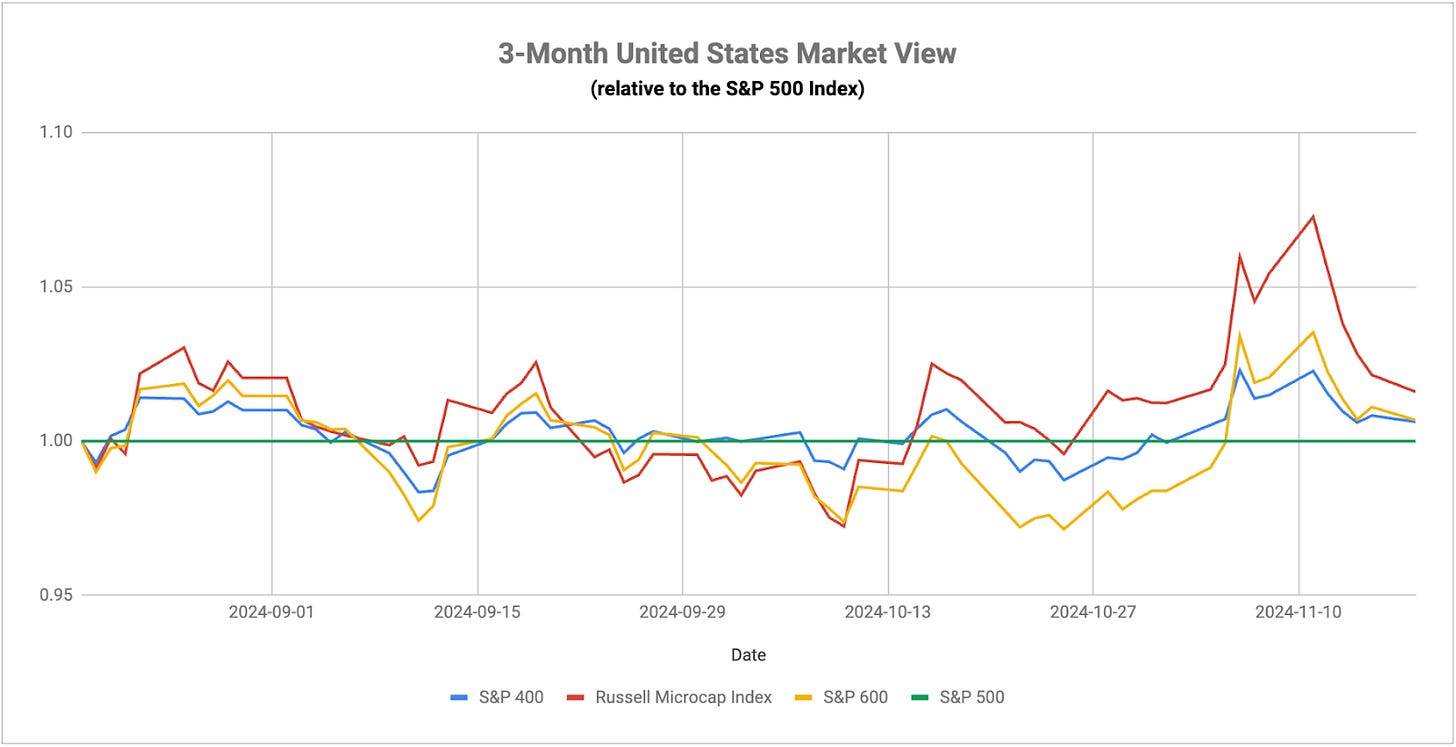

The Trump trade from a 30,000 foot view appears to be over for the time, but some of the sectors and asset classes likely to be direct policy beneficiaries are still doing well. Financials, energy and crypto have been the biggest winners, which means that value has also been making a comeback. The rallies, however, may be due for a pause and the chart above demonstrates how small-caps, which should in theory be a big winner of the Trump trade/Fed easing landscape, has failed to hang on to its momentum. This may be a sign that, while investors were initially enthused by the prospect of a pro-business environment, they’re starting to come to terms with the potential consequences of these policies. The obvious one would be inflation, which could pick up quickly with higher government spending, higher liquidity and the imposition of tariffs.

While defensive equities haven’t been signaling a notable risk-off sentiment building, utilities and gold have been staging comebacks in recent days. All of this is consistent with the idea that investors are turning their attention to long-term implications. A lot of people will look at the year following the 2016 election as a roadmap to how things could play out this time around (and I’ve examined that potential path myself), but consider the additional stumbling blocks this time around. The federal debt has nearly doubled. The Fed is no longer holding interest rates at nearly 0%. High yield spreads have gone from 500 basis points to all-time lows. The Chinese and Japanese economies may be on the brink of collapsing. It’s no longer safe to assume that lower taxes and less regulation is the riskless way to drive up asset prices. The U.S. economy is in a much less healthy place to handle the impact of those kinds of policies.

Corporate earnings are back on the radar with quarterly reports expected from NVIDIA, Walmart, Target and Lowe’s among others. NVIDIA, in particular, has been painting a picture of unstoppable growth and demand that can barely be handled. Right now, however, rumors of manufacturing issues with the new Blackwell chips and slowing growth rates could start pumping the brakes on the AI trade. The stock is still within arm’s reach of its all-time high, but I’m not sure we can count on big post-earnings rips from this stock any more. Sure, it may happen again this quarter, but the stock is priced for perfection and slowing growth rates tend to take some air out of the valuation bubble.

I’m curious about what we’ll hear from the big retailers this week, but I’m not sure it’s going to be a market mover. They’ve been talking about consumer weakness for more than a year and how they’ve needed to discount merchandise just to sell it. But retail sales and personal spending figures are still showing healthy growth. I’m not sure which side is more right in this disconnect, but some of the data we’ve seen elsewhere, such as debt levels and delinquency rates, would strongly suggest that the consumer isn’t in quite as good of shape as the high level numbers might suggest. I’m not sure we’ll see a major reaction until sales figures and/or the labor market start to fall through the floor.