Last week’s inflation reports are creating some confusion around whether the report was actually “good” or it was more of the same. For background, both the CPI core and headline rates were up 0.3% month-over-month, which was in line with expectations. The PPI, however, rose by 0.5%, which topped forecasts of 0.3% (although the March number was revised downward). My interpretation of this is that inflation remains persistently sticky and shows no clear resumption of the disinflationary trend we saw several months ago. Therefore, it’s going to make it increasingly difficult for the Fed to cut interest rates later this year. The market’s reaction seems to be that inflation is “cooling” and the disinflation narrative is back on. That’s largely been behind the recent rallies in both tech stocks and Treasuries, the two asset classes that are likely to benefit more from lower interest rates. With the VIX still hovering around 12, the ultra-low volatility environment has investors in a good mood and clearly willing to push risk asset prices to new highs.

But utilities and gold are still rallying. Gold prices are up 17% year-to-date and 21% since the mid-February low. Utilities are the best-performing S&P 500 sector this year. That doesn’t just happen by accident. I know a lot of people are going to say that the utilities rally is happening because of AI and how much electricity is going to be needed for it over time. That’s certainly a long-term catalyst, but the AI boom has been happening for about a year ever since NVIDIA announced that they were going all-in. AI stocks were rallying then, but utilities didn’t participate. In fact, it’s only recently that utilities have really taken off. I think that utilities will undoubtedly get a boost from AI as it develops over time, but I don’t think this is the moment yet. Admittedly, the defensive sectors around utilities & gold, including staples and healthcare, have struggled to participate lately, but I still believe there’s an underlying tone of defensiveness still in place.

There are a lot of Fed speeches this week for investors to interpret. Right now, we’ve got a few members still clinging to the idea that 1-2 rate cuts by year-end are feasible, but more indicating that inflation has yet to reach where it needs to be to make them feel comfortable. At this point, I think the Fed wants to cut rates and they may only need to see inflation stabilizing in order to make a cut before year-end (remember that it often takes 12 months for the effects of a cut to show up and a quarter-point cut isn’t going to be a needle mover). I think energy price inflation is going to continue to be an issue beyond just the summer travel season and we don’t have clear signs yet that housing inflation, one of the biggest reasons for the stickiness we’re seeing, is ready to subside. In other words, I think the door is still open for the Fed to make a policy mistake here by cutting before inflationary conditions have satisfactorily cooled off.

Quietly, one of the best performing sectors of 2024 has been financials. They bottomed out in the 4th quarter of last year relative to the S&P 500, right before the Fed pivot announcement, and have maintained a fairly steady up channel ever since. They began to lag right around the time of peak nuttiness when the market was pricing in 6-7 rate cuts, but have steadily advanced ever since the market started dialing back expectations, something which is still happening now. JPMorgan Chase at its recent investor day announced that it was raising its net interest income guidance on the belief that fewer rate cuts will be coming. Higher rates have generally been viewed as a good thing for banks because it improves financial conditions at the margins and we’re seeing a good example of that here. If JPM is seeing this, odds are that other big banks are experiencing a similar tailwind, which would be bullish for this sector heading into the 2nd half.

