This week, the U.S. and the U.K. announced an “historic” trade deal that will dial back tariff rates for both nations while simultaneously easing trade conditions for British car exports and the agriculture market for both countries. We’ve been promised a huge number of trade deals for months and it looks like we might finally get the first!

In terms of economic impact, this deal in its rumored form would probably have little. The 10% blanket tariff imposed by Trump originally would appear to be staying in place in such a scenario and the U.K. ranked as only the 11th largest trade partner of the United States in March, accounting for less than 3% of total trade.

While the equity markets have had a generally positive reaction to the development so far, I think it’s far safer to assume that we’re still in the midst of a very tense trade war that has no immediate end in sight.

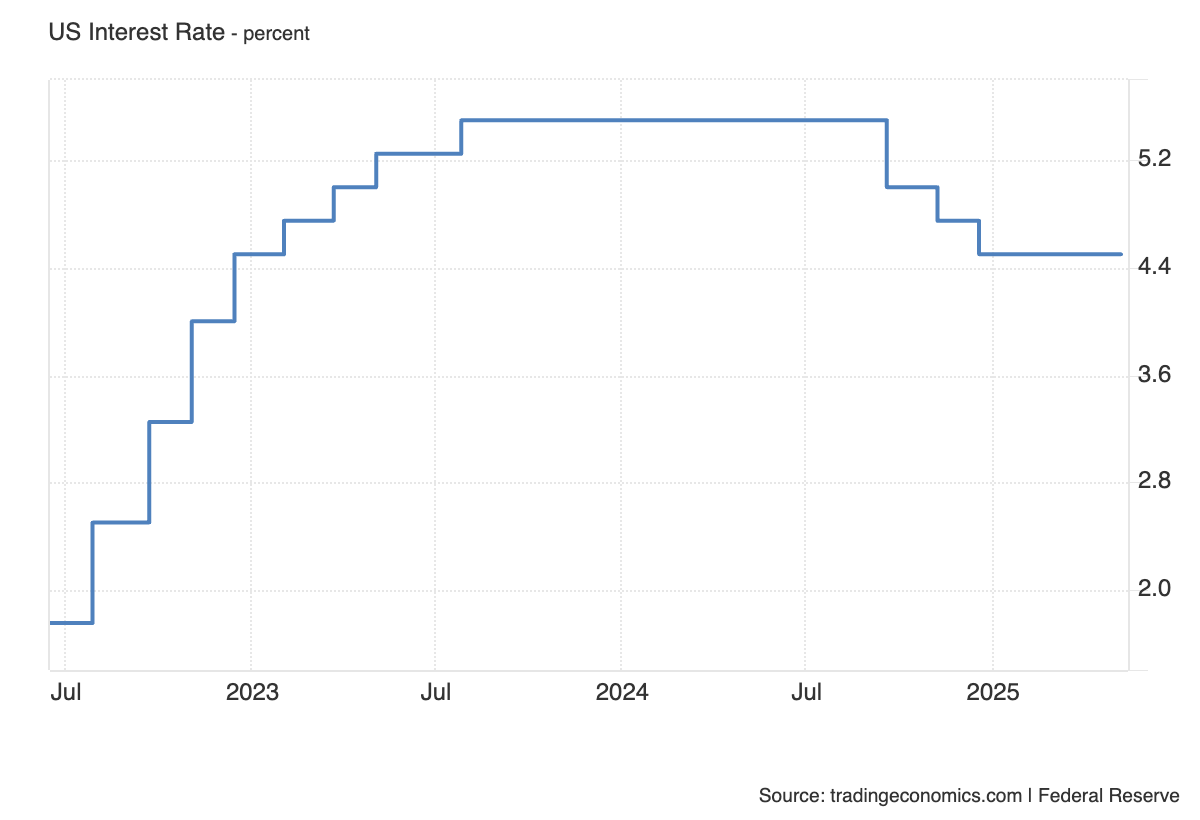

The other major event of the week was the Fed meeting where the central bank, as expected, held the benchmark Fed Funds rate steady in the 4.25% to 4.5% band. Keeping the target rate steady was widely expected, but the market was more interested in the outlook. In the end, Powell ended up giving us…. more of the same.

A couple of the more important takeaways.

The Fed views the negative Q1 GDP print as an isolated occurrence and not necessarily indicative of an imminent recession. This suggests the Fed may not view that as a catalyst to push rates lower later this year.

It’s still in “wait-and-see” mode. Trade risk remains the #1 factor impacting forward-looking policy and with relatively little hard data to work with since Liberation Day, the Fed has opted to keep kicking the can down the road.

The Fed doesn’t have any idea of what the future looks like either. They acknowledged that risks to both inflation and unemployment remain highly uncertain and the end result could go either way. Just like companies that chose to pull their forward guidance due to the lack of clarity, the Fed seems comfortable holding the line until compelled to make a change.

As much as we love to criticize the Fed, this might actually be the right take. If a cooling job market would argue for lower rates, but inflation argues for higher rates, waiting to see which one exerts more control over the economy could be the best way to approach it. This might especially be the case if the Fed truly considers the Q1 GDP print as an anomaly and, by extension, not a major factor in setting future policy conditions.