Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: TREASURIES ARE FINALLY EMERGING FROM THEIR SLUMBER

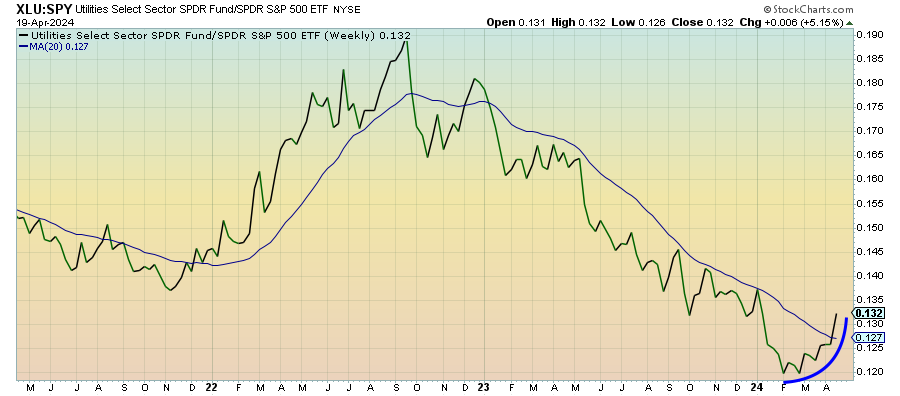

Utilities (XLU) – Early In The Uptrend

The outperformance of utilities is getting more pronounced and there’s a good chance that we still may be very early in the cycle. Utilities have in recent months responded to changes in interest rates, but seem to be ignoring rising rates this time around. This sector was signaling risk-off conditions well ahead of the April pullback and it looks like it may be ready to accelerate further.

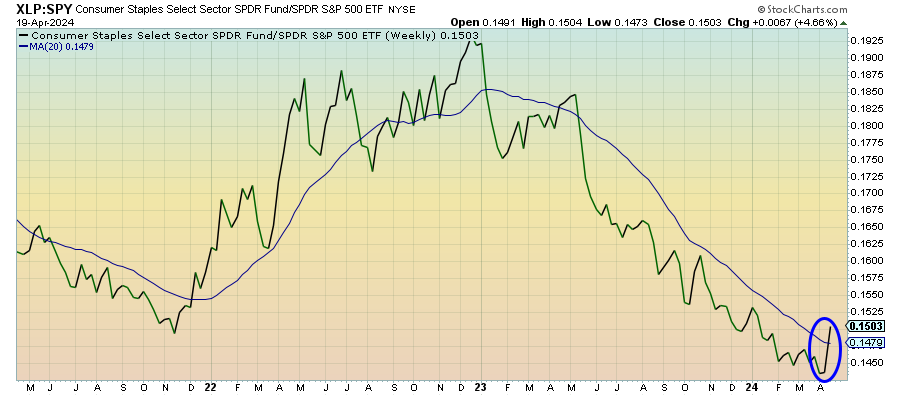

Consumer Staples (XLP) – Finally A Confirmation

And just like that, this ratio is near its highest levels of 2024. I’ve been saying repeatedly that we really need participation from the staples sector in order to feel more strongly that a pivot to defense is taking place and we got that and then some last week. This is still pretty much a one week move and I’d like to see it carry through a little longer to confirm the trend, but moves like this usually don’t happen without a reason.

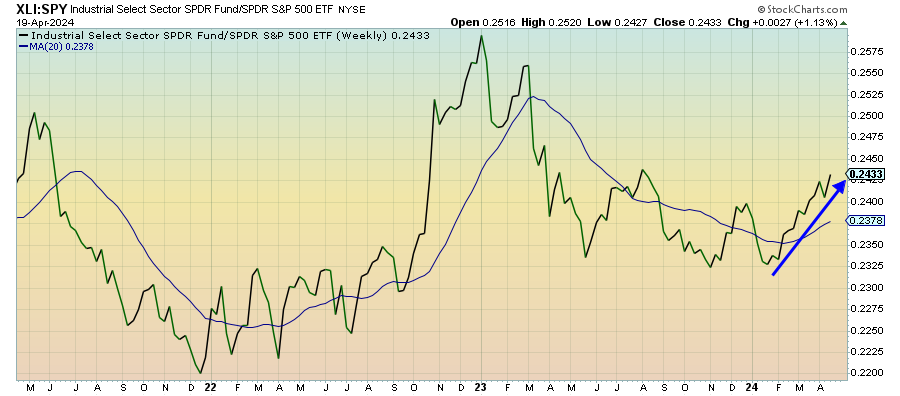

Industrials (XLI) – Rising On The Growth Narrative

Cyclicals quickly recovered after a one-week dip (relatively speaking, of course) as we saw a major defensive shift in the markets. Industrials didn’t necessarily perform well, as they lagged utilities and staples by a sizable margin, but it looks like there may be room to move higher as investors unwind tech positions and buy into the cyclical growth narrative.

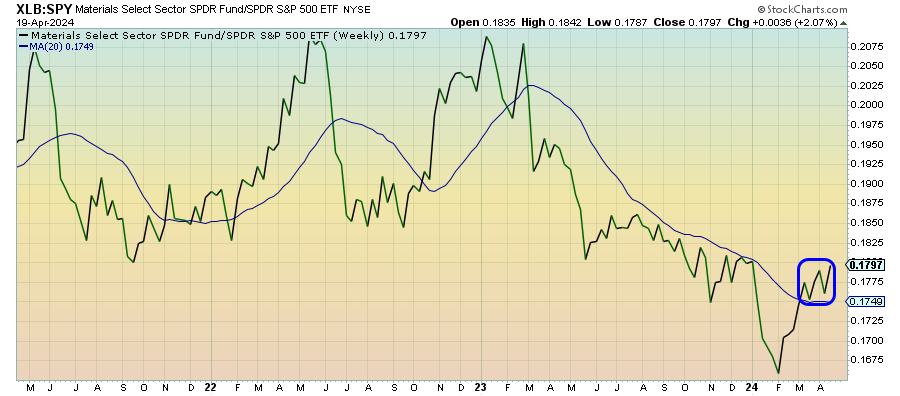

Materials (XLB) – The Rush To Metals

Commodities continue to surge and that’s been underpinning the support for this sector. As has often been the case, there’s a fair amount of volatility here and traders could be punished by the swings. The commodities rally is almost certainly overbought in the short-term and that could result in a potential reversal trade, but the uptick in manufacturing (we’ll get more PMI data this week to confirm that) and the rush to precious metals should add support.

Energy (XLE) – Risks Remain Geopolitical