While not directly a market-related event, the social media sparring match between Donald Trump and Elon Musk will likely be remembered as the highlight of the week. It obviously impacted Tesla’s stock price quite a bit and is probably making Elon wonder if his aspirations over the past 9 months that have seen him invest a couple hundred million dollars in getting Trump re-elected, Tesla sales drop considerably, his public image take a big hit and made him the primary target of a president who has a long list of targets all worth it.

From an economic view, the labor market data was mostly mixed, although Friday’s non-farm payroll report added a bit of optimism. The JOLTS and ADP data released earlier suggested that the non-farm payroll number could be ugly. While the May figure topped expectations, those from the prior two months were revised lower by a combined nearly 100K jobs. There seems to be enough here to convince a lot of market participants that the labor market is still holding up and the performance of stocks on Friday would seem to confirm that. Overall, investors seem to be in a relatively decent mood still as the primary risks remain on the geopolitical front.

Special Announcement

DYMIX: #1 Macro Trading Fund for 2024

Diversification Without Compromise

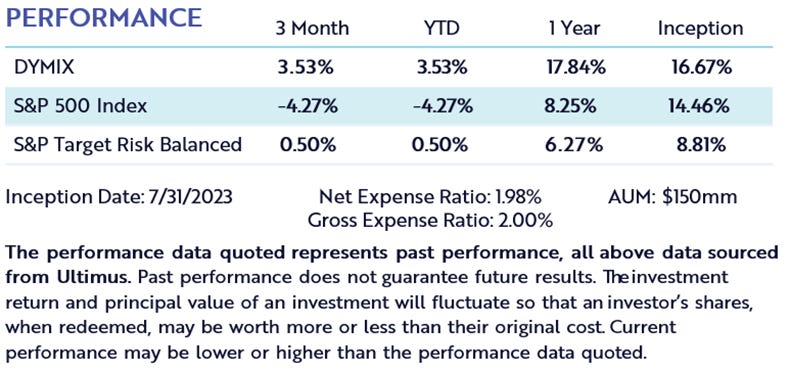

In today’s unpredictable financial markets, achieving true diversification is more critical than ever. The Dynamic Alpha Macro Fund (DYMIX) has been recognized as the #1 Macro Trading Fund of 2024 by Morningstar, affirming its role as an innovative solution.

Performance as of March 31, 2025

Key Highlights:

✅ All Weather Strategy: Designed to help navigate unpredictable market conditions.

✅ Broad Market Access: Exposure to over 40 liquid markets across multiple asset classes.

✅ Dynamic Rebalancing: “Dynamic Alpha” is captured between two sets of noncorrelated strategies.

Whether you are managing your own portfolio or managing portfolios for your clients, you are seeking ways to deliver results and reduce uncertainty. DYMIX aims to offer an innovative solution built for today’s complex investment landscape.

Explore DYMIX Today

Learn how DYMIX can help protect and grow your clients' portfolios.

Disclosures:There is no guarantee the Dynamic Alpha Macro Fund will achieve its investment objective. No investment product or strategy is guaranteed to generate a profit or prevent a loss.

Important Risks: Investing in mutual funds involves risk, including loss of principal. Risks specific to the Dynamic Alpha Macro Fund are detailed in the prospectus and include limited history of operations; equity securities risk; futures and commodities risk (including currency, debt, equity, energy, metals and agricultural commodities risk); ETF risk; market risk; management risk; shorting risk; small and mid-capitalization stock risk and taxation risk. For a complete description of risks specific to the Fund, please refer to Fund’s prospectus.

Request A Prospectus: Investors should carefully consider the investment objectives, risks, charges and expenses of the Dynamic Alpha Macro Fund prior to investing. This and other important information can be found in the Fund’s prospectus and summary prospectus. To obtain a prospectus, please call 1-833-462-6433 or access online at https://regdocs.blugiant.com/dynamic-alpha-macro/ . The prospectus should be read carefully prior to investing.

Relationship Disclosure: Advisors Preferred, LLC serves as Advisor to the Dynamic Alpha Macro Fund, distributed by Ceros Financial Services, Inc., Member FINRA/SIPC. Advisors Preferred and Ceros are commonly held affiliates. Dynamic Wealth Group, LLC serves as Subadvisor to the Fund is not affiliated with the Fund’s advisor or distributor.

Read our full press release and get additional information: https://dynamicwg.com/dynamic-alpha-macro-fund-1-ranking-morningstar-category-for-2024/

© 2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. As of 12/31/24, the fund was ranked #1 in the Morningstar Macro Trading category out of 60 funds for the 1-year period based on total returns. Rankings are based on historical performance and are subject to change.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Dynamic Wealth Group. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Dynamic Wealth Group and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

For the most part, the markets are still in a risk-on mood. Stocks were up, including tech, but small-caps were actually the ones leading the way. I said before that if the lows of this cycle are already in, small-caps genuinely have a chance to lead because the next leg of the market’s move higher would likely be led by some signal of economic expansion. A still healthy labor market would be a good start and small-caps reacted on Friday as if that were the case. This group has been unloved for so long, but I do think there’s still a lot of potential here. If the economy can navigate its way through this current tariff regime and manage to avoid a recession, the subsequent growth re-acceleration should be led by smaller companies.

On the other end, gold traded lower as the week went on and Treasury yields were clearly impacted by the NFP report. Better-than-expected job growth coupled with stronger wage growth and a tame unemployment rate means investors view the odds of a near-term rate cut as lower than before. I expect that the market will continue to struggle with a Fed that seems unwilling to loosen conditions unless obvious evidence of a slowdown emerges.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.