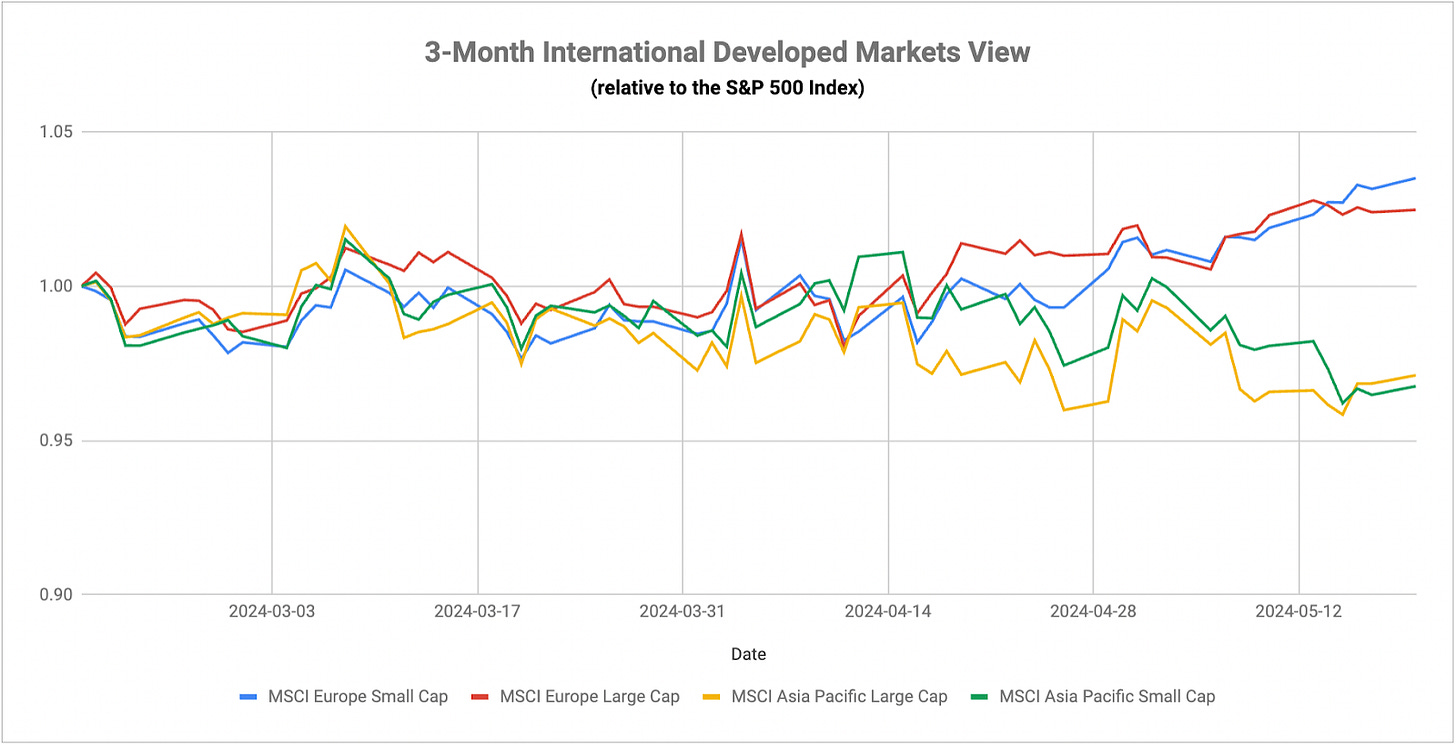

We’re beginning to see a major divergence between European and Asian equities with the latter falling further and further behind. European equities have been responding well to what’s looking more and more like an economic bottom. The financial sector, in particular, has looked robust as a recovery in lending activity and consumer-friendly monetary policy developments have improved sentiment considerably. GDP growth and manufacturing activity also look to be picking up. The inflation risk, however, can’t be ignored. Over the past three months, Eurozone inflation is running at an 8% annualized rate, which would quickly derail any recovery or plans from the ECB to make a substantial number of rate cuts later this year.

The latest meeting minutes from the Reserve Bank of Australia indicated that the central actually considered rate hikes at its May meeting before deciding to hold steady. Even though the current inflation rate is 3.6%, the RBA acknowledged that inflation risks have risen and that higher rates may be required even though consumer demand is weakening. There are a number of factors playing into the rising inflation risk narrative. Wage growth is up to 4%, services inflation is in the 4-5% range and rent inflation has risen to 8%, reflecting a problem that exists in a lot of areas globally right now. The ECB and the Fed may be leaning hard into rate cuts in the 2nd half of the year, but the tone being set by the RBA shows that inflation is likely to remain a long-term risk well into 2025 and beyond.

The Bank of Japan is likely on the path to rate hikes of their own, but for different reasons. I’ve said many times over the past several months that the only recourse for the BoJ to stop the slide in the yen is through higher interest rates. The central bank has taken a few swings at it with intervention measures, but the fact is that the yen is still sitting at the level it was pre-intervention. Moreover, every time the BoJ has intervened on the yen’s behalf, traders have gone right back to selling it off again, something which has been happening again over the past week. Enacting a rate hike and taking the first step towards closing the interest rate gap with those of other sovereign bonds would go a long way towards shoring up the yen in the process. The economy’s inflation rate is likely to cool to around 2.3% when we get the April report this week, but I don’t think that’ll change the fact that the BoJ simply has to raise rates here if the goal is to strengthen the yen. Yes, raising rates would put any potential economic recovery at some risk, but it’s becoming a question of which thing is more important to address at the moment. For Japan, it has to be the currency.