It appears that simple anger might be the thing that finally de-escalates the global trade war. The news cycle is starting to fill up with anecdotes of consumers that are spitting mad once they get the bill on their online purchases. One example I saw today is someone who bought a $19 dress on Temu, but found out that the final bill was $54 after “import taxes” were added on. While tariffs were announced several weeks ago, we’re likely just now entering the phase where consumers are starting to feel the impact of tariffs. These added costs will almost certainly be passed on to consumers and it’s likely just a matter of time before they begin rejecting these higher costs en masse and slow their spending altogether. For as much as we hear about how consumers should just buy American if they want to avoid tariffs, they want to pay low prices above all else. That’s why Temu has become so popular. Even though it may take 2-3 weeks to arrive and the quality may not be the best, it’s the cheapest option out there and that’s what consumers want. That’s why it’s going to be so difficult to reshore manufacturing and business.

The long-awaited Q1 GDP number is set to hit on Wednesday and it won’t be good. In a best case scenario, it comes in somewhere in the 0.5% to 1% range. In a worst case scenario, it’s significantly negative. I’m not sure it’ll be as bad as the Atlanta Fed’s current -2.7% estimate, but a print of -0.5% wouldn’t necessarily be surprising. Companies rushing to import goods ahead of the Trump tariffs are going to be a major driver of the slowdown, but the worst may be yet to come. Only recently are consumers beginning to feel the effects of tariffs on their pocketbooks, but the negative impact is also being felt all along the way too. The transportation and manufacturing sectors are experiencing sharp downturns. Job openings are drying up. It’s safe to say that U.S. companies don’t want to commit capital to almost anything, including payroll, innovation and reinvestment, without having a sense as to what the foreign trade path is and how long it will last. The constant stops and starts on policy are killing companies’ ability to plan effectively and they’re simply going to take the safe route until they get clarity.

