Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

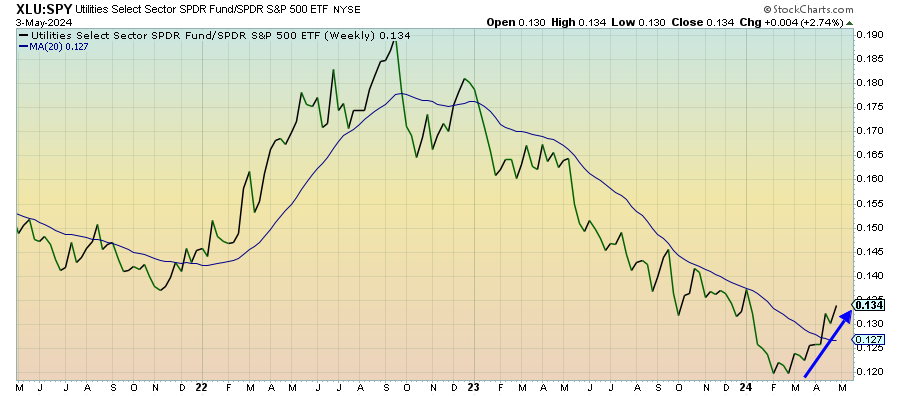

LEADERS: THE STRENGTH IN UTILITIES SHOULD CONCERN YOU

Utilities (XLU) – Defense Still In Control

Even though the major averages posted gains last week, it’s the utilities sector that led the market higher (and by a wide margin). This may partially have been an interest rate play since lower rates would benefit this highly leveraged sector, but I think this also suggests that defense may still be in control despite stocks moving higher. This is a three-month uptrend that shouldn’t be ignored.

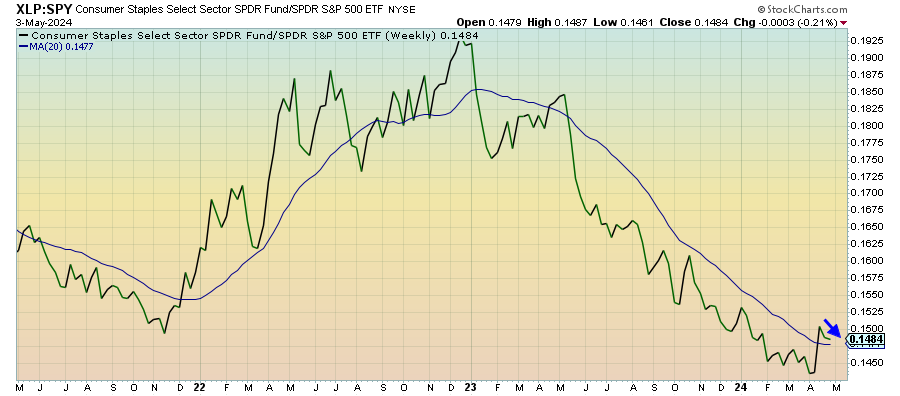

Consumer Staples (XLP) – Still Not Confirming Utilities

A defensive confirmation from the staples sector is something that we just haven’t seen much of throughout the past year and we didn’t get it last week either. With utilities leading and this sector still struggling to outperform for more than a week at a time, we’re still getting mixed signals and nothing that would indicate a major risk-off sentiment shift just yet.

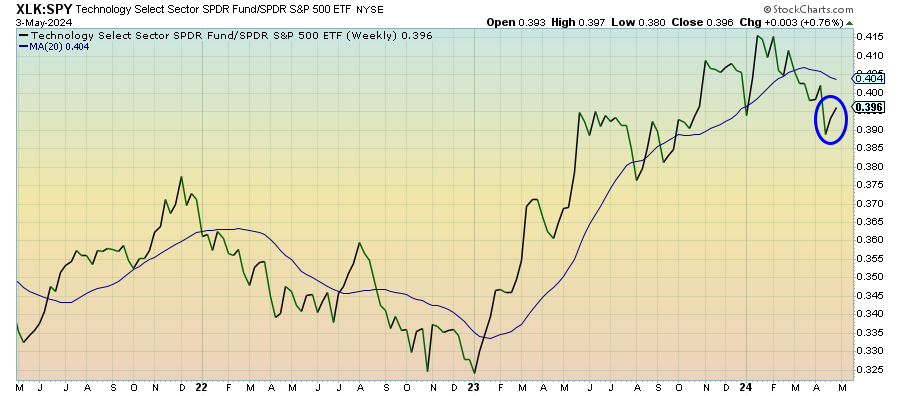

Technology (XLK) – Still Humming

Earnings growth for the magnificent 7 stocks has never really been a problem. While there were some more mixed results in Q1 than we’ve been accustomed to in recent quarters, the big numbers we saw from both Apple and Alphabet should add some comfort that the tech giants are still humming and conditions might not be as bad as have been feared.

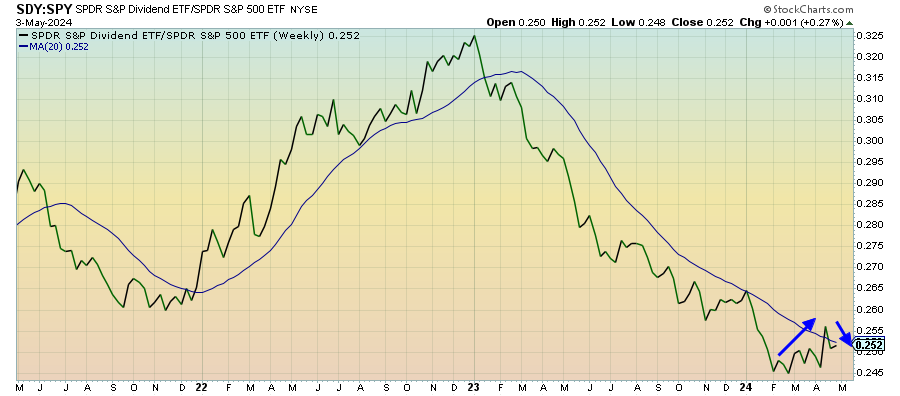

Dividend Stocks (SDY) – Not Enough Breadth

The uptrend for dividend stocks is still hanging on here, but there may not be enough positive breadth within this group to sustain it. One of the trends we’ve seen over the past two years is that most stocks still aren’t back to new highs even though the S&P 500 and Nasdaq 100 have been hitting them on a regular basis. It’s the same thing here. Cyclicals are lagging again. Staples is struggling to pick up momentum. Only utilities are really rallying and that’s likely not going to be enough longer-term.

Treasury Inflation Protected Securities (SPIP) – Interest Isn’t Subsiding