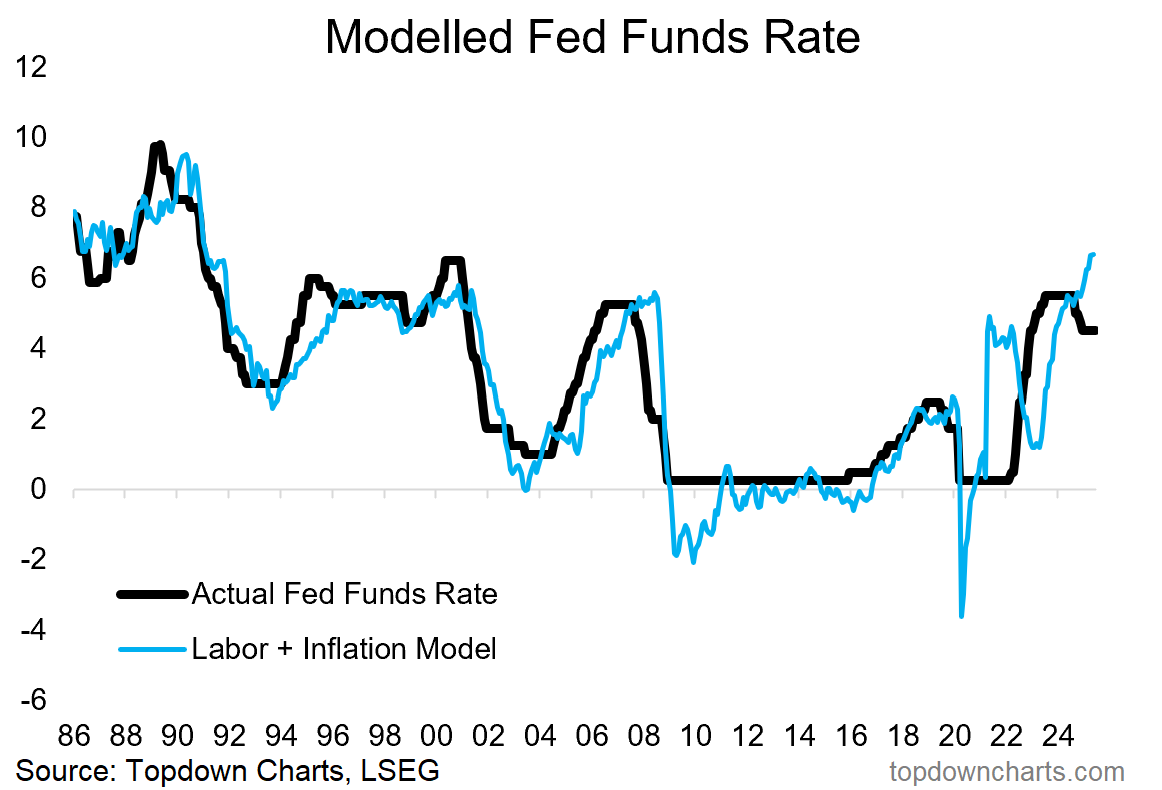

It compares the current Fed Funds rate with what is essentially a measure of combined labor and inflationary conditions. In most cases, the two correlate very closely. When the two get out of line with each other, one of the lines tends to correct to bring the relationship back in line. Periods of turbulence can cause larger disconnects that can require more violent movements to normalize.

You can see that in 2025 the Fed Funds rate and the labor/inflation condition rate are diverging. The latter is rising while the former is trending down. History would suggest (discounting the 2020-2022 period for a moment since it was a once-in-a-generation event) that one of the two will reverse. Maybe not quickly, but history says that it eventually happens.

That means either the labor market is about to weaken, inflation is about to come down and/or the Fed Funds rate needs to go up.

If we look at the current evidence, the labor market remains tight for now and shows little sign of imminently breaking down. Wage growth just came in at 4.6% year-over-year, which is down from what we’ve seen over the past few years but still elevated historically.