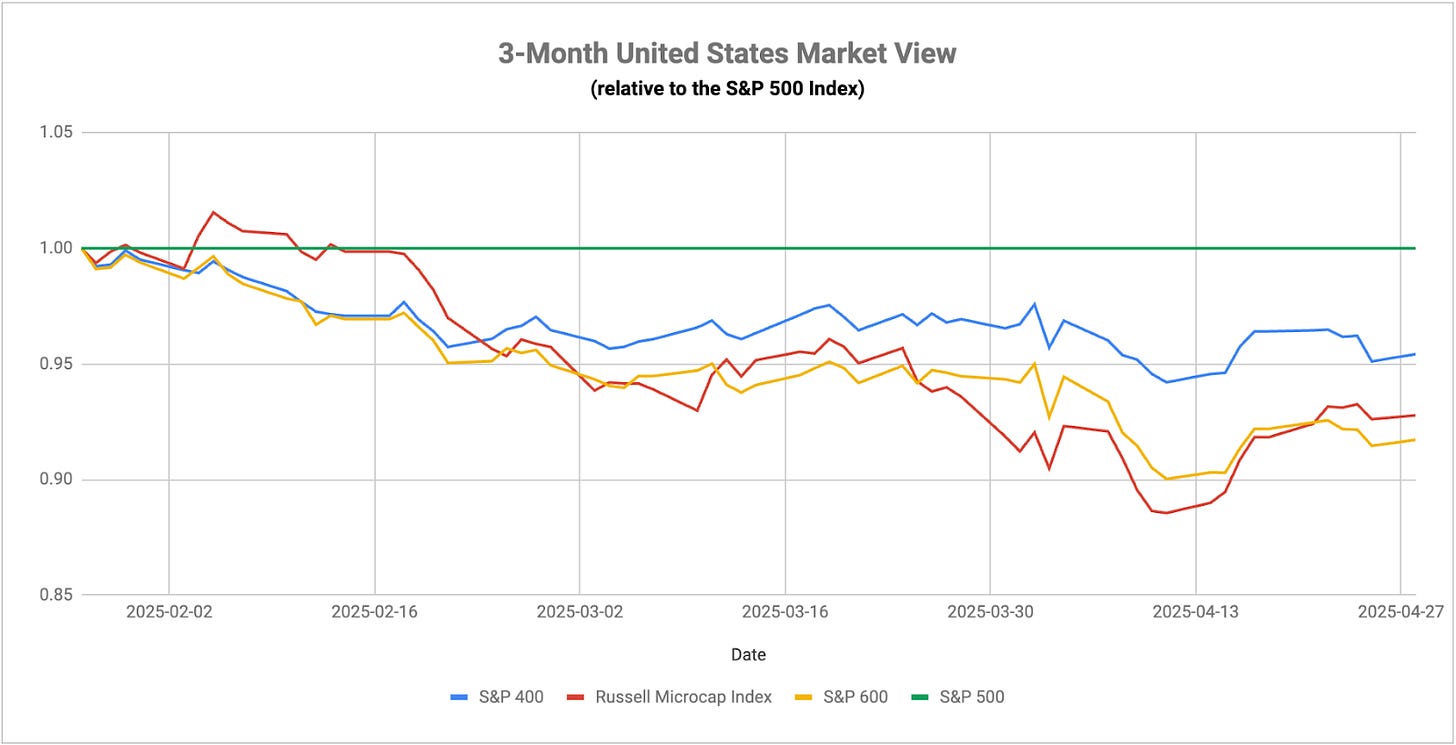

We’re in the heart of Q1 earnings season and all eyes are on forward guidance. Almost every company is at least mentioning challenges ahead due to the Trump tariffs. GM and UPS both pulled their forward guidance due to the uncertainty surrounding the auto tariffs and tariff risk, in general. The best case outcomes at this point seem to be simply reiterating current guidance and insinuating an ability to manage the current environment. The current macro environment is having an almost universal negative effect on companies and the worst part may be that there’s no way of telling whether current conditions are going to get worse or better. The market has been reacting to short-term developments, but I think the uncertainty of it all is why my signals are still indicating risk-off conditions.

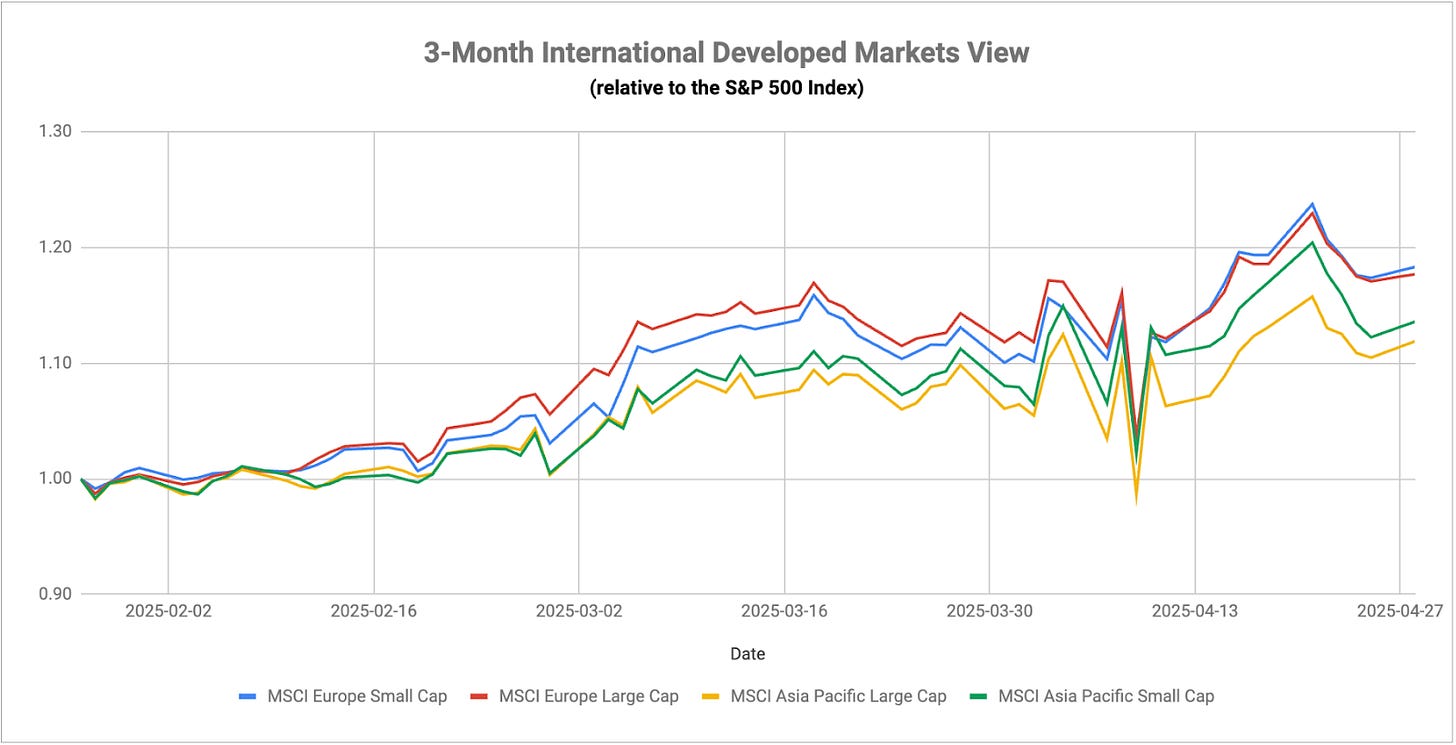

In my opinion, one of the stronger signs that we’re still under risk-off conditions is the resilience of international stocks. Even after last week’s U.S. stock rally, international stocks were able to rebound, suggesting that there’s still a negative aura around domestic stocks and bonds at the moment. There is better value in foreign stocks and I think that’s providing some benefit given how value has led the majority of the time in 2025, but I think there’s also the widespread belief that tariffs in their present form are going to do more damage to the U.S. economy than they will to most of our major trade partners.